|

市場調查報告書

商品編碼

1684697

數位公用事業市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Digital Utility Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

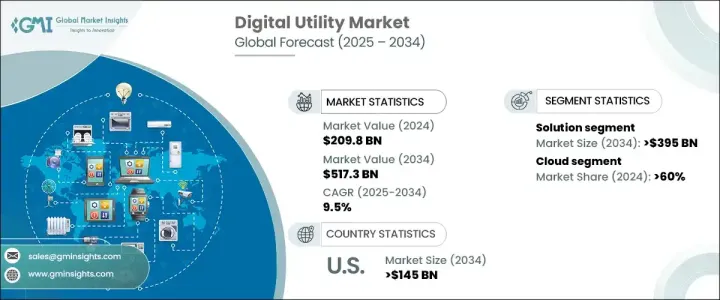

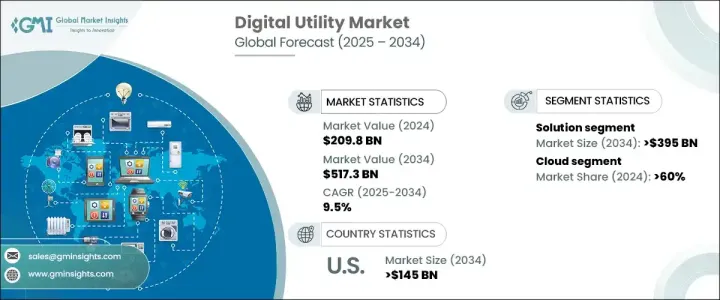

2024 年全球數位公用事業市場規模將達到 2,098 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 9.5%。隨著公用事業供應商尋求提高能源效率、降低營運成本並整合再生能源,智慧電網技術的快速採用正在推動這一擴張。公用事業領域的數位轉型正在透過實現即時監控、預測分析和自動化來重塑營運,最終提高服務可靠性。隨著能源需求的增加和氣候問題的日益嚴重,對先進數位解決方案的需求比以往任何時候都更加迫切。企業正在大力投資數位基礎設施,以實現老化電網的現代化、增強電網安全性、簡化營運,確保適應不斷變化的能源需求。

世界各國政府正在實施永續發展措施和監管框架,促進現代化,加速數位化公用事業的採用。隨著公用事業面臨能源消耗增加和極端天氣事件的挑戰,對彈性和安全的電網解決方案的需求正在激增。先進的計量基礎設施、智慧能源分配系統和自動化工具正在成為提高電網穩定性的基礎。太陽能和風能等分散能源的興起進一步迫使公用事業公司採用最佳化能源分配和需求管理的數位解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2098億美元 |

| 預測值 | 5173億美元 |

| 複合年成長率 | 9.5% |

市場按組件細分為解決方案和服務。 2024 年,解決方案佔 75% 的佔有率,預計到 2034 年將創造 3,900 億美元的產值。智慧電錶、自動化能源管理系統和電網自動化的不斷普及正在改變整個產業。這些創新最佳化了能源分配並提供即時洞察,提高了營運效率。隨著公用事業應對複雜的能源波動,預測性維護和需求反應解決方案變得不可或缺。即時分析和響應電網狀況的能力使數位解決方案成為現代公用事業營運的關鍵要素。公用事業提供者正在利用人工智慧分析來預測能源需求、檢測故障並提高電網效能,確保最少的服務中斷。

市場上的部署方法分為內部部署和基於雲端的解決方案。雲端運算領域將在 2024 年佔據 60% 的市場佔有率,為公用事業提供可擴展且經濟高效的基礎設施解決方案。基於雲端的平台與物聯網和巨量資料分析無縫整合,實現即時監控和高效的電網管理,而無需大量的前期投資。隨著數位公用事業的擴張,對遠端操作和持續數據驅動決策的需求日益加劇。雲端部署確保靈活性和彈性,支援公用事業管理複雜的能源分配網路。安全仍然是重中之重,供應商正在投資先進的加密、自動更新和威脅偵測來保護數位公用事業生態系統。對互聯能源系統和分散式能源資源的日益依賴進一步推動了對雲端解決方案的需求。

2024 年,美國數位公用事業市場佔有 84% 的佔有率,預計到 2034 年將創造 1,400 億美元的產值。政府政策和激勵措施(包括促進能源創新的立法措施)正在推動全國數位公用事業的擴張。領先技術供應商的競爭格局正在推動智慧公用事業解決方案的進步。再生能源的整合和對提高電網可靠性的重視正在塑造市場的成長。對智慧計量和能源管理系統的需求不斷成長,進一步增強了該行業的發展。美國繼續引領數位化公用事業轉型,重點關注自動化、分析和新一代電網基礎設施。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 解決方案提供者

- 服務提供者

- 經銷商

- 最終用戶

- 利潤率分析

- 專利格局

- 成本明細

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 智慧電網技術需求不斷成長

- 物聯網和巨量資料分析的採用日益廣泛

- 政府對再生能源的措施和投資

- 越來越關注能源效率和永續性

- 產業陷阱與挑戰

- 數位公用事業解決方案的初始成本高

- 資料安全和隱私問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 解決方案

- 進階計量基礎設施 (AMI)

- 能源管理系統 (EMS)

- 客戶資訊系統(CIS)

- 地理資訊系統(GIS)

- 服務

- 諮詢服務

- 系統整合

- 託管服務

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地

- 雲

第 7 章:市場估計與預測:按公用事業,2021 - 2034 年

- 主要趨勢

- 電力設施

- 水務設施

- 瓦斯設施

第 8 章:市場估計與預測:按最終用途,2021 - 2032 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- ABB

- Accenture

- Aclara Technologies

- Capgemini

- Cisco Systems

- Eaton

- Emerson Electric

- General Electric Company

- Hitachi Energy

- Honeywell

- IBM

- Infosys

- Itron

- Landis+Gyr Group

- Microsoft

- Oracle

- SAP SE

- Schneider Electric

- Siemens

- Wipro

The Global Digital Utility Market reached USD 209.8 billion in 2024 and is set to grow at a CAGR of 9.5% between 2025 and 2034. The rapid adoption of smart grid technologies is driving this expansion as utility providers seek to enhance energy efficiency, lower operational costs, and integrate renewable energy sources. Digital transformation in the utility sector is reshaping operations by enabling real-time monitoring, predictive analytics, and automation, ultimately improving service reliability. With increasing energy demands and growing climate concerns, the need for advanced digital solutions is more crucial than ever. Companies are investing heavily in digital infrastructure to modernize aging grids, enhance grid security, and streamline operations, ensuring adaptability to evolving energy requirements.

Governments worldwide are implementing sustainability initiatives and regulatory frameworks that promote modernization, accelerating the adoption of digital utilities. The demand for resilient and secure grid solutions is surging as utilities face challenges posed by rising energy consumption and extreme weather events. Advanced metering infrastructure, intelligent energy distribution systems, and automation tools are becoming fundamental in enhancing grid stability. The rise of decentralized energy resources, including solar and wind power, is further compelling utilities to adopt digital solutions that optimize energy distribution and demand management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $209.8 Billion |

| Forecast Value | $517.3 Billion |

| CAGR | 9.5% |

The market is segmented by components into solutions and services. In 2024, solutions dominated with a 75% share and are projected to generate USD 390 billion by 2034. The increasing deployment of smart meters, automated energy management systems, and grid automation is transforming the industry. These innovations optimize energy distribution and provide real-time insights, improving operational efficiency. Predictive maintenance and demand response solutions are becoming indispensable as utilities navigate complex energy fluctuations. The ability to instantly analyze and respond to grid conditions is making digital solutions a critical element of modern utility operations. Utility providers are leveraging AI-powered analytics to predict energy demand, detect faults, and enhance grid performance, ensuring minimal service disruptions.

Deployment methods in the market are categorized into on-premises and cloud-based solutions. The cloud segment accounted for 60% of the market share in 2024, offering scalable and cost-effective infrastructure solutions for utilities. Cloud-based platforms seamlessly integrate with IoT and big data analytics, enabling real-time monitoring and efficient grid management without requiring significant upfront investments. As digital utilities expand, the need for remote operations and continuous data-driven decision-making is intensifying. Cloud deployment ensures flexibility and resilience, supporting utilities in managing complex energy distribution networks. Security remains a top priority, with providers investing in advanced encryption, automated updates, and threat detection to safeguard digital utility ecosystems. The growing reliance on connected energy systems and distributed energy resources is further fueling the demand for cloud solutions.

The US digital utility market held an 84% share in 2024 and is projected to generate USD 140 billion by 2034. Government policies and incentives, including legislative measures promoting energy innovation, are driving the expansion of digital utilities across the country. A competitive landscape featuring leading technology providers is propelling advancements in smart utility solutions. The integration of renewable energy sources and the emphasis on enhancing grid reliability are shaping the market's growth. Increasing demand for smart metering and energy management systems is further strengthening the industry. The US continues to lead the digital utility transformation, with a strong focus on automation, analytics, and next-generation grid infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Solution Providers

- 3.2.2 Service Providers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Patent Landscape

- 3.5 Cost Breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for smart grid technologies

- 3.9.1.2 Increasing adoption of IoT and big data analytics

- 3.9.1.3 Government initiatives and investments in renewable energy

- 3.9.1.4 Growing focus on energy efficiency and sustainability

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of digital utility solutions

- 3.9.2.2 Data security and privacy concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Advanced Metering Infrastructure (AMI)

- 5.2.2 Energy Management System (EMS)

- 5.2.3 Customer Information System (CIS)

- 5.2.4 Geographic Information System (GIS)

- 5.3 Services

- 5.3.1 Consulting services

- 5.3.2 System integration

- 5.3.3 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Utility, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Power utilities

- 7.3 Water utilities

- 7.4 Gas utilities

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2032 ($Bn)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Accenture

- 10.3 Aclara Technologies

- 10.4 Capgemini

- 10.5 Cisco Systems

- 10.6 Eaton

- 10.7 Emerson Electric

- 10.8 General Electric Company

- 10.9 Hitachi Energy

- 10.10 Honeywell

- 10.11 IBM

- 10.12 Infosys

- 10.13 Itron

- 10.14 Landis+Gyr Group

- 10.15 Microsoft

- 10.16 Oracle

- 10.17 SAP SE

- 10.18 Schneider Electric

- 10.19 Siemens

- 10.20 Wipro