|

市場調查報告書

商品編碼

1666995

工業加熱器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Industrial Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

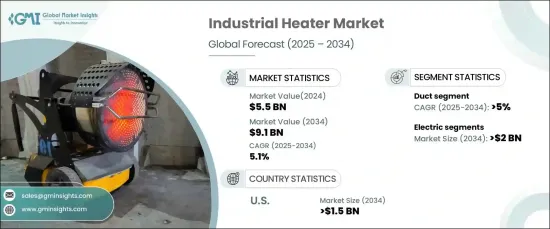

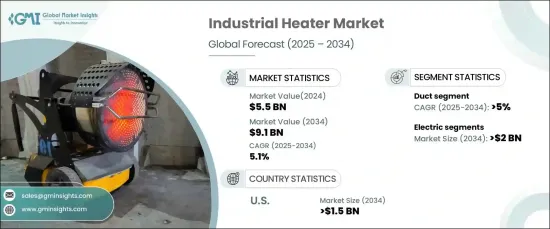

2024 年全球工業加熱器市場價值為 55 億美元,預計 2025 年至 2034 年期間將以 5.1% 的強勁複合年成長率成長。

電工業加熱器是預計到 2034 年將創收 20 億美元的關鍵細分市場之一,由於人們越來越重視能源效率和減少環境影響,電力工業加熱器越來越受歡迎。人們對環境永續性的日益關注導致電加熱解決方案的採用率更高。此外,物聯網連接等智慧技術的整合正在增強電加熱器的功能。這些創新實現了遠端監控、即時控制和預測性維護,幫助企業最佳化供熱操作、最大限度地減少停機時間並提高整體效率。預計這些改進將推動電工業加熱器領域的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 55億美元 |

| 預測值 | 91億美元 |

| 複合年成長率 | 5.1% |

預計到 2034 年,管道工業加熱器市場將以 5% 的穩定複合年成長率成長。向太陽能熱系統、生質能加熱和廢熱回收等再生能源的轉變在減少對化石燃料的依賴和降低排放方面發揮著至關重要的作用。此外,管道加熱器越來越受到青睞,可在較小的空間內提供局部加熱,進一步支援其在各個行業的應用。

在工業加熱領域,對提供精確溫度控制、可程式設定和遠端監控功能的產品的需求明顯增加。這些特性在化學等行業尤其有價值,因為精確的溫度管理對於蒸餾、溶解和結晶等過程至關重要。穩定且準確的溫度控制對於最佳化效率和確保這些製程中的高品質輸出至關重要,從而進一步推動工業加熱器市場的成長。

受汽車產業蓬勃發展和製造業大量投資的推動,亞太地區工業加熱器市場的需求正在快速成長。隨著都市化進程加速、可支配所得上升,消費品需求也隨之增加,進一步推動該地區工業加熱器市場的成長。預計產業擴張和基礎設施發展將繼續推動市場向前發展,使亞太地區成為工業加熱器成長的關鍵地區。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模與預測:依技術,2021 – 2034 年

- 主要趨勢

- 電的

- 油

- 堅硬的

- 氣體

第6章:市場規模及預測:依產能,2021 – 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 7 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 管道加熱器

- 管道加熱器

- 圓筒形加熱器

- 浸入式加熱器

- 循環加熱器

第 8 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 石油和天然氣

- 化學

- 食品和飲料

- 製造業

- 汽車

- 其他

第 9 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 法國

- 荷蘭

- 西班牙

- 挪威

- 英國

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 泰國

- 新加坡

- 馬來西亞

- 菲律賓

- 越南

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 伊拉克

- 土耳其

- 南非

- 拉丁美洲

- 巴西

- 智利

- 阿根廷

第10章:公司簡介

- Accutherm

- Auzhan Electric Appliances

- Backer Hotwatt

- Chromalox

- Dragon Power Electric

- Durex Industries

- Elmec Heaters

- Elmatic

- ExcelHeaters

- Heatcon

- Heatrex

- Heatco

- Indeeco

- Magma Technologies

- Marathon Heater

- Omega Engineering

- Powrmatic

- Tempco Electric Heater

- Thermal

- Tutco Frrnam

- Ulanet

- Warren Electric

- Watlow Electric Manufacturing

- Winterwarm Heating Solutions

The Global Industrial Heater Market was valued at USD 5.5 billion in 2024 and is projected to expand at a robust CAGR of 5.1% from 2025 to 2034. This growth is primarily driven by the increasing demand for industrial heaters across diverse applications and the continuous advancements in technology that focus on energy efficiency and environmental sustainability.

One of the key segments expected to generate USD 2 billion by 2034, electric industrial heaters are gaining popularity due to the growing emphasis on energy efficiency and reducing environmental impact. The rising concerns about environmental sustainability have led to a greater adoption of electric heating solutions. Additionally, the integration of smart technologies like IoT connectivity is enhancing the functionality of electric heaters. These innovations enable remote monitoring, real-time control, and predictive maintenance, helping businesses optimize heating operations, minimize downtime, and boost overall efficiency. Such improvements are expected to drive the continued growth of the electric industrial heater segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.5 Billion |

| Forecast Value | $9.1 Billion |

| CAGR | 5.1% |

The duct industrial heater market is projected to grow at a steady CAGR of 5% through 2034. This growth is largely attributed to the increasing demand for sustainable and localized heating solutions. The shift toward renewable energy sources, such as solar thermal systems, biomass heating, and waste heat recovery, is playing a crucial role in reducing dependence on fossil fuels and lowering emissions. Additionally, duct heaters are increasingly being favored for providing localized heating in smaller spaces, further supporting their adoption across various industries.

Within the industrial heating sector, there is a noticeable surge in the demand for products that offer precise temperature control, programmable settings, and remote monitoring capabilities. These features are especially valuable in industries like chemicals, where precise temperature management is essential for processes such as distillation, dissolution, and crystallization. Stable and accurate temperature control is critical to optimizing efficiency and ensuring high-quality outputs in these processes, driving the growth of the industrial heater market even further.

The industrial heater market in the Asia Pacific region is experiencing a rapid surge in demand, fueled by the booming automotive sector and significant investments in manufacturing. As urbanization accelerates and disposable incomes rise, the demand for consumer goods also increases, further driving the growth of the industrial heater market in this region. The expansion of industries coupled with infrastructure development is expected to continue to propel the market forward, making Asia Pacific a key region for industrial heater growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (Units & USD Million)

- 5.1 Key trends

- 5.2 Electric

- 5.3 Oil

- 5.4 Solid

- 5.5 Gas

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (Units & USD Million)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Size and Forecast, By Product, 2021 – 2034 (Units & USD Million)

- 7.1 Key trends

- 7.2 Pipe heater

- 7.3 Duct heater

- 7.4 Cartridge heater

- 7.5 Immersion heater

- 7.6 Circulation heater

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (Units & USD Million)

- 8.1 Key trends

- 8.2 Oil & gas

- 8.3 chemical

- 8.4 Food & beverage

- 8.5 Manufacturing

- 8.6 Automotive

- 8.7 Others

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (Units & USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 Italy

- 9.3.3 France

- 9.3.4 Netherlands

- 9.3.5 Spain

- 9.3.6 Norway

- 9.3.7 UK

- 9.3.8 Sweden

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Singapore

- 9.4.8 Malaysia

- 9.4.9 Philippines

- 9.4.10 Vietnam

- 9.4.11 Indonesia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Iran

- 9.5.4 Iraq

- 9.5.5 Turkey

- 9.5.6 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Chile

- 9.6.3 Argentina

Chapter 10 Company Profiles

- 10.1 Accutherm

- 10.2 Auzhan Electric Appliances

- 10.3 Backer Hotwatt

- 10.4 Chromalox

- 10.5 Dragon Power Electric

- 10.6 Durex Industries

- 10.7 Elmec Heaters

- 10.8 Elmatic

- 10.9 ExcelHeaters

- 10.10 Heatcon

- 10.11 Heatrex

- 10.12 Heatco

- 10.13 Indeeco

- 10.14 Magma Technologies

- 10.15 Marathon Heater

- 10.16 Omega Engineering

- 10.17 Powrmatic

- 10.18 Tempco Electric Heater

- 10.19 Thermal

- 10.20 Tutco Frrnam

- 10.21 Ulanet

- 10.22 Warren Electric

- 10.23 Watlow Electric Manufacturing

- 10.24 Winterwarm Heating Solutions