|

市場調查報告書

商品編碼

1684815

電解器市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Electrolyzer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

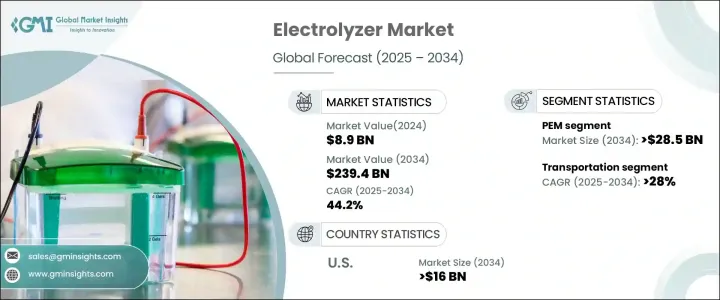

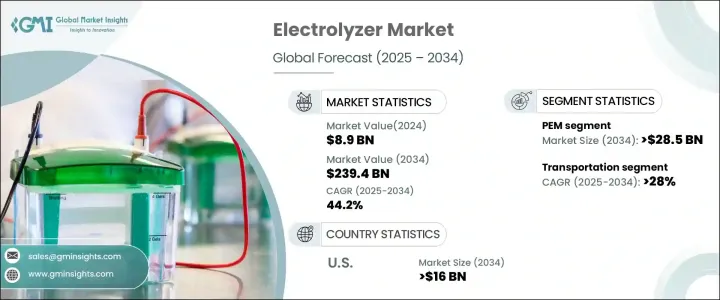

2024 年全球電解器市場規模達到 89 億美元,並有望實現顯著成長,預計 2025 年至 2034 年的複合年成長率將達到 44.2%。電解器透過電解實現氫氣生產,作為清潔能源的關鍵技術,正受到廣泛關注。該過程在電力驅動下將水分解為氫和氧。當與風能和太陽能等再生能源相結合時,電解槽在向永續能源未來過渡過程中發揮關鍵作用。透過電解產生的氫氣可用於各種工業應用、儲能系統和運輸,成為全球脫碳努力的遊戲規則改變者。

隨著世界各國政府和企業加大對永續能源解決方案的投資,人們越來越關注綠氫作為更清潔的燃料替代品,這加速了對電解器的需求。隨著世界各國採取更嚴格的政策來減少排放和提高能源安全,電解器正成為清潔能源結構的重要組成部分。這些系統在氫供應鏈中也越來越受到關注,特別是隨著化學生產、移動性和發電等行業轉向基於氫的解決方案。隨著技術的成熟,系統效率的提高以及與風能、太陽能等間歇性再生能源的結合正在推動更大的需求。此外,有利的監管框架、補貼和脫碳目標正在推動大規模採用,確保未來十年光明的市場前景。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 89億美元 |

| 預測值 | 2394億美元 |

| 複合年成長率 | 44.2% |

電解器市場按產品類型細分,質子交換膜 (PEM) 電解器預計到 2034 年將產生 285 億美元的產值。 PEM 電解器因其將電能轉化為氫氣的卓越效率而聞名,尤其是在再生能源供應波動的環境中。它們的快速反應時間和可擴展性使其成為大規模應用的理想選擇,這就是為什麼增加對研發的投資有望加速它們的採用。支持現場氫氣生產、儲能和電網穩定解決方案的財政激勵措施正在為製造商創造新的商機,促使產量激增,以滿足對高效、經濟氫氣技術日益成長的需求。

交通運輸領域是電解器市場的重要成長動力,預計到 2034 年複合年成長率為 28%。燃料電池汽車開發的投資浪潮,加上控制碳排放的監管要求,正在推動氫氣在行動解決方案中的應用。隨著汽車產業轉向氫基替代品,製造商正致力於將再生燃料融入運輸網路,同時氫燃料補給基礎設施的進步繼續增強產品部署。政府支持的研究和試點計畫正在加速商業化,使氫能成為永續交通轉型中的主導者。

預計到 2034 年,美國電解器市場將創收 160 億美元。政府激勵措施(包括補助和稅收抵免)為氫氣生產創造了有利的投資環境。聯邦政府專注於清潔能源的政策,例如最近的基礎設施投資,也在推動該行業的成長。脫碳過程中對高純度氫氣的工業需求不斷成長,進一步推動了大型電解槽的安裝。隨著能源密集產業日益向更清潔的替代品轉型,氫氣的採用正在加快步伐,鞏固了美國在全球電解器市場的地位。

目錄

第 1 章:方法論與範圍

- 市場定義

- 基礎估算與計算

- 預測計算

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第 5 章:市場規模及預測:依產品,2021 – 2034 年

- 主要趨勢

- 鹼性

- 質子交換膜

- 固體氧化物

- 其他

第6章:市場規模及預測:依產能,2021 – 2034 年

- 主要趨勢

- ≤ 500 千瓦

- > 500 千瓦 – 2 兆瓦

- 2MW以上

第 7 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 發電

- 運輸

- 工業能源

- 工業原料

- 建築供熱與供電

- 其他

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 荷蘭

- 丹麥

- 西班牙

- 挪威

- 亞太地區

- 中國

- 澳洲

- 日本

- 印度

- 世界其他地區

第9章:公司簡介

- Air Liquide

- Asahi Kasei

- Erredue

- Hystar

- IHT

- ITM Power

- McPhy Energy

- Nel

- Plug Power

- Siemens

- Sunfire

- Thyssenkrupp Nucera

- Toshiba

The Global Electrolyzer Market reached USD 8.9 billion in 2024 and is poised for remarkable growth, with projections showing a robust CAGR of 44.2% from 2025 to 2034. Electrolyzers, which enable hydrogen production through electrolysis, are gaining significant attention as a key technology for clean energy. This process splits water into hydrogen and oxygen when powered by electricity. When integrated with renewable energy sources such as wind and solar, electrolyzers play a pivotal role in the transition to a sustainable energy future. Hydrogen produced through electrolysis can be used in a variety of industrial applications, energy storage systems, and transportation, positioning it as a game-changer in decarbonization efforts worldwide.

The increasing focus on green hydrogen as a cleaner fuel alternative is accelerating the demand for electrolyzers as governments and businesses across the globe ramp up investments in sustainable energy solutions. With countries worldwide adopting more stringent policies to reduce emissions and improve energy security, electrolyzers are becoming an essential part of the clean energy mix. These systems are also gaining traction in the hydrogen supply chain, particularly as industries, including chemical production, mobility, and power generation, shift toward hydrogen-based solutions. As the technology matures, rising system efficiency and integration with intermittent renewable energy sources like wind and solar power are driving even greater demand. Furthermore, favorable regulatory frameworks, subsidies, and decarbonization targets are propelling large-scale adoption, ensuring a bright market outlook for the next decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.9 Billion |

| Forecast Value | $239.4 Billion |

| CAGR | 44.2% |

The electrolyzer market is segmented by product type, with Proton Exchange Membrane (PEM) electrolyzers expected to generate USD 28.5 billion by 2034. PEM electrolyzers are renowned for their superior efficiency in converting electricity into hydrogen, particularly in settings with fluctuating renewable energy supply. Their rapid response times and scalability make them ideal for large-scale applications, which is why increasing investments in research and development are expected to accelerate their adoption. Financial incentives supporting on-site hydrogen generation, energy storage, and grid stabilization solutions are creating new business opportunities for manufacturers, prompting a surge in production to meet the growing demand for efficient, cost-effective hydrogen generation technologies.

The transportation segment is a significant growth driver for the electrolyzer market, with an anticipated CAGR of 28% through 2034. A wave of investments in fuel cell vehicle development, coupled with regulatory mandates to curb carbon emissions, is boosting the adoption of hydrogen in mobility solutions. As the automotive industry pivots toward hydrogen-based alternatives, manufacturers are focusing on integrating renewable fuels into transportation networks while advancements in hydrogen refueling infrastructure continue to enhance product deployment. Government-backed research and pilot projects are accelerating commercialization, positioning hydrogen as a leading player in the shift to sustainable mobility.

The US electrolyzer market is expected to generate USD 16 billion by 2034. Government incentives, including grants and tax credits, are creating a favorable investment climate for hydrogen production. Federal policies focused on clean energy, such as recent infrastructure investments, are also driving the growth of the sector. Rising industrial demand for high-purity hydrogen in decarbonization processes is further boosting large-scale electrolyzer installations. As energy-intensive industries increasingly transition to cleaner alternatives, hydrogen adoption is picking up pace, solidifying the US's position in the global electrolyzer market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market Definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion & MW)

- 5.1 Key trends

- 5.2 Alkaline

- 5.3 PEM

- 5.4 Solid Oxide

- 5.5 Others

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Billion & MW)

- 6.1 Key trends

- 6.2 ≤ 500 kW

- 6.3 > 500 kW – 2 MW

- 6.4 Above 2 MW

Chapter 7 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion & MW)

- 7.1 Key trends

- 7.2 Power Generation

- 7.3 Transportation

- 7.4 Industry Energy

- 7.5 Industry Feedstock

- 7.6 Building Heat & Power

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Netherlands

- 8.3.6 Denmark

- 8.3.7 Spain

- 8.3.8 Norway

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 India

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Air Liquide

- 9.2 Asahi Kasei

- 9.3 Erredue

- 9.4 Hystar

- 9.5 IHT

- 9.6 ITM Power

- 9.7 McPhy Energy

- 9.8 Nel

- 9.9 Plug Power

- 9.10 Siemens

- 9.11 Sunfire

- 9.12 Thyssenkrupp Nucera

- 9.13 Toshiba