|

市場調查報告書

商品編碼

1667021

酯基季銨鹽市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Esterquats Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

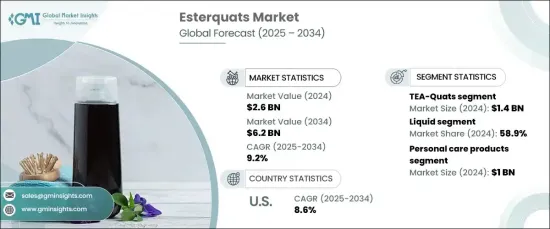

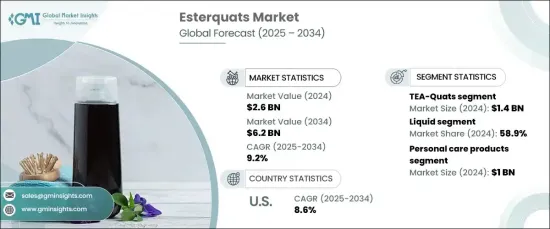

2024 年全球酯基季銨鹽市場價值為 26 億美元,預計 2025 年至 2034 年期間的複合年成長率為 9.2%。消費者越來越意識到他們使用的產品對環境的影響,並推動品牌尋求符合其永續發展目標的成分。酯基季銨鹽以其可生物分解性和有效性而聞名,正在成為頭髮和皮膚護理產品配方的首選,因為性能和環保意識同樣重要。

除了環保優勢以外,酯基季銨鹽還具有增強皮膚和頭髮調理能力等創新特性,吸引了越來越多消費者的注意,他們越來越傾向於購買高階產品。隨著對高品質個人護理的需求不斷成長,酯基季銨鹽已成為關鍵成分,製造商專注於配製具有卓越性能的產品。這在織物柔軟劑和調理劑市場尤其明顯,酯基季銨鹽具有卓越的調理作用,並為消費者提供更有效、更持久的效果。隨著消費者逐漸青睞那些將奢華與永續性結合的產品,酯基季銨鹽預計將繼續在個人護理和家庭護理產品的配方中發揮關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 62億美元 |

| 複合年成長率 | 9.2% |

TEA-Quats 領域在 2024 年的價值為 14 億美元,預計在 2025 年至 2034 年期間將實現 8.9% 的複合年成長率。這些化合物因其多功能性而聞名,使其成為尋求滿足日益成長的高性能產品需求的製造商的首選成分。它們的廣泛使用證明了它們的受歡迎程度和有效性,確保了它們在酯基季銨鹽市場上的持續主導地位。

就產品形式而言,液體酯基季銨鹽佔據市場主導地位,到 2024 年將佔據 58.9% 的佔有率。製造商更喜歡液體,因為它們可以使生產過程更加順暢和高效,尤其是對於護髮素和織物柔軟劑等消費品。液體形式還可以無縫整合到個人護理配方中,使其成為尋求快速有效使用產品的品牌和消費者的首選。

美國的酯基季銨鹽市場也呈現上升趨勢,2024 年價值將達到 7.571 億美元,預估成長率為 8.6%。在美國,個人護理和家庭護理行業是酯基季銨鹽需求的主要貢獻者,越來越多的消費者選擇符合其高性能和永續性需求的高階產品。酯基季銨鹽在織物護理領域尤其受歡迎,它們是織物柔軟劑配方中不可或缺的一部分,在洗衣護理市場中發揮關鍵作用。隨著對環保和有效解決方案的需求不斷成長,美國酯季銨鹽市場將在整個預測期內保持強勁成長。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 個人護理產品需求不斷增加

- 可支配所得增加

- 工業應用需求不斷成長

- 產業陷阱與挑戰

- 原物料價格波動

- 替代產品的可用性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品類型,2021-2034 年

- 主要趨勢

- 季銨鹽

- 季銨鹽

- 其他

第6章:市場估計與預測:依形式,2021-2034

- 主要趨勢

- 乾燥

- 液體

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 個人護理產品

- 織物護理產品

- 居家護理產品

- 工業應用

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ABITEC Corporation

- AkzoNobel

- BASF

- Clariant

- Chemelco

- Dongnam Chemical Industries

- Evonik Industries

- Hangzhou Fandachem

- Italmatch Chemicals

- Kao Corporation

- Stepan Company

- Solvay

- The Lubrizol Corporation

The Global Esterquats Market, valued at USD 2.6 billion in 2024, is expected to expand at a CAGR of 9.2% from 2025 to 2034. The surge in demand for sustainable, eco-friendly, and biodegradable ingredients is one of the primary drivers of market growth, particularly in the personal care sector. Consumers are becoming more aware of the environmental impact of the products they use, pushing brands to seek ingredients that align with their sustainability goals. Esterquats, known for their biodegradability and effectiveness, are emerging as top choices for formulations in hair and skin care products, where performance and eco-consciousness are equally important.

In addition to the eco-friendly appeal, esterquats' innovative properties, such as their ability to enhance skin and hair conditioning, have caught the attention of consumers who are increasingly gravitating toward premium products. As the demand for high-quality personal care continues to rise, esterquats are positioned as a key ingredient, with manufacturers focusing on formulating products that deliver exceptional performance. This is particularly noticeable in the fabric softener and conditioner markets, where esterquats offer superior conditioning and provide consumers with more effective, long-lasting results. As consumers shift their preferences toward products that combine luxury with sustainability, esterquats are expected to continue playing a critical role in the formulation of personal care and home care products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 billion |

| Forecast Value | $6.2 billion |

| CAGR | 9.2% |

The TEA-Quats segment, valued at USD 1.4 billion in 2024, is set to experience a steady growth rate of 8.9% CAGR between 2025 and 2034. Known for their superior conditioning abilities, TEA-Quats (triethanolamine quaternary ammonium compounds) are indispensable in many personal care applications such as fabric softeners, hair conditioners, and various skincare products. These compounds are recognized for their versatility, making them a go-to ingredient for manufacturers looking to meet the growing demand for high-performance products. Their widespread use is a testament to their popularity and effectiveness, ensuring their continued dominance in the esterquats market.

In terms of product format, liquid esterquats dominate the market, accounting for 58.9% of the share in 2024. Liquid formulations are especially favored due to their ease of use and compatibility with high-volume manufacturing processes. Manufacturers prefer liquids because they facilitate a smoother and more efficient production process, especially for consumer goods like hair conditioners and fabric softeners. The liquid form also integrates seamlessly into personal care formulations, making it the go-to choice for both brands and consumers looking for quick and effective product use.

The esterquats market in the U.S. is also on the rise, valued at USD 757.1 million in 2024, with a projected growth rate of 8.6% CAGR. In the U.S., the personal care and home care sectors are major contributors to the demand for esterquats, with consumers increasingly opting for premium products that align with their desire for high performance and sustainability. Esterquats are particularly popular in fabric care, where they are integral to the formulation of fabric softeners, playing a key role in the laundry care market. As demand for eco-friendly and effective solutions continues to grow, the U.S. esterquats market is set to maintain strong growth throughout the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for personal care products

- 3.6.1.2 Rising disposable income

- 3.6.1.3 Increasing demand in industrial applications

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility of raw materials

- 3.6.2.2 Availability of substitute products

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 TEA-Quats

- 5.3 MDEA-Quats

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Dry

- 6.3 Liquid

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Personal care products

- 7.3 Fabric care products

- 7.4 Home care products

- 7.5 Industrial applications

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ABITEC Corporation

- 9.2 AkzoNobel

- 9.3 BASF

- 9.4 Clariant

- 9.5 Chemelco

- 9.6 Dongnam Chemical Industries

- 9.7 Evonik Industries

- 9.8 Hangzhou Fandachem

- 9.9 Italmatch Chemicals

- 9.10 Kao Corporation

- 9.11 Stepan Company

- 9.12 Solvay

- 9.13 The Lubrizol Corporation