|

市場調查報告書

商品編碼

1685204

再生碳纖維市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Recycled Carbon Fiber Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

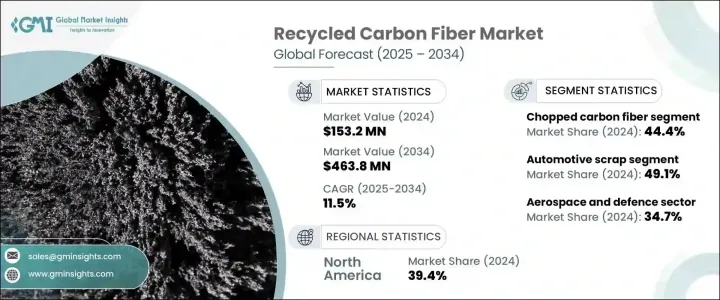

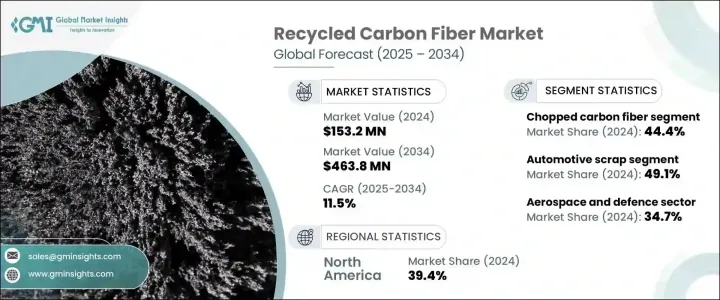

2024 年全球再生碳纖維市場規模達 1.532 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 11.5%。這一成長主要得益於環保意識的增強、支持永續發展的政府法規以及再生材料的成本優勢。隨著全球各行各業都優先考慮環保解決方案,再生碳纖維作為原生碳纖維的永續且經濟高效的替代品,獲得了顯著的關注。

隨著汽車、航太和再生能源領域處於這一轉型的前沿,未來幾年對再生碳纖維的需求預計將迅速上升。公司正致力於利用回收材料來實現永續發展目標、減少碳足跡並管理資源限制。這種轉變不僅有助於減少浪費,也支持循環經濟原則。持續開發先進回收技術的努力進一步加速了市場的成長,使得回收的碳纖維更易於獲取,並更有效率地應用於各種應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.532億美元 |

| 預測值 | 4.638 億美元 |

| 複合年成長率 | 11.5% |

按產品類型分類,短切碳纖維由於其多功能性和高強度,在 2024 年佔據 44.4% 的市場佔有率,佔據市場主導地位,非常適合用於增強塑膠和複合材料。以質地細密、精度高而聞名的研磨碳纖維也佔有相當大的市場佔有率,尤其是在需要精細加固的應用中。碳纖維墊因其重量輕和高性能的特性而受到重視,也繼續受到青睞。同時,其他形式的再生碳纖維逐漸受到歡迎,反映了汽車、航太和再生能源等行業不斷變化的需求,這些行業對高強度和輕質材料至關重要。

從來源來看,汽車廢棄物在 2024 年佔據了 49.1% 的市場。汽車產業對輕量化材料和永續性的日益關注正在推動該領域對再生碳纖維的需求。航太業由於其對高性能材料的需求也為市場的成長做出了重大貢獻。此外,其他產業如風能、海洋和建築也開始對再生碳纖維表現出日益濃厚的興趣,顯示其在各行業中的作用正在擴大。

2024 年,北美佔據再生碳纖維市場的 39.4%。該地區受益於強大的工業基礎設施和對創新的重視。隨著航太、汽車和再生能源領域的蓬勃發展,北美對永續材料的需求激增。對減少碳足跡和遵守嚴格的環境法規的重視導致了對回收技術的投資增加。因此,再生碳纖維與各行業的融合預計將持續成長,技術進步和永續發展措施將進一步推動市場的擴張。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 複合材料產業蓬勃發展

- 節省成本

- 技術進步

- 產業陷阱與挑戰

- 供應鏈有限

- 經濟可行性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模與預測:依產品類型,2021-2034 年

- 主要趨勢

- 短切碳纖維

- 研磨碳纖維

- 碳纖維墊

- 其他

第 6 章:市場規模與預測:按來源,2021-2034 年

- 主要趨勢

- 汽車廢料

- 航太廢料

- 其他

第 7 章:市場規模及預測:依回收方式,2021-2034 年

- 主要趨勢

- 機械回收

- 化學回收

- 熱解

- 溶劑分解

- 其他

第 8 章:市場規模與預測:依最終用途方法,2021-2034 年

- 主要趨勢

- 航太和國防

- 汽車

- 風能

- 體育和休閒

- 建造

- 電子產品

- 其他

第 9 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Toray Industries

- Gen 2 Carbon

- Carbon Conversions

- Procotex Corporation SA

- SGL Carbon

- ELG Carbon Fibre

- Teijin

The Global Recycled Carbon Fiber Market reached USD 153.2 million in 2024 and is projected to grow at a strong CAGR of 11.5% from 2025 to 2034. This growth is primarily driven by increasing environmental awareness, government regulations that support sustainability, and the cost advantages of recycled materials. As industries across the globe prioritize eco-friendly solutions, recycled carbon fiber has gained significant traction as a sustainable and cost-effective alternative to virgin carbon fiber.

With the automotive, aerospace, and renewable energy sectors at the forefront of this transformation, the demand for recycled carbon fiber is projected to rise rapidly in the coming years. Companies are focusing on incorporating recycled materials to meet sustainability goals, reduce their carbon footprint, and manage resource limitations. This shift not only helps reduce waste but also supports circular economy principles. The ongoing efforts to develop advanced recycling technologies are further accelerating market growth, making recycled carbon fiber more accessible and efficient for various applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $153.2 Million |

| Forecast Value | $463.8 Million |

| CAGR | 11.5% |

By product type, the chopped carbon fiber segment dominated the market with a 44.4% share in 2024, thanks to its versatility and high strength, making it ideal for use in reinforced plastics and composite materials. Milled carbon fiber, which is known for its fine texture and precision, also holds a significant market share, especially in applications that require detailed reinforcement. Carbon fiber mats, valued for their lightweight and high-performance properties, continue to gain momentum as well. Meanwhile, other forms of recycled carbon fiber are steadily gaining popularity, reflecting the evolving demands of industries such as automotive, aerospace, and renewable energy, where high-strength and lightweight materials are essential.

Looking at the sources, automotive scrap accounted for 49.1% of the market share in 2024. The automotive industry's increasing focus on lightweight materials and sustainability is driving demand for recycled carbon fiber in this segment. The aerospace sector has also significantly contributed to the market's growth due to its high-performance material requirements. Additionally, other sectors such as wind energy, marine, and construction are beginning to show growing interest in recycled carbon fiber, signaling its expanding role across various industries.

In 2024, North America held a 39.4% share of the recycled carbon fiber market. The region benefits from strong industrial infrastructure and a focus on innovation. With significant activity in the aerospace, automotive, and renewable energy sectors, North America has seen a surge in demand for sustainable materials. The emphasis on reducing carbon footprints and adhering to stringent environmental regulations has led to a rise in investments in recycling technologies. As a result, recycled carbon fiber's integration into various industries is expected to grow, with technological advancements and sustainability initiatives further driving the market's expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing composites industry

- 3.6.1.2 Cost Savings

- 3.6.1.3 Advancements in technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Limited supply chain

- 3.6.2.2 Economic viability

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Chopped carbon fiber

- 5.3 Milled carbon fiber

- 5.4 Carbon fiber mat

- 5.5 Others

Chapter 6 Market Size and Forecast, By Source, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive scrap

- 6.3 Aerospace scrap

- 6.4 Other

Chapter 7 Market Size and Forecast, By Recycling method, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Mechanical recycling

- 7.3 Chemical recycling

- 7.4 Pyrolysis

- 7.5 Solvolysis

- 7.6 Others

Chapter 8 Market Size and Forecast, By End Use method, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Aerospace and defense

- 8.3 Automotive

- 8.4 Wind energy

- 8.5 Sports and leisure

- 8.6 Construction

- 8.7 Electronics

- 8.8 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Toray Industries

- 10.2 Gen 2 Carbon

- 10.3 Carbon Conversions

- 10.4 Procotex Corporation SA

- 10.5 SGL Carbon

- 10.6 ELG Carbon Fibre

- 10.7 Teijin