|

市場調查報告書

商品編碼

1684642

臨床試驗生物庫和歸檔解決方案市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Clinical Trial Biorepository and Archiving Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

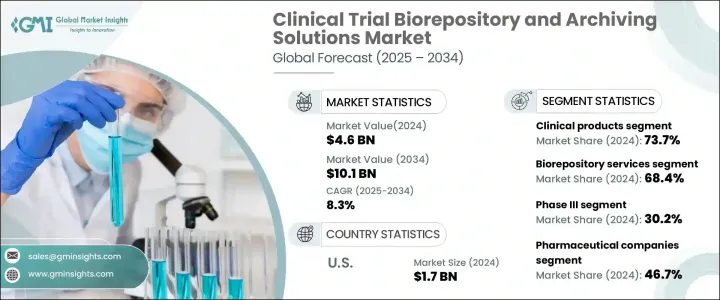

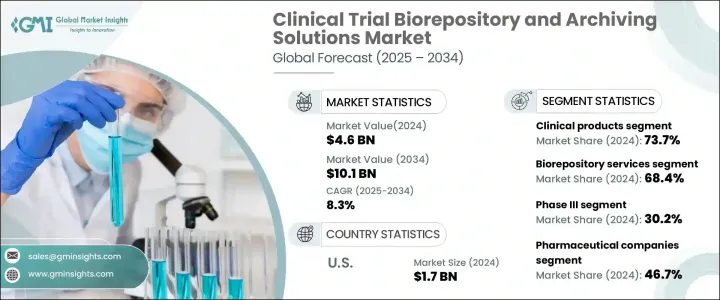

2024 年全球臨床試驗生物庫和歸檔解決方案市場價值為 46 億美元,預計 2025 年至 2034 年期間將以 8.3% 的強勁複合年成長率成長。 這一成長受到多種關鍵因素的推動,包括臨床試驗數量的激增、嚴格的監管合規要求、對長期數據存儲 這一成長受到多種關鍵因素的推動,包括臨床試驗數量的激增、嚴格的監管合規要求、對長期資料存儲的需求不斷成長以及對生物銀行的投資基礎成長。隨著生物製藥領域在藥物研發和個人化醫療方面的突破性發展而不斷發展,生物庫在保護關鍵生物樣本方面的作用已變得不可或缺。這一趨勢凸顯了對能夠滿足全球臨床試驗大量需求的創新解決方案日益成長的需求。

慢性病發病率的不斷上升以及對尖端療法的需求推動製藥和生物製藥公司加快研發力度。這些公司不僅引領了臨床試驗的熱潮,而且還大力投資最先進的生物銀行和存檔系統。這種系統對於維持新療法嚴格測試所需的生物樣本的品質、安全性和完整性至關重要。此外,生物庫解決方案的技術進步(例如自動儲存系統和先進的追蹤功能)進一步提升了市場的吸引力。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 46億美元 |

| 預測值 | 101億美元 |

| 複合年成長率 | 8.3% |

市場按產品類型細分為臨床前產品和臨床產品,其中臨床產品部分在 2024 年佔據 73.7% 的市場佔有率。臨床試驗日益複雜以及保存這些生物樣本的需要凸顯了強大的儲存和管理解決方案的重要性。

生物庫和歸檔解決方案的最終用戶包括製藥公司、生物技術公司、合約研究組織 (CRO) 以及學術和研究機構。 2024 年,製藥公司佔據最大的市場佔有率,為 46.7%,反映了其作為臨床試驗主要發起者的關鍵作用。這些公司依靠先進的生物庫服務來管理大規模臨床研究期間收集的大量生物樣本。確保樣品品質並符合監管標準對於成功的試驗結果至關重要。

2024 年,美國市場產值達 17 億美元,美國將持續引領全球臨床研究工作。美國進行的臨床試驗數量不斷成長,對複雜的生物庫和歸檔解決方案的需求也空前龐大。該國強大的研究基礎設施,加上對創新生物銀行技術的大量投資,鞏固了其作為市場成長關鍵驅動力的地位。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 臨床試驗的增加

- 遵守嚴格法規的需求日益成長

- 對長期資料儲存和保存的需求不斷增加

- 增加對生物銀行基礎設施的投資

- 產業陷阱與挑戰

- 與資料安全相關的擔憂

- 先進儲存設施的資本密集性質

- 成長動力

- 成長潛力分析

- 差距分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望

第 5 章:市場估計與預測:按產品類型,2021 年至 2034 年

- 主要趨勢

- 臨床前產品

- 臨床產品

- 人體組織

- 器官

- 幹細胞

- 其他臨床產品

第6章:市場估計與預測:按服務,2021 年至 2034 年

- 主要趨勢

- 生物樣本庫服務

- 倉儲

- 樣品處理

- 運輸

- 其他服務

- 歸檔解決方案服務

- 資料庫索引和管理

- 掃描和銷毀

第7章:市場估計與預測:依階段,2021 – 2034 年

- 主要趨勢

- 臨床前

- 第一階段

- 第二階段

- 第三階段

- 第四階段

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥公司

- 生技公司

- 合約研究組織

- 學術及研究機構

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- American Type Culture Collection

- Azenta US Inc.

- BioStorage Technologies

- Celerion

- Celerion

- Charles River Laboratories

- CryoPort

- Hamilton Company

- IQVIA

- Labcorp

- NMDP BioTherapies

- STC Biologics

- Thermo Fisher Scientific

- Veristat

- VWR International (Avantor)

The Global Clinical Trial Biorepository And Archiving Solutions Market was valued at USD 4.6 billion in 2024 and is projected to grow at a robust CAGR of 8.3% from 2025 to 2034. This growth is fueled by several critical factors, including the surging number of clinical trials, stringent regulatory compliance requirements, rising demand for long-term data storage, and increased investments in advanced biobanking infrastructure. As the biopharmaceutical sector continues to evolve with groundbreaking developments in drug discovery and personalized medicine, the role of biorepositories in safeguarding critical biological samples has become indispensable. This trend underscores the expanding need for innovative solutions that can cater to the high-volume demands of global clinical trials.

The increasing prevalence of chronic diseases and the demand for cutting-edge therapies drive pharmaceutical and biopharmaceutical companies to accelerate their research and development efforts. These companies are not only spearheading the surge in clinical trials but also investing heavily in state-of-the-art biobanking and archiving systems. Such systems are crucial for maintaining the quality, safety, and integrity of biological samples required for rigorous testing of novel treatments. Moreover, technological advancements in biorepository solutions, such as automated storage systems and advanced tracking capabilities, further boost the market's appeal.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 8.3% |

The market is segmented by product type into preclinical and clinical products, with the clinical products segment dominating at 73.7% of the market share in 2024. This segment encompasses human tissues, organs, stem cells, and other biological materials that are vital for testing the efficacy and safety of new drugs. The growing complexity of clinical trials and the need to preserve these biological samples underscore the importance of robust storage and management solutions.

End users of biorepository and archiving solutions include pharmaceutical companies, biotechnology firms, contract research organizations (CROs), and academic and research institutions. In 2024, pharmaceutical companies held the largest market share at 46.7%, reflecting their pivotal role as primary sponsors of clinical trials. These companies rely on advanced biorepository services to manage the vast volumes of biological samples collected during large-scale clinical studies. Ensuring sample quality and compliance with regulatory standards is critical to achieving successful trial outcomes.

The U.S. market generated USD 1.7 billion in 2024, with the country continuing to lead global clinical research efforts. The growing volume of clinical trials conducted in the U.S. has created an unparalleled demand for sophisticated biorepository and archiving solutions. The nation's strong research infrastructure, coupled with significant investments in innovative biobanking technologies, solidifies its position as a key driver of market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in clinical trials

- 3.2.1.2 Growing demand for adhering to stringent regulations

- 3.2.1.3 Increasing demand for long term data storage and preservation

- 3.2.1.4 Increasing investments in biobanking infrastructure

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Concerns related to data security and safety

- 3.2.2.2 Capital intensive nature of advanced storage facilities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Gap analysis

- 3.5 Regulatory landscape

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Preclinical products

- 5.3 Clinical products

- 5.3.1 Human tissue

- 5.3.2 Organs

- 5.3.3 Stem cells

- 5.3.4 Other clinical products

Chapter 6 Market Estimates and Forecast, By Services, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Biorepository services

- 6.2.1 Warehousing and storage

- 6.2.2 Sample processing

- 6.2.3 Transportation

- 6.2.4 Other services

- 6.3 Archiving solution services

- 6.3.1 Database indexing and management

- 6.3.2 Scanning and destruction

Chapter 7 Market Estimates and Forecast, By Phase, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Preclinical

- 7.3 Phase I

- 7.4 Phase II

- 7.5 Phase III

- 7.6 Phase IV

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical companies

- 8.3 Biotechnology companies

- 8.4 Contract research organizations

- 8.5 Academic and research institutions

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 American Type Culture Collection

- 10.2 Azenta US Inc.

- 10.3 BioStorage Technologies

- 10.4 Celerion

- 10.5 Celerion

- 10.6 Charles River Laboratories

- 10.7 CryoPort

- 10.8 Hamilton Company

- 10.9 IQVIA

- 10.10 Labcorp

- 10.11 NMDP BioTherapies

- 10.12 STC Biologics

- 10.13 Thermo Fisher Scientific

- 10.14 Veristat

- 10.15 VWR International (Avantor)