|

市場調查報告書

商品編碼

1698246

家庭睡眠篩檢設備市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Home Sleep Screening Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

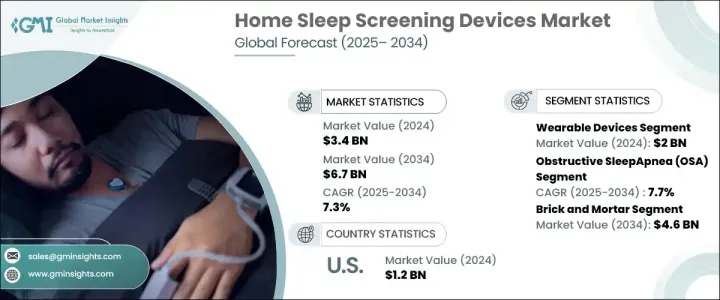

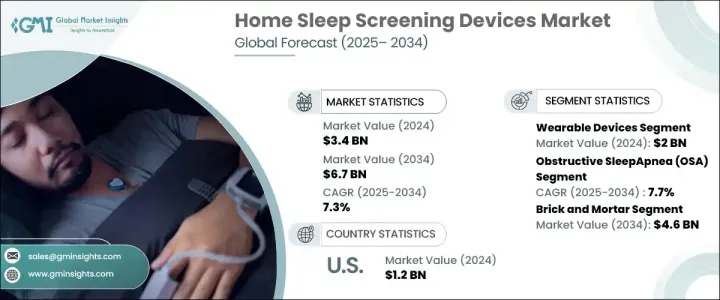

2024 年全球家用睡眠篩檢設備市場價值為 34 億美元,預計 2025 年至 2034 年的複合年成長率為 7.3%。穿戴式和可攜式技術的進步、對經濟高效的睡眠解決方案日益成長的需求、更高的診斷率以及人口老化是推動擴張的關鍵因素。失眠、不安腿症候群和阻塞性睡眠呼吸中止症等睡眠障礙的盛行率不斷上升,推動了家庭睡眠監測解決方案的需求。

居家睡眠篩檢設備監測和分析睡眠模式並檢測睡眠障礙。這些工具包括智慧手錶和健身追蹤器等穿戴式裝置以及攜帶式多導睡眠圖和睡眠呼吸中止監測器等不穿戴式系統。 2024 年,穿戴式裝置引領市場,創造 20 億美元收入,較 2021 年的 17 億美元成長。這些輕巧的設備使用戶可以輕鬆追蹤他們的睡眠模式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 34億美元 |

| 預測值 | 67億美元 |

| 複合年成長率 | 7.3% |

2022 年全球穿戴式科技出貨量將達到 5.343 億美元,智慧手錶和健身追蹤器的受歡迎程度日益成長。隨著消費者對睡眠健康的認知不斷提高,穿戴式睡眠監測設備市場大幅擴張。報告顯示,成年人的睡眠不足率穩定上升,促使更多人採用穿戴式睡眠追蹤解決方案。

根據應用,市場分為阻塞性睡眠呼吸中止症、失眠、不安腿症候群、晝夜節律紊亂和其他情況。阻塞性睡眠呼吸中止症市場在 2024 年的市場規模為 16 億美元,預計到 2034 年的複合年成長率將達到 7.7%。該疾病被廣泛認為是一個主要的健康問題,人們對其風險的認知也不斷提高,包括心血管疾病和白天嗜睡。睡眠障礙評估的診斷和轉診的增加增加了對家庭睡眠測試解決方案的需求。

提高人們對睡眠障礙認知的公共衛生措施在市場成長中發揮重要作用。針對識別和管理睡眠呼吸中止症狀的教育項目明顯增加。此外,居家睡眠篩檢設備的採用率也大幅上升,過去幾年的使用量顯著增加。

根據分銷管道,市場分為實體店和電子商務平台。實體零售店(包括藥局、醫療用品店和睡眠診所)在 2024 年佔據主導地位,預計到 2034 年將達到 46 億美元。對於大多數尋求健康相關產品的消費者來說,店內購買仍然是首選。這些地點提供專家指導和實際產品體驗,增強客戶信心和滿意度。

2024 年,美國家用睡眠篩檢設備市場規模達到 12 億美元,預計到 2034 年將以 6.4% 的複合年成長率擴張。家用睡眠測試為傳統的實驗室為基礎的多導睡眠圖提供了一種經濟高效的替代方案,使消費者更容易獲得。成本降低和保險覆蓋範圍擴大正在推動市場滲透,同時也更廣泛地推動預防性醫療保健措施。更高的價格和便利性正在加速向家庭睡眠監測解決方案的轉變,為未來幾年市場持續成長奠定基礎。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 全球睡眠障礙盛行率不斷上升

- 家庭醫療保健解決方案的需求不斷成長

- 睡眠監測技術的進步

- 對整合數位健康和穿戴式技術的需求激增

- 產業陷阱與挑戰

- 先進設備的初始成本高

- 資料隱私和安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 美國

- 歐洲

- 技術格局

- 報銷場景

- 波特的分析

- PESTEL 分析

- 差距分析

- 價值鏈分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 穿戴式裝置

- 智慧手錶

- 健身追蹤器

- 其他穿戴式裝置

- 非穿戴式裝置

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 阻塞性睡眠呼吸中止症(OSA)

- 失眠

- 不安腿症候群

- 晝夜節律紊亂

- 其他應用

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 實體店面

- 電子商務

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ApneaMed

- BMC

- BRAEBON

- CleveMed

- GARMIN

- HUAWEI

- natus

- NovaSom

- PHILIPS

- ResMed

- SleepWorks

- SOMNOmedics

- VIRTUOX

- ZEPP

- ZOLL itamar

The Global Home Sleep Screening Devices Market was valued at USD 3.4 billion in 2024 and is expected to grow at a CAGR of 7.3% from 2025 to 2034. Advances in wearable and portable technology, the increasing need for cost-effective sleep solutions, higher diagnosis rates, and an aging population are key factors driving expansion. The rising prevalence of sleep disorders such as insomnia, restless leg syndrome, and obstructive sleep apnea is fueling demand for home-based sleep monitoring solutions.

Home sleep screening devices monitor and analyze sleep patterns and detect disorders. These tools include wearable options like smartwatches and fitness trackers and non-wearable systems like portable polysomnography and sleep apnea monitors. In 2024, wearable devices led the market, generating USD 2 billion, an increase from USD 1.7 billion in 2021. These lightweight devices allow users to track their sleep patterns conveniently.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 Billion |

| Forecast Value | $6.7 Billion |

| CAGR | 7.3% |

Global shipments of wearable technology reached USD 534.3 million in 2022, with a growing preference for smartwatches and fitness trackers. The market for wearable sleep monitoring devices has expanded significantly, driven by increasing consumer awareness of sleep health. Reports indicate that sleep deprivation rates among adults have risen steadily, encouraging more individuals to adopt wearable sleep-tracking solutions.

By application, the market is segmented into obstructive sleep apnea, insomnia, restless leg syndrome, circadian rhythm disorders, and other conditions. The obstructive sleep apnea segment accounted for USD 1.6 billion in 2024 and is projected to grow at a CAGR of 7.7% through 2034. The condition is widely recognized as a major health concern, with rising awareness about its risks, including cardiovascular disease and daytime drowsiness. Increased diagnoses and referrals for sleep disorder evaluations have amplified the demand for home-based sleep testing solutions.

Public health initiatives promoting awareness of sleep disorders are playing a significant role in market growth. There has been a noticeable rise in educational programs focused on recognizing and managing sleep apnea symptoms. Additionally, the adoption of home sleep screening devices has surged, with a significant increase in their use over the past few years.

Based on distribution channels, the market is divided into brick-and-mortar stores and e-commerce platforms. Physical retail outlets, including pharmacies, medical supply stores, and sleep clinics, held the dominant share in 2024 and are projected to reach USD 4.6 billion by 2034. In-store purchases remain the preferred option for most consumers seeking health-related products. These locations offer expert guidance and hands-on product experience, enhancing customer confidence and satisfaction.

In 2024, the U.S. home sleep screening devices market generated USD 1.2 billion and is expected to expand at a CAGR of 6.4% through 2034. Home sleep tests offer a cost-effective alternative to traditional lab-based polysomnography, making them more accessible for consumers. Lower costs and expanding insurance coverage are driving market penetration, alongside a broader push toward preventive healthcare measures. Greater affordability and convenience are accelerating the shift toward at-home sleep monitoring solutions, positioning the market for sustained growth in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing global prevalence of sleep disorders

- 3.2.1.2 Growing demand for home healthcare solutions

- 3.2.1.3 Advancements in sleep monitoring technologies

- 3.2.1.4 Surging need for integrated digital health and wearable technology

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs for advanced devices

- 3.2.2.2 Data privacy and security concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Wearable devices

- 5.2.1 Smartwatches

- 5.2.2 Fitness trackers

- 5.2.3 Other wearable devices

- 5.3 Non-wearable devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Obstructive sleep apnea (OSA)

- 6.3 Insomnia

- 6.4 Restless leg syndrome

- 6.5 Circadian rhythm disorders

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ApneaMed

- 9.2 BMC

- 9.3 BRAEBON

- 9.4 CleveMed

- 9.5 GARMIN

- 9.6 HUAWEI

- 9.7 natus

- 9.8 NovaSom

- 9.9 PHILIPS

- 9.10 ResMed

- 9.11 SleepWorks

- 9.12 SOMNOmedics

- 9.13 VIRTUOX

- 9.14 ZEPP

- 9.15 ZOLL itamar