|

市場調查報告書

商品編碼

1685075

紡織著色劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Textile Colorant Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

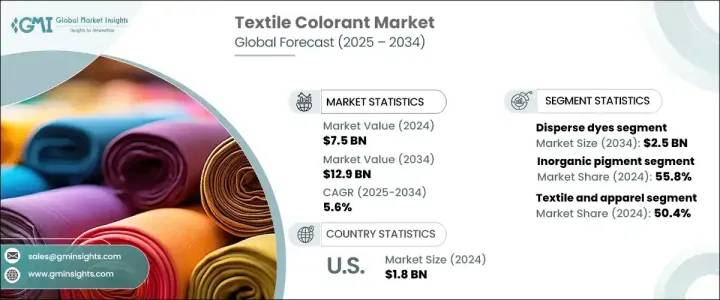

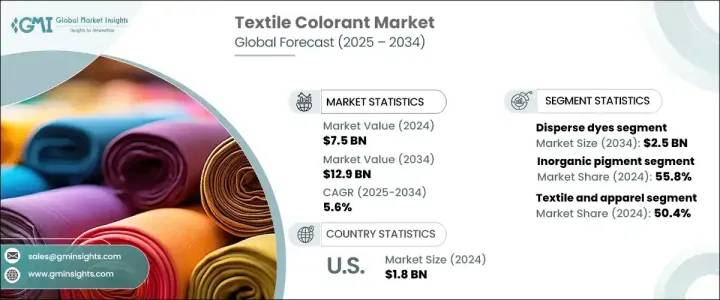

全球紡織品著色劑市場價值將於 2024 年達到 75 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 5.6%,這主要得益於時尚和家紡領域對鮮豔、持久染料的需求激增。隨著消費者偏好轉向永續性,環保和生物基著色劑越來越受到關注,推動了有機染料技術的創新。時尚產業的快速發展不斷推動對多樣化色彩和高效染色技術的需求,使製造商能夠跟上不斷變化的趨勢。

隨著永續性成為焦點,各家公司都在大力投資尖端、節水的染色解決方案。對水污染的擔憂推動了無水染色方法的進步,在保持高品質結果的同時最大限度地減少對環境的影響。此外,促進永續實踐的監管框架正在加速向無毒、可生物分解的紡織著色劑的轉變。隨著品牌和製造商優先考慮永續性,創新染色解決方案的採用正在重塑紡織著色劑格局,確保長期市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 75億美元 |

| 預測值 | 129億美元 |

| 複合年成長率 | 5.6% |

根據染料類型,市場分為鹼性染料、酸性染料、直接染料、分散染料和活性染料。分散染料是主要染料類別,2024 年其市場價值為 16 億美元,預計到 2034 年將達到 25 億美元。此類染料之所以受到青睞,是因為它們與合成纖維(尤其是聚酯纖維)具有很強的兼容性,而聚酯纖維在全球紡織品生產中仍然占主導地位。快時尚的盛行,快速的周轉和實惠是關鍵,加劇了對分散染料的需求,因為分散染料能夠在合成纖維上呈現豐富、持久的色彩。

根據顏料類型分類,市場分為有機顏料和無機顏料。無機顏料在 2024 年佔據了 55.8% 的市場佔有率,這主要歸功於其出色的色彩穩定性和優異的耐熱和耐光性。無機顏料具有優異的色牢度,是戶外紡織品和高耐久性應用的理想選擇。與有機顏料相比,它們的經濟實惠使其成為大眾市場紡織品的首選,進一步鞏固了它們在該行業中的地位。

美國紡織品著色劑市場價值 18 億美元,2024 年仍將在全球保持領先地位,這得益於強大的紡織製造基礎、持續的創新以及對高品質永續染料日益成長的需求。該市場受益於快速的生產週期和針對快時尚和家紡領域量身定做的廣泛的色彩解決方案。隨著永續性成為焦點,對生物基和天然染料以及無水染色技術的需求正在上升。加強環境安全的監管壓力進一步推動了對環保染色解決方案的投資,確保美國市場繼續保持強勁的成長軌跡。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 對永續和環保著色劑的需求不斷成長

- 快時尚和紡織業的成長

- 染色技術和數位印花的進步

- 產業陷阱與挑戰

- 嚴格的環境法規和合規性

- 永續色彩的生產成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模及預測:依染料類型,2021-2034 年

- 主要趨勢

- 酸性染料

- 鹼性染料

- 直接染料

- 分散染料

- 活性染料

- 其他

第 6 章:市場規模與預測:依顏料,2021-2034 年

- 主要趨勢

- 有機的

- 無機

第 7 章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 紡織和服裝

- 居家裝飾

- 汽車

- 衛生保健

- 其他

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Allied Industrial Corp.

- Archroma

- BASF

- Colorant

- DuPont de Nemours

- Dystar Group

- Huntsman Corporation

- JAY Chemical Industries

- Kiri Industries

- Lanxess

The Global Textile Colorant Market, valued at USD 7.5 billion in 2024, is set to expand at a CAGR of 5.6% from 2025 to 2034, fueled by the surging demand for vibrant, long-lasting dyes in fashion and home textiles. As consumer preferences shift toward sustainability, eco-friendly and bio-based colorants are gaining traction, encouraging innovation in organic dye technologies. The fashion industry's rapid evolution continues to drive demand for a diverse color palette and efficient dyeing techniques, allowing manufacturers to keep pace with ever-changing trends.

With sustainability becoming a focal point, companies are investing heavily in cutting-edge, water-efficient dyeing solutions. Concerns over water pollution are pushing advancements in waterless dyeing methods, minimizing environmental impact while maintaining high-quality results. Furthermore, regulatory frameworks promoting sustainable practices are accelerating the transition toward non-toxic, biodegradable textile colorants. As brands and manufacturers prioritize sustainability, the adoption of innovative dyeing solutions is reshaping the textile colorant landscape, ensuring long-term market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 5.6% |

By dye type, the market is segmented into basic dyes, acid dyes, direct dyes, dispersed dyes, and reactive dyes. Disperse dyes, a dominant category accounted for USD 1.6 billion in 2024 and are projected to reach USD 2.5 billion by 2034. These dyes are preferred for their strong compatibility with synthetic fibers, particularly polyester, which continues to dominate global textile production. The prevalence of fast fashion, where quick turnarounds and affordability are key, has intensified demand for disperse dyes due to their ability to deliver rich, enduring color on synthetic fabrics.

When categorized by pigment type, the market is divided into organic and inorganic pigments. Inorganic pigments commanded a 55.8% market share in 2024, primarily due to their exceptional color stability and superior resistance to heat and light. With excellent color fastness, inorganic pigments are ideal for outdoor textiles and high-durability applications. Their affordability compared to organic pigments makes them a preferred choice for mass-market textiles, further solidifying their position in the industry.

The United States textile colorant market, valued at USD 1.8 billion in 2024, remains a leader in the global landscape, supported by a robust textile manufacturing base, continuous innovation, and increasing demand for high-quality, sustainable dyes. The market benefits from rapid production cycles and an extensive array of color solutions tailored to the fast fashion and home textile segments. As sustainability takes center stage, the demand for bio-based and natural dyes, along with waterless dyeing technologies, is on the rise. Regulatory pressures reinforcing environmental safety are further fueling investment in eco-friendly dyeing solutions, ensuring the U.S. market continues its strong growth trajectory.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for sustainable and eco-friendly colorant

- 3.6.1.2 Growth of the fast fashion and textile industry

- 3.6.1.3 Advancements in dyeing technology and digital printing

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Stringent environmental regulations and compliance

- 3.6.2.2 High production cost of sustainable colors

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Dye Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Acid dyes

- 5.3 Basic dyes

- 5.4 Direct dyes

- 5.5 Disperse dyes

- 5.6 Reactive dyes

- 5.7 Others

Chapter 6 Market Size and Forecast, By Pigment, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Organic

- 6.3 Inorganic

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Textile & apparel

- 7.3 Home furnishing

- 7.4 Automotive

- 7.5 Healthcare

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Allied Industrial Corp.

- 9.2 Archroma

- 9.3 BASF

- 9.4 Colorant

- 9.5 DuPont de Nemours

- 9.6 Dystar Group

- 9.7 Huntsman Corporation

- 9.8 JAY Chemical Industries

- 9.9 Kiri Industries

- 9.10 Lanxess