|

市場調查報告書

商品編碼

1685146

床上監護和嬰兒監護系統市場機會、成長動力、行業趨勢分析和預測 2025 - 2034Bed Monitoring and Baby Monitoring System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

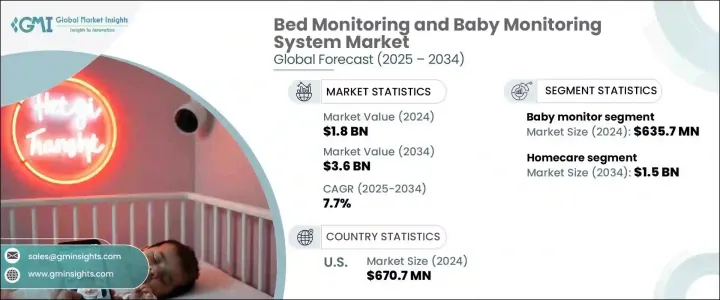

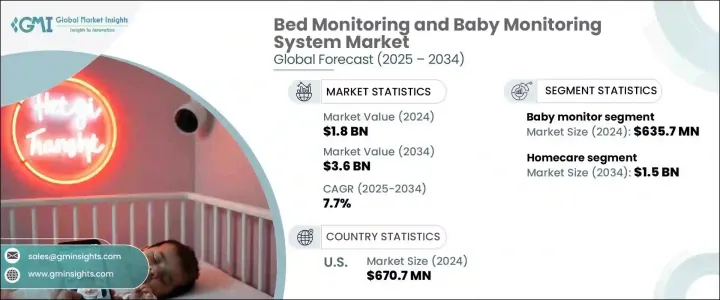

2024 年全球床上監護和嬰兒監護系統市場規模達到 18 億美元,並將經歷強勁成長,預計 2025 年至 2034 年的複合年成長率為 7.7%。市場擴張受到多種因素推動,包括技術的快速進步、對病人安全和舒適度的日益關注以及對預防性醫療保健的日益重視。隨著已開發經濟體和新興經濟體的醫療保健支出不斷增加,對創新監測系統的需求也隨之激增。這些系統提供健康指標的即時監測,改善治療結果,降低醫療成本,並提高整體照護品質。醫療保健提供者和個人擴大轉向這些系統,因為他們尋求高效、經濟的解決方案。無線連接、人工智慧(AI)和非侵入式感測器等創新進一步加速了醫療機構甚至家庭環境中床上監護和嬰兒監護系統的採用。這種向家庭監控和遠距病人照護的轉變正在塑造醫療保健服務的未來,特別是隨著越來越多的人更喜歡在舒適的家中管理自己的健康狀況。

床上監測和嬰兒監測系統市場按產品類型細分,主要類別包括嬰兒監測器、老年監測器、睡眠監測器和壓瘡監測器。嬰兒監視器市場價值預計於 2024 年達到 6.357 億美元,呈現顯著成長。父母越來越認知到關注嬰兒健康和安全的重要性,尤其是在他們睡覺時。嬰兒監視器可以讓父母遠端監視嬰兒的動作、睡眠模式和整體健康狀況,通常是在夜間保持警惕時,從而讓他們安心。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 36億美元 |

| 複合年成長率 | 7.7% |

就最終用途而言,市場分為家庭護理、醫院、療養院和其他醫療機構。家庭護理領域在 2024 年創造 15 億美元,預計在整個預測期內將繼續擴大。這反映了從傳統的醫院護理轉向更具成本效益、以患者為中心的家庭護理日益成長的趨勢。隨著追蹤生命徵象、運動和睡眠模式的監測系統的進步,家庭護理解決方案對於管理醫院外的慢性病和術後護理變得越來越重要。

在美國,床上監護和嬰兒監護系統市場在 2024 年創造了 6.707 億美元的收入,預計 2025 年至 2034 年的複合年成長率為 7%。美國人口老化在推動這一需求方面發揮著重要作用,因為大量老年人因心血管疾病和失智症等慢性疾病而需要持續監護。隨著老年人口的不斷成長,對先進監測系統的需求也在增加,以便為面臨多種慢性健康挑戰的老年人提供持續的遠端照護。

目錄

第 1 章:方法論與範圍

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 非侵入式監控解決方案的採用日益增多

- 醫院內感染盛行率不斷上升

- 家庭醫療保健和遠端監控激增

- 睡眠障礙發生率上升

- 產業陷阱與挑戰

- 監控系統成本高

- 有關資料安全和濫用的隱私擔憂

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 定價分析

- 波特的分析

- PESTEL 分析

- 差距分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 嬰兒監視器

- 感應器

- 穿戴式裝置

- 老人監護儀

- 睡眠監測

- 壓瘡監測儀

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 居家護理

- 醫院

- 安養院及輔助生活設施

- 其他最終用戶

第7章:市場估計與預測:按地區,2021 — 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- BLT BIOLIGHT

- EMFIT

- FOSCAM

- hisense Health Monitoring Technologies

- iBaby

- Infant Optics

- Levana

- LOREX

- motorola

- nanit

- PHILIPS

- SMART CAREGIVER

- Tekscan

- vtech

- wellsense

The Global Bed Monitoring And Baby Monitoring System Market reached USD 1.8 billion in 2024 and is set to experience robust growth, with a projected CAGR of 7.7% from 2025 to 2034. The market expansion is driven by several factors, including rapid technological advancements, an increasing focus on patient safety and comfort, and a growing emphasis on preventive healthcare. As healthcare expenditures rise in both developed and emerging economies, demand for innovative monitoring systems is surging. These systems offer real-time monitoring of health metrics, improving treatment outcomes, reducing healthcare costs, and enhancing the overall quality of care. Healthcare providers and individuals are increasingly turning to these systems as they seek efficient, cost-effective solutions. Innovations such as wireless connectivity, artificial intelligence (AI), and non-invasive sensors are further accelerating the adoption of bed monitoring and baby monitoring systems across healthcare facilities and even home settings. This shift toward at-home monitoring and remote patient care is shaping the future of healthcare delivery, particularly as more individuals prefer managing their health from the comfort of their homes.

The bed monitoring and baby monitoring system market is segmented by product type, with key categories including baby monitors, elderly monitors, sleep monitors, and pressure ulcer monitors. The baby monitor segment, valued at USD 635.7 million in 2024, is seeing significant growth. Parents are increasingly recognizing the importance of keeping track of their infant's health and safety, especially while they sleep. Baby monitors offer peace of mind by enabling parents to monitor their baby's movements, sleep patterns, and overall well-being remotely, often during nighttime when vigilance is crucial.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 7.7% |

In terms of end-use, the market is divided into homecare, hospitals, nursing homes, and other healthcare facilities. The homecare segment generated USD 1.5 billion in 2024 and is expected to continue expanding throughout the forecast period. This reflects the growing trend of shifting from traditional hospital-based care to more cost-effective, patient-centric home-based care. With advancements in monitoring systems that track vital signs, movement, and sleep patterns, homecare solutions are increasingly vital for managing chronic conditions and post-operative care outside of hospital settings.

In the U.S., the bed monitoring and baby monitoring system market generated USD 670.7 million in 2024 and is anticipated to grow at a CAGR of 7% from 2025 to 2034. The aging population in the U.S. plays a significant role in driving this demand, as a large number of elderly individuals require continuous monitoring due to chronic conditions like cardiovascular diseases and dementia. As the elderly population continues to grow, so too does the need for advanced monitoring systems that provide continuous, remote care for older adults facing multiple chronic health challenges.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of unobtrusive monitoring solutions

- 3.2.1.2 Increasing prevalence of hospital acquired infections

- 3.2.1.3 Surge in home healthcare and remote monitoring

- 3.2.1.4 Rising incidence of sleep disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with monitoring systems

- 3.2.2.2 Privacy concerns about data security and misuse

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pricing analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Baby monitor

- 5.2.1 Sensors

- 5.2.2 Wearables

- 5.3 Elderly monitor

- 5.4 Sleep monitor

- 5.5 Pressure ulcer monitor

Chapter 6 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Homecare

- 6.3 Hospitals

- 6.4 Nursing home & assisted living facilities

- 6.5 Other end users

Chapter 7 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BLT BIOLIGHT

- 8.2 EMFIT

- 8.3 FOSCAM

- 8.4 hisense Health Monitoring Technologies

- 8.5 iBaby

- 8.6 Infant Optics

- 8.7 Levana

- 8.8 LOREX

- 8.9 motorola

- 8.10 nanit

- 8.11 PHILIPS

- 8.12 SMART CAREGIVER

- 8.13 Tekscan

- 8.14 vtech

- 8.15 wellsense