|

市場調查報告書

商品編碼

1667150

超級結 MOSFET 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Super Junction MOSFET Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

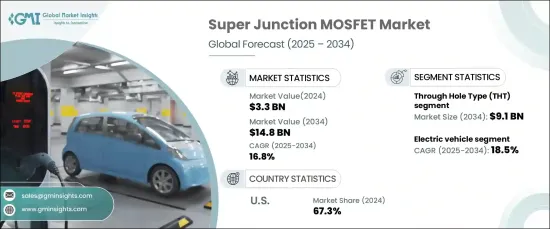

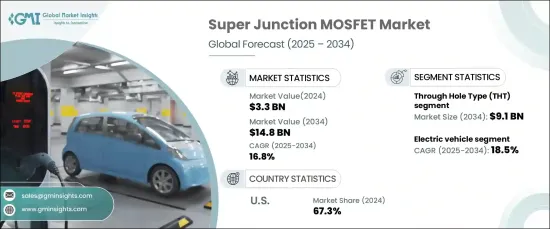

2024 年全球超級結 MOSFET 市場價值為 33 億美元,預計 2025 年至 2034 年期間的複合年成長率為 16.8%。超級結 MOSFET 在最小化傳導和開關損耗、提高整體系統效率方面發揮著至關重要的作用。這些設備對於再生能源、工業自動化和電動車等能源密集產業來說是不可或缺的,因為提高功率密度和降低能源消耗至關重要。電力電子領域節能技術的日益普及以及高壓應用的進步,持續推動對超級結 MOSFET 的需求。電信、汽車和資料中心等行業正在擴大部署這些組件,以支援高效的能源轉換、可靠的性能和緊湊的系統設計。市場的發展軌跡反映了對先進電源解決方案的需求,符合全球永續和節能創新的趨勢。

根據類型,市場分為通孔型(THT)和表面貼裝型(SMT)。預計到 2034 年,THT 領域的市場規模將達到 91 億美元,這得益於其耐用性和處理高功率耗散的能力。這些 MOSFET 非常適合需要機械強度和強大熱管理的嚴苛應用。常見用例包括電源、汽車系統和工業設備。儘管向小型化技術轉變,THT MOSFET 對於惡劣環境下的大電流應用仍然至關重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 33億美元 |

| 預測值 | 148億美元 |

| 複合年成長率 | 16.8% |

相反,SMT MOSFET 因其緊湊的設計和在高頻場景中的卓越性能而越來越受到關注。這些組件在空間效率和散熱至關重要的應用領域中表現出色,例如消費性電子產品、電信和再生能源系統。 SMT 設備可降低寄生電感並提高電路性能,使其適用於需要先進熱管理的現代化高密度電子系統。

在應用方面,超結 MOSFET 廣泛應用於能源和電力系統、逆變器、工業設備和電動車。電動車領域預計將呈現最快的成長,預計 2025 年至 2034 年之間的複合年成長率為 18.5%。 這些 MOSFET 可提高電動車動力系統、充電站和電池管理系統的能源效率,從而最佳化整體車輛性能。

在北美,美國佔據市場主導地位,2024 年佔地區收入的 67.3%。這些因素為超結 MOSFET 技術的持續進步和應用創造了強大的生態系統。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 能源效率需求不斷成長

- 電力電子應用快速成長

- 半導體技術的進步

- 汽車產業不斷發展,向再生能源系統轉變

- 擴大不間斷電源系統的生產

- 產業陷阱與挑戰

- 製造成本高、生產流程複雜

- 技術進步與快速創新週期

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 通孔型

- 表面貼裝型

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 能源和電力

- 消費性電子產品

- 逆變器和 UPS

- 電動車

- 產業體系

- 其他

第 7 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Alpha and Omega Semiconductor

- Diodes Incorporated

- Fuji Electric

- Infineon Technologies

- KEC Corporation

- Microchip Technology

- Mitsubishi Electric

- Nantong Hornby Electronic Co., Ltd.

- Nexperia

- NXP Semiconductors

- ON Semiconductor

- OS ELECTRONICS Co., Ltd.

- Renesas Electronics

- Richtek Technology Corporation

- ROHM Semiconductor

- SemiHow

- STMicroelectronics

- Texas Instruments

- Toshiba Corporation

- Vishay Intertechnology

The Global Super Junction MOSFET Market, valued at USD 3.3 billion in 2024, is anticipated to expand at a CAGR of 16.8% from 2025 to 2034. This rapid growth is largely attributed to increasing emphasis on energy efficiency across various industries. Super junction MOSFETs play a crucial role in minimizing conduction and switching losses, enhancing overall system efficiency. These devices are indispensable in energy-intensive sectors such as renewable energy, industrial automation, and electric vehicles, where improving power density and reducing energy consumption are vital. The growing adoption of energy-efficient technologies in power electronics, along with advancements in high-voltage applications, continues to propel the demand for super junction MOSFETs. Industries such as telecommunications, automotive, and data centers are increasingly deploying these components to support efficient energy conversion, reliable performance, and compact system designs. The market's trajectory reflects the need for advanced power solutions in line with global trends toward sustainable and energy-efficient innovations.

The market is segmented by type into Through Hole Type (THT) and Surface Mount Type (SMT). The THT segment is forecasted to reach USD 9.1 billion by 2034, driven by its durability and ability to handle high power dissipation. These MOSFETs are ideal for demanding applications requiring mechanical strength and robust thermal management. Common use cases include power supplies, automotive systems, and industrial equipment. Despite the shift toward miniaturized technologies, THT MOSFETs remain vital for high-current applications in harsh environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.3 Billion |

| Forecast Value | $14.8 Billion |

| CAGR | 16.8% |

Conversely, SMT MOSFETs are gaining traction for their compact design and superior performance in high-frequency scenarios. These components excel in applications where space efficiency and heat dissipation are critical, such as consumer electronics, telecommunications, and renewable energy systems. SMT devices reduce parasitic inductance and improve circuit performance, making them suitable for modern, high-density electronic systems that require advanced thermal management.

On the application front, super junction MOSFETs are extensively used in energy and power systems, inverters, industrial setups, and electric vehicles. The electric vehicle segment is expected to exhibit the fastest growth, with a projected CAGR of 18.5% between 2025 and 2034. These MOSFETs enhance the energy efficiency of EV powertrains, charging stations, and battery management systems, optimizing overall vehicle performance.

In North America, the United States dominates the market, accounting for 67.3% of regional revenue in 2024. Growth is fueled by investments in renewable energy, EV infrastructure, and industrial automation, alongside government initiatives promoting clean energy and stringent efficiency regulations. These factors create a robust ecosystem for the continued advancement and adoption of super junction MOSFET technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for energy efficiency

- 3.6.1.2 Rapid growth in power electronics applications

- 3.6.1.3 Advancements in semiconductor technology

- 3.6.1.4 Growing automotive sector and shift towards renewable energy system

- 3.6.1.5 Expansion in the production of uninterruptible power systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing costs and complex production processes

- 3.6.2.2 Technological advancements and rapid innovation cycles

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Through hole type

- 5.3 Surface mount type

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Energy and power

- 6.3 Consumer electronics

- 6.4 Inverter and UPS

- 6.5 Electric vehicle

- 6.6 Industrial system

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alpha and Omega Semiconductor

- 8.2 Diodes Incorporated

- 8.3 Fuji Electric

- 8.4 Infineon Technologies

- 8.5 KEC Corporation

- 8.6 Microchip Technology

- 8.7 Mitsubishi Electric

- 8.8 Nantong Hornby Electronic Co., Ltd.

- 8.9 Nexperia

- 8.10 NXP Semiconductors

- 8.11 ON Semiconductor

- 8.12 OS ELECTRONICS Co., Ltd.

- 8.13 Renesas Electronics

- 8.14 Richtek Technology Corporation

- 8.15 ROHM Semiconductor

- 8.16 SemiHow

- 8.17 STMicroelectronics

- 8.18 Texas Instruments

- 8.19 Toshiba Corporation

- 8.20 Vishay Intertechnology