|

市場調查報告書

商品編碼

1684560

馬來酸氯苯那敏市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Chlorpheniramine Maleate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

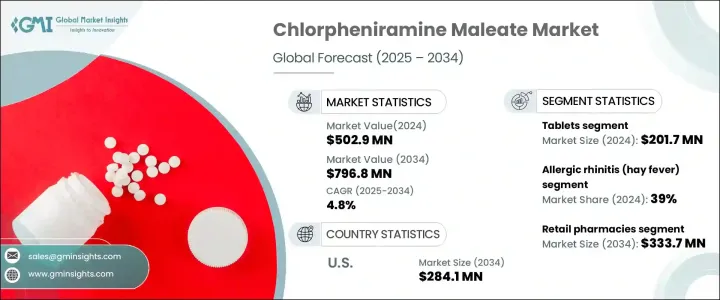

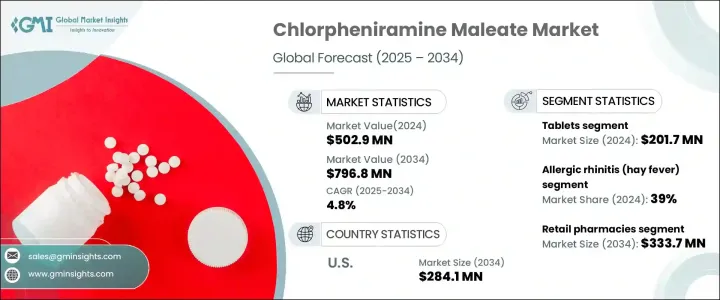

2024 年全球馬來酸氯苯那敏市場價值為 5.029 億美元,預計將實現穩步成長,預計 2025 年至 2034 年的複合年成長率為 4.8%。隨著醫療保健系統的改善和抗過敏藥物的普及,馬來酸氯苯那敏的受歡迎程度持續上升。此外,抗組織胺配方的持續創新使治療更加有效、更容易取得,擴大了馬來酸氯苯那敏在治療季節性和常年過敏症方面的使用範圍。自我藥療的趨勢日益成長,特別是在過敏性鼻炎和花粉症發病率高的市場,也刺激了對這種藥物的需求。便利性、經濟性和患者意識的提高進一步促進了其市場的擴張。

市場依劑型類型細分,注射劑、錠劑、糖漿和其他形式分別滿足不同的消費者偏好。 2024 年平板電腦將佔據市場主導地位,市場規模達 2.017 億美元。由於其易於使用、經濟高效以及廣泛普及的便利性,它們成為治療花粉症等疾病的個人的首選。此外,平板電腦的供應鏈成本相對較低,這也鞏固了其在市場上的主導地位。製藥公司熱衷於開發改進的片劑配方,例如緩釋版本,以增強治療效果並提高患者的依從性。這些進步預計將進一步加強平板電腦領域的市場佔有率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.029 億美元 |

| 預測值 | 7.968 億美元 |

| 複合年成長率 | 4.8% |

在應用方面,馬來酸氯苯那敏市場分為過敏、過敏性鼻炎(花粉症)、普通感冒等。過敏性鼻炎領域在 2024 年佔據最大佔有率,佔市場佔有率的 39%。這種普遍的呼吸系統疾病影響著各個年齡層的人,其發病率的不斷上升是推動對馬來酸氯苯那敏等有效治療藥物的需求的主要因素。隨著對這種疾病的認知不斷提高,患者和醫療保健專業人員都開始使用這種抗組織胺來緩解症狀。隨著全球範圍內花粉症和相關過敏症的發病率不斷上升,越來越多的人尋求治療,預計該領域將繼續佔據主導地位。

具體來看美國市場,預計馬來酸氯苯那敏市場的複合年成長率為 4.7%,到 2034 年將達到 2.841 億美元。美國約有 1,920 萬成年人患有花粉症,對馬來酸氯苯那敏等抗組織胺的需求持續存在。美國市場受益於非處方藥(OTC)的優惠法規,加上強大的製藥基礎設施,確保這些產品在全國範圍內易於獲得。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球過敏症盛行率不斷上升

- 已開發市場和新興市場對抗組織胺藥物的需求不斷增加

- 擴大藥品和非處方藥 (OTC) 領域

- 產業陷阱與挑戰

- 有副作用較少的替代抗組織胺藥

- 影響產品發布和分銷的嚴格監管要求

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第 5 章:市場估計與預測:依配方類型,2021-2034 年

- 主要趨勢

- 注射

- 平板電腦

- 糖漿

- 其他配方類型

第 6 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 過敏

- 過敏性鼻炎(花粉症)

- 普通感冒

- 其他應用

第 7 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Aden Healthcare

- Alkem Laboratories

- Bayer

- Centaur Pharmaceuticals

- Cipla

- Dr. Reddy's Laboratories

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Merck & Co.

- Montage Laboratories

- Novalab Healthcare

- Pfizer

- Sun Pharmaceutical

The Global Chlorpheniramine Maleate Market, valued at USD 502.9 million in 2024, is poised to experience steady growth, with a projected CAGR of 4.8% from 2025 to 2034. The increasing prevalence of respiratory issues, including allergies, is a significant driver of this growth, as more people seek effective antihistamine treatments. As healthcare systems improve and greater access to allergy medications becomes available, chlorpheniramine maleate's popularity continues to rise. Additionally, ongoing innovations in antihistamine formulations are making treatments more effective and accessible, expanding the use of chlorpheniramine maleate for both seasonal and perennial allergies. The growing trend of self-medication, especially in markets with a high incidence of allergic rhinitis and hay fever, is also fueling the demand for this medication. The combination of convenience, affordability, and increased patient awareness is further promoting its market expansion.

The market is segmented based on formulation type, with injections, tablets, syrup, and other forms each serving distinct consumer preferences. Tablets led the market in 2024, accounting for USD 201.7 million. Their ease of use, cost-effectiveness, and the convenience of being widely available make them the preferred choice for individuals dealing with conditions like hay fever. Moreover, the relatively low supply chain costs associated with tablets have contributed to their dominant market position. Pharmaceutical companies are keen on developing improved tablet formulations, such as extended-release versions, to enhance therapeutic outcomes and improve patient compliance. These advancements are expected to further strengthen the tablet segment's market share.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $502.9 Million |

| Forecast Value | $796.8 Million |

| CAGR | 4.8% |

In terms of application, the chlorpheniramine maleate market is segmented into allergic conditions, allergic rhinitis (hay fever), common colds, and others. The allergic rhinitis segment held the largest share in 2024, representing 39% of the market. This widespread respiratory condition affects individuals of all ages, and its increasing incidence is a primary factor driving the demand for effective treatments like chlorpheniramine maleate. With growing awareness of the condition, both patients and healthcare professionals are turning to this antihistamine for relief. The segment is expected to continue its dominance as more individuals seek treatment for hay fever and related allergies, which are on the rise globally.

Looking specifically at the U.S. market, the chlorpheniramine maleate segment is forecast to grow at a CAGR of 4.7%, reaching USD 284.1 million by 2034. This growth is being driven by the increasing prevalence of allergies, particularly hay fever, among adults. With approximately 19.2 million adults in the U.S. affected by hay fever, there is a significant and ongoing demand for antihistamine treatments like chlorpheniramine maleate. The U.S. market benefits from favorable regulations surrounding over-the-counter (OTC) medications, coupled with a strong pharmaceutical infrastructure that ensures the easy availability of these products across the nation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of allergic conditions worldwide

- 3.2.1.2 Increasing demand for antihistamine medications in both developed and emerging markets

- 3.2.1.3 Expansion of pharmaceutical and over-the-counter (OTC) drug sectors

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Availability of alternative antihistamines with fewer side effects

- 3.2.2.2 Strict regulatory requirements affecting product launches and distribution

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Formulation Type, 2021-2034 ($ Mn)

- 5.1 Key trends

- 5.2 Injections

- 5.3 Tablets

- 5.4 Syrup

- 5.5 Other formulation types

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 ($ Mn)

- 6.1 Key trends

- 6.2 Allergic

- 6.3 Allergic rhinitis (hay fever)

- 6.4 Common cold

- 6.5 Other applications

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 Online pharmacies

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Aden Healthcare

- 9.2 Alkem Laboratories

- 9.3 Bayer

- 9.4 Centaur Pharmaceuticals

- 9.5 Cipla

- 9.6 Dr. Reddy’s Laboratories

- 9.7 GlaxoSmithKline

- 9.8 Glenmark Pharmaceuticals

- 9.9 Merck & Co.

- 9.10 Montage Laboratories

- 9.11 Novalab Healthcare

- 9.12 Pfizer

- 9.13 Sun Pharmaceutical