|

市場調查報告書

商品編碼

1684786

住宅太陽能儲能市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Solar Energy Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

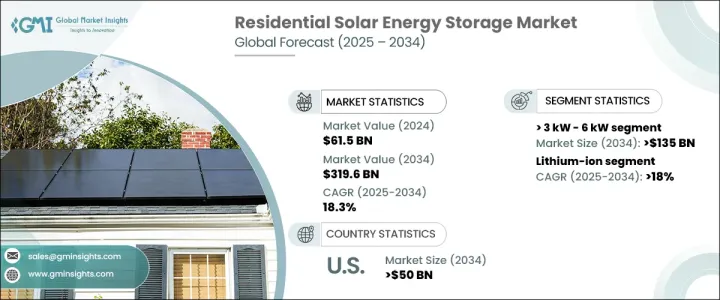

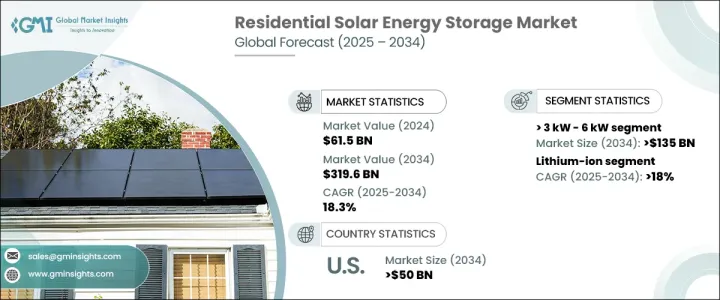

2024 年全球住宅太陽能儲存市場價值為 615 億美元,預計將大幅擴張,預計 2025 年至 2034 年期間的複合年成長率為 18.3%。隨著向再生能源轉型的加速,屋主越來越重視能源效率和永續性,推動對先進儲存解決方案的需求。隨著住宅消費者積極尋求傳統電網的替代品,能源獨立的轉變已經勢頭強勁。先進的電池技術在這一演變中發揮關鍵作用,可提供更高的能量密度、更長的使用壽命和增強的安全性能。

政府激勵措施和清潔能源政策進一步推動太陽能儲存解決方案的採用,使其更具經濟可行性和可取得性。隨著屋主認知到太陽能儲存的經濟和環境效益,促進脫碳和再生能源整合的監管框架正在加強市場擴張。城市化的快速發展和智慧家居技術的日益普及,促進了其更廣泛的應用,推動了最佳化性能、可靠性和壽命的技術進步。為了滿足這一需求,電池製造商正在開發具有成本效益、高容量的解決方案,以增強能源管理並支援與太陽能系統的無縫整合。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 615億美元 |

| 預測值 | 3196億美元 |

| 複合年成長率 | 18.3% |

到 2034 年,由於電池成本下降和對能源獨立的偏好日益增加,滿足特定功率範圍內系統的細分市場預計將產生 1,350 億美元的收入。屋主正在投資具有更高能量密度、更長使用壽命和先進安全功能的儲能設備。智慧儲存技術的整合正在最佳化太陽能利用率、提高效率並實現與住宅能源系統的無縫連接。家庭正在利用這些進步來管理高峰時段的能源需求,同時減少對外部電源的依賴。隨著技術的不斷改進和消費者對能源最佳化策略意識的不斷增強,人們正不斷轉向可靠、高效能的儲存解決方案。

鋰離子技術將徹底改變市場,到 2034 年,其複合年成長率將達到 18%,這得益於其效率、成本效益以及與住宅太陽能系統無縫整合的能力。材料、生產流程和供應鏈物流的不斷創新正在大幅降低成本,使得鋰離子儲能對於尋求長期價值的屋主來說是一項極具吸引力的投資。消費者優先考慮能源效率和更低的碳足跡,進一步鞏固了先進電池技術在現代住宅能源基礎設施中的作用。鋰離子電池的價格越來越便宜、可擴展性越來越強,其採用率也越來越高,使其成為太陽能儲能市場的主導力量。

在聯邦和州級旨在脫碳和清潔能源擴張的監管授權的支持下,美國住宅太陽能儲存市場預計到 2034 年將創收 500 億美元。財政誘因和太陽能裝置成本的下降正在推動其廣泛實施,鼓勵屋主投資太陽能儲存解決方案。不斷變化的監管政策繼續增強市場的長期生存力,而能源效率仍然是首要任務。隨著屋主注重節省成本和可靠性,對先進儲存解決方案的需求不斷增加,從而強化了市場的成長軌跡並塑造了住宅能源消費的未來。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依功率等級,2021 – 2034 年

- 主要趨勢

- ≤ 3 千瓦

- > 3 千瓦 - 6 千瓦

- > 6 千瓦

第6章:市場規模及預測:依技術,2021 – 2034 年

- 主要趨勢

- 鋰離子

- 鉛酸

第 7 章:市場規模及預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 義大利

- 西班牙

- 英國

- 瑞士

- 奧地利

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ABB

- Eaton

- Enphase Energy

- EnerSys

- Fluence

- Honeywell

- Huawei

- Johnson Controls

- Leclanche

- LG Electronics

- Maxwell Technologies

- Primus Power

- Saft

- SAMSUNG SDI

- Schneider Electric

- Siemens Energy

- SolarEdge Technologies

- Tesla

- Toshiba

- Uniper

The Global Residential Solar Energy Storage Market, valued at USD 61.5 billion in 2024, is on track to experience significant expansion, with an anticipated CAGR of 18.3% between 2025 and 2034. As the transition to renewable energy accelerates, homeowners are increasingly prioritizing energy efficiency and sustainability, driving demand for advanced storage solutions. The shift toward energy independence has gained momentum, with residential consumers actively seeking alternatives to conventional power grids. Advanced battery technologies are playing a pivotal role in this evolution, offering improved energy density, extended lifespan, and enhanced safety features.

Government incentives and clean energy policies are further propelling the adoption of solar storage solutions, making them more financially viable and accessible. Regulatory frameworks promoting decarbonization and renewable integration are reinforcing market expansion, as homeowners recognize the economic and environmental benefits of solar storage. The rapid growth of urbanization and the increasing deployment of smart home technologies are fostering greater adoption, encouraging technological advancements that optimize performance, reliability, and longevity. Battery manufacturers are responding to this demand by developing cost-effective, high-capacity solutions that enhance energy management and support seamless integration with solar power systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $61.5 Billion |

| Forecast Value | $319.6 Billion |

| CAGR | 18.3% |

By 2034, the segment catering to systems within a specific power range is projected to generate USD 135 billion, fueled by declining battery costs and the rising preference for energy independence. Homeowners are investing in storage units that provide superior energy density, longer operational life, and advanced safety features. The integration of intelligent storage technologies is optimizing solar power utilization, enhancing efficiency, and enabling seamless connectivity with residential energy systems. Households are leveraging these advancements to manage peak-hour energy demand while reducing dependence on external power sources. The ongoing shift toward reliable, high-performance storage solutions is being reinforced by continuous technological refinements and growing consumer awareness of energy optimization strategies.

Lithium-ion technology is set to revolutionize the market, growing at a CAGR of 18% through 2034, driven by its efficiency, cost-effectiveness, and ability to integrate seamlessly with residential solar systems. Continuous innovation in materials, production processes, and supply chain logistics is significantly reducing costs, making lithium-ion storage a compelling investment for homeowners seeking long-term value. Consumers are prioritizing energy efficiency and lower carbon footprints, further solidifying the role of advanced battery technologies in modern residential energy infrastructure. The increasing affordability and scalability of lithium-ion batteries are accelerating adoption rates, positioning them as a dominant force in the solar storage market.

The US residential solar energy storage market is forecasted to generate USD 50 billion by 2034, supported by federal and state-level regulatory mandates aimed at decarbonization and clean energy expansion. Financial incentives and declining costs of solar installations are driving widespread implementation, encouraging homeowners to invest in solar storage solutions. Evolving regulatory policies continue to enhance the long-term viability of the market, with energy efficiency remaining a top priority. As homeowners focus on cost savings and reliability, the demand for advanced storage solutions continues to escalate, reinforcing the market's growth trajectory and shaping the future of residential energy consumption.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (MW & USD Million)

- 5.1 Key trends

- 5.2 ≤ 3 kW

- 5.3 > 3 kW - 6 kW

- 5.4 > 6 kW

Chapter 6 Market Size and Forecast, By Technology, 2021 – 2034 (MW & USD Million)

- 6.1 Key trends

- 6.2 Lithium ion

- 6.3 Lead acid

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (MW & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Italy

- 7.3.4 Spain

- 7.3.5 UK

- 7.3.6 Switzerland

- 7.3.7 Austria

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ABB

- 8.2 Eaton

- 8.3 Enphase Energy

- 8.4 EnerSys

- 8.5 Fluence

- 8.6 Honeywell

- 8.7 Huawei

- 8.8 Johnson Controls

- 8.9 Leclanche

- 8.10 LG Electronics

- 8.11 Maxwell Technologies

- 8.12 Primus Power

- 8.13 Saft

- 8.14 SAMSUNG SDI

- 8.15 Schneider Electric

- 8.16 Siemens Energy

- 8.17 SolarEdge Technologies

- 8.18 Tesla

- 8.19 Toshiba

- 8.20 Uniper