|

市場調查報告書

商品編碼

1684728

虛擬客戶端設備市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Virtual Customer Premises Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

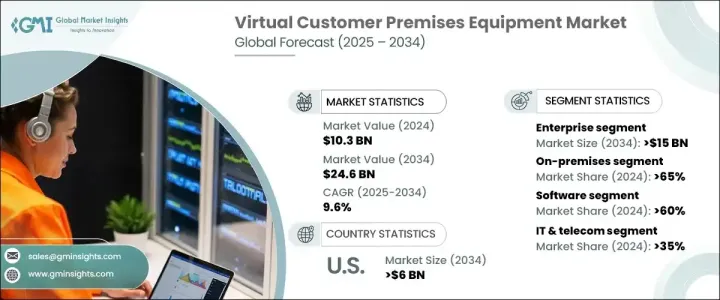

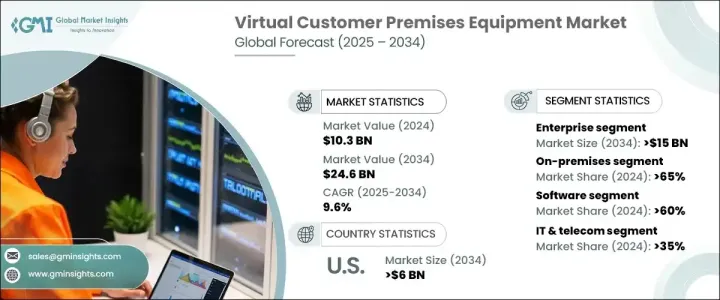

2024 年全球虛擬客戶端設備市場價值為 103 億美元,預計在 2025 年至 2034 年期間將以 9.6% 的複合年成長率成長,這得益於 5G 技術的快速普及和高速網際網路需求的不斷成長。隨著企業和消費者接受數位轉型,對高效、可擴展且經濟高效的網路解決方案的需求比以往任何時候都更加迫切。 vCPE 將傳統上由實體設備處理的網路功能虛擬化,它正在徹底改變企業和住宅用戶管理其網路基礎設施的方式。向雲端運算的轉變、對遠端工作的日益依賴以及跨行業數位基礎設施的擴展是推動 vCPE 解決方案需求的主要驅動力。

5G網路的廣泛部署,迫切需要增強網路的靈活性和可擴展性。隨著越來越多的設備和用戶上線,企業需要適應性解決方案來支援無縫連接。 vCPE 等虛擬化解決方案為企業提供了對其網路的更大控制,確保提高效能和安全性,同時降低營運成本。此外,軟體定義網路 (SDN) 和網路功能虛擬化 (NFV) 的日益普及正在加速市場擴大,使企業能夠從昂貴的基於硬體的網路管理轉向更高效的基於雲端的解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 103億美元 |

| 預測值 | 246億美元 |

| 複合年成長率 | 9.6% |

vCPE市場根據應用分為企業和住宅領域。企業部門在 2024 年佔了 70% 以上的市場佔有率,預計到 2034 年將創收 150 億美元。企業擴大轉向 vCPE 解決方案來管理點對點連接、增強安全性並實現遠端操作。這些解決方案具有無與倫比的可擴展性和易於部署的特點,成為尋求經濟高效且靈活的網路管理的企業的理想選擇。

在部署模式方面,市場分為內部部署和基於雲端的解決方案。由於企業優先考慮安全性和法規合規性,本地 vCPE 系統在 2024 年佔據了 65% 的市場佔有率。許多組織喜歡內部部署,因為它們具有高效能和強大的安全功能,可確保對網路基礎架構的完全控制。然而,基於雲端的 vCPE 解決方案正在迅速獲得關注。尋求靈活、可擴展且經濟高效的網路選項的公司擴大採用基於雲端的部署,以減少基礎設施投資,同時保持營運效率。

美國在虛擬客戶端設備市場佔據主導地位,2024 年將佔有 80% 的佔有率,預計到 2034 年將創造 60 億美元的市場價值。該國仍然處於數位轉型的前沿,多個行業廣泛採用先進的網路解決方案。領先的技術供應商和電信公司正在大力投資 vCPE 創新,增強其提供高效能、可擴展且經濟高效的網路解決方案的能力。隨著對雲端運算和 5G 連接的依賴日益增加,預計未來幾年美國對 vCPE 解決方案的需求將飆升。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 虛擬客戶端設備軟體供應商

- 服務提供者

- 經銷商

- 最終用戶

- 供應商概況

- 利潤率分析

- 專利格局

- 成本明細

- 技術與創新格局

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 5G 和高速網路的普及

- 雲端服務和虛擬化

- 提高成本效率

- 對網路靈活性和敏捷性的需求

- 產業陷阱與挑戰

- 安全問題

- 互通性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 軟體

- 服務

第6章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 本地

- 基於雲端

第 7 章:市場估計與預測:按應用,2021 - 2032 年

- 主要趨勢

- 企業

- 住宅

第 8 章:市場估計與預測:按垂直產業,2021 - 2032 年

- 主要趨勢

- 金融保險業協會

- 資訊科技和電信

- 衛生保健

- 零售

- 製造業

- 其他

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Cisco Systems

- ADVA Optical Networking

- Amdocs

- Arista Networks

- AT&T

- Broadcom

- Ciena

- Ericsson

- Fortinet

- Hewlett Packard Enterprise (HPE)

- Huawei Technologies

- Juniper Networks

- NEC

- Nokia

- Orange Business Services

- RAD Data Communications

- Riverbed Technology

- Versa Networks

- VMware

- Wind River Systems

The Global Virtual Customer Premises Equipment Market was valued at USD 10.3 billion in 2024 and is projected to expand at a CAGR of 9.6% between 2025 and 2034, driven by the rapid adoption of 5G technology and the increasing demand for high-speed internet. As businesses and consumers embrace digital transformation, the need for efficient, scalable, and cost-effective networking solutions is more pressing than ever. vCPE, which virtualizes network functions traditionally handled by physical devices, is revolutionizing how enterprises and residential users manage their network infrastructure. The shift toward cloud computing, growing dependence on remote work, and expansion of digital infrastructure across industries are major drivers fueling the demand for vCPE solutions.

The widespread deployment of 5G networks has created an urgent need for enhanced network flexibility and scalability. With more devices and users coming online, businesses require adaptable solutions to support seamless connectivity. Virtualized solutions like vCPE provide enterprises with greater control over their networks, ensuring improved performance and security while reducing operational costs. Additionally, the growing popularity of software-defined networking (SDN) and network functions virtualization (NFV) is accelerating market expansion, enabling organizations to move away from expensive, hardware-based network management toward more efficient cloud-based solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.3 billion |

| Forecast Value | $24.6 billion |

| CAGR | 9.6% |

The vCPE market is segmented by application into enterprise and residential sectors. The enterprise segment accounted for more than 70% of the market share in 2024 and is expected to generate USD 15 billion by 2034. Businesses are increasingly turning to vCPE solutions to manage point-to-point connections, enhance security, and enable remote operations. These solutions offer unmatched scalability and ease of deployment, making them an ideal choice for enterprises seeking cost-effective and flexible network management.

In terms of deployment models, the market is divided into on-premises and cloud-based solutions. On-premises vCPE systems held a 65% market share in 2024 as businesses prioritized security and regulatory compliance. Many organizations prefer on-premises deployments due to their high performance and robust security features, ensuring full control over network infrastructure. However, cloud-based vCPE solutions are rapidly gaining traction. Companies looking for flexible, scalable, and cost-efficient networking options are increasingly adopting cloud-based deployments to reduce infrastructure investment while maintaining operational efficiency.

The US dominated the virtual customer premises equipment market, holding an 80% share in 2024, and is projected to generate USD 6 billion by 2034. The country remains at the forefront of digital transformation, with widespread adoption of advanced networking solutions across multiple industries. Leading technology providers and telecom companies are heavily investing in vCPE innovations, enhancing their ability to deliver high-performance, scalable, and cost-effective networking solutions. With the increasing reliance on cloud computing and 5G connectivity, the demand for vCPE solutions in the US is expected to soar in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Virtual customer premises equipment software providers

- 3.1.2 Service providers

- 3.1.3 Distributors

- 3.1.4 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Patent landscape

- 3.5 Cost breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 5G and high-speed internet adoption

- 3.9.1.2 Cloud services and virtualization

- 3.9.1.3 Increasing cost efficiency

- 3.9.1.4 Demand for network flexibility and agility

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Security concerns

- 3.9.2.2 Interoperability issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.3 Services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-Premises

- 6.3 Cloud-Based

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Enterprise

- 7.3 Residential

Chapter 8 Market Estimates & Forecast, By Industry Vertical, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 BFSI

- 8.3 IT & Telecom

- 8.4 Healthcare

- 8.5 Retail

- 8.6 Manufacturing

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Cisco Systems

- 10.2 ADVA Optical Networking

- 10.3 Amdocs

- 10.4 Arista Networks

- 10.5 AT&T

- 10.6 Broadcom

- 10.7 Ciena

- 10.8 Ericsson

- 10.9 Fortinet

- 10.10 Hewlett Packard Enterprise (HPE)

- 10.11 Huawei Technologies

- 10.12 Juniper Networks

- 10.13 NEC

- 10.14 Nokia

- 10.15 Orange Business Services

- 10.16 RAD Data Communications

- 10.17 Riverbed Technology

- 10.18 Versa Networks

- 10.19 VMware

- 10.20 Wind River Systems