|

市場調查報告書

商品編碼

1684561

被動光學元件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Passive Optical Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

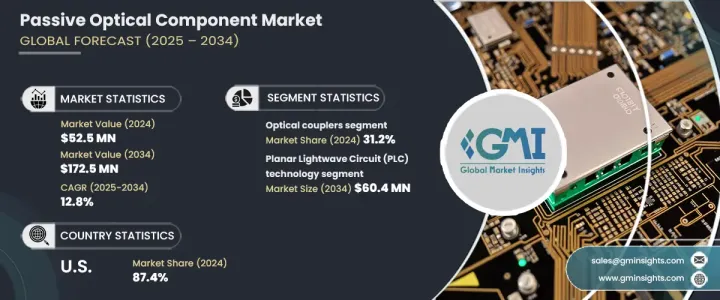

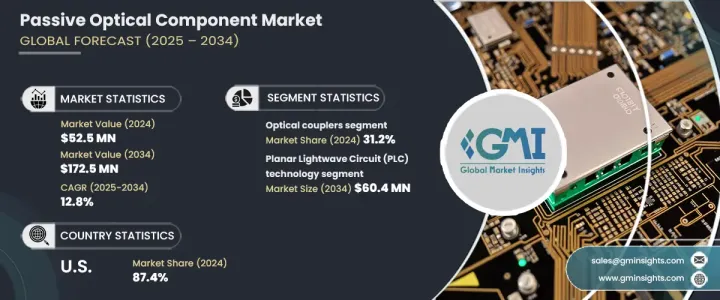

2024 年全球被動光元件市場規模達到 5,250 萬美元,預計 2025 年至 2034 年期間複合年成長率將達到驚人的 12.8%。對高速網際網路的不斷成長的需求和資料消費的急劇成長,推動著光纖通訊成為現代網路基礎設施的關鍵要素。隨著產業和消費者優先考慮無縫數位連接,被動光元件對於確保資料的有效傳輸、路由和放大已成為不可或缺的。此外,5G、人工智慧 (AI) 和物聯網 (IoT) 等下一代技術的興起正在推動對強大光纖網路的需求。這些元件支援高頻寬、低延遲和節能的資料傳輸,對於電信營運商、企業和超大規模資料中心來說至關重要。

隨著企業遷移到基於雲端的應用程式和儲存解決方案,雲端運算繼續受到青睞。超大規模資料中心是這些雲端服務的骨幹,嚴重依賴先進的光纖網路來管理大量資料流量。被動光學元件,包括光耦合器、分光器和波分複用器 (WDM),在實現這些網路內的無縫資料流方面發揮關鍵作用。它們能夠提供高效、經濟的資料路由和訊號分發解決方案,使其成為現代數位基礎設施的基石。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5250 萬美元 |

| 預測值 | 1.725億美元 |

| 複合年成長率 | 12.8% |

市場按元件類型細分,包括光耦合器、光分路器、光濾波器、光循環器、WDM 和其他元件。 2024年光耦合器佔31.2%的市佔率。這些設備是光纖網路不可或缺的一部分,能夠組合或分割光訊號而無需將其轉換為電訊號,從而保持其效率和完整性。光耦合器廣泛應用於電信、工業自動化和資料中心等應用領域,這些領域的可靠訊號路由是首要考慮因素。

從技術面來看,被動光元件市場包括平面光波電路(PLC)技術、光纖布拉格光柵(FBG)技術、薄膜技術、熔融雙錐(FBT)技術等。預計到 2034 年,PLC 技術的市場規模將達到 6,040 萬美元,這得益於將光波導蝕刻到二氧化矽基板上的先進製造流程。該技術可確保精度並實現小型化,使其成為分離器和連接複用器等組件的理想選擇。

在美國,無源光元件市場在 2024 年佔有 87.4% 的佔有率。北美的成長受到基礎設施的大量投資推動,包括 5G 部署、光纖到府 (FTTH) 計畫和資料中心擴建。電信營運商和科技公司處於增強數位連接的前沿,推動了對耦合器、分離器和 WDM 設備等組件的需求。美國注重創新和採用先進的網路技術,並持續引領全球市場。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 光纖通訊的普及率不斷提高

- 雲端服務和資料中心的激增

- 增加對5G基礎設施的投資

- 無源光學技術的進步

- 產業陷阱與挑戰

- 安裝和維護複雜

- 來自無線技術的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按材料,2021 年至 2034 年

- 主要趨勢

- 玻璃

- 塑膠

- 其他

第 6 章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 平面光波電路(PLC)技術

- 光纖布拉格光柵(FBG)技術

- 薄膜技術

- 熔融雙錐 (FBT) 技術

- 其他

第 7 章:市場估計與預測:按組件類型,2021 年至 2034 年

- 主要趨勢

- 光耦合器

- 光分路器

- 光學濾光片

- 光學環行器

- 波分複用器 (WDM)

- 其他

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 電信

- 資料中心

- 有線電視(CATV)

- 光纖到府 (FTTH)

- 企業網路

- 航太和國防

- 醫療和保健

- 工業網路

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Accelink Technologies Co., Ltd.

- Amphenol Corporation

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Corning Incorporated

- Fujitsu Limited

- Furukawa Electric Co., Ltd.

- Huawei Technologies Co., Ltd.

- Huber+Suhner AG

- II-VI Incorporated

- Lumentum Holdings Inc.

- Molex LLC

- NEC Corporation

- Nokia Corporation

- Sterlite Technologies Limited

- Sumitomo Electric Industries Ltd.

- TE Connectivity

- Tellabs Inc.

- ZTE Corporation

The Global Passive Optical Component Market reached USD 52.5 million in 2024 and is projected to grow at an impressive CAGR of 12.8% between 2025 and 2034. The growing demand for high-speed internet and the exponential increase in data consumption are driving the adoption of fiber optic communication as a critical element of modern network infrastructures. As industries and consumers prioritize seamless digital connectivity, passive optical components have become indispensable for ensuring the efficient transmission, routing, and amplification of data. Furthermore, the rise of next-generation technologies, such as 5G, artificial intelligence (AI), and the Internet of Things (IoT), is fueling the need for robust optical networks. These components support high bandwidth, low latency, and energy-efficient data transmission, making them essential for telecom operators, enterprises, and hyperscale data centers.

Cloud computing continues to gain traction as businesses migrate to cloud-based applications and storage solutions. Hyperscale data centers, which form the backbone of these cloud services, depend heavily on advanced optical networks to manage vast volumes of data traffic. Passive optical components, including optical couplers, splitters, and wavelength division multiplexers (WDMs), play a pivotal role in enabling seamless data flow within these networks. Their ability to provide efficient, cost-effective solutions for data routing and signal distribution makes them a cornerstone of modern digital infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.5 Million |

| Forecast Value | $172.5 Million |

| CAGR | 12.8% |

The market is segmented by component type, including optical couplers, optical splitters, optical filters, optical circulators, WDMs, and other components. In 2024, optical couplers accounted for 31.2% of the market share. These devices are integral to optical fiber networks, enabling the combination or division of light signals without converting them to electrical signals, thereby preserving their efficiency and integrity. Optical couplers are widely used in applications such as telecommunications, industrial automation, and data centers, where reliable signal routing is a priority.

In terms of technology, the passive optical component market encompasses Planar Lightwave Circuit (PLC) technology, Fiber Bragg Grating (FBG) technology, thin-film technology, Fused Biconical Taper (FBT) technology, and others. PLC technology is projected to reach USD 60.4 million by 2034, driven by its advanced fabrication processes that etch optical waveguides onto silica substrates. This technology ensures precision and enables miniaturization, making it ideal for components like splitters and multiplexers.

In the United States, the passive optical component market held an 87.4% share in 2024. Growth in North America is propelled by significant investments in infrastructure, including 5G rollouts, fiber-to-the-home (FTTH) initiatives, and data center expansions. Telecom operators and technology firms are at the forefront of enhancing digital connectivity, driving demand for components like couplers, splitters, and WDM devices. The U.S. continues to lead the global market thanks to its focus on innovation and adoption of advanced networking technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising adoption of fiber optic communication

- 3.6.1.2 Proliferation of cloud services and data centers

- 3.6.1.3 Increasing investments in 5G infrastructure

- 3.6.1.4 Advancements in passive optical technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complex installation and maintenance

- 3.6.2.2 Competition from wireless technologies

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Glass

- 5.3 Plastic

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Planar Lightwave Circuit (PLC) Technology

- 6.3 Fiber Bragg Grating (FBG) Technology

- 6.4 Thin film technology

- 6.5 Fused Biconical Taper (FBT) Technology

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Component Type, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Optical couplers

- 7.3 Optical splitters

- 7.4 Optical filters

- 7.5 Optical circulators

- 7.6 Wavelength Division Multiplexers (WDMs)

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Telecommunications

- 8.3 Data centers

- 8.4 Cable Television (CATV)

- 8.5 Fiber to the Home (FTTH)

- 8.6 Enterprise networks

- 8.7 Aerospace and defense

- 8.8 Medical and healthcare

- 8.9 Industrial networking

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accelink Technologies Co., Ltd.

- 10.2 Amphenol Corporation

- 10.3 Broadcom Inc.

- 10.4 Ciena Corporation

- 10.5 Cisco Systems, Inc.

- 10.6 Corning Incorporated

- 10.7 Fujitsu Limited

- 10.8 Furukawa Electric Co., Ltd.

- 10.9 Huawei Technologies Co., Ltd.

- 10.10 Huber+Suhner AG

- 10.11 II-VI Incorporated

- 10.12 Lumentum Holdings Inc.

- 10.13 Molex LLC

- 10.14 NEC Corporation

- 10.15 Nokia Corporation

- 10.16 Sterlite Technologies Limited

- 10.17 Sumitomo Electric Industries Ltd.

- 10.18 TE Connectivity

- 10.19 Tellabs Inc.

- 10.20 ZTE Corporation