|

市場調查報告書

商品編碼

1684531

牙科印模系統市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Dental Impression Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

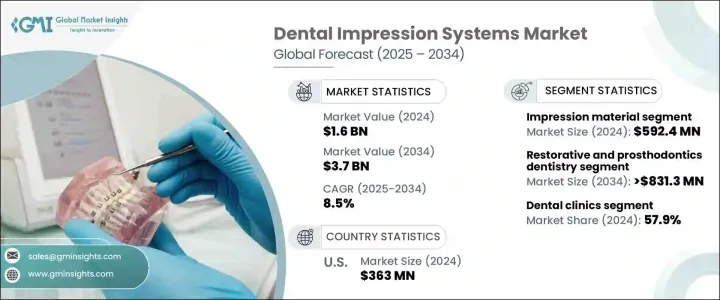

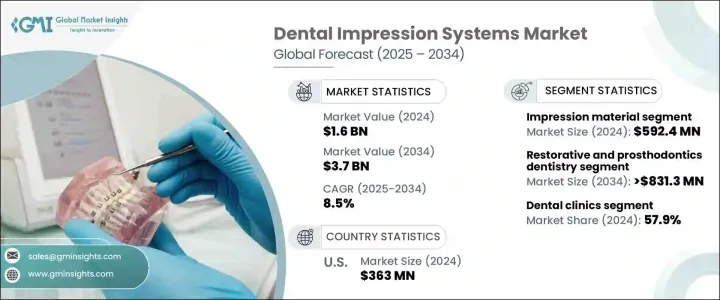

2024 年全球牙科印模系統市場規模達到 16 億美元,預計 2025 年至 2034 年期間將以 8.5% 的強勁複合年成長率成長。隨著人口老化和口腔健康意識的不斷增強,越來越多的人尋求先進的牙科治療,從而推動對可靠、精確的印模系統的需求。此外,牙科技術的發展徹底改變了傳統的實踐,提供了更好的治療效果和患者滿意度。

數位化牙科的創新進步,例如 3D 列印、CAD/CAM 系統和口內掃描儀,正在改變印模技術。這些技術顯著提高了牙科印模的準確性、效率和患者的舒適度。透過減少錯誤、簡化工作流程和提供精確的結果,數位印模系統正在成為現代牙科實踐中不可或缺的工具。向數位化解決方案的轉變不僅最佳化了臨床結果,而且符合人們對微創手術和客製化牙科假體的日益成長的偏好,進一步推動了全球的採用率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 16億美元 |

| 預測值 | 37億美元 |

| 複合年成長率 | 8.5% |

市場按產品類型分類,包括口內掃描器、印模材料、印模托盤、 CAD/CAM 系統和相關產品。僅印模材料一項,2024 年就創造了 5.924 億美元的收入,反映了它們在為各種牙科手術提供高品質印模方面的重要作用。矽基、聚醚和水膠體材料可滿足不同的處理需求,其中乙烯基聚矽氧烷 (VPS) 因其出色的尺寸穩定性和精度而脫穎而出。 VPS 材料廣泛用於生產牙冠、牙橋和假牙等精密修復體,凸顯了其需求日益成長。

在應用方面,修復和假牙牙科領域佔據市場主導地位,預計複合年成長率為 9.4%,到 2034 年達到 8.313 億美元。先進技術的不斷應用在修復治療中進一步推動了這一領域的擴張。

2024 年,美國牙科印模系統市場規模將達到 3.63 億美元,到 2034 年的複合年成長率為 8.2%。微創治療和客製化假牙的需求不斷上升,推動了全國對精準、高效的牙科印模系統的需求。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 牙齒修復和假牙的需求不斷成長

- 數位化牙科和口內掃描儀的採用率不斷提高

- 牙齒疾病和牙齒脫落的盛行率不斷上升

- CAD/CAM 系統的技術進步

- 產業陷阱與挑戰

- 數位化牙科印模系統成本高

- 發展中地區數位系統採用有限

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 印模材料

- 聚乙烯矽氧烷 (PVS)

- 聚醚

- 矽酮

- 海藻酸鹽

- 其他印模材料

- 口內掃描儀

- 印模托盤

- CAD/CAM 系統

- 其他產品類型

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 修復和口腔修復學

- 正畸

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 牙醫診所

- 醫院

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3shape

- AMANN GIRRBACH

- Carestream DENTAL

- Dentsply Sirona

- GC America

- HENRY SCHEIN

- ivoclar

- KULZER

- MEDIT

- PLANMECA

- solventum

- straumann

- VITA Zahnfabrik

- VOCO

- Zirkonzahn

The Global Dental Impression Systems Market reached USD 1.6 billion in 2024 and is anticipated to grow at a robust CAGR of 8.5% between 2025 and 2034. This growth is fueled by the increasing prevalence of dental diseases, such as tooth decay, periodontal diseases, and tooth loss, as well as the rising demand for dental restorations. With the aging population and the growing awareness of oral health, more individuals are seeking advanced dental treatments, driving demand for reliable and precise impression systems. Furthermore, the evolution of dental technologies has revolutionized traditional practices, offering improved outcomes and patient satisfaction.

Innovative advancements in digital dentistry, such as 3D printing, CAD/CAM systems, and intraoral scanners, are transforming impression-taking techniques. These technologies have significantly enhanced the accuracy, efficiency, and patient comfort of dental impressions. By reducing errors, streamlining workflows, and delivering precise results, digital impression systems are becoming indispensable tools in modern dental practices. The shift toward digital solutions not only optimizes clinical outcomes but also aligns with the increasing preference for minimally invasive procedures and customized dental prosthetics, further driving adoption rates worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $3.7 Billion |

| CAGR | 8.5% |

The market is categorized by product type, intraoral scanners, encompassing impression materials, impression trays, CAD/CAM systems, and related products. Impression materials alone generated USD 592.4 million in 2024, reflecting their essential role in delivering high-quality impressions for various dental procedures. Silicone-based, polyether, and hydrocolloid materials cater to diverse treatment needs, with vinyl polysiloxane (VPS) standing out for its exceptional dimensional stability and precision. VPS materials are widely favored for producing accurate restorations such as crowns, bridges, and dentures, underscoring their growing demand.

In terms of application, the restorative and prosthodontic dentistry segment dominates the market and is projected to grow at a CAGR of 9.4%, reaching USD 831.3 million by 2034. This segment's growth is attributed to the rising demand for crowns, bridges, dentures, and implants, which require precise dental impressions for optimal fit and functionality. The increasing adoption of advanced technologies for restorative treatments further propels this segment's expansion.

The U.S. dental impression systems market reached USD 363 million in 2024, growing at a CAGR of 8.2% through 2034. The adoption of digital impression technologies, including CAD/CAM systems and intraoral scanners, is driving growth as dental practices embrace these tools to improve workflow efficiency and accuracy. The demand for minimally invasive treatments and tailored prosthetics continues to rise, bolstering the need for precise and efficient dental impression systems across the country.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for dental restorations and prosthetics

- 3.2.1.2 Increasing adoption of digital dentistry and intraoral scanners

- 3.2.1.3 Rising prevalence of dental disorders and tooth loss

- 3.2.1.4 Technological advancements in CAD/CAM systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of digital dental impression systems

- 3.2.2.2 Limited adoption of digital systems in developing regions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Impression materials

- 5.2.1 Polyvinyl Siloxane (PVS)

- 5.2.2 Polyether

- 5.2.3 Silicone

- 5.2.4 Alginate

- 5.2.5 Other impression materials

- 5.3 Intraoral scanners

- 5.4 Impression trays

- 5.5 CAD/CAM systems

- 5.6 Other product types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Restorative and prosthodontics dentistry

- 6.3 Orthodontics

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Dental clinics

- 7.3 Hospitals

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3shape

- 9.2 AMANN GIRRBACH

- 9.3 Carestream DENTAL

- 9.4 Dentsply Sirona

- 9.5 GC America

- 9.6 HENRY SCHEIN

- 9.7 ivoclar

- 9.8 KULZER

- 9.9 MEDIT

- 9.10 PLANMECA

- 9.11 solventum

- 9.12 straumann

- 9.13 VITA Zahnfabrik

- 9.14 VOCO

- 9.15 Zirkonzahn