|

市場調查報告書

商品編碼

1698267

汽車牽引馬達市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Traction Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024 年全球汽車牽引馬達市場價值為 122 億美元,預計 2025 年至 2034 年期間的複合年成長率為 20.1%。全球電動車 (EV) 產量的大幅成長是這一成長的主要驅動力。各國政府正在透過減少對柴油車隊的依賴和促進汽車電氣化來降低碳排放。消費者也越來越注重永續性和燃料節約,進一步加速了向電動車的轉變。

電力電子和馬達控制技術的進步正在提高牽引馬達的效率和性能。採用碳化矽(SiC)和氮化鎵(GaN)半導體可提高電源效率、最大限度地減少能量損失並最佳化馬達輸出。這項進步使製造商能夠開發出更緊湊、更輕的引擎,從而提高車輛性能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 122億美元 |

| 預測值 | 726億美元 |

| 複合年成長率 | 20.1% |

汽車牽引馬達市場依馬達類型分為永磁同步馬達(PMSM)和交流感應馬達。 2024 年,PMSM 佔據市場主導地位,創造超過 450 億美元的收入。這些馬達因其輕質結構、卓越扭力和更高效率而受到青睞,成為電動車牽引系統的熱門選擇。由於 PMSM 比感應馬達消耗更多的電能,因此製造商優先將其整合到現代電動車設計中。

稀土材料成本的上升和供應問題的出現,促使製造商開發不含稀土元素的永磁同步馬達,這種電機無需釹或鏑就能高效運行。這些創新正在穩定供應鏈並促進永磁同步馬達在電動車中的更廣泛應用。隨著這些設計的不斷改進,預計將有更多製造商採用它們,從而進一步推動市場擴張。

根據功率輸出,市場也分為三類:低於 200 kW、200-400 kW 和高於 400 kW。預計到 2034 年,200-400 kW 細分市場的複合年成長率將超過 22%。該範圍內的高輸出牽引馬達在電動 SUV、跑車和商用車中越來越受歡迎。汽車製造商正在整合這些馬達以提高加速度和性能,滿足對強大而高效的電動傳動系統日益成長的需求。

卡車和公共汽車等電動商用車也推動了對高功率牽引馬達的需求。物流和貨運正在向電氣化轉型,對高扭力和高功率容量馬達的需求不斷增加。現在許多電動車都配備了雙馬達全輪驅動 (AWD) 系統,以提高穩定性和牽引力,同時要求額定功率在 200-400 kW 範圍內。汽車製造商正在採用這種設計來最佳化車輛動力學,進一步推動對高功率牽引馬達的需求。

亞太地區仍然是電動車生產的主導力量,中國、日本、韓國和印度等國家大力投資電動車基礎設施和製造業。領先的電動車製造商的存在以及區域供應鏈的進步,特別是稀土磁鐵生產方面的進步,正在支持市場成長。中國作為全球最大的電動車市場,不斷擴大產能以滿足國內和全球需求。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 原料及零件供應商

- 製造商

- 汽車製造商

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 價格趨勢

- 案例研究

- 衝擊力

- 成長動力

- 政府加強激勵措施和減排政策力度,推動電動車發展

- 消費者對環保節能電動車的需求不斷成長

- 提高馬達效率,降低能耗,延長車輛行駛里程

- 人工智慧和自動駕駛技術的日益普及,推動了牽引馬達系統的創新

- 產業陷阱與挑戰

- 引擎所需的稀土元素等關鍵材料的供應鏈限制

- 先進牽引馬達技術開發成本高昂

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車(HCV)

- 二輪車

- 越野車

第6章:市場估計與預測:按電動傳動系統,2021 - 2034 年

- 主要趨勢

- 純電動車(BEV)

- 混合動力電動車 (HEV)

- 插電式混合動力電動車(PHEV)

第7章:市場估計與預測:按汽車,2021 - 2034 年

- 主要趨勢

- 永磁同步馬達

- 交流感應

第8章:市場估計與預測:依發電量,2021 - 2034

- 主要趨勢

- 小於200千瓦

- 200-400千瓦

- 400度以上

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Audi

- Bosch

- Continental

- Ford

- General

- Honda

- Hyundai

- Kia

- Magna

- Magneti Marelli

- Mercedes Benz

- Mitsubishi

- Nidec

- Parker Hannifin

- PSA Group

- SAIC Motor

- Schaeffler

- Valeo

- Volkswagen

- ZF Friedrichshafen

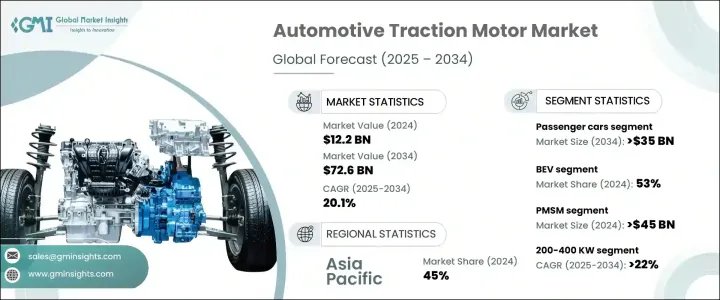

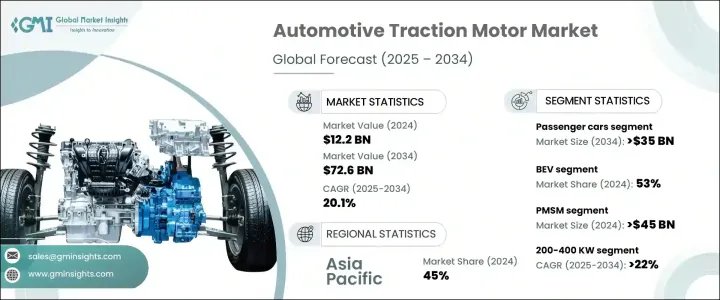

The Global Automotive Traction Motor Market was valued at USD 12.2 billion in 2024 and is projected to grow at a CAGR of 20.1% from 2025 to 2034. A significant rise in electric vehicle (EV) production worldwide is a key driver of this growth. Governments are pushing for lower carbon emissions by reducing reliance on diesel fleets and promoting vehicle electrification. Consumers are also becoming more conscious of sustainability and fuel conservation, further accelerating the transition to EVs.

Technological advancements in power electronics and motor control are improving the efficiency and performance of traction motors. The adoption of silicon carbide (SiC) and gallium nitride (GaN) semiconductors enhances power efficiency, minimizes energy loss, and optimizes motor output. This progress allows manufacturers to develop more compact and lightweight motors, leading to better vehicle performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $72.6 Billion |

| CAGR | 20.1% |

The automotive traction motor market is categorized by motor type into Permanent Magnet Synchronous Motors (PMSM) and AC induction motors. PMSM dominated the market in 2024, generating over USD 45 billion in revenue. These motors are preferred due to their lightweight structure, superior torque, and higher efficiency, making them a popular choice for EV traction systems. As PMSMs consume more electric energy compared to induction motors, manufacturers are prioritizing their integration into modern EV designs.

Rising costs and supply concerns surrounding rare earth materials have prompted manufacturers to develop rare-earth-free PMSMs that function efficiently without neodymium or dysprosium. These innovations are stabilizing the supply chain and facilitating broader adoption of PMSMs in EVs. As these designs continue to improve, more manufacturers are expected to implement them, further driving market expansion.

The market is also segmented by power output into three categories: less than 200 kW, 200-400 kW, and above 400 kW. The 200-400 kW segment is anticipated to grow at a CAGR of over 22% by 2034. High-output traction motors in this range are becoming increasingly popular in electric SUVs, sports cars, and commercial vehicles. Automakers are integrating these motors to enhance acceleration and performance, meeting the growing demand for powerful yet efficient electric drivetrains.

Electric commercial vehicles, including trucks and buses, are also fueling the demand for high-power traction motors. Logistics and freight transport are transitioning toward electrification, increasing the need for motors with high torque and power capacity. Many EVs are now equipped with dual-motor all-wheel-drive (AWD) systems, improving stability and traction while requiring power ratings within the 200-400 kW range. Automakers are adopting this design to optimize vehicle dynamics, further driving the demand for high-power traction motors.

Asia Pacific remains a dominant force in EV production, with countries such as China, Japan, South Korea, and India investing heavily in EV infrastructure and manufacturing. The presence of leading EV manufacturers and advancements in the regional supply chain, particularly in rare earth magnet production, are supporting market growth. China, as the world's largest EV market, continues to expand production capacity to cater to both domestic and global demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material & component suppliers

- 3.1.2 Manufacturers

- 3.1.3 Automotive manufacturers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trend

- 3.9 Case studies

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing government incentives and emission reduction policies promoting electric vehicles

- 3.10.1.2 Rising consumer demand for eco-friendly and energy-efficient electric vehicles

- 3.10.1.3 Advancements in motor efficiency, reducing energy consumption and extending vehicle range

- 3.10.1.4 Growing adoption of AI and autonomous technologies, driving innovation in traction motor systems

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Supply chain constraints for critical materials such as rare earth elements needed for motors

- 3.10.2.2 High development costs associated with advanced traction motor technologies

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicles (LCV)

- 5.3.2 Heavy Commercial Vehicles (HCV)

- 5.4 Two-wheelers

- 5.5 Off-road vehicles

Chapter 6 Market Estimates & Forecast, By Electric Drivetrain, 2021 - 2034($Bn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicle (BEV)

- 6.3 Hybrid Electric Vehicle (HEV)

- 6.4 Plug-in Hybrid Electric Vehicle (PHEV)

Chapter 7 Market Estimates & Forecast, By Motor, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 PMSM

- 7.3 AC Induction

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Less than 200 KW

- 8.3 200-400 KW

- 8.4 Above 400 KW

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Audi

- 10.2 Bosch

- 10.3 Continental

- 10.4 Ford

- 10.5 General

- 10.6 Honda

- 10.7 Hyundai

- 10.8 Kia

- 10.9 Magna

- 10.10 Magneti Marelli

- 10.11 Mercedes Benz

- 10.12 Mitsubishi

- 10.13 Nidec

- 10.14 Parker Hannifin

- 10.15 PSA Group

- 10.16 SAIC Motor

- 10.17 Schaeffler

- 10.18 Valeo

- 10.19 Volkswagen

- 10.20 ZF Friedrichshafen