|

市場調查報告書

商品編碼

1684559

抗凝血逆轉藥物市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Anticoagulant Reversal Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

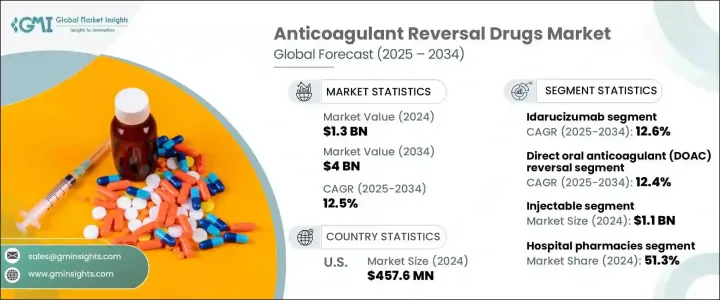

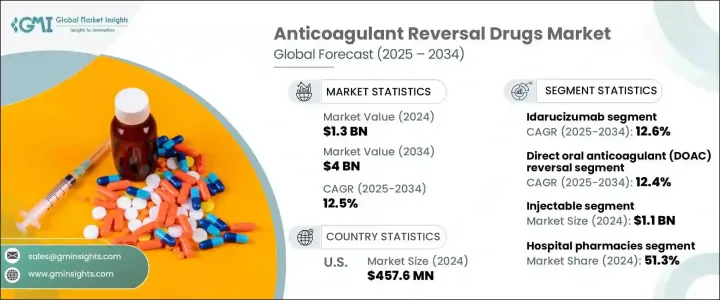

2024 年全球抗凝血逆轉藥物市場價值為 13 億美元,將經歷令人矚目的成長,預計 2025 年至 2034 年的複合年成長率為 12.5%。這一市場擴張很大程度上是由於抗凝血劑的使用量不斷增加以及出血併發症發生率不斷上升,凸顯了對有效逆轉劑的需求。隨著心血管疾病和深部靜脈栓塞、肺栓塞、心房顫動等血栓性疾病的發生率不斷增加,對能夠在緊急情況下快速逆轉抗凝血作用的藥物的需求也不斷增加。隨著直介面服抗凝血劑 (DOAC)、華法林和肝素的新型逆轉劑的推出,情況正在發生變化,使得治療對患者和醫療保健提供者來說更加可靠和可及。

全球人口老化,加上慢性病的盛行率上升,大大增加了抗凝血劑的使用。長期抗凝血治療目前已成為多種心血管及血栓疾病的常見治療方法。然而,這些治療方法會增加出血併發症的風險,因此迫切需要可靠的逆轉方法。抗凝血逆轉藥物解決了這項挑戰,確保了患者在嚴重出血或手術等不良事件期間的安全。隨著醫療技術的進步推動更有效、更快速的逆轉療法的發展,市場將進一步成長,受益於這些治療方法在臨床和醫院環境中更廣泛的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 13億美元 |

| 預測值 | 40億美元 |

| 複合年成長率 | 12.5% |

市場按產品類型細分,包括安得拉胺、維生素 K、凝血酶原複合物濃縮物、依達賽珠單抗、魚精蛋白和其他相關產品。 Idarucizumab 的市值在 2024 年將達到 4.435 億美元,預計在預測期內的複合年成長率將達到 12.6%,這得益於其在逆轉達比加群作用方面所發揮的作用。達比加群是一種廣泛使用的 DOAC,特別用於治療心房顫動和深部靜脈栓塞等疾病。

根據給藥途徑,市場分為注射劑和口服劑。注射劑領域引領市場,到 2024 年價值將達到 11 億美元,因為注射劑因其快速有效的作用而在危急情況下受到青睞。這些速效藥物對於在嚴重出血或緊急手術等緊急情況下逆轉抗凝血至關重要,因為立即干涉至關重要。

在美國,2024 年抗凝血逆轉藥物市值為 4.576 億美元。心血管疾病和腎臟疾病等需要抗凝血治療的慢性病發生率不斷增加,推動了對抗凝血劑及其逆轉劑的需求。此外,鼓勵開發更安全的抗凝血劑和逆轉療法的監管支持進一步推動了正在持續成長的美國市場。隨著越來越多老年人面臨血栓栓塞和出血性疾病的風險,隨著新的逆轉藥物和療法被引入並納入臨床實踐,美國市場預計將出現持續的需求。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 老齡人口不斷增加

- 需要抗凝血治療的疾病盛行率不斷上升

- 新型抗凝血劑的出現

- 產業陷阱與挑戰

- 與這些藥物相關的副作用

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 伊達珠單抗

- 維生素 K

- 凝血酶原複合物濃縮物

- 安地沙奈特阿爾法

- 魚精蛋白

- 其他產品

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 直介面服抗凝血劑 (DOAC) 逆轉

- 華法林逆轉

- 肝素和低分子量肝素 (LMWH) 逆轉

- 其他應用

第 7 章:市場估計與預測:按管理路線,2021 年至 2034 年

- 主要趨勢

- 注射劑

- 口服

第 8 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amneal Pharmaceuticals

- AstraZeneca

- Cipla

- CSL Behring Limited

- Dr. Reddy's Laboratories

- Endo International

- Lupin

- Mylan NV

- Novartis

- Pfizer

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

The Global Anticoagulant Reversal Drugs Market, valued at USD 1.3 billion in 2024, is set to experience impressive growth, projected at a CAGR of 12.5% from 2025 to 2034. This market expansion is largely driven by the growing usage of anticoagulants and the rising incidence of bleeding complications, which emphasize the need for effective reversal agents. As cardiovascular diseases and thrombotic conditions like deep vein thrombosis, pulmonary embolism, and atrial fibrillation continue to increase, so does the demand for drugs that can quickly reverse anticoagulation effects in emergency situations. With the introduction of novel reversal agents for direct oral anticoagulants (DOACs), warfarin, and heparin, the landscape is transforming, making treatment more reliable and accessible for both patients and healthcare providers.

Aging populations worldwide, coupled with an increasing prevalence of chronic conditions, have significantly amplified the use of anticoagulants. Long-term anticoagulation therapy is now a common treatment for a variety of cardiovascular and thrombotic diseases. However, these treatments increase the risk of bleeding complications, creating a critical need for reliable reversal options. Anticoagulant reversal drugs address this challenge, ensuring patient safety during adverse events like severe bleeding or surgeries. As advancements in medical technology drive the development of more effective and rapid reversal therapies, the market is poised for further growth, benefiting from the wider adoption of these treatments in both clinical and hospital settings.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.3 Billion |

| Forecast Value | $4 Billion |

| CAGR | 12.5% |

The market is segmented by product type, which includes andexanet alfa, phytonadione (vitamin K), prothrombin complex concentrates, idarucizumab, protamine, and other related products. Idarucizumab, valued at USD 443.5 million in 2024, is anticipated to experience a CAGR of 12.6% during the forecast period, driven by its role in reversing the effects of dabigatran. Dabigatran is a widely used DOAC, particularly for managing conditions such as atrial fibrillation and deep venous thrombosis.

When it comes to the route of administration, the market is split into injectable and oral forms. The injectable segment leads the market, valued at USD 1.1 billion in 2024, as injectables are preferred in critical situations for their quick and effective action. These fast-acting drugs are essential for reversing anticoagulation during emergencies like severe bleeding or urgent surgeries, where immediate intervention is crucial.

In the U.S., the anticoagulant reversal drugs market was valued at USD 457.6 million in 2024. The increasing incidence of chronic conditions requiring anticoagulation therapy, such as cardiovascular and kidney diseases, has driven the demand for both anticoagulants and their reversal agents. Furthermore, regulatory support that encourages the development of safer anticoagulants and reversal therapies further boosts the U.S. market, which is experiencing continued growth. With a large and growing elderly population at risk for thromboembolic and bleeding disorders, the U.S. market is expected to see sustained demand as new reversal drugs and therapies are introduced and incorporated into clinical practices.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing aging population

- 3.2.1.2 Rising prevalence of conditions requiring anticoagulation therapy

- 3.2.1.3 Emergence of new anticoagulants

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with these drugs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Idarucizumab

- 5.3 Phytonadione (Vitamin K)

- 5.4 Prothrombin complex concentrates

- 5.5 Andexanet alfa

- 5.6 Protamine

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Direct oral anticoagulant (DOAC) reversal

- 6.3 Warfarin reversal

- 6.4 Heparin and low-molecular-weight heparin (LMWH) reversal

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injectable

- 7.3 Oral

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amneal Pharmaceuticals

- 10.2 AstraZeneca

- 10.3 Cipla

- 10.4 CSL Behring Limited

- 10.5 Dr. Reddy’s Laboratories

- 10.6 Endo International

- 10.7 Lupin

- 10.8 Mylan N.V.

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sun Pharmaceutical Industries

- 10.12 Teva Pharmaceutical Industries