|

市場調查報告書

商品編碼

1666978

車載網路市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vehicle Networking Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

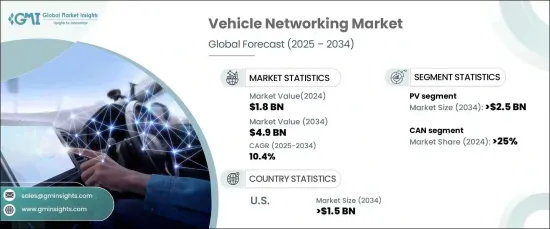

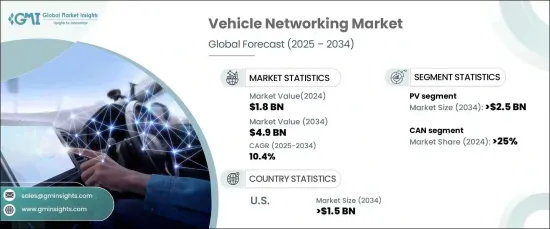

全球車輛網路市場在 2024 年的估值為 18 億美元,預計在 2025 年至 2034 年期間將以 10.4% 的強勁複合年成長率成長。這些尖端技術實現了車輛和基礎設施之間的無縫即時通訊,提高了安全性、效率和整體駕駛體驗。自動駕駛汽車的擴張進一步刺激了對先進網路解決方案的需求。高效的車對車 (V2V) 和車對基礎設施 (V2I) 通訊對於自動駕駛汽車的順利運行至關重要,使其成為未來汽車行業的關鍵組成部分。

此外,對車輛診斷和預測性維護的日益重視正在成為主要的市場驅動力。有了先進的網路技術,現在可以持續監控車輛性能,從而提前發現潛在問題。這種早期檢測不僅可以確保更好的可靠性,而且還有助於降低維護成本和車輛停機時間,使個人消費者和車隊營運商都受益。此外,即時防撞和緊急煞車等安全功能的進步也推動了對可靠、高性能車輛網路系統的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 49億美元 |

| 複合年成長率 | 10.4% |

就車輛類型而言,市場分為乘用車 (PV)、輕型商用車 (LCV)、重型商用車 (HCV) 和自動導引車 (AGV)。 2024 年,光伏市場佔據了 50% 的主導佔有率,預計到 2034 年將達到 25 億美元。 這種主導地位很大程度上是由於消費者對先進車載技術的需求不斷成長,包括資訊娛樂系統、即時導航和增強的安全功能,這些功能擴大被納入乘用車中。

在連接方面,車輛網路市場分為 LIN、CAN、RF、乙太網路、FlexRay 和 MOST。 CAN(控制器區域網路)領域由於其可靠性、穩健性和成本效益,在 2024 年佔據了 25% 的佔有率。它廣泛用於引擎控制和煞車等關鍵汽車系統中的即時資料傳輸,即使在電磁干擾嚴重的惡劣環境中也能提供出色的性能。

美國車聯網市場在2024年處於領先地位,佔全球90%的佔有率。由於美國成熟的汽車產業以及自動駕駛、電動車和 5G 連接等突破性技術的快速應用,美國市場規模預計到 2034 年將達到 15 億美元。這些創新在很大程度上依賴先進的車聯網解決方案,推動美國市場實現大幅成長。隨著消費者期望的提高和技術的不斷發展,車載網路市場將實現顯著擴張,提供增強車輛連接性和性能的創新解決方案。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 技術提供者

- 服務提供者

- 經銷商

- 最終用途

- 利潤率分析

- 定價分析

- 成本明細

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 政府專注於減少碳排放

- 電動車銷量不斷成長

- 政府支持汽車零件產業

- 市場參與者的策略性舉措

- 產業陷阱與挑戰

- 電動車中半導體的消耗不斷增加

- 發展中國家和低度開發國家缺乏自主行動基礎設施

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 光電

- 輕型商用車

- 丙型肝炎病毒

- 自動導引車

第6章:市場估計與預測:依連結性,2021 - 2034 年

- 主要趨勢

- CAN(控制器區域網路)

- LIN(本地互連網路)

- RF(射頻)

- FlexRay

- 乙太網路

- MOST(媒體導向系統傳輸)

第 7 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 動力傳動系統

- 安全

- 車身電子

- 機殼

- 資訊娛樂

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Acome

- Analog Devices

- Bosch

- Broadcom

- Continental

- Intel

- Harman

- Marvell Semiconductor

- Microchip Technology

- NXP Semiconductors

- ON Semiconductor

- Qualcomm

- Renesas

- Sierra Wireless

- Spiarent

- Communications

- STMicroelectronics NV

- Texas Instrumental

- Toshiba

- Xilinx

The Global Vehicle Networking Market, with a valuation of USD 1.8 billion in 2024, is expected to grow at a robust CAGR of 10.4% from 2025 to 2034. This growth is primarily driven by the accelerating adoption of connected car technologies, fueled by the integration of the Internet of Things (IoT) and 5G networks. These cutting-edge technologies enable seamless real-time communication between vehicles and infrastructure, enhancing safety, efficiency, and the overall driving experience. The expansion of autonomous vehicles has further spurred demand for advanced networking solutions. Efficient vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication are vital for the smooth functioning of self-driving cars, making them a critical component in the future of the automotive industry.

Furthermore, the increasing emphasis on vehicle diagnostics and predictive maintenance is becoming a major market driver. With advanced networking technologies in place, continuous monitoring of vehicle performance is now possible, allowing for early detection of potential issues. This early detection not only ensures better reliability but also helps to reduce maintenance costs and vehicle downtime, benefiting both individual consumers and fleet operators. In addition, advancements in safety features, such as real-time collision avoidance and emergency braking, are pushing the need for reliable, high-performance vehicle networking systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 10.4% |

In terms of vehicle types, the market is segmented into Passenger Vehicles (PV), Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and Autonomous Guided Vehicles (AGV). The PV segment held a dominant 50% share in 2024 and is forecast to reach USD 2.5 billion by 2034. This dominance is largely due to the growing consumer demand for advanced in-car technologies, including infotainment systems, real-time navigation, and enhanced safety features that are increasingly being incorporated into passenger vehicles.

On the connectivity front, the vehicle networking market is categorized into LIN, CAN, RF, Ethernet, FlexRay, and MOST. The CAN (Controller Area Network) segment held a 25% share in 2024 thanks to its reliability, robustness, and cost-effectiveness. It's widely used for real-time data transmission in critical automotive systems like engine control and braking, providing exceptional performance even in harsh environments with high electromagnetic interference.

The U.S. vehicle networking market was the leader in 2024, accounting for 90% of the global share. The market in the U.S. is expected to reach USD 1.5 billion by 2034, driven by the country's well-established automotive sector and rapid adoption of groundbreaking technologies such as autonomous driving, electric vehicles, and 5G connectivity. These innovations rely heavily on advanced vehicle networking solutions, propelling the U.S. market toward substantial growth. As consumer expectations rise and technology continues to evolve, the vehicle networking market is poised for remarkable expansion, delivering innovative solutions that enhance vehicle connectivity and performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 Service providers

- 3.2.3 Distributors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Pricing analysis of

- 3.5 Cost breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Government focus on reducing carbon emissions

- 3.9.1.2 Growing sales of electric vehicles

- 3.9.1.3 Government support for automotive components industry

- 3.9.1.4 Strategic initiatives by market players

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Increasing consumption of semiconductors in electric vehicles

- 3.9.2.2 Lack of autonomous mobility infrastructure in developing and underdeveloped countries

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 PV

- 5.3 LCV

- 5.4 HCV

- 5.5 AGV

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 CAN (Controller Area Network)

- 6.3 LIN (Local Interconnect Network)

- 6.4 RF (Radio Frequency)

- 6.5 FlexRay

- 6.6 Ethernet

- 6.7 MOST (Media Oriented Systems Transport)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Powertrain

- 7.3 Safety

- 7.4 Body electronics

- 7.5 Chassis

- 7.6 Infotainment

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Acome

- 9.2 Analog Devices

- 9.3 Bosch

- 9.4 Broadcom

- 9.5 Continental

- 9.6 Intel

- 9.7 Harman

- 9.8 Marvell Semiconductor

- 9.9 Microchip Technology

- 9.10 NXP Semiconductors

- 9.11 ON Semiconductor

- 9.12 Qualcomm

- 9.13 Renesas

- 9.14 Sierra Wireless

- 9.15 Spiarent

- 9.16 Communications

- 9.17 STMicroelectronics NV

- 9.18 Texas Instrumental

- 9.19 Toshiba

- 9.20 Xilinx