|

市場調查報告書

商品編碼

1685148

入侵偵測系統/入侵防禦系統 (IDS/IPS) 市場機會、成長動力、產業趨勢分析與預測 2025 - 2034Intrusion Detection System / Intrusion Prevention System (IDS / IPS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

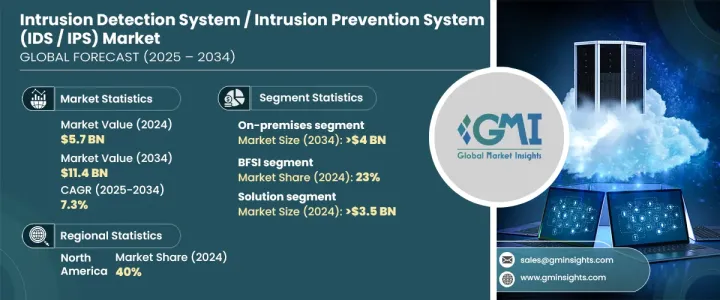

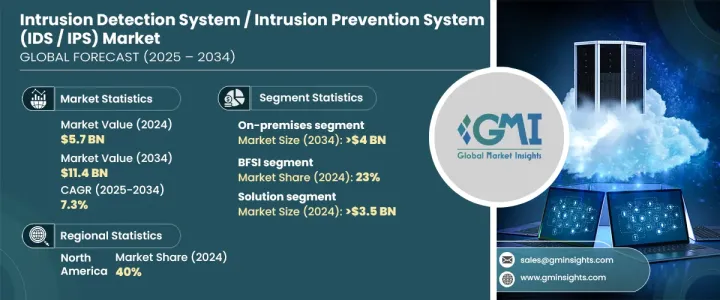

2024 年全球入侵偵測系統/入侵預防系統市場價值為 57 億美元,預計 2025 年至 2034 年期間的複合年成長率為 7.3%。網路威脅日益複雜化,推動了對先進的 IDS/IPS 解決方案的需求,以保護網路、應用程式和敏感資料。各行各業的企業都優先考慮這些系統,以增強安全性、防止未經授權的存取並即時檢測潛在的漏洞。數位技術的快速應用、對資料外洩的擔憂日益加劇以及遵守嚴格的資料保護法規的需要進一步推動了市場的成長。

隨著企業認知到敏感資料的價值日益成長,對 IDS/IPS 解決方案的投資已成為其網路安全策略的關鍵組成部分。此外,對雲端運算、物聯網設備和遠端工作環境的日益依賴增加了對強大安全措施的需求,進一步推動了市場的擴張。人工智慧和機器學習與 IDS/IPS 系統的整合也增強了其功能,能夠即時偵測威脅並主動應對不斷演變的網路風險。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 57億美元 |

| 預測值 | 114億美元 |

| 複合年成長率 | 7.3% |

根據部署模式,市場分為內部部署、雲端和混合解決方案。 2024 年,本地部署部分佔據了超過 40% 的市場佔有率,預計到 2034 年將超過 40 億美元。處理高度敏感資料的行業(例如政府、金融和醫療保健)更喜歡本地部署系統,因為它們具有增強的控制和安全性。這些部門優先考慮減輕第三方風險並確保遵守 HIPAA、PCI DSS 和 GDPR 等法規。此外,航太和能源等行業也受益於內部部署 IDS/IPS 解決方案,因為它們允許根據特定的安全需求自訂檢測規則。由於其可擴展性、成本效益以及支援遠端操作的能力,雲端和混合部署模型也越來越受到關注。

根據應用,IDS/IPS 市場服務於各個領域,包括 BFSI(銀行、金融服務和保險)、醫療保健、IT 和電信、政府、製造業、運輸和物流以及零售業。由於數位交易日益普及以及網路犯罪風險不斷上升,BFSI 部門在 2024 年將佔據約 23% 的市場佔有率。隨著數位銀行的不斷發展,金融機構正在大力投資 IDS/IPS 解決方案,以保護敏感的客戶資料並維護信任。同樣,醫療保健行業正在採用這些系統來保護患者資料並遵守法規,而 IT 和電信行業則利用 IDS/IPS 來保護龐大的網路並防止服務中斷。

2024 年,北美佔據 IDS/IPS 市場的主導地位,佔有 40% 的佔有率,其中美國是最大的貢獻者。該地區對先進安全系統的需求是由於針對關鍵基礎設施、政府組織和金融機構的網路攻擊日益頻繁。網路犯罪分子正在採用更為複雜的策略,例如網路入侵和電子郵件攻擊,這加劇了對可靠的 IDS/IPS 解決方案的需求。隨著北美的企業和政府繼續優先考慮網路安全,IDS/IPS 系統的採用預計將保持強勁,確保對不斷演變的威脅提供強力的保護。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- IDS/IPS解決方案供應商

- IDS/IPS 服務供應商

- 系統整合商

- 加值經銷商 (VAR) 和分銷商

- 最終用戶

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞及舉措

- 監管格局

- 各地區的網路安全威脅

- 案例研究

- 衝擊力

- 成長動力

- 網路攻擊的頻率和複雜度不斷增加

- 雲端服務和混合基礎設施的快速採用

- 物聯網設備整合度不斷提高

- 日益成長的監管合規要求

- 產業陷阱與挑戰

- 實施和營運成本高

- 管理誤報和維護系統準確性的複雜性增加

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 解決方案

- IDS/IPS 軟體

- 實體/虛擬設備

- 整合安全平台

- 服務

- 託管服務

- 專業服務

第 6 章:市場估計與預測:按解決方案架構,2021 - 2034 年

- 主要趨勢

- 基於主機的IDS/IPS

- 基於無線的IDS/IPS

- 網路為基礎的IDS/IPS

第 7 章:市場估計與預測:按檢測方法,2021 - 2034 年

- 主要趨勢

- 基於簽名

- 基於異常

- 基於策略

第 8 章:市場估計與預測:按部署模型,2021 - 2034 年

- 主要趨勢

- 本地

- 雲

- 混合

第 9 章:市場估計與預測:按組織規模,2021 - 2034 年

- 主要趨勢

- 大型企業

- 中小企業

第 10 章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 金融保險業協會

- 航太和國防

- 衛生保健

- 資訊科技和電信

- 政府

- 製造業

- 運輸與物流

- 零售

- 其他

第 11 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 12 章:公司簡介

- Alert Logic

- AT&T

- Barracuda Networks

- Check Point Software Technologies

- Cisco

- CrowdStrike

- Darktrace

- F5 Networks

- FireEye

- Fortinet

- IBM

- Imperva

- Juniper Networks

- McAfee

- Palo Alto Networks

- SonicWall

- Sophos

- Splunk

- Trend Micro

- Trustwave

The Global Intrusion Detection System / Intrusion Prevention System Market was valued at USD 5.7 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2034. The increasing sophistication of cyber threats has driven the demand for advanced IDS/IPS solutions to protect networks, applications, and sensitive data. Businesses across industries are prioritizing these systems to enhance security, prevent unauthorized access, and detect potential breaches in real-time. The market's growth is further fueled by the rapid adoption of digital technologies, rising concerns over data breaches, and the need to comply with stringent data protection regulations.

As organizations recognize the growing value of sensitive data, investments in IDS/IPS solutions have become a critical component of their cybersecurity strategies. Additionally, the increasing reliance on cloud computing, IoT devices, and remote work environments has heightened the need for robust security measures, further propelling the market's expansion. The integration of artificial intelligence and machine learning into IDS/IPS systems is also enhancing their capabilities, enabling real-time threat detection and proactive responses to evolving cyber risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 7.3% |

The market is segmented by deployment models into on-premises, cloud, and hybrid solutions. In 2024, the on-premises segment accounted for over 40% of the market share and is expected to surpass USD 4 billion by 2034. Industries handling highly sensitive data, such as government, finance, and healthcare, prefer on-premises systems due to their enhanced control and security. These sectors prioritize mitigating third-party risks and ensuring compliance with regulations like HIPAA, PCI DSS, and GDPR. Additionally, industries such as aerospace and energy benefit from on-premises IDS/IPS solutions, as they allow for customized detection rules tailored to specific security needs. The cloud and hybrid deployment models are also gaining traction, driven by their scalability, cost-effectiveness, and ability to support remote operations.

By application, the IDS/IPS market serves various sectors, including BFSI (banking, financial services, and insurance), healthcare, IT and telecom, government, manufacturing, transportation and logistics, and retail. The BFSI segment held approximately 23% of the market share in 2024, driven by the increasing prevalence of digital transactions and the rising risk of cybercrime. As digital banking continues to grow, financial institutions are investing heavily in IDS/IPS solutions to safeguard sensitive customer data and maintain trust. Similarly, the healthcare sector is adopting these systems to protect patient data and comply with regulations, while the IT and telecom industry leverages IDS/IPS to secure vast networks and prevent service disruptions.

North America dominated the IDS/IPS market in 2024, holding a 40% share, with the United States being the largest contributor. The region's demand for advanced security systems is driven by the increasing frequency of cyberattacks targeting critical infrastructure, government organizations, and financial institutions. Cybercriminals are employing more sophisticated tactics, such as network intrusions and email compromises, which has intensified the need for reliable IDS/IPS solutions. As businesses and governments in North America continue to prioritize cybersecurity, the adoption of IDS/IPS systems is expected to remain strong, ensuring robust protection against evolving threats.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 IDS/IPS solution providers

- 3.1.2 IDS/IPS service providers

- 3.1.3 System integrators

- 3.1.4 Value-Added Resellers (VARs) and distributors

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cybersecurity threats, by region

- 3.9 Case studies

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing frequency and sophistication of cyberattacks

- 3.10.1.2 Rapid adoption of cloud services and hybrid infrastructures

- 3.10.1.3 Rising integration of IoT devices

- 3.10.1.4 Growing regulatory compliance requirements

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High implementation and operational costs

- 3.10.2.2 Increasing complexity in managing false positives and maintaining system accuracy

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 IDS/IPS software

- 5.2.2 Physical/virtual appliances

- 5.2.3 Integrated security platforms

- 5.3 Services

- 5.3.1 Managed services

- 5.3.2 Professional services

Chapter 6 Market Estimates & Forecast, By Solution Architecture, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Host-based IDS/IPS

- 6.3 Wireless-based IDS/IPS

- 6.4 Network-based IDS/IPS

Chapter 7 Market Estimates & Forecast, By Detection Method, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Signature-based

- 7.3 Anomaly-based

- 7.4 Policy-based

Chapter 8 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Large enterprises

- 9.3 SME

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Aerospace & defense

- 10.4 Healthcare

- 10.5 IT & telecom

- 10.6 Government

- 10.7 Manufacturing

- 10.8 Transportation & logistics

- 10.9 Retail

- 10.10 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Alert Logic

- 12.2 AT&T

- 12.3 Barracuda Networks

- 12.4 Check Point Software Technologies

- 12.5 Cisco

- 12.6 CrowdStrike

- 12.7 Darktrace

- 12.8 F5 Networks

- 12.9 FireEye

- 12.10 Fortinet

- 12.11 IBM

- 12.12 Imperva

- 12.13 Juniper Networks

- 12.14 McAfee

- 12.15 Palo Alto Networks

- 12.16 SonicWall

- 12.17 Sophos

- 12.18 Splunk

- 12.19 Trend Micro

- 12.20 Trustwave

![下一代入侵防禦系統 (NGIPS) 市場:趨勢、機會和競爭分析 [2023-2028]](/sample/img/cover/42/1342036.png)