|

市場調查報告書

商品編碼

1684831

汽車軟體市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Automotive Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

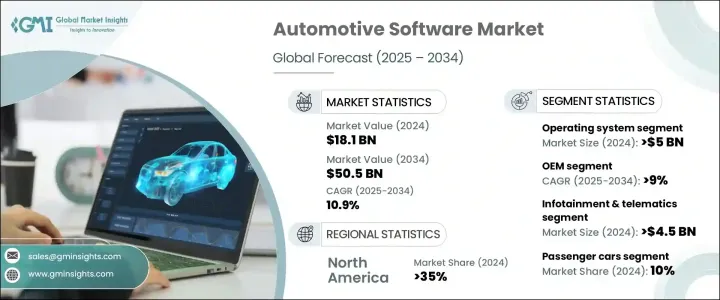

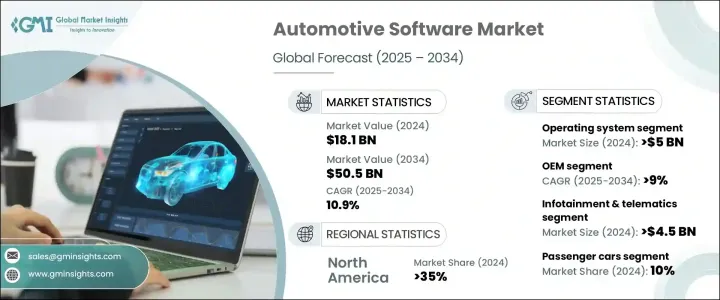

2024 年全球汽車軟體市場價值為 181 億美元,預計 2025 年至 2034 年的複合年成長率為 10.9%。對連網汽車的需求不斷成長以及對自動駕駛的日益重視是這一擴張的主要驅動力。預計 3 級及更高級別自動駕駛汽車的採用將激增,從而對促進連接、資料處理和自動駕駛功能的先進軟體解決方案產生強烈需求。資訊娛樂和動力系統管理等軟體應用的日益整合進一步推動了市場的成長。

隨著電氣化和連結性重塑汽車格局,對強大軟體解決方案的需求持續成長。汽車公司正在積極投入研發,以增強車輛軟體功能,實現新技術的無縫整合並提高車輛整體性能。全球軟體中心的擴張也凸顯了人們對軟體定義汽車和自動駕駛技術日益成長的關注。隨著汽車製造商優先考慮軟體驅動的創新以提高安全性、效率和用戶體驗,競爭格局正在改變。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 181億美元 |

| 預測值 | 505億美元 |

| 複合年成長率 | 10.9% |

汽車軟體市場可分為作業系統、中介軟體和應用軟體。作業系統的價值到 2024 年將超過 50 億美元,在將應用程式與硬體整合以支援先進的車輛功能方面發揮著至關重要的作用。中間件的採用正在增加,因為它可以實現各種軟體組件之間的無縫通訊,這對於現代互聯汽車至關重要。消費者對資訊娛樂、導航和連接的偏好日益成長,推動了對增強用戶體驗的應用軟體的需求。汽車製造商正在不斷開發創新應用程式,以滿足連網汽車用戶不斷變化的期望。

根據最終用途,市場分為OEM和售後市場部分。由於製造商大力投資開發複雜的軟體解決方案,預計 2025 年至 2034 年期間 OEM 的複合年成長率將超過 9%。嚴格的監管要求迫使汽車製造商整合先進的軟體來提高車輛性能和安全性。此外,隨著消費者尋求透過先進功能、最佳化功能和客製化來升級他們的車輛,售後軟體解決方案正在獲得關注。

根據應用,市場分為安全系統、動力系統和底盤、資訊娛樂和遠端資訊處理、車身控制和舒適度等。資訊娛樂和遠端資訊處理引領市場,到 2024 年創造超過 45 億美元的產值。對即時資訊、娛樂和連接的需求不斷成長,推動著先進資訊娛樂系統的發展。對增強安全功能的追求正在加速對旨在滿足法規遵循和提高車輛安全性的軟體解決方案的投資。隨著製造商努力提高燃油效率和減少排放,動力系統和底盤管理軟體也經歷了顯著成長

市場依車輛類型分為乘用車和商用車。隨著用於連接、安全和娛樂的嵌入式軟體解決方案的應用日益增多,乘用車將在 2024 年佔據約 10% 的市場佔有率。先進的汽車軟體擴大融入乘用車中,實現無線更新、自主功能和個人化的使用者體驗。在商用車領域,隨著技術的日益先進,對最佳化性能、安全性和法規遵循的軟體的需求也日益增加。

北美引領汽車軟體市場,到2024年將佔據全球35%以上的佔有率,其中美國位居前列。商業領域正在向節能汽車轉變,促使製造商透過先進的軟體解決方案來提高引擎性能。隨著汽車製造商對提高安全性、效率和合規性的技術進行投資,市場將會擴大。採用先進駕駛輔助系統變得越來越重要,以確保遵守法規並提高車輛安全性。對科技先進型汽車的需求不斷成長,凸顯了智慧軟體解決方案在汽車領域日益成長的重要性。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 技術整合商

- 平台提供者

- 服務提供者

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 2021 年至 2024 年連網汽車車隊規模

- ADAS 與資訊娛樂軟體的比較分析

- 衝擊力

- 成長動力

- 連網汽車技術的採用日益廣泛

- 消費者對車載資訊娛樂系統的偏好日益增加

- 加速部署進階駕駛輔助系統 (ADAS)

- 越來越重視車輛安全合規性和法規遵守性

- 擴大人工智慧(AI)在汽車軟體中的整合

- 產業陷阱與挑戰

- 為多供應商平台開發可互通軟體的複雜性

- 與連網汽車相關的網路安全威脅

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依供應量,2021 - 2034 年

- 主要趨勢

- 作業系統

- 中介軟體

- 應用軟體

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車 (HCV)

第 7 章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電動車

第 8 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 安全系統

- 資訊娛樂和遠端資訊處理

- 動力系統和底盤

- 車身控制與舒適度

- 其他

第 9 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第 10 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aptiv

- BlackBerry Limited (QNX)

- Continental

- Denso

- Elektrobit Automotive

- Harman International

- Intel Corporation

- KPIT

- Luxoft

- Magna

- NVIDIA

- NXP Semiconductors

- Panasonic

- Renesas Electronics

- Robert Bosch

- Siemens

- Tata Elxsi

- Vector Informatik

- Visteon

- Wind River Systems

The Global Automotive Software Market, valued at USD 18.1 billion in 2024, is projected to grow at a CAGR of 10.9% from 2025 to 2034. The rising demand for connected vehicles and the growing emphasis on autonomous driving are key drivers of this expansion. The adoption of Level 3 and higher autonomous vehicles is anticipated to surge, creating a strong demand for advanced software solutions that facilitate connectivity, data processing, and autonomous functionality. The increasing integration of software applications, such as infotainment and powertrain management, further fuels market growth.

As electrification and connectivity reshape the automotive landscape, the demand for robust software solutions continues to escalate. Automotive companies are actively investing in research and development to enhance vehicle software capabilities, enabling seamless integration of new technologies and improving overall vehicle performance. The expansion of global software hubs also underscores the growing focus on software-defined vehicles and automated driving technology. The competitive landscape is evolving as automakers prioritize software-driven innovations to enhance safety, efficiency, and user experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.1 Billion |

| Forecast Value | $50.5 Billion |

| CAGR | 10.9% |

The automotive software market is categorized by offering into operating systems, middleware, and application software. Operating systems, valued at over USD 5 billion in 2024, play a crucial role in integrating applications with hardware to support advanced vehicle functionalities. Middleware adoption is increasing as it enables seamless communication between various software components, essential for modern interconnected vehicles. The rising consumer preference for infotainment, navigation, and connectivity drives demand for application software that enhances user experience. Automakers are continuously developing innovative applications to meet the evolving expectations of connected vehicle users.

Based on end use, the market is divided into OEM and aftermarket segments. OEMs are expected to grow at a CAGR of over 9% from 2025 to 2034 as manufacturers invest heavily in developing sophisticated software solutions. Stringent regulatory requirements are pushing automakers to integrate advanced software that enhances vehicle performance and safety. Additionally, aftermarket software solutions are gaining traction as consumers seek to upgrade their vehicles with advanced features, optimizing functionality and customization.

By application, the market is segmented into safety systems, powertrain & chassis, infotainment & telematics, body control & comfort, and others. Infotainment & telematics led the market, generating over USD 4.5 billion in 2024. Increasing demand for real-time information, entertainment, and connectivity is driving the development of advanced infotainment systems. The push for enhanced safety features is accelerating investment in software solutions designed to meet regulatory compliance and improve vehicle security. Powertrain and chassis management software is also experiencing significant growth as manufacturers strive for fuel efficiency and emissions reduction

The market is segmented by vehicle type into passenger cars and commercial vehicles. Passenger cars accounted for approximately 10% of the market share in 2024, with the growing adoption of embedded software solutions for connectivity, safety, and entertainment. Advanced automotive software is increasingly integrated into passenger vehicles, enabling over-the-air updates, autonomous features, and personalized user experiences. In commercial vehicles, the need for software that optimizes performance, safety, and regulatory compliance is increasing as technology becomes more advanced.

North America led the automotive software market, holding over 35% of the global share in 2024, with the United States at the forefront. The commercial sector is experiencing a shift toward fuel-efficient vehicles, prompting manufacturers to enhance engine performance through advanced software solutions. The market is set to expand as automakers invest in technologies that improve safety, efficiency, and compliance. The adoption of advanced driver assistance systems is becoming essential, ensuring regulatory compliance while enhancing vehicle safety. The rising demand for technologically advanced vehicles underscores the growing importance of smart software solutions in the automotive sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology integrators

- 3.2.2 Platform providers

- 3.2.3 Service providers

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Connected car fleet size, 2021-2024

- 3.8 Comparative analysis of ADAS vs. infotainment software

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of connected car technologies

- 3.9.1.2 Rising consumer preference for in-vehicle infotainment systems

- 3.9.1.3 Accelerated deployment of Advanced Driver-Assistance Systems (ADAS)

- 3.9.1.4 Growing emphasis on vehicle safety compliance and regulatory adherence

- 3.9.1.5 Expanding integration of Artificial Intelligence (AI) in automotive software

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Complexity in developing interoperable software for multi-vendor platforms

- 3.9.2.2 Cybersecurity threats associated with connected vehicles

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Operating system

- 5.3 Middleware

- 5.4 Application software

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric vehicle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Safety systems

- 8.3 Infotainment & telematics

- 8.4 Powertrain & chassis

- 8.5 Body control & comfort

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 BlackBerry Limited (QNX)

- 11.3 Continental

- 11.4 Denso

- 11.5 Elektrobit Automotive

- 11.6 Harman International

- 11.7 Intel Corporation

- 11.8 KPIT

- 11.9 Luxoft

- 11.10 Magna

- 11.11 NVIDIA

- 11.12 NXP Semiconductors

- 11.13 Panasonic

- 11.14 Renesas Electronics

- 11.15 Robert Bosch

- 11.16 Siemens

- 11.17 Tata Elxsi

- 11.18 Vector Informatik

- 11.19 Visteon

- 11.20 Wind River Systems