|

市場調查報告書

商品編碼

1684551

乳房植入物組織擴張器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Breast Implant Tissue Expanders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

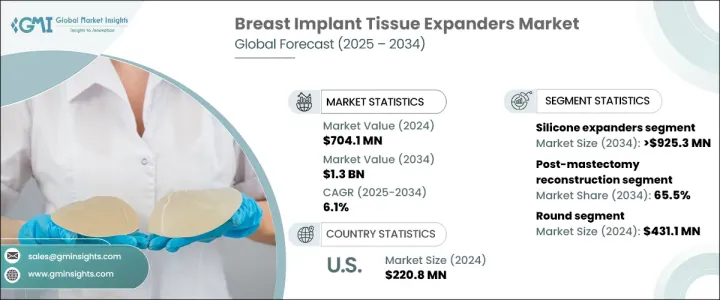

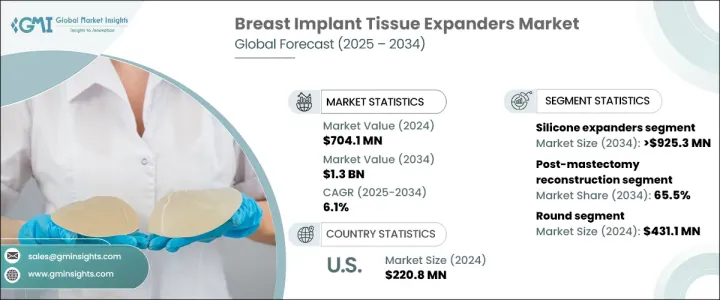

2024 年全球乳房植入物組織擴張器市場價值為 7.041 億美元,並將經歷強勁成長,2025 年至 2034 年的複合年成長率為 6.1%。組織擴張器是關鍵的醫療設備,在為乳房重建或增大準備皮膚和軟組織方面發揮重要作用。這些裝置主要用於乳房切除術後、創傷後或治療先天性畸形。

隨著人們對乳房重建的關注度不斷提高,特別是乳癌倖存者,以及整容手術需求的不斷增加,市場正在經歷大幅成長。此外,新興經濟體的認知不斷提高和手術選擇的可及性改善也極大地促進了這一上升趨勢。組織擴張器設計技術的進步也支持了這一成長,確保了患者獲得更大的舒適度、安全性和滿意度。如今,越來越多的患者選擇手術,不僅能滿足醫療需求,還能改善美觀,進而進一步推動市場的發展。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7.041億美元 |

| 預測值 | 13億美元 |

| 複合年成長率 | 6.1% |

根據產品類型,市場分為矽膠擴張器和鹽水擴張器,其中矽膠基擴張器預計將保持穩定的成長軌跡。矽膠擴張器市場預計將以 6.3% 的複合年成長率擴張,到 2034 年市值將達到 9.253 億美元。矽膠擴張器因其與人體組織極為相似而備受青睞,使其成為重建和美容用途的理想選擇。它們的柔軟度、耐用性以及模仿乳房組織自然感覺的能力使它們在患者中越來越受歡迎,從而導致需求不斷上升,特別是在人們對手術選擇的認知日益增強的新興市場。

從應用角度來看,市場分為隆乳、乳房切除術後重建等用途。 2024 年,乳房切除術後重建部分佔了最大的佔有率,為 65.5%。隨著全球乳癌發生率的持續上升,越來越多的女性接受乳房切除術,這增加了透過重建手術恢復乳房形狀和結構的需求。這一領域的成長不僅是由醫療需求推動的,而且還受到這些手術對乳癌倖存者帶來的心理和情感益處的推動,使其成為乳癌治療的一個重要方面。

2024 年美國乳房植入物組織擴張器市場價值為 2.208 億美元,並將持續成長。美國擁有最多的專注於乳房重建的專業整形外科醫生,這使其成為組織擴張器的主要市場。作為全球最大的整容手術市場,尤其是隆乳手術市場,組織擴張器的需求正在上升。此外,美國市場受益於對客製化、符合人體解剖學形狀的矽膠擴張器的日益成長的偏好,為患者提供更自然的效果。這些因素,再加上組織擴張器在分階段隆乳手術中的整合,進一步推動了美國市場的成長,確保了其在全球市場繼續佔據主導地位。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 隆乳手術數量增加

- 乳癌發生率不斷上升

- 技術進步

- 產業陷阱與挑戰

- 手術費用高,併發症風險高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 波特的分析

- PESTEL 分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 矽膠膨脹劑

- 鹽水擴張器

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 乳房切除術後重建

- 隆乳

- 其他應用

第 7 章:市場估計與預測:按形狀,2021 – 2034 年

- 主要趨勢

- 圓形的

- 解剖

第 8 章:市場估計與預測:按港口類型,2021 年至 2034 年

- 主要趨勢

- 整合連接埠

- 遠端埠

第 9 章:市場估計與預測:按質地,2021 年至 2034 年

- 主要趨勢

- 紋理

- 光滑的

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診所

- 其他最終用戶

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 12 章:公司簡介

- Abbvie

- AirXpanders

- Eurosilicone

- GC Aesthetics

- GROUPE SEBBIN SAS

- Guangzhou Wanhe Plastic Materials

- KOKEN

- Mentor Worldwide

- Oxtex

- PMT Corporation

- POLYTECH Health & Aesthetics GmbH

- Sientra

- Silimed

The Global Breast Implant Tissue Expanders Market was valued at USD 704.1 million in 2024 and is set to experience robust growth, with a CAGR of 6.1% from 2025 to 2034. Tissue expanders are critical medical devices that play an essential role in preparing the skin and soft tissue of the breast for reconstruction or augmentation. These devices are predominantly used after mastectomy, trauma, or to address congenital deformities.

With the increasing focus on breast reconstruction, particularly among breast cancer survivors, and rising cosmetic surgery demand, the market is witnessing substantial growth. Moreover, expanding awareness and improved accessibility to surgical options in emerging economies contribute significantly to this upward trend. This growth is also supported by technological advancements in tissue expander design, ensuring greater patient comfort, safety, and satisfaction. Patients today are increasingly opting for surgeries that not only address medical needs but also enhance their aesthetic appearance, further propelling the market forward.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $704.1 Million |

| Forecast Value | $1.3 Billion |

| CAGR | 6.1% |

The market is categorized by product type into silicone and saline expanders, with silicone-based expanders projected to maintain a steady growth trajectory. The silicone expander segment is expected to expand at a CAGR of 6.3%, reaching a market value of USD 925.3 million by 2034. Silicone expanders are highly favored due to their superior resemblance to human tissue, making them ideal for both reconstructive and cosmetic purposes. Their softness, durability, and ability to mimic the natural feel of breast tissue have made them increasingly popular among patients, leading to rising demand, particularly in emerging markets where awareness of surgical options is growing.

When looking at applications, the market is divided into breast augmentation, post-mastectomy reconstruction, and other uses. The post-mastectomy reconstruction segment accounted for the largest share of 65.5% in 2024. With the ongoing rise in breast cancer incidences worldwide, more women are undergoing mastectomy procedures, which increases the need for reconstructive surgeries to restore breast shape and structure. This segment's growth is not only driven by medical necessity but also by the psychological and emotional benefits these surgeries offer to breast cancer survivors, making it an essential aspect of breast cancer treatment.

The U.S. breast implant tissue expander market is valued at USD 220.8 million in 2024 and continues to experience growth. The U.S. has the largest concentration of specialized plastic surgeons focusing on breast reconstruction, making it a key market for tissue expanders. As the world's largest market for cosmetic surgeries, particularly breast augmentation, the demand for tissue expanders is on the rise. Additionally, the U.S. market benefits from an increasing preference for customized and anatomically shaped silicone expanders, offering patients more natural-looking outcomes. These factors, coupled with the integration of tissue expanders in staged breast augmentation surgeries, are further fueling the growth of the U.S. market, ensuring its continued dominance in the global landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in number of breast augmentation procedures

- 3.2.1.2 Increasing prevalence of breast cancer

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High procedure cost and risk of complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Silicone expanders

- 5.3 Saline expanders

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Post-mastectomy reconstruction

- 6.3 Breast augmentation

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Shape, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Round

- 7.3 Anatomical

Chapter 8 Market Estimates and Forecast, By Port Type, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Integrated port

- 8.3 Remote port

Chapter 9 Market Estimates and Forecast, By Texture, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Textured

- 9.3 Smooth

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Hospitals

- 10.3 Clinics

- 10.4 Other end users

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 Japan

- 11.4.3 India

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 Abbvie

- 12.2 AirXpanders

- 12.3 Eurosilicone

- 12.4 GC Aesthetics

- 12.5 GROUPE SEBBIN SAS

- 12.6 Guangzhou Wanhe Plastic Materials

- 12.7 KOKEN

- 12.8 Mentor Worldwide

- 12.9 Oxtex

- 12.10 PMT Corporation

- 12.11 POLYTECH Health & Aesthetics GmbH

- 12.12 Sientra

- 12.13 Silimed