|

市場調查報告書

商品編碼

1667175

脂肪吸除設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Liposuction Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

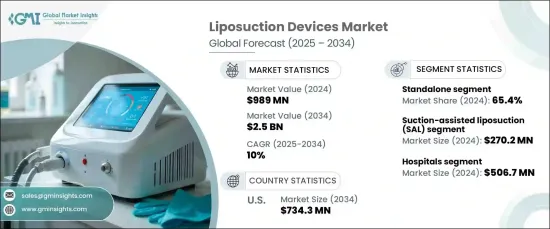

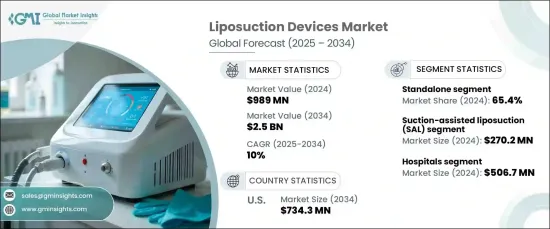

2024 年全球抽脂設備市場價值為 9.89 億美元,預計 2025 年至 2034 年期間將以 10% 的強勁複合年成長率成長。隨著對美容手術和身體塑形治療的需求激增,市場正在大幅成長。可支配收入的增加和消費者對整容手術意識的增強是推動這一成長的重要因素。隨著人們越來越專注於改善自己的外表,脂肪抽吸設備市場正受益於向更安全、侵入性更小的塑身解決方案的轉變。

技術進步在塑造該市場的成長軌跡方面發揮關鍵作用。雷射輔助抽脂術、超音波輔助抽脂術和冷凍溶脂術等創新技術的引入極大地提高了脂肪去除手術的安全性、精確度和整體有效性。這些技術由於其微創性、較短的恢復時間和良好的美學效果而越來越受歡迎。隨著這些技術變得越來越容易取得,越來越多的患者選擇這些先進的治療方法,從而帶來巨大的市場發展動力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.89億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 10% |

就產品類型而言,市場分為獨立設備和攜帶式設備,其中獨立設備將在 2024 年佔據市場主導地位,佔 65.4% 的佔有率。這些設備因其先進的技術和處理更複雜程序的能力而被廣泛應用於高階醫療機構,包括醫院和大型整形外科中心。獨立設備因其卓越的效果而受到青睞,特別是對於需要高精度和患者安全的複雜和大規模脂肪去除治療。

市場根據技術進一步細分,具有幾種類型的抽脂設備,例如負壓輔助抽脂 (SAL)、腫脹抽脂、超音波輔助抽脂 (UAL)、動力輔助抽脂 (PAL)、水輔助抽脂術 (Bodyjet) 和雷射輔助抽脂 (LAL)。 2024 年,負壓抽脂術 (SAL) 將引領市場,佔據主導地位,收入佔有率達 2.702 億美元。 SAL 仍然是一種受歡迎的選擇,因為它是一種透過使用套管手動抽吸來去除脂肪的簡單且高效的方法。其已確立的安全性和有效性使其成為許多尋求有效脂肪去除解決方案的患者的首選。

在美國,抽脂設備市場將經歷顯著成長,預計到 2034 年將達到 7.343 億美元。隨著人們越來越意識到肥胖帶來的健康風險,如心臟病和糖尿病,越來越多的消費者選擇抽脂術作為有針對性去除脂肪的可行選擇。預計這種日益增強的認知將進一步刺激對這些程序的需求,從而促進市場持續擴大。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 微創手術越來越受青睞

- 慢性病盛行率不斷上升

- 技術進步

- 老年人口不斷增加

- 產業陷阱與挑戰

- 對替代治療方法的認知度低且可用性低

- 治療費用高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 獨立

- 便攜的

第6章:市場估計與預測:按技術,2021 – 2034 年

- 主要趨勢

- 腫脹抽脂術

- 超音波輔助抽脂(UAL)

- 雷射輔助抽脂(LAL)

- 動力輔助抽脂術 (PAL)

- BodyJet 或水輔助抽脂 (WAL)

- 抽脂手術(SAL)

- 其他技術

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診所

- 美容整形中心

- 其他最終用途

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 瑞士

- 荷蘭

- 丹麥

- 波蘭

- 瑞典

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 紐西蘭

- 越南

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 土耳其

第9章:公司簡介

- Bausch Health Companies

- Cynosure

- Euromi

- Human Med AG

- InMode

- INTERmedic Arfran

- INVAMED

- Johnson & Johnson

- LHbiomed

- MicroAire

- MOLLER Medical GmbH

- NOUVAG AG

- Sciton

- Sisram Medical

- Vitruvian Partners

The Global Liposuction Devices Market was valued at USD 989 million in 2024 and is projected to grow at a robust CAGR of 10% from 2025 to 2034. Liposuction devices are crucial in cosmetic and plastic surgery for fat removal in targeted body areas, achieved through small incisions and suction techniques. With a surge in demand for aesthetic procedures and body contouring treatments, the market is seeing substantial growth. The rise in disposable incomes and heightened consumer awareness of cosmetic procedures are significant factors driving this expansion. As people increasingly focus on enhancing their appearance, the liposuction devices market is benefiting from a shift towards safer, less invasive body sculpting solutions.

Technological advancements play a pivotal role in shaping the growth trajectory of this market. The introduction of innovative techniques such as laser-assisted liposuction, ultrasound-assisted liposuction, and cryolipolysis has greatly improved the safety, precision, and overall effectiveness of fat removal procedures. These technologies are gaining popularity due to their minimally invasive nature, reduced recovery times, and appealing aesthetic results. As these techniques become more accessible, an increasing number of patients are opting for these advanced treatments, leading to significant market momentum.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $989 Million |

| Forecast Value | $2.5 Billion |

| CAGR | 10% |

In terms of product type, the market is divided into standalone and portable devices, with the standalone segment dominating the market in 2024, accounting for a substantial 65.4% share. These devices are widely used in high-end medical facilities, including hospitals and large cosmetic surgery centers, due to their advanced technology and ability to handle more complex procedures. Standalone devices are preferred for their superior outcomes, particularly for intricate and large-scale fat removal treatments that require high precision and patient safety.

The market is further segmented by technology, featuring several types of liposuction devices, such as suction-assisted liposuction (SAL), tumescent liposuction, ultrasound-assisted liposuction (UAL), power-assisted liposuction (PAL), water-assisted liposuction (Bodyjet), and laser-assisted liposuction (LAL). In 2024, suction-assisted liposuction (SAL) leads the market, with a dominant revenue share of USD 270.2 million. SAL remains a popular choice due to its simple yet highly effective method of fat removal through manual suction with a cannula. Its established safety profile and effectiveness make it the preferred option for many patients seeking a proven solution to fat removal.

In the U.S., the liposuction devices market is set to experience significant growth, with projections indicating it will reach USD 734.3 million by 2034. This rise is primarily driven by the increasing prevalence of obesity, with more individuals seeking fat removal as part of their weight loss journey. As awareness of the health risks associated with obesity, such as heart disease and diabetes, grows, more consumers are turning to liposuction as a viable option for targeted fat removal. This growing awareness is expected to further fuel demand for these procedures, contributing to the continued expansion of the market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing preference for minimally invasive procedures

- 3.2.1.2 Growing prevalence of chronic diseases

- 3.2.1.3 Advancements in technology

- 3.2.1.4 Growing geriatric population

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Low awareness and availability of alternative treatment method

- 3.2.2.2 High treatment cost

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Standalone

- 5.3 Portable

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Tumescent liposuction

- 6.3 Ultrasound-assisted liposuction (UAL)

- 6.4 Laser-assisted liposuction (LAL)

- 6.5 Power-assisted liposuction (PAL)

- 6.6 BodyJet or water assisted liposuction (WAL)

- 6.7 Suction-assisted liposuction (SAL)

- 6.8 Other technologies

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Cosmetic surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Switzerland

- 8.3.7 Netherlands

- 8.3.8 Denmark

- 8.3.9 Poland

- 8.3.10 Sweden

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 New Zealand

- 8.4.7 Vietnam

- 8.4.8 Indonesia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Colombia

- 8.5.5 Chile

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Turkey

Chapter 9 Company Profiles

- 9.1 Bausch Health Companies

- 9.2 Cynosure

- 9.3 Euromi

- 9.4 Human Med AG

- 9.5 InMode

- 9.6 INTERmedic Arfran

- 9.7 INVAMED

- 9.8 Johnson & Johnson

- 9.9 LHbiomed

- 9.10 MicroAire

- 9.11 MOLLER Medical GmbH

- 9.12 NOUVAG AG

- 9.13 Sciton

- 9.14 Sisram Medical

- 9.15 Vitruvian Partners