|

市場調查報告書

商品編碼

1667009

氟彈性體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Fluoroelastomers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

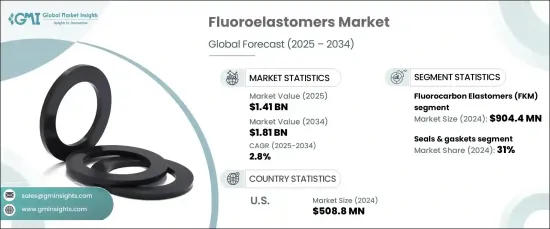

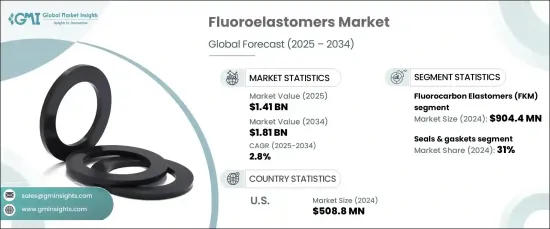

預計全球氟彈性體市場規模到 2024 年將達到 14.1 億美元,預計 2025 年至 2034 年期間的複合年成長率為 2.8%。氟彈性體以其獨特的耐極熱、耐化學品和耐壓能力而聞名,擴大被汽車、航太、石油和天然氣等關鍵領域所採用。隨著產業的發展和對更具彈性的材料的需求,氟彈性體正成為從燃油系統和引擎部件到密封件和墊圈等眾多應用中必不可少的組件。此外,隨著企業優先考慮永續性和能源效率,氟彈性體因其持久的性能和滿足環境標準的能力而受到高度需求。

氟彈性體主要分為氟碳彈性體(FKM)和全氟彈性體(FFKM)。 2024 年,氟碳彈性體佔據市場主導地位,佔整體收入的巨大佔有率。這歸因於它們出色的熱穩定性、耐化學性以及在需要強大密封解決方案的行業中的廣泛用途。這些彈性體通常用於引擎、變速箱和燃油系統中使用的墊圈、密封件和 O 形環。另一方面,全氟彈性體由於其增強的耐化學性和耐熱性而越來越受到關注,使其成為對可靠性要求極高的行業(如半導體和化學加工領域)的高度專業化應用的理想選擇。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14.1億美元 |

| 預測值 | 18.1億美元 |

| 複合年成長率 | 2.8% |

氟彈性體市場的應用部分包括密封件和墊圈、O 形環、軟管和管材以及其他專門應用。密封件和墊圈佔據最大的市場佔有率,佔 2024 年總收入的 31%,預計在整個預測期內將保持強勁成長。汽車產業是這項需求的重要動力,依賴氟彈性體抵抗極端高溫和刺激性化學物質的能力。 O 型環廣泛應用於航太領域,因其能確保關鍵零件的防漏密封,所以持續受到熱捧。軟管和管材在各種工業製程的流體傳輸和控制中也發揮著至關重要的作用,進一步促進了氟彈性體市場的成長。

在美國,氟彈性體市場在 2024 年創造了 5.088 億美元的產值。持續的研發投資以及基礎設施改善預計將推動持續擴張。隨著產業的發展和對更有效率、更可靠材料的追求,美國氟彈性體市場將透過傳統和新興應用進一步成長。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 汽車產業需求不斷成長

- 航太應用的採用率不斷提高

- 不斷成長的化學加工工業

- 產業陷阱與挑戰

- 氟彈性體成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模及預測:依產品,2021-2034 年

- 主要趨勢

- 氟碳彈性體 (FKM)

- 全氟橡膠 (FFKM)

第 6 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- D 密封件和墊圈

- O 型環

- 軟管和管子

- 其他

第 7 章:市場規模與預測:依最終用途產業,2021-2034 年

- 主要趨勢

- 汽車

- 航太

- 石油和天然氣

- 化學加工

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3M

- AGC (Asahi Glass)

- Chemours

- Daikin Industries

- DowDuPont

- DuPont (EI du Pont de Nemours and Company)

- Gujarat Fluorochemicals

- HaloPolymer

- Mitsui Chemicals

- Momentive Performance Materials

- Saint-Gobain Performance Plastics

- Shin-Etsu Chemical

- Solvay

- Wacker Chemie

- Zeon Corporation

The Global Fluoroelastomers Market is projected to reach USD 1.41 billion in 2024 and is expected to grow at a CAGR of 2.8% from 2025 to 2034. This growth is primarily driven by the rising demand for high-performance elastomers across various industries requiring superior durability and resistance to harsh environments. Fluoroelastomers, known for their unique ability to withstand extreme heat, chemicals, and pressures, are increasingly being adopted in critical sectors such as automotive, aerospace, and oil and gas. As industries evolve and demand more resilient materials, fluoroelastomers are becoming essential components in numerous applications, ranging from fuel systems and engine components to seals and gaskets. Furthermore, as companies prioritize sustainability and energy efficiency, fluoroelastomers are in high demand for their long-lasting performance and ability to meet environmental standards.

Fluoroelastomers are mainly categorized into fluorocarbon elastomers (FKM) and perfluoroelastomers (FFKM). In 2024, fluorocarbon elastomers dominated the market, accounting for a significant share of the overall revenue. This can be attributed to their exceptional thermal stability, chemical resistance, and wide range of uses in industries that require robust sealing solutions. These elastomers are commonly found in gaskets, seals, and o-rings used in engines, transmissions, and fuel systems. Perfluoroelastomers, on the other hand, are gaining traction due to their enhanced chemical and heat resistance, making them ideal for highly specialized applications in industries that demand the utmost reliability, such as semiconductor and chemical processing sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.41 Billion |

| Forecast Value | $1.81 Billion |

| CAGR | 2.8% |

The application segment of the fluoroelastomers market includes seals & gaskets, o-rings, hoses & tubings, and other specialized applications. Seals and gaskets held the largest market share, accounting for 31% of the total revenue in 2024, and are expected to maintain strong growth throughout the forecast period. The automotive industry is a significant driver of this demand, relying on fluoroelastomers for their ability to withstand extreme heat and harsh chemicals. O-rings, widely used in aerospace applications, continue to be in high demand, as they ensure leak-proof seals in critical components. Hoses and tubings also play a vital role in fluid transfer and containment across various industrial processes, further bolstering the growth of the fluoroelastomers market.

In the U.S., the fluoroelastomers market generated USD 508.8 million in 2024. Growth in this region is driven by advancements in material technologies and a growing demand for high-performance sealing solutions, particularly in the automotive, aerospace, and energy sectors. Ongoing investments in research and development, along with infrastructure improvements, are expected to fuel continued expansion. As industries evolve and seek more efficient and reliable materials, the fluoroelastomers market in the U.S. is set to experience further growth through both traditional and emerging applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in automotive industry

- 3.6.1.2 Rising adoption in aerospace applications

- 3.6.1.3 Growing chemical processing industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of fluoroelastomers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fluorocarbon elastomers (FKM)

- 5.3 Perfluoroelastomers (FFKM)

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 D seals and gaskets

- 6.3 O-rings

- 6.4 Hoses and tubings

- 6.5 Others

Chapter 7 Market Size and Forecast, By End Use Industries, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace

- 7.4 Oil & gas

- 7.5 Chemical processing

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 AGC (Asahi Glass)

- 9.3 Chemours

- 9.4 Daikin Industries

- 9.5 DowDuPont

- 9.6 DuPont (E. I. du Pont de Nemours and Company)

- 9.7 Gujarat Fluorochemicals

- 9.8 HaloPolymer

- 9.9 Mitsui Chemicals

- 9.10 Momentive Performance Materials

- 9.11 Saint-Gobain Performance Plastics

- 9.12 Shin-Etsu Chemical

- 9.13 Solvay

- 9.14 Wacker Chemie

- 9.15 Zeon Corporation