|

市場調查報告書

商品編碼

1684843

廢熱回收系統市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Waste Heat Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

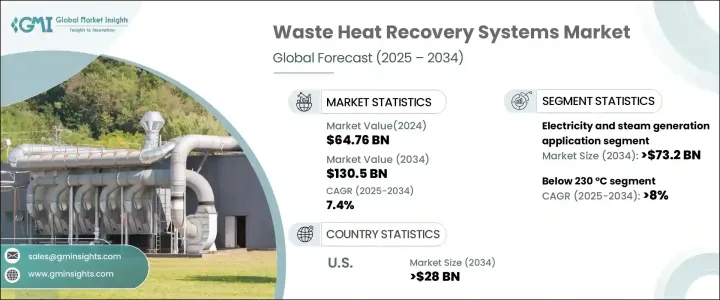

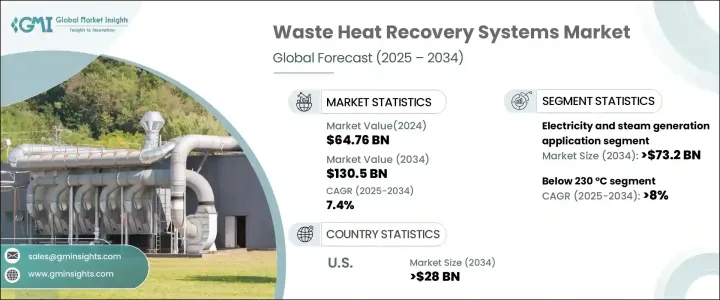

2024 年全球廢熱回收系統市場規模將達到 647.6 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 7.5%,這得益於永續發展舉措的不斷增加、嚴格的環境法規以及能源效率的提高。各行各業的公司擴大採用廢熱回收解決方案來最佳化資源利用率、提高能源效率並滿足不斷變化的監管要求。這些系統捕獲工業過程中的多餘熱量並將其轉化為可用能源,從而減少碳排放並降低營運成本。隨著水泥、玻璃、化學品和石油煉製等行業尋求經濟高效的解決方案,廢熱回收技術在現代工業運作中變得不可或缺。對更清潔的能源解決方案和更好的永續性實踐的推動繼續加強這些先進技術的採用,使其成為全球能源轉型的關鍵組成部分。

隨著全球各地的產業都注重減少碳足跡和實現長期能源效率,廢熱回收系統的發展勢頭強勁。企業逐漸意識到這些技術不僅有助於保護環境,還可以透過降低能源消耗來節省大量成本。對循環經濟實踐的日益重視和對節能製造流程的推動正在加速市場擴張。此外,熱交換器、熱電發電機和有機朗肯循環的技術進步正在提高系統效率,使其對各行各業更具吸引力。政府的激勵措施和促進清潔能源的優惠政策進一步支持了廢熱回收解決方案的採用。隨著企業繼續優先考慮永續性,對這些系統的需求預計將激增,從而重塑工業能源管理的未來。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 647.6 億美元 |

| 預測值 | 1305億美元 |

| 複合年成長率 | 7.5% |

到 2034 年,電力和蒸汽發電部門預計將創收 732 億美元。人們對全球環境問題日益擔憂以及溫室氣體排放不斷增加,促使各行各業將節能解決方案融入其營運中。廢熱回收技術透過捕獲餘熱並將其重新用於發電,有效地解決了這些問題,顯著提高了營運的永續性。隨著全球工業加大脫碳力度,這些系統已成為提高能源效率和減少排放的重要工具。企業越來越認知到實施廢熱回收的長期益處,從降低成本到提高法規遵從性,從而推動市場持續成長。

到 2034 年,運轉溫度低於 230°C 的廢熱回收系統市場預計將以 8% 的複合年成長率成長。中等溫度範圍的行業(包括紙漿和造紙、食品加工和化學品)擴大採用該系統,推動了這一市場的擴張。工業製程產生的廢熱為能源回收提供了巨大的機會,使得這些產業成為回收技術的主要採用者。投資這些系統的公司可受益於長期成本節約、能源消耗減少和碳排放減少,從而增強了他們對永續發展的承諾。人們對資源最佳化和節能製造的日益關注進一步擴大了對這些先進系統的需求。

受高昂的能源成本、嚴格的環境法規以及日益轉向永續工業實踐的推動,美國廢熱回收系統市場預計到 2034 年將創收 280 億美元。各行業的公司都在大力投資尖端廢熱回收解決方案,以提高能源效率並支持脫碳措施。產業和技術供應商之間的合作正在進一步加強市場,努力的重點是利用回收的熱能發電並減少對傳統能源的依賴。隨著工業部門繼續優先考慮永續性和成本效益,對廢熱回收技術的需求將會加速,從而決定能源管理和工業營運的未來。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 市場估計和預測參數

- 預測計算

- 資料來源

- 基本的

- 次要

- 有薪資的

- 民眾

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第 5 章:市場規模與預測:按應用,2021 – 2034 年

- 主要趨勢

- 預熱

- 電力和蒸汽發電

- 蒸汽朗肯循環

- 有機朗肯循環

- 卡林納循環

- 其他

第 6 章:市場規模與預測:按溫度,2021 – 2034 年

- 主要趨勢

- <230度C

- 230°C - 650°C

- >650 攝氏度

第 7 章:市場規模與預測:依最終用途,2021 – 2034 年

- 主要趨勢

- 石油精煉

- 水泥

- 重金屬製造

- 化學

- 紙漿和造紙

- 食品和飲料

- 玻璃

- 其他製造業

第 8 章:市場規模與預測:按地區,2021 – 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第9章:公司簡介

- Aura

- BIHL

- Bosch Industriekessel

- Climeon

- Cochran

- Durr Group

- Echogen

- Exergy International

- Forbes Marshall

- General Electric

- IHI Power Systems

- John Wood Group

- Mitsubishi Heavy Industries

- Ormat

- Promec Engineering

- Rentech Boilers

- Siemens Energy

- Sofinter

- Thermax

- Viessmann

The Global Waste Heat Recovery Systems Market reached USD 64.76 billion in 2024 and is projected to expand at a 7.5% CAGR from 2025 to 2034, driven by rising sustainability initiatives, stringent environmental regulations, and advancements in energy efficiency. Companies across multiple industries are increasingly adopting waste heat recovery solutions to optimize resource utilization, enhance energy efficiency, and meet evolving regulatory requirements. These systems capture excess heat from industrial processes and convert it into usable energy, reducing carbon emissions and lowering operational costs. With industries such as cement, glass, chemicals, and petroleum refining seeking cost-effective solutions, waste heat recovery technologies are becoming indispensable in modern industrial operations. The push toward cleaner energy solutions and improved sustainability practices continues to reinforce the adoption of these advanced technologies, making them a critical component of the global energy transition.

As industries worldwide focus on reducing carbon footprints and achieving long-term energy efficiency, waste heat recovery systems are gaining momentum. Companies are realizing that these technologies not only contribute to environmental conservation but also provide significant cost savings by reducing energy consumption. The growing emphasis on circular economy practices and the push for energy-efficient manufacturing processes are accelerating market expansion. Furthermore, technological advancements in heat exchangers, thermoelectric generators, and organic Rankine cycles are enhancing system efficiency, making them more attractive to a wide range of industries. Government incentives and favorable policies promoting clean energy further support the adoption of waste heat recovery solutions. As businesses continue prioritizing sustainability, demand for these systems is expected to surge, reshaping the future of industrial energy management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $64.76 Billion |

| Forecast Value | $130.5 Billion |

| CAGR | 7.5% |

By 2034, the electricity and steam generation segment is projected to generate USD 73.2 billion. Rising concerns over global environmental issues and increasing greenhouse gas emissions are pushing industries to integrate energy-efficient solutions into their operations. Waste heat recovery technologies effectively address these concerns by capturing residual heat and repurposing it for power generation, significantly improving operational sustainability. With global industries intensifying their decarbonization efforts, these systems have become essential tools for enhancing energy efficiency and reducing emissions. Businesses are increasingly recognizing the long-term benefits of implementing waste heat recovery, from cost reductions to improved regulatory compliance, driving sustained market growth.

The market for waste heat recovery systems operating at temperatures below 230 °C is expected to grow at a CAGR of 8% through 2034. The expansion is fueled by rising adoption in industries with moderate temperature ranges, including pulp and paper, food processing, and chemicals. Waste heat from industrial processes presents a substantial opportunity for energy recovery, making these sectors key adopters of recovery technologies. Companies investing in these systems benefit from long-term cost savings, reduced energy consumption, and minimized carbon emissions, reinforcing their commitment to sustainability. The increasing focus on resource optimization and energy-efficient manufacturing further amplifies the demand for these advanced systems.

The U.S. waste heat recovery systems market is poised to generate USD 28 billion by 2034, driven by high energy costs, stringent environmental regulations, and the growing shift toward sustainable industrial practices. Companies across various sectors are heavily investing in cutting-edge waste heat recovery solutions to enhance energy efficiency and support decarbonization initiatives. The collaboration between industries and technology providers is further strengthening the market, with efforts focused on utilizing recovered heat for power generation and reducing dependence on traditional energy sources. As industrial sectors continue prioritizing sustainability and cost-efficiency, the demand for waste heat recovery technologies is set to accelerate, shaping the future of energy management and industrial operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Pre-Heating

- 5.3 Electricity & steam generation

- 5.3.1 Steam rankine cycle

- 5.3.2 Organic rankine cycle

- 5.3.3 Kalina cycle

- 5.4 Other

Chapter 6 Market Size and Forecast, By Temperature, 2021 – 2034 (USD Billion)

- 6.1 Key trends

- 6.2 <230°C

- 6.3 230°C - 650 °C

- 6.4 >650 °C

Chapter 7 Market Size and Forecast, By End Use, 2021 – 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Petroleum refining

- 7.3 Cement

- 7.4 Heavy metal manufacturing

- 7.5 Chemical

- 7.6 Pulp & paper

- 7.7 Food & beverage

- 7.8 Glass

- 7.9 Other manufacturing

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Aura

- 9.2 BIHL

- 9.3 Bosch Industriekessel

- 9.4 Climeon

- 9.5 Cochran

- 9.6 Durr Group

- 9.7 Echogen

- 9.8 Exergy International

- 9.9 Forbes Marshall

- 9.10 General Electric

- 9.11 IHI Power Systems

- 9.12 John Wood Group

- 9.13 Mitsubishi Heavy Industries

- 9.14 Ormat

- 9.15 Promec Engineering

- 9.16 Rentech Boilers

- 9.17 Siemens Energy

- 9.18 Sofinter

- 9.19 Thermax

- 9.20 Viessmann