|

市場調查報告書

商品編碼

1667200

活性碳纖維 (ACF) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Activated Carbon Fiber (ACF) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

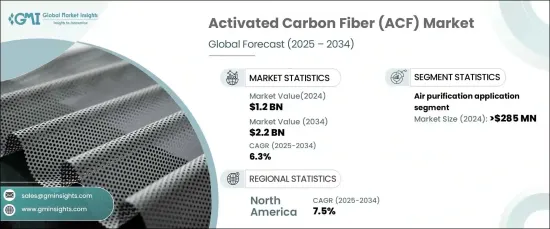

2024 年全球活性碳纖維市場規模達到 12 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.3%。隨著工業化的快速發展和水資源的日益減少,對有效的廢水處理解決方案的需求比以往任何時候都更加迫切。來自工業和生活來源的污染物,包括固體、液體和氣體污染物,帶來了嚴重的環境風險,這進一步加速了對基於 ACF 的解決方案的需求。

聚丙烯腈 (PAN) 基 ACF 因其優異的抗張強度和多功能性預計將實現強勁成長。 PAN作為一種熱塑性半結晶聚合物,經過碳化、控制活化、穩定化等工藝,可生產出高品質的ACF。它的耐用性和效率使其成為電容器、催化劑載體和過濾系統等應用的理想選擇。對催化劑載體的需求不斷增加,加上超級電容器技術的進步,進一步推動了對 PAN 基材的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 12億美元 |

| 預測值 | 22億美元 |

| 複合年成長率 | 6.3% |

空氣淨化應用在 2024 年佔據了相當大的收入,凸顯了 ACF 在解決空氣品質問題方面日益成長的重要性。全球空氣污染法規促使各行各業採用先進的過濾技術,其中ACF過濾器已被證明能有效吸收氮氧化物 (NOx) 等污染物。交通運輸、工業單位和住宅環境等領域採用基於 ACF 的空氣過濾系統對市場擴張做出了重大貢獻。

預計北美將實現顯著成長,到 2034 年複合年成長率將達到 7.5%。增加對環境保護的投資,加上向永續解決方案的轉變,進一步促進了採用。美國仍然是ACF的主要消費國,特別是在水處理和空氣淨化應用領域。北美各地成熟的製造商和廣泛的分銷網路進一步增強了市場前景。

受環境問題、材料技術進步和永續工業解決方案日益普及的推動,活性碳纖維市場將穩步擴大。各行各業對高效水和空氣處理系統的需求日益成長,使得 ACF 成為實現全球環境和法規合規性的關鍵組成部分。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 北美:廢水處理需求不斷增加

- 歐洲:活性碳纖維在空氣淨化領域的新興應用

- 亞太地區:與空氣和水污染相關的環境問題日益嚴重

- 產業陷阱與挑戰

- 產品成本高且原料供應波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模及預測:按材料,2021-2034 年

- 主要趨勢

- 纖維素基

- 聚丙烯腈(PAN)基

- 酚醛樹脂基

- 基於音調

- 其他

第 6 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 空氣淨化

- 水處理

- 化學回收

- 催化劑載體

- 其他

第 7 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Anshan Sinocarb Carbon Fibers

- Awa Paper & Technological Company

- Evertech Envisafe Ecology

- Gun Ei Chemical Industry

- Hangzhou Nature Technology

- HP Materials Solutions

- Jiangsu Kejing Carbon Fiber

- Jiangsu Sutong Carbon Fiber

- Jiangsu Tongkang Activated Carbon Fiber

- Kuraray

- OJSC – Open Joint Stock Company

- Osaka Gas Chemical

- Toyobo

- Unitika

The Global Activated Carbon Fiber Market reached USD 1.2 billion in 2024 and is projected to grow at a CAGR of 6.3% between 2025 and 2034. The rising focus on water treatment, driven by strict government regulations and increasing public health concerns, is fueling market growth. With rapid industrialization and dwindling water resources, the need for effective wastewater treatment solutions is more critical than ever. Contaminants from industrial and domestic sources, including solid, liquid, and gaseous pollutants, pose significant environmental risks, which further accelerates demand for ACF-based solutions.

Polyacrylonitrile (PAN) based ACF is expected to witness robust growth owing to its superior tensile strength and versatility. As a thermoplastic semi-crystalline polymer, PAN undergoes processes such as carbonization, controlled activation, and stabilization to produce high-quality ACF. Its durability and efficiency make it ideal for applications such as capacitors, catalyst carriers, and filtration systems. The increasing need for catalyst carriers, combined with advancements in supercapacitor technologies, is further driving demand for PAN-based materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 6.3% |

Air purification applications accounted for significant revenue in 2024, highlighting the growing importance of ACF in addressing air quality concerns. Global air pollution regulations are prompting industries to adopt advanced filtration technologies, with ACF filters proving effective in absorbing pollutants like nitrogen oxides (NOx). The adoption of ACF-based air filtration systems across sectors such as transportation, industrial units, and residential settings is contributing significantly to market expansion.

North America is anticipated to record notable growth, with a projected CAGR of 7.5% through 2034. The region's thriving chemical and petroleum industries are key drivers for ACF demand, particularly for chemical recovery and solvent purification systems. Increasing investments in environmental protection, coupled with a shift toward sustainable solutions, further bolster adoption. The U.S. remains a major consumer of ACF, particularly in water treatment and air purification applications. The presence of established manufacturers and extensive distribution networks across North America further strengthens the market outlook.

The activated carbon fiber market is set to expand steadily, driven by environmental concerns, advancements in material technologies, and the growing adoption of sustainable industrial solutions. The rising need for efficient water and air treatment systems across industries positions ACF as a critical component in achieving environmental and regulatory compliance globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 North America: Increasing demand for wastewater treatment

- 3.6.1.2 Europe: Emerging application of activated carbon fiber in air purification

- 3.6.1.3 Asia Pacific: Increasing environmental concerns related to air and water pollution

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High product cost and fluctuation in raw material availability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Material, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Cellulose based

- 5.3 Polyacrylonitrile (PAN) based

- 5.4 Phenolic resin based

- 5.5 Pitch based

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Air purification

- 6.3 Water treatment

- 6.4 Chemical recovery

- 6.5 Catalyst carrier

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Anshan Sinocarb Carbon Fibers

- 8.2 Awa Paper & Technological Company

- 8.3 Evertech Envisafe Ecology

- 8.4 Gun Ei Chemical Industry

- 8.5 Hangzhou Nature Technology

- 8.6 HP Materials Solutions

- 8.7 Jiangsu Kejing Carbon Fiber

- 8.8 Jiangsu Sutong Carbon Fiber

- 8.9 Jiangsu Tongkang Activated Carbon Fiber

- 8.10 Kuraray

- 8.11 OJSC – Open Joint Stock Company

- 8.12 Osaka Gas Chemical

- 8.13 Toyobo

- 8.14 Unitika

![活性碳纖維(ACF)市場:趨勢、機遇、競爭對手分析 [2023-2028]](/sample/img/cover/42/1289752.png)