|

市場調查報告書

商品編碼

1667074

高階電動摩托車市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Premium Electric Motorcycle Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

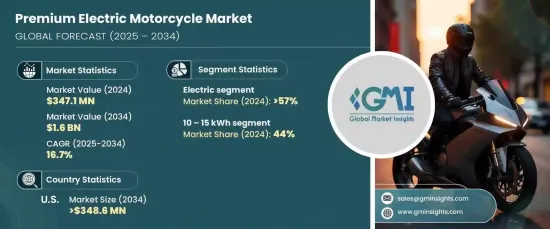

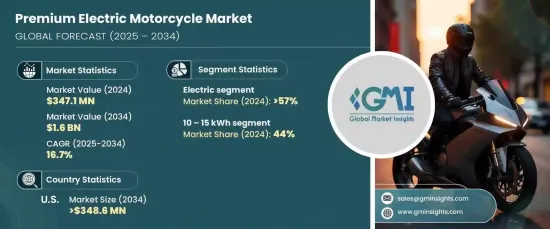

2024 年全球高階電動摩托車市場價值為 3.471 億美元,預計在 2025 年至 2034 年期間將實現 16.7% 的強勁複合年成長率。政府為減少碳排放而訂定的嚴格法規、購買電動車的財政激勵措施以及電池技術的快速進步進一步推動了對更清潔的出行解決方案的追求,而電池技術的快速進步則不斷提高電動自行車的性能和續航里程。

隨著技術創新重新定義電動摩托車市場,消費者被具有尖端功能、卓越速度和時尚設計的車型所吸引。從人工智慧騎乘模式到再生煞車系統,這些進步為摩托車愛好者和專業人士創造了引人注目的主張。此外,電動車基礎設施的投資不斷增加,包括快速充電網路的擴展,正在緩解里程焦慮,使電動摩托車成為日常通勤和長途旅行的可行選擇。這種性能、永續性和便利性的結合預計將在未來幾年吸引更廣泛的消費者群體。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.471億美元 |

| 預測值 | 16億美元 |

| 複合年成長率 | 16.7% |

市場按產品類型分為運動型、越野型和其他型,其中運動型佔據主導地位,到 2024 年將佔據 57% 的佔有率。高階電動運動摩托車擁有非凡的加速度,最高時速超過 200 公里/小時,同時還具有人工智慧輔助騎乘最佳化和再生煞車等創新功能。這些高科技產品使電動運動摩托車成為傳統 ICE 運動自行車的強大競爭對手,吸引了追求速度和永續性的騎士的注意。

就電池容量而言,市場分為 10 kWh 以下、10 - 15 kWh、15 - 20 kWh 和 21 kWh 以上。 10 - 15 kWh 類別由於其性能、續航里程和可負擔性的理想平衡,在 2024 年佔據了 44% 的主導市場佔有率。這些摩托車每次充電通常可行駛 100 至 200 英里,適合日常使用和長途旅行。憑藉高效的能源管理和令人印象深刻的加速能力,該領域可滿足廣大騎士的需求,同時又不影響品質或性能。

2024 年,美國市場佔全球收入的 82%,預計到 2034 年價值將達到 3.486 億美元。消費者對豪華和高性能電動車的偏好,加上政府的優惠政策和不斷擴大的快速充電站網路,進一步推動了美國高階電動摩托車的普及

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 技術提供者

- 零件供應商

- 原始設備製造商

- 最終用途

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 燃料成本上漲

- 政府激勵措施和政策

- 科技快速進步

- 環保意識增強

- 產業陷阱與挑戰

- 先進模型的初始成本較高

- 充電基礎設施有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 運動

- 越野

- 其他

第6章:市場估計與預測:依電池容量,2021 - 2034 年

- 主要趨勢

- 10千瓦時以下

- 10 – 15 千瓦時

- 15 – 20 千瓦時

- 21度以上

第7章:市場估計與預測:依價格範圍,2021 - 2034 年

- 主要趨勢

- 入門保費($10,000 - $20,000)

- 中保費 ($20,000 - $50,000)

- 高階保費(50,000 美元以上)

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Arc Vehicle Ltd.

- BMW Motorrad

- Damon Motorcycles

- Ducati Motor Holding SpA

- Energica Motor Company

- Harley-Davidson (LiveWire)

- Husqvarna Motorcycles

- KTM AG

- Lightning Motorcycle

- Maeving

- Savic Motorcycles

- Ultraviolette Automotive Pvt. Ltd.

- Verge Motorcycles

- Voxan Motors

- Zero Motorcycles

The Global Premium Electric Motorcycle Market, valued at USD 347.1 million in 2024, is expected to achieve a robust CAGR of 16.7% from 2025 to 2034. With growing awareness about climate change and an ever-increasing demand for sustainable transportation, electric motorcycles are becoming the preferred choice for consumers seeking performance-driven and environmentally friendly alternatives to traditional internal combustion engine (ICE) motorcycles. The push for cleaner mobility solutions is further propelled by stringent government regulations aimed at reducing carbon emissions, financial incentives for electric vehicle purchases, and the rapid advancement of battery technology, which continues to enhance the performance and range of electric bikes.

As technological innovations redefine the electric motorcycle market, consumers are drawn to models that offer cutting-edge features, superior speed, and sleek designs. From artificial intelligence-enabled riding modes to regenerative braking systems, these advancements create a compelling proposition for motorcycle enthusiasts and professionals alike. Additionally, growing investments in EV infrastructure, including the expansion of fast-charging networks, are easing range anxiety, making electric motorcycles a viable option for both daily commutes and long-distance travel. This combination of performance, sustainability, and convenience is expected to attract a broader consumer base in the coming years.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $347.1 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 16.7% |

The market is categorized by product type into sport, off-road, and others, with the sport segment dominating with a 57% share in 2024. By 2034, this segment is projected to generate USD 1 billion in revenue, driven by its appeal to performance-oriented riders. Premium electric sport motorcycles boast remarkable acceleration and top speeds exceeding 200 km/h, alongside innovative features like AI-assisted ride optimization and regenerative braking. These high-tech offerings position electric sport motorcycles as formidable competitors to traditional ICE sports bikes, capturing the attention of riders seeking both speed and sustainability.

In terms of battery capacity, the market is segmented into Below 10 kWh, 10 - 15 kWh, 15 - 20 kWh, and Above 21 kWh. The 10 - 15 kWh category held a dominant 44% market share in 2024 due to its ideal balance of performance, range, and affordability. These motorcycles typically deliver ranges of 100 to 200 miles per charge, making them practical for daily use and longer trips. With efficient energy management and impressive acceleration capabilities, this segment caters to a wide range of riders without compromising on quality or performance.

The U.S. market accounted for 82% of global revenue in 2024, with an anticipated value of USD 348.6 million by 2034. A robust infrastructure, high disposable income, and a strong presence of leading manufacturers drive growth in this region. Consumer preference for luxury and high-performance electric vehicles, coupled with attractive government incentives and an expanding network of fast-charging stations, further bolsters the adoption of premium electric motorcycles in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 OEMs

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising fuel costs

- 3.7.1.2 Government incentives and policies

- 3.7.1.3 Rapid technological advancements

- 3.7.1.4 Rising environmental awareness

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs for advanced models

- 3.7.2.2 Limited charging infrastructure

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Sport

- 5.3 Off-road

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Battery Capacity, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Below 10 kWh

- 6.3 10 – 15 kWh

- 6.4 15 – 20 kWh

- 6.5 Above 21 kWh

Chapter 7 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Entry-Level Premium ($10,000 - $20,000)

- 7.3 Mid-Premium ($20,000 - $50,000)

- 7.4 High-End Premium (Above $50,000)

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Arc Vehicle Ltd.

- 9.2 BMW Motorrad

- 9.3 Damon Motorcycles

- 9.4 Ducati Motor Holding S.p.A.

- 9.5 Energica Motor Company

- 9.6 Harley-Davidson (LiveWire)

- 9.7 Husqvarna Motorcycles

- 9.8 KTM AG

- 9.9 Lightning Motorcycle

- 9.10 Maeving

- 9.11 Savic Motorcycles

- 9.12 Ultraviolette Automotive Pvt. Ltd.

- 9.13 Verge Motorcycles

- 9.14 Voxan Motors

- 9.15 Zero Motorcycles