|

市場調查報告書

商品編碼

1685228

牡蠣和蛤蜊市場機會、成長動力、產業趨勢分析和 2025 - 2034 年預測Oyster and Clam Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

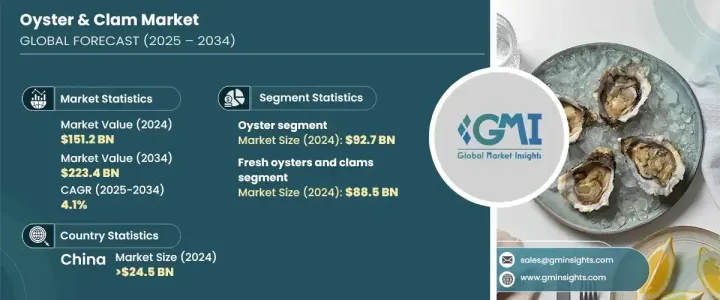

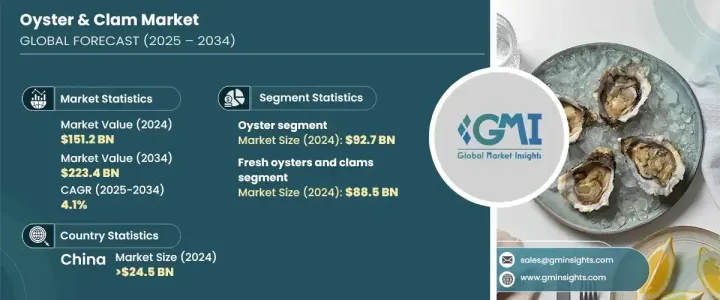

2024 年全球牡蠣和蛤蜊市場規模達到 1,512 億美元,預計 2025 年至 2034 年的複合年成長率為 4.1%。牡蠣和蛤蜊仍然是海鮮行業的重要組成部分,因其獨特的口感、在廚房中的多功能性以及眾多健康益處而聞名。消費者對營養、永續和優質蛋白質來源的偏好日益增加,大大促進了市場的擴張。牡蠣和蛤蜊營養豐富,包括有益於心血管和認知健康的歐米伽 3 脂肪酸、維生素和礦物質。隨著越來越多的人將海鮮視為一種健康選擇,對這些軟體動物的需求也不斷上升,使它們成為世界各地廚房的主食。隨著人們越來越意識到牡蠣和蛤蜊的健康益處,它們已成為全球飲食中不可或缺的一部分,不僅在傳統地區,而且在新興市場,不斷突破其烹飪範圍的界限。

2024年,牡蠣將成為主導類別,產值達927億美元。無論是牡蠣還是蛤蜊,每種類型都以其獨特的風味和質地而著稱,可以滿足各種消費者的喜好。這些差異使得它們可以融入各種各樣的菜餚中,從開胃菜到主菜,無論是在家庭烹飪中還是在高檔餐廳中。新鮮牡蠣和蛤蜊尤其受歡迎,2024 年產值達 885 億美元,佔 60% 的市場佔有率。消費者繼續青睞新鮮海鮮,因為它具有無與倫比的風味和品質,使其成為餐飲場所的首選。同時,冷凍牡蠣和蛤蜊由於方便、保存期限較長、品質保持良好,仍然是許多人的可行選擇。冷凍海鮮日益成長的趨勢反映了人們對既方便獲取又不損害口味和營養價值的選擇的需求日益成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1512億美元 |

| 預測值 | 2234億美元 |

| 複合年成長率 | 4.1% |

在分銷方面,零售業呈現強勁成長,預計到 2034 年將以 3.5% 的複合年成長率擴張。隨著越來越多的消費者轉向超市、海鮮專賣店和線上平台購買海鮮,零售市場正在成為一個重要的管道。隨著海鮮菜餚在餐廳和餐飲服務中越來越受歡迎,食品服務業繼續發揮重要作用。從休閒餐廳到高級餐廳,牡蠣和蛤蜊都是受歡迎的選擇,確保了餐飲服務作為主要配銷通路的持續強勁發展。

2024年,光是中國牡蠣和蛤蜊市場就創造了245億美元的產值,鞏固了其在全球市場領先地位。該國龐大的水產養殖業以及多種多樣的牡蠣和蛤蜊品種為其佔據主導地位做出了貢獻。中國沿海地區的大規模養殖為全球市場,特別是北美和歐洲,提供了穩定的軟體動物供應,進一步促進了國際貿易,並使中國成為該行業的主要出口中心。

目錄

第 1 章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第 2 章:執行摘要

第 3 章:產業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商概況

- 利潤率分析

- 重要新聞及舉措

- 監管格局

- 衝擊力

- 成長動力

- 海鮮需求不斷成長

- 感知到的健康益處

- 年輕一代的烹飪潮流日益興起

- 產業陷阱與挑戰

- 疾病和寄生蟲的威脅

- 氣候條件變化影響供應和品質

- 市場波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第 5 章:市場規模與預測:按類型,2021-2034 年

- 主要趨勢

- 牡蠣型

- 拖鞋牡蠣

- 太平洋巨牡蠣

- 蛤蜊類型

- 硬蜆

- 塔卡蛤

- 斯廷普森衝浪

第6章:市場規模及預測:依形式,2021-2034

- 主要趨勢

- 新鮮的

- 冰凍

- 罐頭

第 7 章:市場規模及預測:按配銷通路,2021-2034 年

- 主要趨勢

- 零售

- 餐飲服務

- 其他

第 8 章:市場規模與預測:按地區,2021-2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Clearwater Seafoods

- Colville Bay Oyster Co. Ltd

- Five Star Shellfish Inc

- High Liner Foods

- Island Creek Oysters

- Mazetta Company, LLC

- Pacific Seafood

- Pangea Shellfish Company

- Royal Hawaiian Seafood

- Taylor Shellfish Farms

- Ward Oyster Company

- Woodstown Bay Shellfish Ltd

The Global Oyster And Clam Market reached USD 151.2 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2034. Oysters and clams continue to be an essential part of the seafood industry, recognized for their distinct taste, versatility in the kitchen, and numerous health benefits. The increasing consumer preference for nutritious, sustainable, and premium sources of protein has significantly contributed to the market's expansion. Oysters and clams offer a wealth of nutritional benefits, including omega-3 fatty acids, vitamins, and minerals that support cardiovascular and cognitive health. As more people turn to seafood as a health-conscious option, the demand for these mollusks has been on the rise, making them a staple in kitchens worldwide. With this increasing awareness of their health advantages, oysters and clams are becoming integral to diets globally, not only in traditional regions but also in emerging markets, pushing the boundaries of their culinary reach.

In 2024, oysters are the dominant category, generating USD 92.7 billion. Each type, whether oysters or clams, is distinguished by its unique flavor and texture, catering to a wide variety of consumer preferences. These differences allow them to be incorporated into an extensive range of dishes, from appetizers to main courses, in both home cooking and high-end restaurants. Fresh oysters and clams are particularly popular, generating USD 88.5 billion in 2024 and commanding 60% of the market share. Consumers continue to favor fresh seafood for its unmatched flavor and quality, making it the go-to option for dining establishments. Meanwhile, frozen oysters and clams remain a viable choice for many due to their convenience, longer shelf life, and maintained quality. This growing trend towards frozen seafood reflects the increasing need for options that provide easy access without compromising on taste and nutritional value.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $151.2 Billion |

| Forecast Value | $223.4 Billion |

| CAGR | 4.1% |

In terms of distribution, the retail sector is showing robust growth, expected to expand at a CAGR of 3.5% through 2034. With more consumers turning to supermarkets, seafood specialty stores, and online platforms for their seafood purchases, the retail market is becoming an essential channel. The food service sector continues to play a significant role, driven by the increasing popularity of seafood dishes in restaurants and catering services. From casual eateries to fine dining, oysters and clams are a popular choice, ensuring the continued strength of food service as a key distribution channel.

In 2024, China's oyster and clam market alone generated USD 24.5 billion, solidifying its position as a leading player in the global market. The country's vast aquaculture industry, along with diverse species of oysters and clams, contributes to its dominance. Extensive farming operations along China's coastlines provide a steady supply of these mollusks to global markets, especially North America and Europe, further fueling international trade and establishing China as a key export hub in the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for seafood

- 3.6.1.2 Perceived Health Benefits

- 3.6.1.3 Rising culinary trends amongst young generation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Threat of disease and parasites

- 3.6.2.2 Changing climate conditions impacting availability & quality

- 3.6.2.3 Market Volatality

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oyster type

- 5.2.1 Slipper oyster

- 5.2.2 Pacific cupped oyster

- 5.3 Clam type

- 5.3.1 Hard clam

- 5.3.2 Taca clam

- 5.3.3 Stimpson surf

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fresh

- 6.3 Frozen

- 6.4 Canned

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Retail

- 7.3 Foodservice

- 7.4 Other

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Clearwater Seafoods

- 9.2 Colville Bay Oyster Co. Ltd

- 9.3 Five Star Shellfish Inc

- 9.4 High Liner Foods

- 9.5 Island Creek Oysters

- 9.6 Mazetta Company, LLC

- 9.7 Pacific Seafood

- 9.8 Pangea Shellfish Company

- 9.9 Royal Hawaiian Seafood

- 9.10 Taylor Shellfish Farms

- 9.11 Ward Oyster Company

- 9.12 Woodstown Bay Shellfish Ltd