|

市場調查報告書

商品編碼

1667121

超低溫冷凍機市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ultra-low Temperature Freezers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

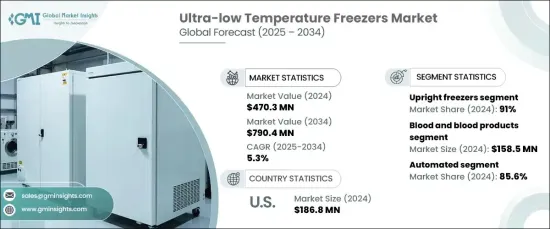

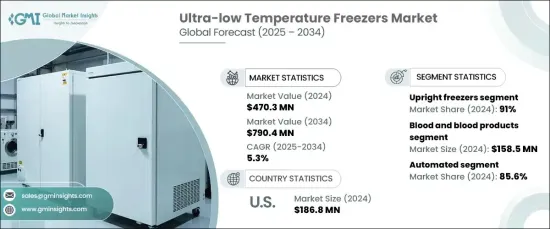

2024 年全球超低溫冷凍機市場價值為 4.703 億美元,預計 2025 年至 2034 年的複合年成長率為 5.3%。生物庫正在成為保存這些關鍵材料的基石,推動基因研究、再生醫學和幹細胞療法等領域的進步。疫苗儲存解決方案的創新、製藥和生物技術研究的擴展以及對節能技術的日益重視進一步推動了這一成長。

除了醫療保健的進步之外,嚴格的生物樣本保存監管準則和不斷增加的醫療基礎設施投資也在推動全球採用超低溫冰箱。市場還受益於冷凍機技術的進步,例如更好的溫度均勻性、增強的能源效率以及確保樣品儲存最佳條件的智慧監控系統。這些創新解決了對環境影響的擔憂,同時滿足了實驗室、研究機構和醫療機構對大容量儲存的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.703億美元 |

| 預測值 | 7.904 億美元 |

| 複合年成長率 | 5.3% |

市場包括兩種主要產品類型:立式冷凍櫃和臥式冷凍櫃。立式冷凍機在 2024 年佔據了市場主導地位,由於其節省空間的設計和易於訪問性而佔據了相當大的佔有率。它們的垂直配置可以更好地組織和檢索樣本,使其成為效率和可近性至關重要的實驗室、研究中心和醫療機構的首選。立式冷凍機在地面空間有限的環境中尤其受歡迎,並且因其節能運作而受到青睞,從而得到了廣泛採用。

超低溫冰箱的應用涉及多個領域,包括器官、藥品、血液和血液製品、法醫研究和基因組研究。其中,血液及血液製品板塊佔據領先地位。保存血液、血漿和其他衍生物的需求不斷成長,推動了血庫和醫療機構使用超低溫冰箱。隨著對關鍵生物材料的可靠、高效儲存解決方案的需求不斷增加,該領域繼續推動市場成長。

美國是超低溫冷凍機市場的重要貢獻者。這一成長得益於完善的醫療保健基礎設施、蓬勃發展的製藥和生物技術行業以及強勁的研發活動。製藥業對超低溫冰箱進行長期樣本保存的依賴是該市場的關鍵促進因素。此外,血庫對血液儲存解決方案的需求不斷成長,進一步加強了該市場在美國擴張,並使其成為該領域的全球領導者。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 生物銀行和冷凍保存的需求不斷成長

- 疫苗儲存方面的進展

- 製藥和生物技術研究的成長

- 節能超低溫冷凍機的創新

- 產業陷阱與挑戰

- 與醫療級冷凍系統相關的監管問題

- 超低溫冰箱成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 立式冷凍櫃

- 立式冰櫃

- 其他類型

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 血液和血液製品

- 器官

- 藥品

- 法醫和基因組研究

- 其他應用

第 7 章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 自動化

- 半自動化

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Arctiko

- Avantor (VWR International)

- Azbil Corporation

- BINDER

- CryoScientific

- Eppendorf

- Esco Micro

- EVERMED

- Haier Biomedical

- Helmer Scientific

- Labcold

- LabRepCo

- PHC Holdings Corporation

- Stirling Ultracold (Global Cooling)

- Thermo Fischer Scientific

- Vestfrost Solutions

The Global Ultra-Low Temperature Freezers Market was valued at USD 470.3 million in 2024 and is projected to grow at a CAGR of 5.3% from 2025 to 2034. The increasing demand for reliable long-term storage solutions for biological samples such as blood, tissues, stem cells, and genetic materials is a significant factor driving this growth. Biobanks are emerging as a cornerstone in preserving these critical materials, fueling advancements in fields like genetic research, regenerative medicine, and stem cell therapies. This growth is further bolstered by innovations in vaccine storage solutions, the expansion of pharmaceutical and biotechnology research, and a growing emphasis on energy-efficient technologies.

In addition to healthcare advancements, stringent regulatory guidelines for biological sample preservation and growing investments in medical infrastructure are encouraging the adoption of ultra-low temperature freezers worldwide. The market is also benefiting from advancements in freezer technology, such as better temperature uniformity, enhanced energy efficiency, and smart monitoring systems that ensure optimal conditions for sample storage. These innovations are addressing concerns about environmental impact while meeting the need for high-capacity storage in laboratories, research facilities, and healthcare institutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $470.3 Million |

| Forecast Value | $790.4 Million |

| CAGR | 5.3% |

The market comprises two primary product types: upright freezers and chest freezers. Upright freezers dominated the market in 2024, capturing a significant share due to their space-saving designs and ease of access. Their vertical configuration allows for better organization and retrieval of samples, making them a preferred choice for laboratories, research centers, and healthcare facilities where efficiency and accessibility are critical. Upright freezers are especially popular in environments with limited floor space and are favored for their energy-efficient operations, contributing to their widespread adoption.

Applications for ultra-low temperature freezers span across a variety of sectors, including organs, pharmaceuticals, blood and blood products, forensic research, and genomic studies. Among these, the blood and blood products segment holds a leading position. The increasing demand for preserving blood, plasma, and other derivatives is propelling the use of ultra-low temperature freezers in blood banks and healthcare facilities. This segment continues to drive market growth as the need for reliable and efficient storage solutions for critical biological materials escalates.

The United States stands out as a significant contributor to the ultra-low temperature freezers market. This growth is supported by a well-established healthcare infrastructure, a thriving pharmaceutical and biotechnology sector, and robust research and development activities. The pharmaceutical industry's reliance on ultra-low temperature freezers for long-term sample preservation is a key driver in this market. Additionally, the rising demand for blood storage solutions in blood banks further reinforces the market's expansion in the U.S., positioning it as a global leader in this space.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for biobanking and cryopreservation

- 3.2.1.2 Advancements in vaccine storage

- 3.2.1.3 Growth in pharmaceutical and biotechnology research

- 3.2.1.4 Innovations in energy efficient ultra-low temperature freezers

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory issues pertaining to medical grade refrigeration systems

- 3.2.2.2 High cost associated with ultra-low temperature freezers

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn and Units)

- 5.1 Key trends

- 5.2 Chest freezers

- 5.3 Upright freezers

- 5.4 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood and blood products

- 6.3 Organs

- 6.4 Pharmaceuticals

- 6.5 Forensic and genomic research

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Automated

- 7.3 Semi-automated

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Arctiko

- 9.2 Avantor (VWR International)

- 9.3 Azbil Corporation

- 9.4 BINDER

- 9.5 CryoScientific

- 9.6 Eppendorf

- 9.7 Esco Micro

- 9.8 EVERMED

- 9.9 Haier Biomedical

- 9.10 Helmer Scientific

- 9.11 Labcold

- 9.12 LabRepCo

- 9.13 PHC Holdings Corporation

- 9.14 Stirling Ultracold (Global Cooling)

- 9.15 Thermo Fischer Scientific

- 9.16 Vestfrost Solutions