|

市場調查報告書

商品編碼

1684696

汽車配電模組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Power Distribution Modules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

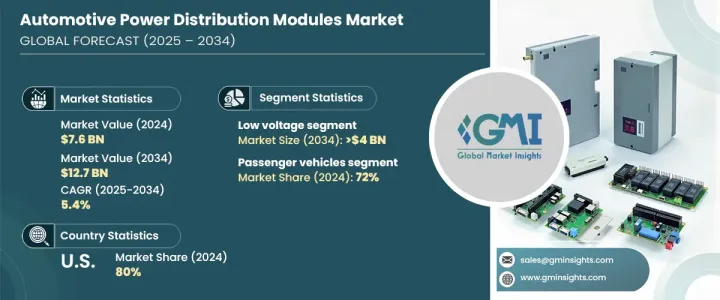

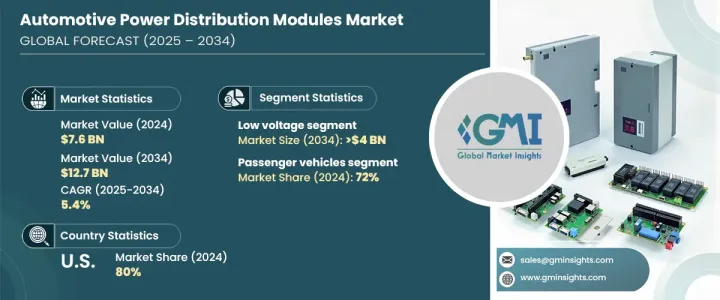

2024 年全球汽車配電模組市場規模達到 76 億美元,預計 2025 年至 2034 年期間的複合年成長率為 5.4%。這些模組對於管理各個車輛系統的電力消耗、確保最佳能源利用和減少浪費至關重要。隨著汽車製造商不斷整合更多的電子元件,從高級駕駛輔助系統 (ADAS) 到下一代資訊娛樂和氣候控制,對高效電源管理的需求變得比以往任何時候都更加迫切。

電動和混合動力汽車的日益普及進一步推動了需求,因為這些平台需要複雜的電力分配來提高整體性能和安全性。世界各國政府正在實施更嚴格的排放法規,並提供激勵措施以促進電動車(EV)的普及,推動汽車製造商投資於尖端的節能解決方案。智慧配電、負載平衡功能以及與車載診斷的整合等技術創新正在提高現代車輛的可靠性和效率。此外,消費者偏好轉向永續交通解決方案加強了市場的擴張,行業領導者投資下一代模組以最佳化電力流,減少能源損失並支持日益成長的電氣化趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 76億美元 |

| 預測值 | 127億美元 |

| 複合年成長率 | 5.4% |

市場按模組類型分為低壓、中壓和高壓。 2024 年,低壓模組佔據了 40% 的市場佔有率,預計到 2034 年將創造 40 億美元的市場價值。隨著電動車市場的快速擴張,對高效能電源管理解決方案的需求也日益增加,以確保這些系統可靠運行,而不會耗盡電池儲備。製造商正在整合先進的配電模組以提高安全性、能源效率和節約,使其成為現代車輛架構的關鍵部件。先進的智慧系統可以無縫分配電力,防止過載並確保高效使用能源,進一步推動應用。

根據車輛類型,市場分為乘用車和商用車。 2024年,乘用車佔據主導地位,佔有72%的市場。車載電子設備(包括電動動力系統和 ADAS)的日益複雜,增加了對高效配電解決方案的需求。隨著汽車技術的發展,車輛現在依賴需要穩定電力傳輸的多個電子元件。配電模組調節能量流,防止過載,最佳化系統性能並提高可靠性。汽車製造商正在不斷升級分銷系統,以支援消費者對技術驅動駕駛體驗不斷變化的期望,並整合增強安全性和用戶便利性的功能。隨著智慧汽車技術的不斷進步,對下一代電源管理解決方案的需求預計將激增。

2024 年,美國汽車配電模組市場佔全球佔有率的 80%。不斷發展的電動車產業加劇了對先進電源管理解決方案的需求,以最佳化電池系統、電動馬達和其他關鍵零件之間的電流。配電模組可實現高效的能源分配,確保電動車安全高效運作。隨著製造商優先考慮永續解決方案和尖端技術,對最佳化配電的需求持續上升,鞏固了美國作為這個不斷發展的產業主導地位。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 最終客戶

- 供應商概況

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 價格分析

- 衝擊力

- 成長動力

- 汽車電子的進步

- 消費者對節能汽車的偏好日益增加

- 採用智慧配電解決方案

- 擴大電動車基礎設施

- 產業陷阱與挑戰

- 高級模組成本高

- 設計和整合的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 電源模組

- 保險絲和斷路器

- 連接器和端子

- 繼電器

- 電壓調節器

- 其他

第6章:市場估計與預測:按模組,2021 - 2034 年

- 主要趨勢

- 低電壓

- 中壓

- 高壓

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 照明系統

- 資訊娛樂系統

- 暖通空調系統

- 安全和駕駛輔助系統

- 電池管理系統

- 其他

第 9 章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aptiv

- Bosch

- Continental

- Delphi (BorgWarner)

- Denso

- Eaton

- Hitachi

- Infineon

- Lear Corporation

- Mitsubishi

- NXP Semiconductors

- ON Semiconductor

- Panasonic

- Sensata

- STMicroelectronics

- TE Connectivity

- Texas Instruments

- Valeo

- ZF Friedrichshafen

The Global Automotive Power Distribution Modules Market reached USD 7.6 billion in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. Rising demand for fuel-efficient and eco-friendly vehicles is driving significant advancements in power distribution technology. These modules are critical in managing power consumption across various vehicle systems, ensuring optimal energy use and minimizing waste. As automakers continue to integrate more electronic components, from advanced driver-assistance systems (ADAS) to next-generation infotainment and climate control, the need for efficient power management has become more pressing than ever.

The growing adoption of electric and hybrid vehicles is further fueling demand, as these platforms require sophisticated power distribution to enhance overall performance and safety. Governments worldwide are implementing stricter emissions regulations and providing incentives to boost electric vehicle (EV) adoption, pushing automakers to invest in cutting-edge energy-efficient solutions. Technological innovations such as smart power distribution, load-balancing capabilities, and integration with onboard diagnostics are enhancing the reliability and efficiency of modern vehicles. Moreover, shifting consumer preferences toward sustainable transportation solutions reinforces the market's expansion, with industry leaders investing in next-generation modules to optimize power flow, reduce energy loss, and support growing electrification trends.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 5.4% |

The market is segmented by module type into low voltage, medium voltage, and high voltage. In 2024, low voltage modules accounted for 40% of the market share and are expected to generate USD 4 billion by 2034. The increasing use of these modules in electric and hybrid vehicles is a major driver of growth, as they power essential auxiliary functions such as lighting, infotainment, and climate control. With the EV market expanding rapidly, the need for efficient power management solutions has intensified to ensure these systems operate reliably without draining battery reserves. Manufacturers are integrating advanced power distribution modules to improve safety, energy efficiency, and conservation, making them a key component in modern vehicle architecture. Advanced smart systems allow seamless distribution of electricity, preventing overload and ensuring efficient energy use, further driving adoption.

Based on vehicle type, the market is categorized into passenger and commercial vehicles. Passenger vehicles dominated in 2024, holding 72% of the market share. The increasing complexity of in-vehicle electronics, including electric powertrains and ADAS, has heightened the demand for efficient power distribution solutions. As automotive technology evolves, vehicles now rely on multiple electronic components that require stable power delivery. Power distribution modules regulate energy flow, preventing overloads, optimizing system performance, and enhancing reliability. Automakers are continuously upgrading distribution systems to support evolving consumer expectations for technology-driven driving experiences, integrating features that enhance both safety and user convenience. As smart vehicle technology continues to advance, the demand for next-generation power management solutions is expected to surge.

The US automotive power distribution modules market accounted for 80% of the global share in 2024. The country's aggressive push toward vehicle electrification, supported by government incentives and stringent emissions regulations, is accelerating market growth. The expanding EV industry has intensified the need for advanced power management solutions that optimize electrical flow between battery systems, motors, and other critical components. Power distribution modules enable efficient energy allocation, ensuring electric vehicles operate safely and efficiently. As manufacturers prioritize sustainable solutions and cutting-edge technology, the demand for optimized power distribution continues to rise, solidifying the US as a dominant player in this evolving industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Advancements in automotive electronics

- 3.9.1.2 growing consumer preference for fuel-efficient vehicles

- 3.9.1.3 Adoption of smart power distribution solutions

- 3.9.1.4 Expansion of electric vehicle infrastructure

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of advanced modules

- 3.9.2.2 Complexity in design and integration

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Power modules

- 5.3 Fuses and circuit breakers

- 5.4 Connectors and terminals

- 5.5 Relays

- 5.6 Voltage regulators

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Module, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Low voltage

- 6.3 Medium voltage

- 6.4 High voltage

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUVs

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCVs)

- 7.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lighting systems

- 8.3 Infotainment systems

- 8.4 HVAC systems

- 8.5 Safety and driver assistance systems

- 8.6 Battery management systems

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 South Korea

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 UAE

- 10.5.2 South Africa

- 10.5.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Bosch

- 11.3 Continental

- 11.4 Delphi (BorgWarner)

- 11.5 Denso

- 11.6 Eaton

- 11.7 Hitachi

- 11.8 Infineon

- 11.9 Lear Corporation

- 11.10 Mitsubishi

- 11.11 NXP Semiconductors

- 11.12 ON Semiconductor

- 11.13 Panasonic

- 11.14 Sensata

- 11.15 STMicroelectronics

- 11.16 TE Connectivity

- 11.17 Texas Instruments

- 11.18 Valeo

- 11.19 ZF Friedrichshafen