|

市場調查報告書

商品編碼

1666959

輪胎熱解油市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Tire Pyrolysis Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球輪胎熱解油市場價值為 3.632 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.4%。隨著工業轉向環保實踐,由廢料熱分解產生的輪胎熱解油(TPO)正成為減少碳排放和促進循環經濟的可行解決方案。世界各國政府都在推出嚴格的法規來控制垃圾掩埋,進一步推動TPO的採用。石油能夠作為傳統化石燃料的經濟高效且環保的替代品,這使得它在能源、製造和運輸等行業中得到廣泛應用。

由於多種原料的整合,市場正在經歷強勁成長,其中廢塑膠和廢舊輪胎處於最前沿。廢塑膠因其高熱量而成為TPO生產的關鍵原料。預計到 2034 年該領域的規模將達到 2.754 億美元,複合年成長率高達 6.2%。廢舊輪胎仍然是主要的投入品,廣泛的回收計劃促進了這一趨勢,旨在最大限度地減少對環境的影響並減少垃圾掩埋場中不可生物分解材料的堆積。此外,油泥、木材和工業殘渣等原料也被納入熱解過程,擴大了原料範圍並提高了生產效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.632 億美元 |

| 預測值 | 6.119 億美元 |

| 複合年成長率 | 5.4% |

快速熱解在技術領域處於領先地位,到 2024 年將佔有 60.5% 的市場佔有率,價值 2.197 億美元。它能夠有效地提供高油產量,同時消耗更少的能源,使其成為生產 TPO 的首選方法。閃速熱解利用快速加熱技術,在最佳化輸出品質和製程效率方面越來越受到關注。另一方面,緩慢熱解雖然產油量較低,但會持續產生焦炭和鋼等有價值的副產品,這些副產品具有重要的工業應用價值。

美國正成為輪胎熱解油市場的重要參與者,預計到 2034 年將達到 1.458 億美元,複合年成長率為 5.1%。成長的動力來自於嚴格的環境法規、回收規定以及對先進熱解系統的投資增加。政府推動永續技術和減少碳足跡的激勵措施進一步鼓勵了各個領域採用TPO。隨著企業注重整合綠色實踐,美國市場將繼續處於全球輪胎熱解油產業創新和擴張的前沿。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 產業衝擊力

- 成長動力

- 環境問題和廢棄物處理問題

- 燃料價格上漲和經濟效益

- 多種應用領域的多功能性和適應性

- 市場挑戰

- 技術限制和生產效率

- 成長動力

- 法規和市場影響

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模及預測:依原料,2021-2034 年

- 主要趨勢

- 廢塑膠

- 廢橡膠

- 木頭

- 油泥

- 其他

第 6 章:市場規模及預測:依工藝,2021-2034 年

- 主要趨勢

- 快速熱解

- 快速熱解

- 緩慢熱解

第 7 章:市場規模與預測:依最終用途,2021-2034 年

- 主要趨勢

- 化學品

- 燃料

- 其他

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Alterra Energy

- Bioenergy Ae Cote-Nord

- Bridgestone Corporation

- Ensyn

- Green Fuel Nordic Oy

- Mk Aromatics Limited

- New Energy Kft.

- New Hope Energy

- Nexus Circular

- Plastic Energy

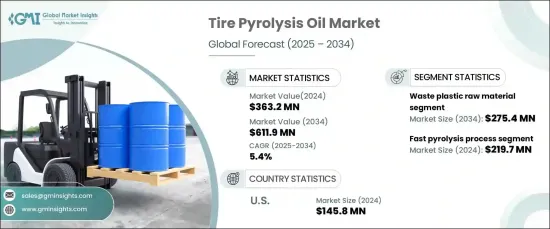

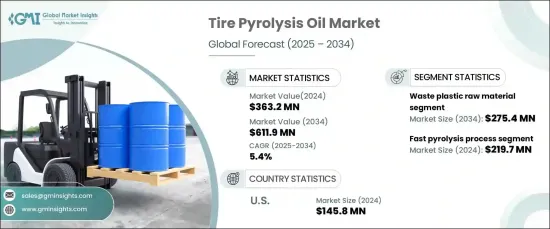

The Global Tire Pyrolysis Oil Market, valued at USD 363.2 million in 2024, is projected to expand at a CAGR of 5.4% between 2025 and 2034. This growth is fueled by the increasing demand for sustainable alternatives and continuous advancements in waste management technologies. As industries shift toward environmentally friendly practices, tire pyrolysis oil (TPO), derived from the thermal decomposition of waste materials, is emerging as a viable solution for reducing carbon emissions and promoting a circular economy. Governments worldwide are introducing stringent regulations to curb landfill waste, further driving the adoption of TPO. The oil's ability to serve as a cost-effective and eco-friendly substitute for traditional fossil fuels is encouraging its widespread utilization across industries such as energy, manufacturing, and transportation.

The market is experiencing robust growth due to the integration of diverse feedstocks, with waste plastic and end-of-life tires at the forefront. Waste plastic, recognized for its high calorific content, is becoming a key raw material for TPO production. The segment is expected to reach USD 275.4 million by 2034, growing at a remarkable CAGR of 6.2%. End-of-life tires remain a dominant input, bolstered by widespread recycling initiatives designed to minimize environmental impact and reduce the accumulation of non-biodegradable materials in landfills. Additionally, feedstocks such as oil sludge, wood, and industrial residues are being incorporated into the pyrolysis process, broadening the range of raw materials and enhancing production efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $363.2 Million |

| Forecast Value | $611.9 Million |

| CAGR | 5.4% |

Fast pyrolysis is leading the technological landscape, holding a 60.5% market share in 2024 and valued at USD 219.7 million. Its ability to deliver high oil yields efficiently while consuming less energy positions it as a preferred method for TPO production. Flash pyrolysis, which utilizes rapid heating technologies, is gaining traction for optimizing output quality and process efficiency. On the other hand, slow pyrolysis, though yielding lower oil volumes, continues to produce valuable byproducts such as char and steel, which have significant industrial applications.

The United States is emerging as a key player in the tire pyrolysis oil market, anticipated to reach USD 145.8 million by 2034 with a CAGR of 5.1%. Growth is driven by stringent environmental regulations, recycling mandates, and increased investments in advanced pyrolysis systems. Government incentives to promote sustainable technologies and reduce carbon footprints are further encouraging the adoption of TPO across various sectors. As businesses focus on integrating green practices, the US market is poised to remain at the forefront of innovation and expansion in the global tire pyrolysis oil industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Environmental concerns and waste disposal issues

- 3.7.1.2 Rising fuel prices and economic benefits

- 3.7.1.3 Versatility and adaptability in various applications

- 3.7.2 Market challenges

- 3.7.2.1 Technological limitations and production efficiency

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Raw Material, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Waste plastic

- 5.3 Waste rubber

- 5.4 Wood

- 5.5 Oil sludge

- 5.6 Others

Chapter 6 Market Size and Forecast, By Process, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fast pyrolysis

- 6.3 Flash pyrolysis

- 6.4 Slow pyrolysis

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Chemicals

- 7.3 Fuel

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alterra Energy

- 9.2 Bioenergy Ae Cote-Nord

- 9.3 Bridgestone Corporation

- 9.4 Ensyn

- 9.5 Green Fuel Nordic Oy

- 9.6 Mk Aromatics Limited

- 9.7 New Energy Kft.

- 9.8 New Hope Energy

- 9.9 Nexus Circular

- 9.10 Plastic Energy