|

市場調查報告書

商品編碼

1685144

磁振造影 (MRI) 系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Magnetic Resonance Imaging (MRI) Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

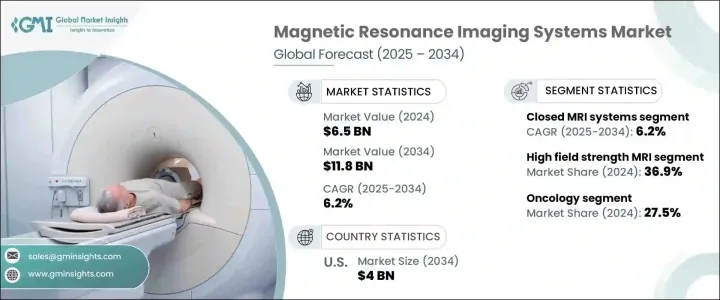

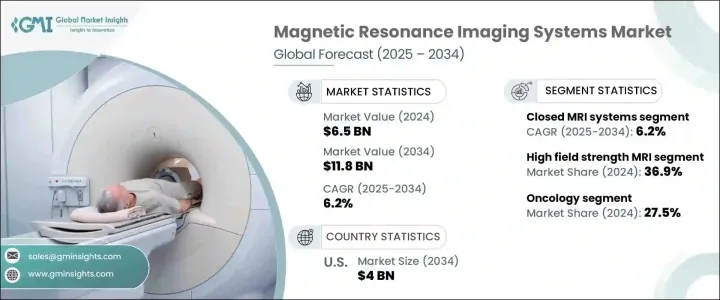

2024 年全球磁振造影系統市場規模將達到 65 億美元,預計 2025 年至 2034 年期間的複合年成長率為 6.2%。 MRI 技術是一種非侵入性成像方法,它利用強磁場和無線電波產生人體內部結構的詳細影像,在現代診斷中發揮至關重要的作用。與其他影像技術不同,MRI 不需要切口或暴露於電離輻射,使其成為精確可視化軟組織的首選。神經系統疾病、心血管疾病和肌肉骨骼問題等慢性疾病的發生率不斷上升,加劇了對先進診斷解決方案的需求。

MRI 系統的技術進步正在推動市場擴張,重點是提高影像解析度、縮短掃描時間和增強患者舒適度。人工智慧 (AI) 與 MRI 成像的整合透過自動化影像解釋和減少變異性進一步提高了診斷的準確性。此外,向攜帶式和開放式 MRI 系統的轉變使得行動不便或幽閉恐懼症患者更容易獲得影像。醫療保健投資的增加,加上對早期疾病檢測的日益重視,預計將推動市場成長。政府和私人醫療保健提供者正在投資尖端診斷設備,以滿足日益成長的精準成像需求。隨著醫療保健基礎設施的進步,特別是在新興經濟體,高性能 MRI 系統的採用將繼續加速。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 118億美元 |

| 複合年成長率 | 6.2% |

根據架構,市場分為開放式和封閉式 MRI 系統。預計整個預測期內封閉式 MRI 系統部分將以 6.2% 的複合年成長率成長。這些系統採用全封閉的圓柱形設計,透過最大限度地減少外部干擾和運動偽影來提供卓越的影像品質。封閉式 MRI 機器廣泛用於神經病學和腫瘤學的高解析度診斷,其中精確的成像對於檢測異常至關重要。最近的創新帶來了更寬敞的設計和更短的掃描時間,減輕了患者對成像過程中幽閉恐懼症和不適的擔憂。

根據場強,MRI 系統分為低場強、中場強、高場強。高場強領域在 2024 年佔據市場主導地位,佔有 36.9% 的佔有率,預計將保持領先地位。高場 MRI 系統通常在 1.5 特斯拉以上運行,可提供出色的影像清晰度,確保準確的診斷。這些系統受益於提高影像保真度、減少失真和加快掃描速度的進步,顯著改善了整體患者體驗。隨著醫院和影像中心重視精準診斷,對高場 MRI 技術的需求持續上升。

在對尖端診斷技術的高度關注的推動下,美國 MRI 系統市場預計到 2034 年將創造 40 億美元。全國各地的醫院和影像中心正在對下一代 MRI 設備進行大量投資,以提高診斷的準確性和效率。美國醫療保健產業正在轉向整合人工智慧和機器學習的更先進的成像系統,最佳化工作流程並縮短掃描時間。隨著對改善患者治療結果的需求不斷成長,MRI 技術的擴展預計將在不斷發展的醫療診斷領域中發揮關鍵作用。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 已開發經濟體和發展中經濟體的老年人口都在成長

- 全球慢性病盛行率不斷上升

- 北美和歐洲對早期診斷的認知不斷提高

- 已開發經濟體 MRI 系統的技術進步

- 亞太地區和其他新興經濟體的事故數量不斷增加

- 產業陷阱與挑戰

- 缺乏熟練的專業人員

- MRI 系統成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 2024 年定價分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按建築,2021 – 2034 年

- 主要趨勢

- 開放系統

- 封閉系統

第 6 章:市場估計與預測:按場強,2021 – 2034 年

- 主要趨勢

- 低場強

- 中場實力

- 高場強

第 7 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 腫瘤學

- 神經病學

- 肌肉骨骼

- 血管

- 胃腸病學

- 心臟病學

- 其他應用

第 8 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 影像中心

- 門診手術中心

- 其他最終用戶

第 9 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 波蘭

- 瑞士

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 泰國

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 哥倫比亞

- 智利

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 以色列

第10章:公司簡介

- Aurora Imaging Technologies

- Esaote

- Fonar

- FUJIFILM

- GE HealthCare Technologies

- Koninklijke Philips

- Neusoft Medical Systems

- Sanrad Medical Systems

- Siemens Healthineers

- Toshiba

The Global Magnetic Resonance Imaging Systems Market reached USD 6.5 billion in 2024 and is set to grow at a CAGR of 6.2% between 2025 and 2034. MRI technology, a non-invasive imaging method that utilizes strong magnetic fields and radio waves to generate detailed images of the body's internal structures, plays a crucial role in modern diagnostics. Unlike other imaging techniques, MRI does not require incisions or exposure to ionizing radiation, making it a preferred choice for precise visualization of soft tissues. The rising prevalence of chronic diseases, including neurological disorders, cardiovascular conditions, and musculoskeletal issues, has intensified the demand for advanced diagnostic solutions.

Technological advancements in MRI systems are driving market expansion, with a focus on improved image resolution, shorter scan times, and enhanced patient comfort. The integration of artificial intelligence (AI) into MRI imaging has further refined diagnostic accuracy by automating image interpretation and reducing variability. Additionally, the shift toward portable and open MRI systems has made imaging more accessible for patients with mobility challenges or claustrophobia. Increasing healthcare investments, coupled with a growing emphasis on early disease detection, are expected to propel market growth. Governments and private healthcare providers are investing in cutting-edge diagnostic equipment to meet the rising demand for precision imaging. As healthcare infrastructure advances, particularly in emerging economies, the adoption of high-performance MRI systems will continue to accelerate.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $11.8 Billion |

| CAGR | 6.2% |

The market is segmented based on architecture into open and closed MRI systems. The closed MRI system segment is anticipated to grow at a 6.2% CAGR throughout the forecast period. These systems, characterized by fully enclosed cylindrical designs, deliver superior image quality by minimizing external interference and motion artifacts. Closed MRI machines are widely used for high-resolution diagnostics in neurology and oncology, where precise imaging is critical for detecting abnormalities. Recent innovations have led to more spacious designs and shorter scan durations, alleviating patient concerns about claustrophobia and discomfort during imaging procedures.

Based on field strength, MRI systems are categorized into low, mid, and high field strength. The high field strength segment dominated the market in 2024 with a 36.9% share and is expected to maintain its leading position. Typically operating above 1.5 Tesla, high-field MRI systems provide exceptional image clarity, ensuring accurate diagnostics. These systems benefit from advancements that enhance image fidelity, reduce distortions, and expedite scanning, significantly improving the overall patient experience. As hospitals and imaging centers prioritize precision diagnostics, the demand for high-field MRI technology continues to rise.

U.S. MRI systems market is projected to generate USD 4 billion by 2034, driven by a strong focus on cutting-edge diagnostic technologies. Hospitals and imaging centers across the country are making significant investments in next-generation MRI equipment to enhance diagnostic accuracy and efficiency. The U.S. healthcare sector is shifting toward more advanced imaging systems that integrate AI and machine learning, optimizing workflow and reducing scan times. As the demand for improved patient outcomes grows, the expansion of MRI technology is expected to play a key role in the evolving landscape of medical diagnostics.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing geriatric population in developed as well as developing economies

- 3.2.1.2 Increasing chronic disease prevalence globally

- 3.2.1.3 Growing awareness pertaining to early diagnosis in North America and Europe

- 3.2.1.4 Technological advancements in MRI system in developed economies

- 3.2.1.5 Increasing number of accidents in Asia Pacific and other emerging economies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Dearth of skilled professionals

- 3.2.2.2 High cost of MRI system

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Pricing analysis, 2024

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Architecture, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Open system

- 5.3 Closed system

Chapter 6 Market Estimates and Forecast, By Field Strength, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Low field strength

- 6.3 Mid field strength

- 6.4 High field strength

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oncology

- 7.3 Neurology

- 7.4 Musculoskeletal

- 7.5 Vascular

- 7.6 Gastroenterology

- 7.7 Cardiology

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Imaging centers

- 8.4 Ambulatory surgical centers

- 8.5 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Poland

- 9.3.8 Switzerland

- 9.3.9 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Thailand

- 9.4.7 Indonesia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Colombia

- 9.5.5 Chile

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Israel

Chapter 10 Company Profiles

- 10.1 Aurora Imaging Technologies

- 10.2 Esaote

- 10.3 Fonar

- 10.4 FUJIFILM

- 10.5 GE HealthCare Technologies

- 10.6 Koninklijke Philips

- 10.7 Neusoft Medical Systems

- 10.8 Sanrad Medical Systems

- 10.9 Siemens Healthineers

- 10.10 Toshiba