|

市場調查報告書

商品編碼

1685052

雲端遷移服務市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Cloud Migration Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

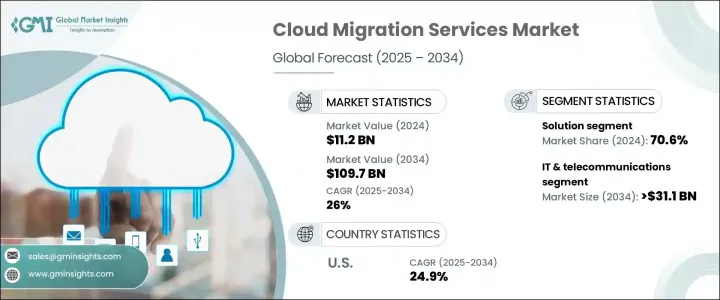

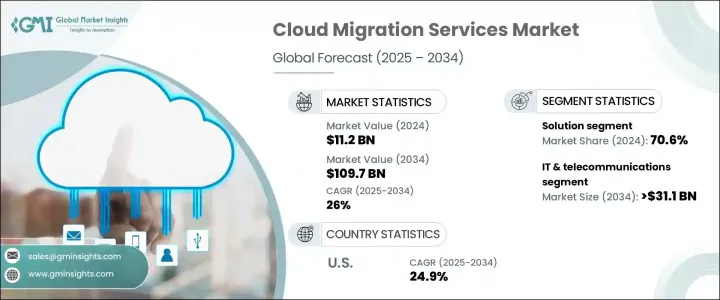

2024 年全球雲端遷移服務市場價值為 112 億美元,預計 2025 年至 2034 年期間將實現驚人的 26% 複合年成長率。隨著企業對可擴展、靈活和高效的 IT 基礎架構的需求不斷增加,雲端遷移服務的採用正在迅速獲得發展動力。這些服務對於 IT 策略現代化至關重要,可協助企業削減成本、提高營運效率並加速數位解決方案的部署。當今企業面臨著保持競爭力的越來越大的壓力,雲端遷移服務提供了一種在最佳化基礎設施的同時增強靈活性、提高安全性和滿足不斷變化的客戶需求的方法。

然而,向雲端的過渡並非沒有挑戰。缺乏適當的規劃和策略往往會導致延誤、意外成本和營運效率低下。如果沒有結構化方法進行遷移,則可能會導致相容性問題、資料安全漏洞以及遷移過程中的中斷。因此,組織必須優先考慮周密的規劃和執行,以確保順利、高效的雲端遷移,從而降低這些挫折的風險並保證長期成功。實現無縫的雲端過渡需要利用專業知識和工具來管理遷移基礎架構、應用程式和資料的複雜性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 112億美元 |

| 預測值 | 1097億美元 |

| 複合年成長率 | 26% |

市場分為解決方案和服務,其中解決方案在 2024 年佔據 70.6% 的主導佔有率。這包括基礎設施、平台、資料庫、應用程式和儲存遷移。這些解決方案對於管理複雜的 IT 環境至關重要,並為企業提供順利有效地評估、規劃和執行雲端遷移所需的工具和專業知識。隨著越來越多的組織採用雲端遷移服務來簡化流程並提高生產力,對全面雲端解決方案的需求持續激增。

按垂直行業分類,雲端遷移服務市場分為 IT 和電信、BFSI、醫療保健、政府和公共部門等。尤其是 IT 和電信業,預計將大幅成長,到 2034 年將達到 311 億美元。對可擴展基礎架構的需求,以處理不斷成長的資料量並支援尖端技術,正在推動這一垂直領域對雲端遷移服務的需求。這些服務使組織能夠最佳化工作量、提高效率並降低營運成本,這對於技術快速進步的產業至關重要。

在美國,雲端遷移服務市場預計到 2034 年將以 24.9% 的複合年成長率成長。先進的 IT 基礎設施加上高度集中的雲端服務供應商使美國成為全球市場的重要參與者。全國各地的組織越來越依賴雲端遷移服務來擺脫傳統的內部部署系統並加速其數位轉型計畫。此外,有利的法規和政府支持的計劃創造了有利於更廣泛地採用雲端運算的環境,特別是在公共服務領域。雖然大型企業引領市場,但中型企業也正在採用滿足其獨特需求的經濟高效的雲端解決方案,進一步促進該行業的快速擴張。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對敏捷性和自動化的需求不斷增加

- 雲端原生技術的採用日益廣泛

- 不斷演變的安全情勢

- 政府措施和法規

- 雲端服務的成熟度和成本效益

- 產業陷阱與挑戰

- 缺乏規劃和策略

- 隱性成本和供應商鎖定

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場估計與預測:按平台,2021-2034 年

- 主要趨勢

- 解決方案

- 基礎設施遷移

- 平台遷移

- 資料庫遷移

- 應用程式遷移

- 儲存遷移

- 服務

- 專業服務

- 託管服務

第6章:市場估計與預測:依部署,2021-2034 年

- 主要趨勢

- 公共雲端

- 私有雲端

- 混合

第 7 章:市場估計與預測:依組織規模,2021-2034 年

- 主要趨勢

- 大型企業

- 中小企業(SME)

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 專案管理

- 基礎設施管理

- 安全與合規管理

- 供應鏈管理(SCM)

- 內容管理

- 其他

第 9 章:市場估計與預測:按垂直產業,2021-2034 年

- 主要趨勢

- 資訊科技和電信

- 金融保險業協會

- 衛生保健

- 政府和公共部門

- 其他

第 10 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地區

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- MEA 其他地區

第 11 章:公司簡介

- Accenture

- Amazon Web Services, Inc.

- Capgemini

- Cognizant Technology Solutions Corp

- DXC Technology

- Evolve IP LLC

- Google LLC

- Hewlett Packard Enterprise Development LP

- IBM Corporation

- Kyndryl Inc.

- Microsoft

- NTT DATA Americas, Inc.

- Oracle Corporation

- Rackspace Hosting Inc.

- SAP SE

- Sunrise Technologies

- Tata Communications

- Veritis Group Inc.

- VMware, Inc.

- Wipro

- WSM International LLC

The Global Cloud Migration Services Market was valued at USD 11.2 billion in 2024 and is anticipated to experience an impressive growth rate of 26% CAGR from 2025 to 2034. As organizations increasingly demand scalable, flexible, and efficient IT infrastructure, the adoption of cloud migration services is rapidly gaining momentum. These services are crucial for modernizing IT strategies, enabling businesses to cut costs, improve operational efficiency, and speed up the deployment of digital solutions. Businesses today face mounting pressure to stay competitive, and cloud migration services offer a way to enhance agility, improve security, and meet evolving customer needs while optimizing their infrastructure.

The transition to the cloud, however, is not without its challenges. A lack of proper planning and strategy often results in delays, unexpected costs, and operational inefficiencies. Migrating without a structured approach can lead to compatibility issues, data security vulnerabilities, and disruptions during the process. Therefore, organizations must prioritize meticulous planning and execution to ensure smooth, efficient cloud migration, which reduces the risk of these setbacks and guarantees long-term success. Achieving a seamless cloud transition requires leveraging specialized knowledge and tools to manage the complexities of migrating infrastructure, applications, and data.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.2 Billion |

| Forecast Value | $109.7 Billion |

| CAGR | 26% |

The market is split into solutions and services, with solutions accounting for a dominant share of 70.6% in 2024. This includes infrastructure, platform, database, application, and storage migration. These solutions are essential for managing complex IT environments and provide businesses with the tools and expertise necessary to assess, plan, and execute their cloud migrations smoothly and effectively. As more organizations adopt cloud migration services to streamline their processes and enhance productivity, the demand for comprehensive cloud solutions continues to surge.

By vertical, the cloud migration services market is segmented into IT & telecommunications, BFSI, healthcare, government & public sector, and others. The IT & telecommunications sector, in particular, is expected to see substantial growth, reaching USD 31.1 billion by 2034. The need for scalable infrastructure to handle the growing volumes of data and support cutting-edge technologies is fueling the demand for cloud migration services in this vertical. These services allow organizations to optimize workloads, boost efficiency, and reduce operational costs, which is vital in an industry marked by rapid technological advancements.

In the U.S., the cloud migration services market is poised to grow at a CAGR of 24.9% through 2034. The presence of advanced IT infrastructure, coupled with a high concentration of cloud service providers, positions the U.S. as a key player in the global market. Organizations across the country are increasingly relying on cloud migration services to move away from traditional on-premises systems and to accelerate their digital transformation initiatives. Additionally, favorable regulations and government-backed programs have created an environment conducive to greater cloud adoption, particularly in public services. While large enterprises lead the market, mid-sized businesses are also embracing cost-effective cloud solutions that cater to their unique requirements, further contributing to the sector's rapid expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Growth drivers

- 3.7.1 Increasing demand for agility and automation

- 3.7.2 Growing adoption of cloud-native technologies

- 3.7.3 Evolving security landscape

- 3.7.4 Government initiatives and regulations

- 3.7.5 Maturity and cost-effectiveness of cloud services

- 3.8 Industry pitfalls & challenges

- 3.8.1 Lack of planning and strategy

- 3.8.2 Hidden costs and vendor lock-in

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Platform, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Infrastructure migration

- 5.2.2 Platform migration

- 5.2.3 Database migration

- 5.2.4 Application migration

- 5.2.5 Storage migration

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Public cloud

- 6.3 Private cloud

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 Small & medium-sized enterprises(SME)

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Project management

- 8.3 Infrastructure management

- 8.4 Security & compliance management

- 8.5 Supply chain management(SCM)

- 8.6 Content management

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Vertical, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 IT & telecommunications

- 9.3 BFSI

- 9.4 Healthcare

- 9.5 Government & public sector

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of MEA

Chapter 11 Company Profiles

- 11.1 Accenture

- 11.2 Amazon Web Services, Inc.

- 11.3 Capgemini

- 11.4 Cognizant Technology Solutions Corp

- 11.5 DXC Technology

- 11.6 Evolve IP LLC

- 11.7 Google LLC

- 11.8 Hewlett Packard Enterprise Development LP

- 11.9 IBM Corporation

- 11.10 Kyndryl Inc.

- 11.11 Microsoft

- 11.12 NTT DATA Americas, Inc.

- 11.13 Oracle Corporation

- 11.14 Rackspace Hosting Inc.

- 11.15 SAP SE

- 11.16 Sunrise Technologies

- 11.17 Tata Communications

- 11.18 Veritis Group Inc.

- 11.19 VMware, Inc.

- 11.20 Wipro

- 11.21 WSM International LLC