|

市場調查報告書

商品編碼

1685157

自動駕駛汽車市場機會、成長動力、產業趨勢分析與 2025 - 2034 年預測Autonomous Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

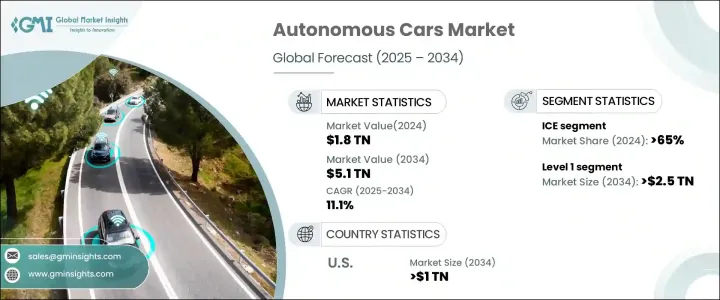

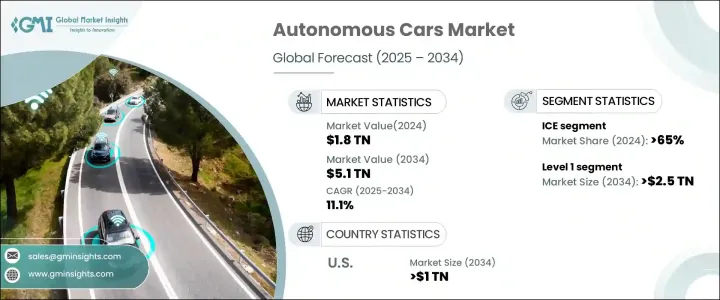

到 2024 年,全球自動駕駛汽車市場規模將達到 1.8 兆美元,預計到 2034 年將以 11.1% 的複合年成長率成長。這一成長主要得益於人工智慧 (AI) 和機器學習的突破,這些突破正在增強汽車的自主性。LiDAR和攝影機等感測器技術的最新進展使得車輛能夠更可靠地與周圍環境互動,從而增強了消費者對採用自動駕駛汽車的信心。這些技術改進不僅改變了車輛的性能,而且還改善了即時決策,從而增強了安全性並最佳化了路線效率。隨著對連網和自動駕駛汽車的需求不斷成長,這些技術對於滿足日益成長的消費者興趣和期望變得至關重要。

促成市場擴張的另一個因素是人們對交通安全的日益重視。自動駕駛汽車旨在減少人為錯誤,因為人為錯誤是造成大量道路交通事故的根源。碰撞偵測、自適應巡航控制和自動煞車等自動安全系統的實施提高了安全性並加速了市場的成長。政府和產業機構透過優惠法規支援這些系統的開發和部署,進一步推動市場擴張。隨著自動駕駛技術的不斷發展,預計它們將對道路安全和效率產生更大的影響。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.8兆美元 |

| 預測值 | 5.1兆美元 |

| 複合年成長率 | 11.1% |

市場按自動化程度細分,包括 1 級、2 級、3 級和 4 級。截至 2024 年,1 級自動化佔據超過 55% 的市場佔有率,預計這一地位將保持到 2034 年,預計價值將超過 2.5 兆美元。這一級別由於其多功能性和成本效益而特別具有吸引力,因為它可以融入到各種各樣的車輛中而不需要對基礎設施進行重大的改變。車道維持輔助和自適應巡航控制等功能不僅可以提高駕駛者的安全性,還可以滿足那些不願意完全接受自動駕駛系統的消費者的需求。

燃料類型在市場中也發揮著重要作用,其中內燃機 (ICE)、電動和混合動力引擎構成主要部分。 2024年,內燃機汽車佔65%以上的市佔率。內燃機汽車的廣泛使用,加上其相對較低的成本,確保了其在市場上繼續佔據主導地位。 ICE 汽車與現有的燃料基礎設施相容,從而增強了其實用性和對消費者的吸引力。

從地理上看,美國引領北美市場,2024 年佔據該地區 90% 以上的佔有率,預計到 2034 年將超過 1 兆美元。美國是自動駕駛汽車技術的中心,這得益於其強大的技術基礎設施和在人工智慧、機器學習和感測器技術方面的大量投資。此外,美國還受益於支持性監管框架,有利於自動駕駛汽車的測試和部署。電動和自動駕駛汽車的強勁需求,加上配套基礎設施的快速發展,預計將在未來幾年進一步推動市場成長。

目錄

第 1 章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估計和計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 供應商概況

- 零件供應商

- 自動駕駛汽車製造商

- 技術提供者

- 經銷商

- 最終用戶

- 利潤率分析

- 價格趨勢

- 成本明細

- 技術與創新格局

- 重要新聞及舉措

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 環保交通方式日益普及

- 自動駕駛汽車新創企業不斷壯大

- 北美擴大採用自動駕駛技術

- 政府對自動駕駛技術的支援法規

- 產業陷阱與挑戰

- 不斷提高技術進步

- 自動駕駛汽車初期投資高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依自主性,2021 - 2034 年

- 主要趨勢

- 1級

- 2 級

- 3 級

- 4 級

第6章:市場估計與預測:按燃料,2021 - 2034 年

- 主要趨勢

- 冰

- 電的

- 混合

第 7 章:市場估計與預測:按最終用途,2021 - 2034 年

- 主要趨勢

- 個人的

- 共享出行

第 8 章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Aptiv

- Aurora Innovation

- Baidu Apollo

- BMW Group

- Ford Motor

- General Motors

- Honda Motor

- Hyundai Motor

- Mercedes-Benz

- Mobileye

- NIO

- Nissan Motor

- Rivian Automotive

- Stellantis NV

- Tesla

- Toyota Motor

- Volkswagen Group

- Volvo Cars

- Waymo

- Zoox

The Global Autonomous Cars Market reached USD 1.8 trillion by 2024 and is anticipated to grow at a CAGR of 11.1% through 2034. This surge is primarily driven by breakthroughs in artificial intelligence (AI) and machine learning, which are enhancing vehicle autonomy. Recent advancements in sensor technologies, such as LiDAR and cameras, have enabled vehicles to interact with their surroundings more reliably, leading to increased consumer confidence in adopting autonomous vehicles. These technological improvements are not only transforming vehicle capabilities but also improving real-time decision-making, which bolsters safety and optimizes routing efficiency. As the demand for connected and autonomous vehicles rises, these technologies are becoming essential to meet the growing consumer interest and expectations.

Another factor contributing to market expansion is the growing emphasis on traffic safety. Autonomous vehicles aim to reduce human error, which is responsible for a significant number of road accidents. The implementation of automated safety systems such as collision detection, adaptive cruise control, and automatic braking enhances safety and accelerates the market's growth. Governments and industry bodies are supporting the development and deployment of these systems through favorable regulations, further fueling market expansion. As autonomous technologies continue to evolve, they are expected to make an even greater impact on road safety and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Trillion |

| Forecast Value | $5.1 Trillion |

| CAGR | 11.1% |

The market is segmented by levels of automation, including Level 1, Level 2, Level 3, and Level 4. As of 2024, Level 1 automation commands over 55% of the market share, a position it is expected to maintain through 2034, with projections to exceed USD 2.5 trillion. This level is particularly attractive due to its versatility and cost-effectiveness, as it can be incorporated into a wide range of vehicles without requiring major infrastructure changes. Features such as lane-keeping assistance and adaptive cruise control not only improve driver safety but also cater to consumers who are hesitant to fully embrace autonomous systems.

Fuel type also plays a significant role in the market, with internal combustion engines (ICE), electric, and hybrid engines making up the major segments. In 2024, ICE vehicles accounted for more than 65% of the market. The widespread use of ICE vehicles, coupled with their relatively lower cost, ensures their continued dominance in the market. ICE vehicles are compatible with existing fuel infrastructure, which enhances their practicality and appeal to consumers.

Geographically, the United States leads the North American market, holding more than 90% of the regional share in 2024, with projections to surpass USD 1 trillion by 2034. The U.S. is a hub for autonomous car technology, thanks to its robust technological infrastructure and significant investments in AI, machine learning, and sensor technologies. Additionally, the U.S. benefits from a supportive regulatory framework that facilitates testing and deployment of autonomous vehicles. The strong demand for electric and self-driving vehicles, coupled with the rapid development of supporting infrastructure, is expected to further drive market growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Autonomous car manufacturers

- 3.2.3 Technology providers

- 3.2.4 Distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Price trend

- 3.5 Cost breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Patent analysis

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising adoption of eco-friendly transportation

- 3.10.1.2 Growing autonomous car startups

- 3.10.1.3 Increasing adoption of self-driving technologies in North America

- 3.10.1.4 Supportive government regulations for autonomous driving technology

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Increasing technological advancements

- 3.10.2.2 High initial investments in autonomous cars

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Autonomy, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Level 1

- 5.3 Level 2

- 5.4 Level 3

- 5.5 Level 4

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Personal

- 7.3 Shared mobility

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aptiv

- 9.2 Aurora Innovation

- 9.3 Baidu Apollo

- 9.4 BMW Group

- 9.5 Ford Motor

- 9.6 General Motors

- 9.7 Honda Motor

- 9.8 Hyundai Motor

- 9.9 Mercedes-Benz

- 9.10 Mobileye

- 9.11 NIO

- 9.12 Nissan Motor

- 9.13 Rivian Automotive

- 9.14 Stellantis N.V.

- 9.15 Tesla

- 9.16 Toyota Motor

- 9.17 Volkswagen Group

- 9.18 Volvo Cars

- 9.19 Waymo

- 9.20 Zoox