|

市場調查報告書

商品編碼

1666924

煙氣脫硫系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Flue Gas Desulfurization System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

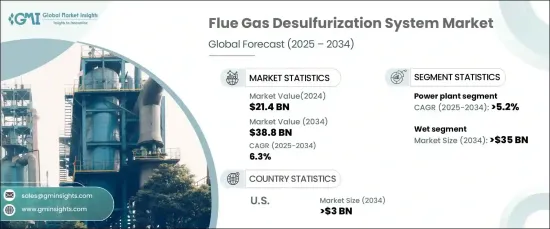

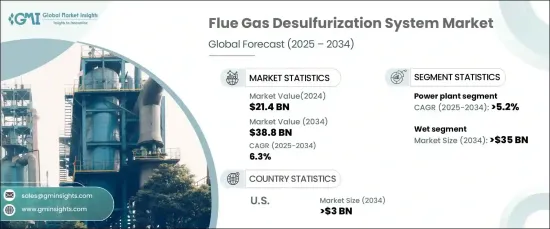

2024 年全球煙氣脫硫系統市場價值為 214 億美元,預計 2025 年至 2034 年期間將以 6.3% 的複合年成長率穩步成長。隨著人們對發電廠和工業設施造成的空氣污染的擔憂日益加劇,世界各國政府和政策制定者都在強調更嚴格的排放控制措施。

新製造設施和工業中心的建立推動了工業活動的快速擴張,進一步凸顯了實施強力的環境法規的迫切性。隨著工業營運的加劇,二氧化硫 (SO2) 等有害污染物的排放量不斷增加,凸顯了對 FGD 系統等先進排放控制技術的迫切需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 214億美元 |

| 預測值 | 388億美元 |

| 複合年成長率 | 6.3% |

預計到 2034 年,濕式煙氣脫硫系統的市場規模將超過 350 億美元。濕式煙氣脫硫系統在管理空氣和廢水污染物方面的有效性使其成為能源密集產業的關鍵解決方案。

煙氣脫硫系統在發電應用領域也越來越受歡迎,預計到 2034 年該領域的複合年成長率將超過 5.2%。煙氣脫硫系統對於減少二氧化硫排放和確保發電廠遵守嚴格的環境準則至關重要。

在美國,FGD 系統市場規模預計到 2034 年將超過 30 億美元。這些進步有助於降低部署複雜系統的成本,為廣泛採用鋪平了道路。

在亞太地區,將能源基礎設施與排放控制技術結合的努力正在加速煙氣脫硫系統的部署。區域協作方式和對工業中心的關注正在促進減少空氣污染的進程,並支持該地區市場的成長。預計該策略將進一步推動全球範圍內 FGD 系統的採用。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模及預測:依技術分類,2021 – 2034 年

- 主要趨勢

- 濕的

- 乾燥

第 6 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 發電廠

- 化工及石化

- 水泥

- 金屬加工和採礦

- 製造業

- 其他

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 澳洲

- 越南

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 奈及利亞

- 拉丁美洲

- 巴西

- 阿根廷

- 智利

第8章:公司簡介

- Alstom

- Andritz

- Babcock & Wilcox

- Beijing SPC Environment Protection Tech

- Chiyoda

- Doosan Enerbility

- Ducon Infratechnologies

- FLSmidth

- General Electric

- Hamon

- Ljungstrom

- Longking Environmental Protection

- Marsulex Environmental Technologies

- Mitsubishi Heavy Industries

- Thermax

- Valmet

The Global Flue Gas Desulfurization System Market, valued at USD 21.4 billion in 2024, is anticipated to grow at a steady CAGR of 6.3% from 2025 to 2034. The increasing energy demand has led to a rise in industrial emissions, contributing to significant environmental challenges. With growing concerns over air pollution caused by power plants and industrial facilities, governments and policymakers worldwide are emphasizing stricter emission control measures.

The rapid expansion of industrial activities, driven by the establishment of new manufacturing facilities and industrial hubs, has further underscored the urgency of implementing robust environmental regulations. As industrial operations intensify, emissions of harmful pollutants such as sulfur dioxide (SO2) have escalated, highlighting the critical need for advanced emission control technologies like FGD systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.4 Billion |

| Forecast Value | $38.8 Billion |

| CAGR | 6.3% |

The market for wet FGD systems is projected to surpass USD 35 billion by 2034. These systems are highly efficient in reducing sulfur dioxide and particulate matter from industrial emissions, making them a popular choice for industries aiming to comply with evolving environmental standards. The effectiveness of wet FGD systems in managing both air and wastewater pollutants has positioned them as a key solution in energy-intensive sectors.

FGD systems are also gaining traction in power generation applications, with this segment expected to grow at a CAGR of over 5.2% by 2034. As the electricity demand continues to rise, driven by economic development and industrialization, the adoption of advanced technologies to curb emission levels has become essential. FGD systems are vital in reducing sulfur dioxide emissions and ensuring adherence to stringent environmental guidelines in power plants.

In the United States, the FGD system market is expected to exceed USD 3 billion by 2034. Investments in emission control technologies, supported by government initiatives and funding, are driving market growth. These advancements are helping to lower the costs of deploying sophisticated systems, paving the way for widespread adoption.

In the Asia Pacific, efforts to integrate energy infrastructure with emission control technologies are accelerating the deployment of FGD systems. Collaborative regional approaches and a focus on industrial hubs are fostering progress toward reducing air pollution, supporting the market's growth in the region. This strategy is expected to drive further advancements in the adoption of FGD systems globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Wet

- 5.3 Dry

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Power Plants

- 6.3 Chemical & petrochemical

- 6.4 Cement

- 6.5 Metal Processing & mining

- 6.6 Manufacturing

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.4.6 Australia

- 7.4.7 Vietnam

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Nigeria

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Chile

Chapter 8 Company Profiles

- 8.1 Alstom

- 8.2 Andritz

- 8.3 Babcock & Wilcox

- 8.4 Beijing SPC Environment Protection Tech

- 8.5 Chiyoda

- 8.6 Doosan Enerbility

- 8.7 Ducon Infratechnologies

- 8.8 FLSmidth

- 8.9 General Electric

- 8.10 Hamon

- 8.11 Ljungstrom

- 8.12 Longking Environmental Protection

- 8.13 Marsulex Environmental Technologies

- 8.14 Mitsubishi Heavy Industries

- 8.15 Thermax

- 8.16 Valmet