|

市場調查報告書

商品編碼

1667087

正子斷層掃描 (PET) 市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Positron Emission Tomography (PET) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

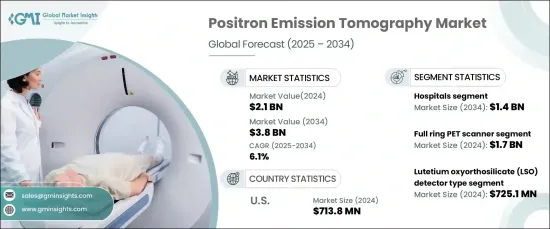

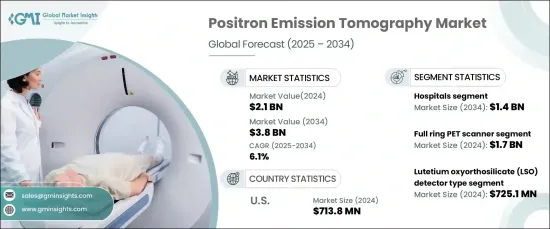

2024 年全球正子斷層掃描市場價值 21 億美元,預計將大幅成長,預計 2025 年至 2034 年的複合年成長率為 6.1%。 PET 技術是一種尖端成像方法,透過提供高解析度功能影像來揭示體內的代謝和生理活動,已成為醫學診斷中不可或缺的一部分。其精確的影像能力對於診斷、監測和管理複雜的醫療狀況至關重要。癌症、心血管疾病和神經系統疾病等慢性疾病的發生率不斷上升,進一步推動了對 PET 掃描儀等先進診斷工具的需求。隨著世界各地的醫療保健系統強調早期檢測和精準醫療,PET 影像正在廣泛的應用,鞏固了其在現代臨床實踐中的作用。

快速的技術進步正在拓展 PET 的應用範圍並改變其在疾病管理中的作用。一項值得注意的創新是飛行時間 PET 技術,它透過計算光子在源和探測器之間傳播的時間來提高影像解析度並減少掃描時間。這項突破不僅實現了更快的成像,而且還提供了更高品質的視覺效果,使其成為 PET 市場未來成長的基石。醫療保健提供者越來越認知到此類技術在改善患者治療效果方面的價值,這推動了對 PET 創新的進一步投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 21億美元 |

| 預測值 | 38億美元 |

| 複合年成長率 | 6.1% |

按產品類型,市場分為部分環 PET 掃描儀和全環 PET 掃描儀,後者將在 2024 年引領市場,創造 17 億美元的收入。全環 PET 掃描儀因其多功能性而備受讚譽,因為它們支持腫瘤學、心臟病學、神經病學和精神病學等廣泛的應用。他們能夠為不同的臨床專業提供詳細的影像,從而確保他們在市場上持續佔據主導地位。人們對 PET 診斷準確性的認知不斷提高,加上對個人化醫療的需求不斷成長以及影像技術的進步,進一步推動了全環 PET 系統的採用。

根據偵測器類型,市場包括數位光子計數器 (DPC)、矽光電倍增管 (SiPM)、镥釔正矽酸鹽 (LYSO)、镥氧正矽酸鹽 (LSO) 和其他偵測器技術。 LSO 探測器在 2024 年脫穎而出,為市場貢獻了 7.251 億美元。這些探測器因其卓越的靈敏度、增強的空間解析度和更快的成像能力而備受追捧。 LSO 晶體的先進性能,包括其快速的光衰減時間和精確的光子檢測,使其在 PET 領域脫穎而出,成為尖端成像系統的首選。

美國 PET 市場將於 2024 年創造 7.138 億美元的產值,並預計在整個預測期內持續成長。慢性病(尤其是癌症和心血管疾病)發生率的上升推動了先進影像解決方案的採用。加上 PET 技術的不斷進步,例如解析度的提高和掃描時間的縮短,美國市場仍然處於全球 PET 創新的前沿。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 將 X 光電腦斷層掃描 (CT) 整合到 PET 中

- 正子斷層掃描技術進步

- 放射性藥物 PET 分析需求不斷成長

- 擴大轉向影像引導干預

- 產業陷阱與挑戰

- 放射性同位素的壽命縮短

- 嚴格的監管環境

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 未來市場趨勢

- 重要新聞和舉措

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 部分環形 PET 掃描儀

- 全環 PET 掃描儀

第6章:市場估計與預測:按探測器類型,2021 – 2034 年

- 主要趨勢

- 氧化矽酸镥 (LSO)

- 矽光電倍增管 (SiPM)

- 矽酸釔镥 (LYSO)

- 數位光子計數器(DPC)

- 其他探測器類型

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 門診手術中心

- 其他最終用途

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Canon Medical Systems Corporation

- CMR Naviscan

- Fujifilm Holdings Corporation

- GE Healthcare

- Koninklijke Philips

- Mediso

- Minfound Medical Systems

- Molecubes

- Neusoft Corporation

- Oncovision

- Positron

- Radialis

- Siemens Healthineers

- Toshiba International Corporation

- Yangzhou Kindsway Biotech

The Global Positron Emission Tomography Market, valued at USD 2.1 billion in 2024, is poised for significant growth, with a projected CAGR of 6.1% from 2025 to 2034. PET technology, a cutting-edge imaging method, has become indispensable in medical diagnostics by providing high-resolution functional images that reveal metabolic and physiological activities within the body. Its precise imaging capabilities are vital in diagnosing, monitoring, and managing complex medical conditions. The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is further driving demand for advanced diagnostic tools like PET scanners. As healthcare systems worldwide emphasize early detection and precision medicine, PET imaging is gaining widespread adoption, cementing its role in modern clinical practices.

Rapid technological advancements are broadening PET's applications and transforming its role in disease management. One notable innovation is time-of-flight PET technology, which enhances image resolution and reduces scan times by calculating the time photons take to travel between the source and detector. This breakthrough not only enables faster imaging but also delivers superior-quality visuals, making it a cornerstone of the PET market's future growth. Healthcare providers are increasingly recognizing the value of such technologies in improving patient outcomes, which is fueling further investment in PET innovations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 6.1% |

The market is segmented by product type into partial ring PET scanners and full ring PET scanners, with the latter leading the market in 2024 by generating USD 1.7 billion in revenue. Full-ring PET scanners are celebrated for their versatility, as they support a wide range of applications across oncology, cardiology, neurology, and psychiatry. Their ability to deliver detailed imaging across diverse clianical specialties ensures their continued dominance in the market. Growing awareness of PET's diagnostic accuracy, coupled with the rising demand for personalized medicine and advancements in imaging technology, further boosts the adoption of full ring PET systems.

By detector type, the market includes digital photon counters (DPC), silicon photomultiplier (SiPM), lutetium yttrium orthosilicate (LYSO), lutetium oxyorthosilicate (LSO), and other detector technologies. LSO detectors stood out in 2024, contributing USD 725.1 million to the market. These detectors are highly sought after for their superior sensitivity, enhanced spatial resolution, and faster imaging capabilities. The advanced performance of LSO crystals, including their rapid light decay time and precise photon detection, sets them apart in the PET landscape, making them a preferred choice for cutting-edge imaging systems.

The U.S. PET market, generating USD 713.8 million in 2024, is positioned for sustained growth throughout the forecast period. The rising incidence of chronic diseases, particularly cancer and cardiovascular conditions, is driving increased adoption of advanced imaging solutions. Coupled with continuous advancements in PET technology, such as improved resolution and reduced scan durations, the U.S. market remains at the forefront of global PET innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Integration of X-ray computed tomography (CT) into PET

- 3.2.1.2 Technological advancements in positron emission tomography

- 3.2.1.3 Rising demand for PET analysis in radio pharmaceuticals

- 3.2.1.4 Increasing shift towards image-guided interventions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Diminished life span of radioisotopes

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Key news and initiatives

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Partial ring PET scanner

- 5.3 Full ring PET scanner

Chapter 6 Market Estimates and Forecast, By Detector Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lutetium oxyorthosilicate (LSO)

- 6.3 Silicon photomultiplier (SiPM)

- 6.4 Lutetium yttrium orthosilicate (LYSO)

- 6.5 Digital photon counters (DPC)

- 6.6 Other detector types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic centers

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Canon Medical Systems Corporation

- 9.2 CMR Naviscan

- 9.3 Fujifilm Holdings Corporation

- 9.4 GE Healthcare

- 9.5 Koninklijke Philips

- 9.6 Mediso

- 9.7 Minfound Medical Systems

- 9.8 Molecubes

- 9.9 Neusoft Corporation

- 9.10 Oncovision

- 9.11 Positron

- 9.12 Radialis

- 9.13 Siemens Healthineers

- 9.14 Toshiba International Corporation

- 9.15 Yangzhou Kindsway Biotech