|

市場調查報告書

商品編碼

1698244

卡車冷凍機組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Truck Refrigeration Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

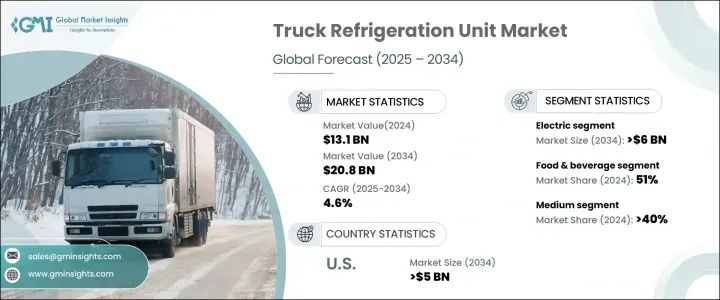

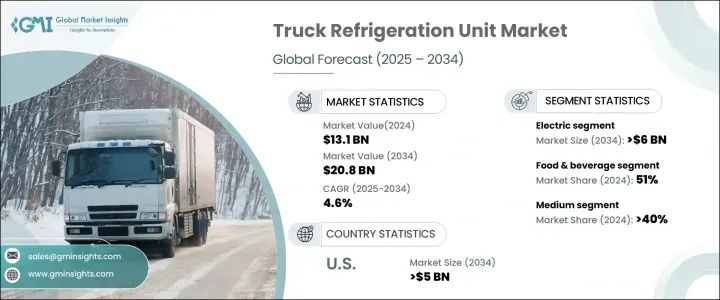

2024 年全球卡車冷凍機組市場價值為 131 億美元,預計 2025 年至 2034 年期間的複合年成長率為 4.6%。這一成長是由對確保產品品質和安全的高效運輸解決方案不斷成長的需求所推動的。對溫控物流日益成長的需求是推動這一擴張的關鍵因素,特別是在食品和飲料、製藥和化學品等行業。

隨著跨境貿易的持續蓬勃發展和電子商務平台的不斷擴大,企業正在大力投資創新冷凍技術。這些進步有助於維持易腐貨物的完整性,同時提高供應鏈效率。法規遵循是另一個主要促進因素,世界各國政府都對敏感產品實施嚴格的溫度控制指南。公司正在整合尖端解決方案以滿足這些標準並最佳化效能。隨著企業尋求環保替代品以減少排放並提高能源效率,永續性也在重塑市場。電動和混合冷凍設備越來越受到關注,製造商專注於長期永續性和營運成本的降低。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 131億美元 |

| 預測值 | 208億美元 |

| 複合年成長率 | 4.6% |

市場根據推進類型分為內燃機 (ICE)、電動和混合冷凍裝置。內燃機系統仍然佔據主導地位,到 2024 年將佔據 45% 的市場佔有率,這主要歸功於其完善的基礎設施、廣泛的可用性以及適合長途運輸。這些設備提供可靠的冷卻能力,使其成為大規模物流營運的首選。然而,該行業正在逐漸轉向電動製冷解決方案。電池技術的進步正在提高能源效率,使電動車成為越來越可行的替代品。到 2034 年,電力部門預計將創造 60 億美元的收入,這反映出對永續製冷選擇的強勁推動。

卡車製冷機組的最終用途應用涵蓋各行各業,其中食品和飲料行業佔據市場主導地位。到 2024 年,這一細分市場將佔據總市場佔有率的 51%,這得益於對新鮮農產品、乳製品、冷凍食品和肉類的需求不斷成長。嚴格的法規要求對易腐貨物進行適當的溫度控制,這促使物流供應商採用先進的冷卻技術。製藥業是另一個主要的成長動力,預計在 2025 年至 2034 年期間的複合年成長率將達到 6%。疫苗、生物製劑和溫度敏感藥物需要精確的冷氣解決方案,從而導致對專業冷鏈物流的投資增加。

美國卡車冷藏機組市場在 2024 年創造了 39 億美元的產值,預計到 2034 年將達到 50 億美元。完善的運輸和物流網路支持市場擴張,同時食品和製藥行業的需求強勁。隨著人們對永續性議題的關注日益加深,美國公司正在積極整合先進的冷凍系統,包括電動和混合動力模型,以提高效率並最大限度地減少對環境的影響。隨著技術的不斷進步和對更環保替代品的監管壓力,市場將在未來幾年發生重大轉變。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場估計的主要趨勢

- 預測模型

- 初步研究與驗證

- 主要來源

- 資料探勘來源

- 市場定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 零件製造商

- OEM

- 經銷商

- 最終用途

- 供應商格局

- 定價分析

- 利潤率分析

- 專利格局

- 成本明細

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對新鮮和冷凍食品的需求不斷增加

- 製藥和生物技術領域的成長

- 電子商務和最後一哩配送服務的擴展

- 電動和混合冷凍裝置的技術進步

- 產業陷阱與挑戰

- 冷凍設備的初始成本和維護費用高昂

- 嚴格的環境法規

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 內燃機

- 電的

- 混合

第6章:市場估計與預測:按溫度,2021 - 2034 年

- 主要趨勢

- 《冰雪奇緣》

- 冷藏

第7章:市場估計與預測:依拖車尺寸,2021 - 2034 年

- 主要趨勢

- 低於 20 英尺

- 20-40英尺

- 40英尺以上

第8章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 輕型商用車 (LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第9章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 食品和飲料

- 製藥

- 化學品

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Carrier Transicold

- Daikin

- Daimler

- Denso

- Frigoblock

- GAH Refrigeration

- Guangzhou Lianxing

- Kingtec Refrigeration

- Klinge Corporation

- Lamberet

- Mitsubishi Heavy Industries

- Tewis Refrigeration

- Thermo King

- Thermoking India

- Trane Technologies

- Transport Refrigeration

- Utility Trailer Manufacturing

- Volvo Group

- Webasto Group

- Zanotti

The Global Truck Refrigeration Unit Market, valued at USD 13.1 billion in 2024, is projected to expand at a CAGR of 4.6% between 2025 and 2034. The growth is driven by the rising demand for efficient transportation solutions that ensure product quality and security. The increasing need for temperature-controlled logistics is a key factor fueling this expansion, particularly in industries such as food and beverages, pharmaceuticals, and chemicals.

As cross-border trade continues to flourish and e-commerce platforms expand their reach, companies are investing heavily in innovative refrigeration technologies. These advancements help maintain the integrity of perishable goods while improving supply chain efficiency. Regulatory compliance is another major driver, with governments worldwide implementing strict temperature control guidelines for sensitive products. Companies are integrating cutting-edge solutions to meet these standards and optimize performance. Sustainability is also reshaping the market as businesses seek eco-friendly alternatives to reduce emissions and enhance energy efficiency. Electric and hybrid refrigeration units are gaining traction, with manufacturers focusing on long-term sustainability and operational cost reductions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.1 Billion |

| Forecast Value | $20.8 Billion |

| CAGR | 4.6% |

The market is segmented by propulsion type into internal combustion engine (ICE), electric, and hybrid refrigeration units. ICE-powered systems remain dominant, accounting for 45% of the market in 2024, largely due to their established infrastructure, widespread availability, and suitability for long-haul transportation. These units offer reliable cooling capabilities, making them the preferred choice for large-scale logistics operations. However, the industry is gradually shifting toward electric-powered refrigeration solutions. Advancements in battery technology are improving energy efficiency, making electric units an increasingly viable alternative. By 2034, the electric segment is projected to generate USD 6 billion, reflecting a strong push toward sustainable refrigeration options.

End-use applications for truck refrigeration units span various industries, with the food and beverage sector leading the market. In 2024, this segment accounted for 51% of the total market share, driven by the rising demand for fresh produce, dairy, frozen foods, and meat. Strict regulations mandating proper temperature control for perishable goods are pushing logistics providers to adopt advanced cooling technologies. The pharmaceutical industry is another major growth driver, expected to expand at a CAGR of 6% between 2025 and 2034. Vaccines, biologics, and temperature-sensitive medications require precise refrigeration solutions, leading to increased investment in specialized cold chain logistics.

The US truck refrigeration unit market generated USD 3.9 billion in 2024 and is projected to reach USD 5 billion by 2034. A well-established transportation and logistics network supports market expansion alongside strong demand from the food and pharmaceutical sectors. As sustainability concerns grow, companies in the US are actively integrating advanced refrigeration systems, including electric and hybrid models, to enhance efficiency and minimize environmental impact. With continuous technological advancements and regulatory pressure for greener alternatives, the market is poised for significant transformation in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component Manufacturers

- 3.1.2 OEM

- 3.1.3 Distributors

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Profit margin analysis

- 3.5 Patent landscape

- 3.6 Cost breakdown

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for fresh and frozen food products

- 3.10.1.2 Growth in the pharmaceutical and biotechnology sectors

- 3.10.1.3 Expansion of e-commerce and last-mile delivery services

- 3.10.1.4 Technological advancements in electric and hybrid refrigeration units

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs and maintenance expenses for refrigeration units

- 3.10.2.2 Stringent environmental regulations

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 ICE engine

- 5.3 Electric

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Temperature, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Frozen

- 6.3 Chilled

Chapter 7 Market Estimates & Forecast, By Trailer Size, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Below 20ft

- 7.3 20-40ft

- 7.4 Above 40ft

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Light Commercial Vehicles (LCV)

- 8.3 Medium Commercial Vehicles (MCV)

- 8.4 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Chemicals

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Carrier Transicold

- 11.2 Daikin

- 11.3 Daimler

- 11.4 Denso

- 11.5 Frigoblock

- 11.6 GAH Refrigeration

- 11.7 Guangzhou Lianxing

- 11.8 Kingtec Refrigeration

- 11.9 Klinge Corporation

- 11.10 Lamberet

- 11.11 Mitsubishi Heavy Industries

- 11.12 Tewis Refrigeration

- 11.13 Thermo King

- 11.14 Thermoking India

- 11.15 Trane Technologies

- 11.16 Transport Refrigeration

- 11.17 Utility Trailer Manufacturing

- 11.18 Volvo Group

- 11.19 Webasto Group

- 11.20 Zanotti