|

市場調查報告書

商品編碼

1684782

方向盤開關市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Steering Wheel Switches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

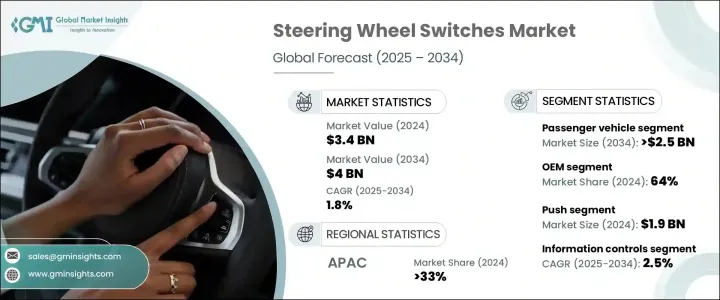

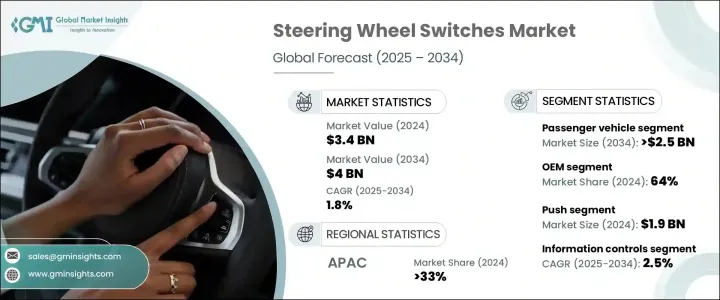

2024 年全球方向盤開關市場價值為 34 億美元,預計 2025 年至 2034 年期間的複合年成長率為 1.8%。道路安全仍然是全世界關注的主要問題,特別是在已開發地區,車輛事故會造成重大傷亡。消費者意識的增強,加上監管的影響和先進的購買力,導致對現代安全技術的需求日益成長。汽車製造商擴大將先進的駕駛輔助功能整合到車輛中,既提高了安全性,也擴大了市場。對駕駛員保護的日益重視推動了方向盤電子設備的採用,減少了干擾,並提高了整體駕駛效率。多功能方向盤控制裝置越來越受歡迎,因為它們不僅提高了用戶的便利性,而且符合行業趨勢,尤其是電動車的快速普及。向無縫車載控制系統的轉變進一步增強了市場前景。

2024 年,乘用車的市佔率超過 60%,預計到 2034 年將超過 25 億美元。轎車、掀背車和 SUV 對方向盤開關的需求很大,因為這些車輛繼續佔據全球銷售主導地位。透過內建控制裝置,駕駛者可以不受干擾地管理資訊娛樂、巡航控制和通訊系統,製造商正專注於整合更直覺、更方便用戶使用的介面。日常使用車輛的需求不斷增加,尤其是在城市地區,進一步推動了對方向盤開關的需求。由於汽車製造商優先考慮駕駛員的便利性和效率,一體化控制解決方案正在成為現代乘用車的關鍵部件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 34億美元 |

| 預測值 | 40億美元 |

| 複合年成長率 | 1.8% |

市場分為OEM和售後市場銷售管道,其中OEM部門在 2024 年佔據 64% 的佔有率。方向盤開關主要由原始設備製造商供應,以確保在生產過程中無縫整合到車輛中。隨著這些開關成為大多數現代汽車的標準配置,汽車製造商正在延長生產週期以滿足不斷成長的需求。汽車裝配線依靠供應商實現高效採購,製造商則投資自動化以簡化生產。對新車的需求不斷增加,特別是在高成長市場,正在推動對OEM方向盤開關的需求。

產品部分包括按鈕開關和蹺蹺板開關,其中按鈕部分在 2024 年創造 19 億美元。按鈕廣泛用於資訊娛樂、音訊、巡航控制和通訊功能,提供直覺的使用者體驗。它們的耐用性和成本效益使其成為汽車製造商的首選,支援多功能應用同時保持價格實惠。向簡化的車載控制系統的轉變,加上先進電子設備的整合,繼續推動該領域的成長。

預計從 2025 年到 2034 年,資訊娛樂控制的複合年成長率將超過 2.5%。連網汽車技術的日益普及增加了對方向盤整合資訊娛樂功能的需求,以確保更安全、更方便的互動。免持存取導航、語音命令和其他功能可提高駕駛員安全性和使用者體驗,使資訊娛樂控制成為現代車輛的重要組成部分。

2024 年亞太地區引領全球市場,佔總佔有率的 33% 以上。隨著汽車產量強勁成長以及對方向盤控制的需求不斷增加,該地區繼續推動市場擴張。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 原物料供應商

- 零件供應商

- 製造商

- 技術提供者

- 經銷商

- 最終用戶

- 利潤率分析

- 供應商概況

- 技術與創新格局

- 專利分析

- 監管格局

- 價格趨勢

- 衝擊力

- 成長動力

- 全球汽車銷售不斷成長

- 道路安全意識增強

- 汽車零件產業興起

- 汽車製造業穩定發展

- 汽車電子和自適應巡航控制技術的進步

- 產業陷阱與挑戰

- 汽車觸控螢幕顯示器的應用日益廣泛

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- SUV

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 6 章:市場估計與預測:按銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 7 章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 推

- 蹺蹺板

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 資訊娛樂控制

- 音訊控件

- 巡航控制

- 電話控制

- 其他

第 9 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- ALPS

- Changjiang Automobile Electronic System

- COBO

- Continental

- Delphi

- Denso

- Dongguan

- Hyundai Motor

- Johnson Electric Holdings

- Kia Corporation

- Leopold Kostal

- LS Automotive Technologies

- Marquardt Group

- Nissan Motor

- Panasonic Corporation

- Preh

- TOKAI RIKA

- Toyota Motor

- Valeo

- ZF Friedrichshafen

The Global Steering Wheel Switches Market was valued at USD 3.4 billion in 2024 and is projected to grow at a CAGR of 1.8% between 2025 and 2034. Road safety remains a major concern worldwide, particularly in developed regions where vehicle accidents result in significant casualties. High consumer awareness, combined with regulatory influences and advanced purchasing power, has led to a growing demand for modern safety technologies. Automakers are increasingly integrating advanced driver-assist features into vehicles, enhancing both safety and market expansion. The rising emphasis on driver protection is fueling the adoption of steering wheel electronics, reducing distractions, and improving overall driving efficiency. Multi-functional steering wheel controls are gaining popularity as they enhance user convenience while aligning with industry trends, particularly the rapid acceptance of electric vehicles. The shift towards seamless in-car control systems further strengthens the market outlook.

Passenger vehicles held a market share of over 60% in 2024 and are expected to surpass USD 2.5 billion by 2034. Sedans, hatchbacks, and SUVs contribute significantly to the demand for steering wheel switches, as these vehicles continue to dominate global sales. With built-in controls allowing drivers to manage infotainment, cruise control, and communication systems without distractions, manufacturers are focusing on integrating more intuitive and user-friendly interfaces. The increasing demand for daily-use vehicles, especially in urban areas, is further driving the need for steering wheel-mounted switches. As automakers prioritize driver convenience and efficiency, all-in-one control solutions are becoming a key component in modern passenger cars.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 billion |

| Forecast Value | $4 billion |

| CAGR | 1.8% |

The market is divided into OEM and aftermarket sales channels, with the OEM segment holding a 64% share in 2024. Steering wheel switches are predominantly supplied by original equipment manufacturers, which ensures seamless integration into vehicles during production. As these switches become standard across most modern cars, automakers are expanding production cycles to meet rising demand. Automotive assembly lines rely on suppliers for efficient sourcing, with manufacturers investing in automation to streamline production. The increasing need for new vehicles, especially in high-growth markets, is boosting demand for OEM steering wheel switches.

The product segment includes push and see-saw switches, with the push button segment generating USD 1.9 billion in 2024. Push buttons are widely used for infotainment, audio, cruise control, and communication functions, providing an intuitive user experience. Their durability and cost-effectiveness make them a preferred choice for automakers, supporting multi-functional applications while maintaining affordability. The shift towards simplified in-car control systems, combined with the integration of advanced electronics, continues to drive segment growth.

Infotainment controls are expected to grow at a CAGR of over 2.5% from 2025 to 2034. The rising adoption of connected vehicle technologies has increased the demand for steering wheel-integrated infotainment features, ensuring safer and more convenient interactions. Hands-free access to navigation, voice commands, and other functions enhances both driver safety and user experience, making infotainment controls a crucial component in modern vehicles.

The Asia Pacific region led the global market in 2024, accounting for over 33% of the total share. With strong automotive production and increasing demand for steering wheel controls, the region continues to drive market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distributors

- 3.1.1.6 End users

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trend

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing sales of vehicles across the globe

- 3.6.1.2 Increased awareness about road safety

- 3.6.1.3 Emergence of automotive parts & components industry

- 3.6.1.4 Steadily developing automotive manufacturing sector

- 3.6.1.5 Advancements in automotive electronics & adaptive cruise control technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Increasing implementation of automotive touchscreen displays

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Push

- 7.3 See-saw

Chapter 8 Market Estimates & Forecast, By application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Infotainment control

- 8.3 Audio controls

- 8.4 Cruise control

- 8.5 Phone control

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ALPS

- 10.2 Changjiang Automobile Electronic System

- 10.3 COBO

- 10.4 Continental

- 10.5 Delphi

- 10.6 Denso

- 10.7 Dongguan

- 10.8 Hyundai Motor

- 10.9 Johnson Electric Holdings

- 10.10 Kia Corporation

- 10.11 Leopold Kostal

- 10.12 LS Automotive Technologies

- 10.13 Marquardt Group

- 10.14 Nissan Motor

- 10.15 Panasonic Corporation

- 10.16 Preh

- 10.17 TOKAI RIKA

- 10.18 Toyota Motor

- 10.19 Valeo

- 10.20 ZF Friedrichshafen