|

市場調查報告書

商品編碼

1684731

石油和天然氣儀表電纜市場機會、成長動力、產業趨勢分析和預測 2025 - 2034Oil and Gas Instrumentation Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

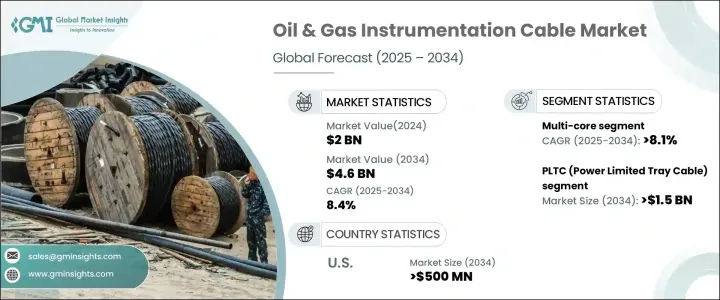

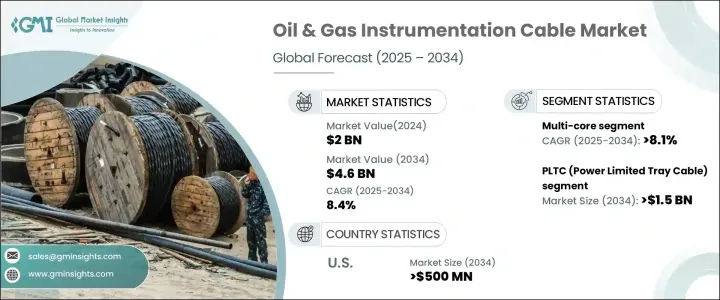

2024 年全球石油和天然氣儀器電纜市場規模將達到 20 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 8.4%。探勘和生產活動的激增,加上自動化的進步,正在推動對高性能儀器電纜的需求。隨著全球能源消耗持續上升,企業開始專注於傳統和非傳統資源,對可靠的佈線解決方案的需求也隨之增加,以確保營運安全、效率和即時資料傳輸。隨著數位技術成為石油和天然氣基礎設施不可或缺的一部分,這些電纜在支援遠端監控、流程自動化和極端環境下的無縫通訊方面發揮關鍵作用。

石油和天然氣業務正在迅速採用人工智慧 (AI)、物聯網和預測分析等智慧技術來提高效率並減少停機時間。這種轉變需要能夠承受惡劣條件的先進儀器電纜,確保不間斷的資料傳輸和電源供應。市場正在轉向具有優異耐用性、靈活性以及抗溫度波動、防潮和耐化學物質侵蝕性能的電纜。此外,全球對能源永續性的推動正在推動對海上鑽井和深水探勘的投資,從而增加了對能夠支援複雜操作的高品質電纜的需求。此外,安全和環境保護的監管要求迫使企業升級到先進的佈線解決方案,從而進一步加速市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 20億美元 |

| 預測值 | 46億美元 |

| 複合年成長率 | 8.4% |

到 2034 年,PLTC(電力限制托盤電纜)領域預計將創造 15 億美元的收入,這得益於石油和天然氣設施對耐用且多功能電纜解決方案日益成長的需求。這些電纜具有供電和控制的雙重用途,同時經過精心設計,可以承受高溫、潮濕和化學物質暴露等極端條件。它們在海上平台、鑽井平台和煉油廠的廣泛應用正在增強需求,因為它們為即時資料傳輸和自動化提供了必要的支援。隨著公司努力最佳化營運並減少停機時間,PLTC 電纜在現代工業系統中的作用不斷擴大。

按芯線類型分類的多芯電纜部分預計到 2034 年將以 8.1% 的複合年成長率成長。不斷擴大的石油和天然氣業務需要高效的訊號和電力傳輸,這使得多芯電纜成為大型專案的首選。與傳統的佈線設置不同,這些電纜將多個導體整合在一個外殼內,從而提高了安裝效率並減少了空間要求。它們處理電訊號和控制訊號的能力使其成為數位油田技術、先進自動化系統和即時監控不可或缺的一部分。這些電纜在海上設施、管道和煉油裝置中的應用越來越廣泛,這是市場成長的主要驅動力。

預計到 2034 年,美國石油和天然氣儀器電纜市場規模將達到 5 億美元。隨著探勘、生產和現代化力度的加大,對高性能儀器電纜的需求正在激增。上游、中游和下游營運中的自動化、數位化和物聯網的整合正在推動對先進佈線解決方案的投資。這些現代技術需要強大的電力和資料傳輸能力,因此儀器電纜對於產業發展至關重要。隨著公司優先考慮效率和可靠性,儀器電纜市場將持續擴張。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- PLTC電纜

- ITC電纜

- TC電纜

- 其他

第6章:市場規模及預測:依核心類型,2021 – 2034 年

- 主要趨勢

- 單核

- 多核心

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- Belden

- CommScope

- Elsewedy Electric

- Fujikura

- Furukawa Electric

- Helukabel

- Hellenic Group

- Kabelwerk Eupen

- Lapp Group

- Leoni

- LS Cable & Systems

- Nexans

- NKT

- Polycab

- Prysmian Group

- Shawcor

- Sumitomo

- Technikabel

- TFKable

The Global Oil And Gas Instrumentation Cable Market reached USD 2 billion in 2024 and is set to expand at a robust CAGR of 8.4% from 2025 to 2034. The surge in exploration and production activities, combined with advancements in automation, is fueling demand for high-performance instrumentation cables. As global energy consumption continues to rise, companies are focusing on both traditional and non-traditional resources, increasing the need for reliable cabling solutions that ensure operational safety, efficiency, and real-time data transmission. With digital technologies becoming integral to oil and gas infrastructure, these cables play a critical role in supporting remote monitoring, process automation, and seamless communication in extreme environments.

Oil and gas operations are rapidly adopting smart technologies such as artificial intelligence (AI), IoT, and predictive analytics to enhance efficiency and reduce downtime. This transformation requires advanced instrumentation cables that can withstand harsh conditions, ensuring uninterrupted data transmission and power supply. The market is seeing a shift towards cables with superior durability, flexibility, and resistance to temperature fluctuations, moisture, and chemical exposure. Furthermore, the global push toward energy sustainability is driving investment in offshore drilling and deepwater exploration, reinforcing the demand for high-quality cables that can support complex operations. In addition, regulatory mandates for safety and environmental protection are compelling companies to upgrade to advanced cabling solutions, further accelerating market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2 Billion |

| Forecast Value | $4.6 Billion |

| CAGR | 8.4% |

By 2034, the PLTC (Power Limited Tray Cable) segment is projected to generate USD 1.5 billion, driven by the growing need for durable and versatile cabling solutions in oil and gas facilities. These cables serve a dual purpose of power supply and control while being engineered to endure extreme conditions such as high temperatures, moisture, and chemical exposure. Their widespread use in offshore platforms, drilling rigs, and refineries is bolstering demand, as they provide essential support for real-time data transmission and automation. As companies strive to optimize operations and reduce downtime, the role of PLTC cables in modern industrial systems continues to expand.

The multi-core cable segment, categorized by core type, is set to grow at a CAGR of 8.1% through 2034. Expanding oil and gas operations demand efficient signal and power transmission, making multi-core cables the preferred choice for large-scale projects. Unlike conventional wiring setups, these cables consolidate multiple conductors within a single casing, enhancing installation efficiency and reducing space requirements. Their capability to handle both electric and control signals makes them indispensable for digital oilfield technologies, advanced automation systems, and real-time monitoring. The increasing adoption of these cables in offshore installations, pipelines, and refining units is a key driver of market growth.

The U.S. oil & gas instrumentation cable market is expected to reach USD 500 million by 2034. With exploration, production, and modernization efforts intensifying, demand for high-performance instrumentation cables is surging. The integration of automation, digitization, and IoT across upstream, midstream, and downstream operations is pushing investment in advanced cabling solutions. These modern technologies require robust power and data transmission capabilities, making instrumentation cables critical for industry growth. As companies prioritize efficiency and reliability, the market for instrumentation cables is set to experience sustained expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 5.1 Key trends

- 5.2 PLTC cable

- 5.3 ITC cable

- 5.4 TC cable

- 5.5 Others

Chapter 6 Market Size and Forecast, By Core Type, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 6.1 Key trends

- 6.2 Single core

- 6.3 Multi core

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Tonnes)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Turkey

- 7.5.4 South Africa

- 7.5.5 Egypt

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Belden

- 8.2 CommScope

- 8.3 Elsewedy Electric

- 8.4 Fujikura

- 8.5 Furukawa Electric

- 8.6 Helukabel

- 8.7 Hellenic Group

- 8.8 Kabelwerk Eupen

- 8.9 Lapp Group

- 8.10 Leoni

- 8.11 LS Cable & Systems

- 8.12 Nexans

- 8.13 NKT

- 8.14 Polycab

- 8.15 Prysmian Group

- 8.16 Shawcor

- 8.17 Sumitomo

- 8.18 Technikabel

- 8.19 TFKable