|

市場調查報告書

商品編碼

1684521

救護車擔架市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Ambulance Stretchers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

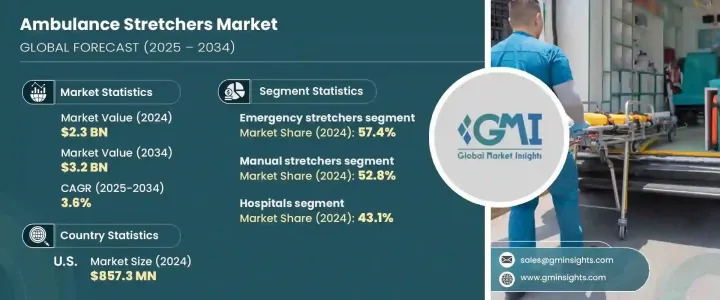

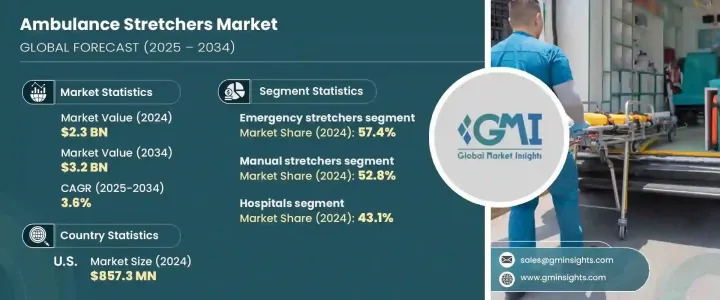

2024 年全球救護車擔架市場價值為 23 億美元,預計 2025 年至 2034 年期間的複合年成長率為 3.6%。醫療緊急情況的增加、擔架設計的技術進步、緊急管理基礎設施投資的增加以及門診護理服務的快速擴展是推動這一成長的關鍵因素。這些趨勢強調了高效、可靠的病人運輸系統日益成長的重要性,特別是在危及生命的情況下。

救護車擔架是院前護理的基石,能夠在道路事故、心臟緊急情況和自然災害期間快速安全地運送病人。此外,全球工作場所傷害和交通事故的發生頻率不斷增加,推動了對滿足不同醫療保健需求的創新擔架解決方案的需求。隨著全球醫療保健系統的不斷發展,對尖端救護車擔架的需求預計將上升,以滿足全球對改善患者治療效果和加快回應時間的要求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 23億美元 |

| 預測值 | 32億美元 |

| 複合年成長率 | 3.6% |

在產品細分方面,市場分為急救擔架和運輸擔架,其中急救擔架在 2024 年佔了 57.4% 的顯著市場佔有率。這種主導地位很大程度上是由於這些擔架在院前和緊急醫療服務中發揮的關鍵作用。急救擔架專為危急情況使用而設計,可在道路事故、心臟驟停和自然災害期間快速安全地運送病人。道路交通事故和工作場所傷害的不斷增加也推動了這些擔架的使用,凸顯了它們在全球緊急系統中的重要作用。

根據技術,市場進一步細分為手動擔架、電動擔架和氣動擔架。其中,手動擔架在 2024 年佔據 52.8% 的市場佔有率,佔據市場主導地位。其成本效益和可負擔性使其在資源匱乏的醫療環境和發展中國家特別受歡迎。與電動或氣動替代品不同,手動擔架不需要電池、馬達或其他複雜系統,從而降低了維護成本,成為注重預算的醫療服務提供者的首選。

美國仍然是救護車擔架市場的主要貢獻者,2024 年創造了 8.573 億美元的收入。該國強大的緊急醫療服務系統,再加上高發性的醫療緊急情況,推動了對這些擔架的需求。由於大量救護車和醫療保健提供者依靠擔架進行緊急和常規病人運輸,美國市場繼續蓬勃發展,成為先進醫療技術和基礎設施的中心。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 醫療緊急狀況發生率不斷上升

- 擔架設計和技術的進步

- 加大緊急管理基礎設施的投資

- 門診護理服務的成長

- 產業陷阱與挑戰

- 高級擔架價格昂貴

- 嚴格的安全標準和認證流程

- 成長動力

- 成長潛力分析

- 專利分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望

第 5 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 急救擔架

- 運輸擔架

第6章:市場估計與預測:按技術,2021 – 2034 年

- 主要趨勢

- 手動擔架

- 電動擔架

- 氣動擔架

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 緊急醫療服務提供者

- 門診服務中心

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Advanced Instrumentations

- Allied Medical

- Baxter International

- Drive DeVilbiss Healthcare

- EMS Mobil Sistemler

- Ferno-Washington

- Kartsana

- MAC Medical

- Medline Industries

- Narang Medical

- Paramed International

- Royax

- Spencer

- Stryker Corporation

- Zhangjiagang New Fellow Med

The Global Ambulance Stretchers Market, valued at USD 2.3 billion in 2024, is poised to grow at a CAGR of 3.6% from 2025 to 2034. The rise in medical emergencies, technological advancements in stretcher design, increased investment in emergency management infrastructure, and the rapid expansion of ambulatory care services are key factors fueling this growth. These trends underscore the growing importance of efficient and reliable patient transport systems, particularly in life-threatening scenarios.

Ambulance stretchers are a cornerstone of pre-hospital care, enabling quick and safe patient transport during road accidents, cardiac emergencies, and natural disasters. Furthermore, the increasing frequency of workplace injuries and traffic incidents worldwide is driving demand for innovative stretcher solutions tailored to diverse healthcare needs. As healthcare systems worldwide continue to evolve, the demand for cutting-edge ambulance stretchers is expected to rise, aligning with the global push for improved patient outcomes and faster response times.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.3 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 3.6% |

In terms of product segmentation, the market is divided into emergency stretchers and transport stretchers, with emergency stretchers holding a significant 57.4% market share in 2024. This dominance is largely due to the critical role these stretchers play in pre-hospital and emergency medical services. Specifically designed for use in critical situations, emergency stretchers facilitate swift and safe patient transport during road accidents, cardiac arrests, and natural disasters. The growing number of road traffic accidents and workplace injuries is also driving increased adoption of these stretchers, highlighting their essential role in emergency response systems worldwide.

The market is further segmented by technology into manual stretchers, electric-powered stretchers, and pneumatic stretchers. Among these, manual stretchers led the market with a 52.8% share in 2024. Their cost-effectiveness and affordability make them particularly popular in low-resource healthcare settings and developing countries. Unlike electric-powered or pneumatic alternatives, manual stretchers do not require batteries, motors, or other complex systems, resulting in lower maintenance costs and making them a preferred choice for budget-conscious medical providers.

The United States remains a major contributor to the ambulance stretchers market, generating USD 857.3 million in revenue in 2024. The robust emergency medical services system in the country, coupled with a high incidence of medical emergencies, drives the demand for these stretchers. With a vast number of ambulances and healthcare providers relying on stretchers for both emergency and routine patient transport, the US market continues to thrive as a hub for advanced medical technologies and infrastructure.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of medical emergencies

- 3.2.1.2 Advancements in stretcher design and technology

- 3.2.1.3 Growing investments in emergency management infrastructure

- 3.2.1.4 Growth in ambulatory care services

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced stretchers

- 3.2.2.2 Stringent safety standards and certification processes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Emergency stretchers

- 5.3 Transport stretchers

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Manual stretchers

- 6.3 Electric powered stretchers

- 6.4 Pneumatic stretchers

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Emergency medical service providers

- 7.4 Ambulatory service centers

- 7.5 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Advanced Instrumentations

- 9.2 Allied Medical

- 9.3 Baxter International

- 9.4 Drive DeVilbiss Healthcare

- 9.5 EMS Mobil Sistemler

- 9.6 Ferno-Washington

- 9.7 Kartsana

- 9.8 MAC Medical

- 9.9 Medline Industries

- 9.10 Narang Medical

- 9.11 Paramed International

- 9.12 Royax

- 9.13 Spencer

- 9.14 Stryker Corporation

- 9.15 Zhangjiagang New Fellow Med