|

市場調查報告書

商品編碼

1698233

自動駕駛汽車市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Self-driving Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

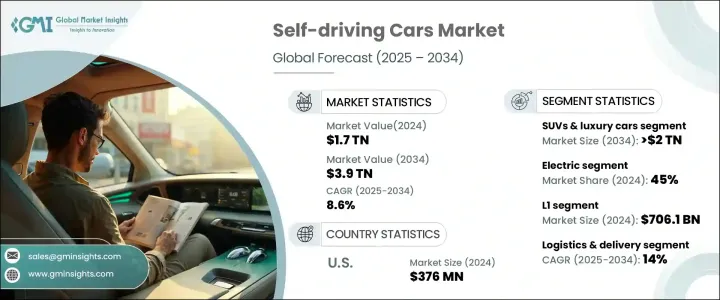

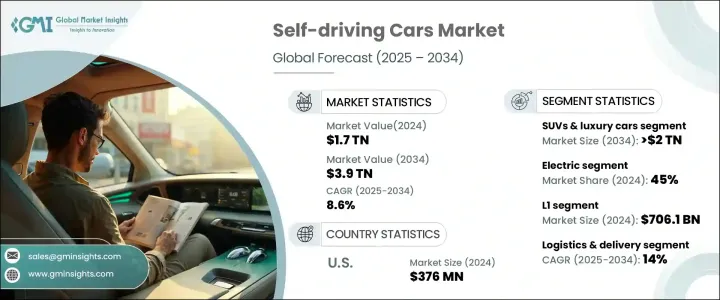

2024 年全球自動駕駛汽車市場價值達 1.7 兆美元,預計 2025 年至 2034 年的複合年成長率將達到 8.6%。推動這一成長的主要因素是自動駕駛汽車有可能大幅減少道路交通事故,根據世界衛生組織報告,道路交通事故每年在全球造成超過 130 萬人死亡。其中 90% 以上的死亡事故都是人為錯誤造成的,自動駕駛系統旨在透過人工智慧驅動的決策和先進的駕駛輔助技術來消除這些錯誤。先進感測器的整合可以在複雜的城市環境中實現精確導航,而 5G 驅動的車對一切 (V2X) 通訊可確保即時交通更新和道路安全。預計到 2050 年城市人口將大幅增加,自動駕駛汽車在智慧城市基礎設施發展中發揮關鍵作用,促進了永續、高效的交通解決方案。

根據產品類型,市場包括緊湊型、中型和豪華 SUV。 2024 年,SUV 和豪華車型佔據了超過 43% 的市場佔有率,預計到 2034 年將超過 2 兆美元。其寬敞的設計可容納 LiDAR、RADAR 和基於 AI 的軟體等尖端自動駕駛技術,同時又不影響舒適性。這些車輛吸引了那些願意投資於先進安全和個人化駕駛體驗的技術嫻熟的早期採用者。此外,SUV 在家庭和越野用途方面仍然具有很高的功能性,進一步促進了其在自動駕駛領域的應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.7兆美元 |

| 預測值 | 3.9兆美元 |

| 複合年成長率 | 8.6% |

依照動力方式,自動駕駛汽車分為內燃機(ICE)、混合動力和電動車型。 2024 年,電動車的市佔率將達到 45%,這主要歸功於其與自動駕駛系統的無縫整合。由於電動車具有集中式電子架構和連接能力,因此在支援自動駕駛功能方面具有天然優勢。世界各國政府繼續透過稅收優惠、補貼和擴大充電基礎設施來推動電動車的普及,使其成為開發下一代自動駕駛車隊的汽車製造商的首選。

自動駕駛等級從 L1 到 L5 不等,其中 L1 到 2024 年市場規模將達到 7,061 億美元。自適應巡航控制和車道維持輔助等 L1 功能可在保持駕駛員監督的同時提高駕駛安全性。這些技術實施起來具有成本效益,可以廣泛應用於各個車輛領域。越來越多的監管要求強制執行基本駕駛輔助功能,包括自動緊急制動,這繼續推動對 L1 系統的需求,確保其強大的市場地位。

自動駕駛汽車的應用涵蓋個人使用、共享出行、物流和公共交通。預計物流和配送產業將出現最快的成長,預測期內複合年成長率為 14%。個人使用的自動駕駛汽車提供了更大的便利,使乘客能夠在旅行時從事其他活動。共享旅遊服務正逐步整合自動駕駛計程車,提高城市交通效率。隨著成本下降和經濟可及性的提高,個人擁有自動駕駛汽車的現象變得越來越普遍。

北美佔據自動駕駛汽車市場的主導地位,佔有 25% 的佔有率,其中美國在 2024 年的收入為 3,760 億美元。該地區在自動駕駛汽車創新方面處於領先地位,科技公司在人工智慧、感測器技術和連接性方面取得開創性進展。有利的政府法規和持續的政策支持進一步加速了市場擴張,鞏固了北美作為自動駕駛技術全球領導者的地位。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件供應商

- 製造商

- 技術提供者

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 價格趨勢

- 衝擊力

- 成長動力

- 人工智慧和感測器的技術進步

- 對增強安全功能的需求

- 共享出行和叫車服務需求不斷成長

- 電子商務的興起和對自動配送的需求

- 環保意識不斷增強,注重永續發展

- 產業陷阱與挑戰

- 監管和法律障礙

- 開發成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依自主級別,2021 年至 2034 年

- 主要趨勢

- L1

- L2

- L3

- L4

- L5

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 緊湊型車

- 中型車

- SUV 和豪華轎車

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電的

- 油電混合車

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 個人使用

- 共享出行

- 物流與配送

- 大眾運輸

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Audi (Volkswagen Group)

- BMW

- BYD (Build Your Dreams)

- Cruise (General Motors)

- Ford Motor Company

- Honda

- Hyundai Motor Group

- Lucid Motors

- Mercedes-Benz (Daimler AG)

- Motional Inc

- Navya

- Nissan

- Stellantis

- Tesla

- Toyota

- Volkswagen

- Volvo Cars

- Waymo (Alphabet Inc.)

- Waymo LLC

- Zoox

The Global Self-Driving Cars Market, valued at USD 1.7 trillion in 2024, is expected to expand at a CAGR of 8.6% from 2025 to 2034. The primary factor fueling this growth is the potential of autonomous vehicles to drastically reduce road accidents, which claim over 1.3 million lives worldwide each year, as reported by the World Health Organization. More than 90% of these fatalities result from human error, which autonomous systems aim to eliminate through AI-driven decision-making and advanced driver-assistance technologies. The integration of sophisticated sensors allows precise navigation in complex urban environments, while 5G-powered vehicle-to-everything (V2X) communication ensures real-time traffic updates and road safety. With urban populations projected to rise significantly by 2050, autonomous vehicles are playing a pivotal role in the development of smart city infrastructure, promoting sustainable and efficient transportation solutions.

By product type, the market includes compact, mid-size, and luxury SUVs. SUVs and luxury models captured over 43% of the market in 2024 and are set to surpass USD 2 trillion by 2034. Their spacious design accommodates cutting-edge autonomous technology such as LiDAR, RADAR, and AI-based software without compromising comfort. These vehicles appeal to tech-savvy early adopters willing to invest in advanced safety and personalized driving experiences. Additionally, SUVs remain highly functional for family and off-road use, further boosting their adoption within the autonomous sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Trillion |

| Forecast Value | $3.9 Trillion |

| CAGR | 8.6% |

In terms of propulsion, self-driving vehicles are classified into internal combustion engine (ICE), hybrid, and electric models. Electric vehicles held a 45% market share in 2024, largely due to their seamless integration with autonomous systems. EVs have a natural advantage in supporting autonomous driving features, given their centralized electronic architecture and connectivity capabilities. Governments worldwide continue to push EV adoption through tax benefits, subsidies and expanded charging infrastructure, making them a preferred choice for automakers developing next-generation autonomous fleets.

Autonomy levels range from L1 to L5, with L1 accounting for USD 706.1 billion in 2024. L1 features, such as adaptive cruise control and lane-keeping assistance, enhance driving safety while maintaining driver oversight. These technologies are cost-effective to implement, making them widely available across various vehicle segments. Growing regulatory requirements mandating basic driver-assistance features, including automatic emergency braking, continue to drive demand for L1 systems, ensuring their strong market presence.

Autonomous vehicle applications span personal use, shared mobility, logistics, and public transport. The logistics and delivery sector is expected to witness the fastest growth, with a 14% CAGR during the forecast period. Personal-use autonomous vehicles provide enhanced convenience, enabling passengers to engage in other activities while traveling. Shared mobility services are gradually integrating autonomous taxis, improving urban transportation efficiency. With declining costs and increasing financial accessibility, personal ownership of self-driving cars is becoming more widespread.

North America dominates the self-driving cars market, holding a 25% share, with the United States generating USD 376 billion in revenue in 2024. The region leads in autonomous vehicle innovation, with tech firms pioneering advancements in AI, sensor technology, and connectivity. Favorable government regulations and ongoing policy support further accelerate market expansion, solidifying North America's position as a global leader in self-driving technology.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trend

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Technological advancements in artificial intelligence and sensors

- 3.6.1.2 Demand for enhanced safety features

- 3.6.1.3 Increasing demand for shared mobility and ride-hailing services

- 3.6.1.4 Rising e-commerce and demand for autonomous delivery

- 3.6.1.5 Growing environmental awareness and focus on sustainability

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Regulatory and legal hurdles

- 3.6.2.2 High development costs

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Level of Autonomy, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 L1

- 5.3 L2

- 5.4 L3

- 5.5 L4

- 5.6 L5

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Compact cars

- 6.3 Mid-size cars

- 6.4 SUVs & luxury cars

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.4 Hybrid Vehicle

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal use

- 8.3 Shared mobility

- 8.4 Logistics & delivery

- 8.5 Public transport

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Audi (Volkswagen Group)

- 10.2 BMW

- 10.3 BYD (Build Your Dreams)

- 10.4 Cruise (General Motors)

- 10.5 Ford Motor Company

- 10.6 Honda

- 10.7 Hyundai Motor Group

- 10.8 Lucid Motors

- 10.9 Mercedes-Benz (Daimler AG)

- 10.10 Motional Inc

- 10.11 Navya

- 10.12 Nissan

- 10.13 Stellantis

- 10.14 Tesla

- 10.15 Toyota

- 10.16 Volkswagen

- 10.17 Volvo Cars

- 10.18 Waymo (Alphabet Inc.)

- 10.19 Waymo LLC

- 10.20 Zoox