|

市場調查報告書

商品編碼

1685092

醫療器材奈米技術市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Nanotechnology in Medical Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

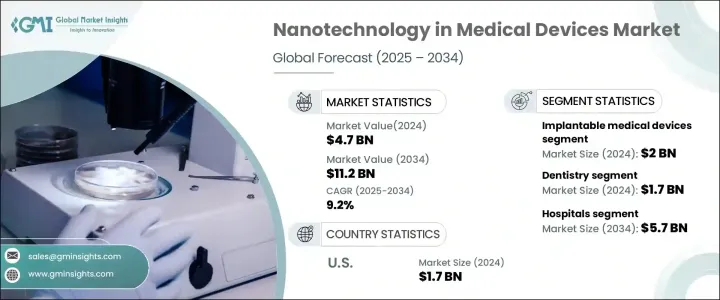

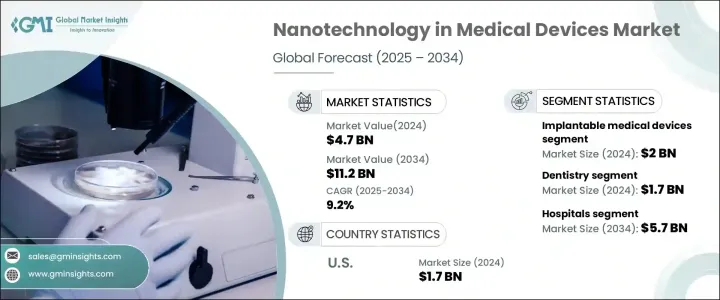

2024 年全球醫療器材奈米技術市場價值為 47 億美元,預計 2025 年至 2034 年的複合年成長率為 9.2%。這一令人印象深刻的成長軌跡受到多種因素的推動,包括奈米醫學的日益普及、向個人化醫療保健的轉變以及對小型攜帶式設備的需求不斷成長。隨著技術的發展,奈米技術正在透過實現高效的藥物輸送系統、提高設備性能和增強整體患者護理來徹底改變醫療器材領域。奈米粒子和奈米管的整合等尖端技術正在為創造不僅更精確而且更耐用和更高效的醫療設備開闢令人興奮的新可能性。正在進行的研究和開發不斷突破奈米技術的界限,為有望進一步加速市場成長的突破性產品鋪平了道路。對這項技術的不斷探索將為改變生活的創新打開大門,改變醫療保健的未來。

市場依產品類型分類,其中植入式醫療設備、牙科材料、傷口護理產品等為主要細分市場。其中,植入式設備是最大、最重要的類別,2024 年將產生 20 億美元的產值。奈米技術透過推進這些設備中使用的材料,例如開發先進的奈米塗層和奈米顆粒,對這一領域產生了深遠的影響。這些創新使得植入物與人體更相容,降低了排斥的可能性,並提高了其整體性能。植入式設備壽命的延長以及與周圍組織的無縫整合是奈米技術帶來的主要優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 47億美元 |

| 預測值 | 112億美元 |

| 複合年成長率 | 9.2% |

醫療器材市場中的奈米技術也按最終用戶進行細分,其中醫院、專科診所和其他醫療機構佔據主導地位。預計到 2034 年醫院部分將達到 57 億美元,佔據最大的市場佔有率。作為奈米技術驅動醫療設備的主要消費者,醫院擴大轉向奈米感測器、先進的成像系統和尖端藥物傳輸平台,以提高診斷準確性、治療效果和患者治療效果。對最先進技術的大量投資使醫院成為市場成長的驅動力,因為它們繼續引領更好的醫療服務和病患照護。

在美國,醫療器材奈米技術市場規模在 2024 年將達到 17 億美元,預計到 2034 年複合年成長率為 8.4%。這一成長得益於政府的大力支持,尤其是美國國立衛生研究院 (NIH) 等機構的支持,以及私營部門的大力投資。美國在個人化醫療領域處於領先地位,利用奈米技術進行更有針對性的治療、提供先進的診斷工具和針對特定生物標記的療法。精準醫療的推動是該地區市場快速成長的關鍵因素。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 醫療器材對奈米技術的需求不斷成長

- 提高護理品質的潛力

- 奈米技術在疾病治療與預防的應用

- 政府的有利舉措

- 產業陷阱與挑戰

- 奈米裝置成本高昂

- 奈米材料的潛在毒性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 報銷場景

- 波特的分析

- PESTEL 分析

- 差距分析

- 未來市場趨勢

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 — 2034 年

- 主要趨勢

- 植入式醫療器材

- 矯形器械

- 助聽器

- 牙科植體

- 其他植入性醫療器械

- 牙科填充材料

- 傷口護理

- 其他產品

第6章:市場估計與預測:按適應症,2021 年至 2034 年

- 主要趨勢

- 牙科

- 骨科

- 聽力損失

- 傷口護理

- 其他適應症

第 7 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 專科診所

- 其他最終用戶

第 8 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- 3M

- Abbott

- Audina HEARING INSTRUMENT INC.

- COLTENE

- convatec

- Dentsply Sirona

- Interton

- Medtronic

- SEBOTEK HEARING SYSTEMS

- SHOFU DENTAL

- Smith & Nephew

- Starkey

- straumann

- Stryker

- ZIMMER BIOMET

The Global Nanotechnology In Medical Devices Market, valued at USD 4.7 billion in 2024, is projected to grow at a CAGR of 9.2% from 2025 to 2034. This impressive growth trajectory is driven by several factors, including the increasing adoption of nanomedicine, the shift toward personalized healthcare treatments, and the growing demand for smaller, portable devices. As technology evolves, nanotechnology is revolutionizing the medical device landscape by enabling highly efficient drug delivery systems, improving device performance, and enhancing overall patient care. Cutting-edge advancements, such as the integration of nanoparticles and nanotubes, are unlocking exciting new possibilities for creating medical devices that are not only more precise but also more durable and efficient. Ongoing research and development continue to push the boundaries of nanotechnology, paving the way for breakthrough products that promise to further accelerate market growth. The continuous exploration of this technology opens doors to life-changing innovations, transforming the future of healthcare.

The market is categorized by product types, with implantable medical devices, dental materials, wound care products, and others as the key segments. Among them, implantable devices are the largest and most significant category, generating USD 2 billion in 2024. Nanotechnology has made a profound impact on this segment by advancing the materials used in these devices, such as the development of advanced nanocoatings and nanoparticles. These innovations are making implants more compatible with the human body, reducing the likelihood of rejection, and improving their overall performance. The enhanced longevity and seamless integration of implantable devices with surrounding tissues are key benefits that nanotechnology is bringing to the table.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.7 Billion |

| Forecast Value | $11.2 Billion |

| CAGR | 9.2% |

The nanotechnology in medical devices market is also segmented by end-users, with hospitals, specialty clinics, and other healthcare facilities leading the way. The hospital segment is expected to reach USD 5.7 billion by 2034, holding the largest market share. As the primary consumers of nanotechnology-driven medical devices, hospitals are increasingly turning to nanosensors, advanced imaging systems, and cutting-edge drug delivery platforms to improve diagnostic accuracy, treatment efficacy, and patient outcomes. The heavy investments in state-of-the-art technologies make hospitals a driving force in market growth as they continue to lead the charge toward better healthcare delivery and patient care.

In the U.S., the nanotechnology in medical devices market reached USD 1.7 billion in 2024, with a projected CAGR of 8.4% through 2034. This growth is fueled by substantial government support, particularly from organizations like the National Institutes of Health (NIH), alongside strong private sector investments. The U.S. is leading the charge in personalized medicine, using nanotechnology for more targeted treatments, advanced diagnostic tools, and therapies focused on specific biomarkers. This drive for precision medicine is a key factor contributing to the rapid market growth in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for nanotechnology in medical devices

- 3.2.1.2 Potential to increase quality of care delivery

- 3.2.1.3 Application of nanotechnology in disease treatment and prevention

- 3.2.1.4 Favourable government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with nanodevices

- 3.2.2.2 Potential toxicity of nanomaterials

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Implantable medical devices

- 5.2.1 Orthopedic devices

- 5.2.2 Hearing aids

- 5.2.3 Dental implants

- 5.2.4 Other implantable medical devices

- 5.3 Dental filling material

- 5.4 Wound care

- 5.5 Other products

Chapter 6 Market Estimates and Forecast, By Indication, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Dentistry

- 6.3 Orthopedics

- 6.4 Hearing loss

- 6.5 Wound care

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 Abbott

- 9.3 Audina HEARING INSTRUMENT INC.

- 9.4 COLTENE

- 9.5 convatec

- 9.6 Dentsply Sirona

- 9.7 Interton

- 9.8 Medtronic

- 9.9 SEBOTEK HEARING SYSTEMS

- 9.10 SHOFU DENTAL

- 9.11 Smith & Nephew

- 9.12 Starkey

- 9.13 straumann

- 9.14 Stryker

- 9.15 ZIMMER BIOMET