|

市場調查報告書

商品編碼

1698269

電子角系統市場機會、成長動力、產業趨勢分析及 2025-2034 年預測e-Corner System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

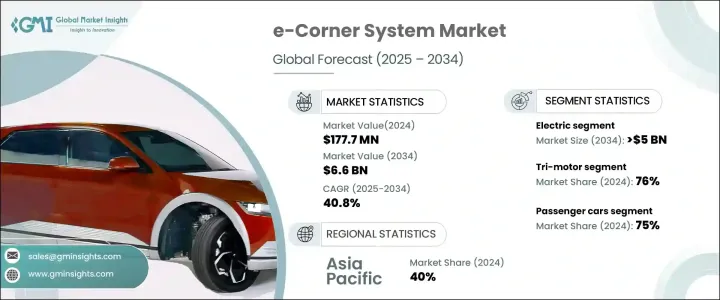

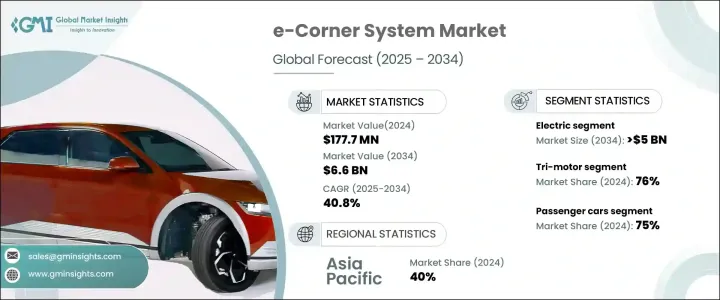

全球電子轉角系統市場在 2024 年的價值為 1.777 億美元,預計在 2025 年至 2034 年期間將以 40.8% 的顯著複合年成長率擴張,這得益於電動汽車 (EV) 的日益普及以及對先進車輛控制系統的推動。這種指數級成長是由汽車產業向電氣化的轉型所推動的,製造商專注於永續性、效率和增強的駕駛性能。

e-Corner 系統透過將轉向、煞車、懸吊和推進系統整合到每個車輪,徹底改變了電動車的設計。該技術增強了車輛的機動性,可以實現精確的扭矩控制並提高穩定性。汽車製造商擴大採用 e-Corner 系統,因為他們尋求創新解決方案來最佳化能源消耗並延長電池續航里程。隨著世界各國政府實施更嚴格的排放法規並推廣零排放汽車,對這些先進系統的需求預計將激增。人們對智慧和自適應移動解決方案的日益青睞進一步推動了市場擴張,使 e-Corner 系統成為下一代電動車的關鍵組件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.777億美元 |

| 預測值 | 66億美元 |

| 複合年成長率 | 40.8% |

根據推進類型細分,e-Corner 系統市場包括電動和內燃機 (ICE) 汽車。 2024 年,電動車領域佔據主導地位,佔 80% 的市場佔有率,預計到 2034 年將創造 50 億美元的市場價值。電動車普及率的上升是推動這一趨勢的重要因素,因為 e-Corner 系統在最佳化推進效率和改善車輛操控性方面發揮著至關重要的作用。這些系統能夠精確控制每個車輪的運動,並增強牽引力、安全性和整體駕駛體驗。隨著全球電動車銷量的成長,e-Corner 技術的採用預計將加速,進一步鞏固其在未來汽車工程中的重要性。

市場也根據馬達配置進行分類,其中三馬達和四馬達配置是主要選擇。 2024 年,三電機車佔據 76% 的市場佔有率,提供卓越的扭力分配和增強的車輛動力。三電機配置最佳化了各個車輪的動力分配,並提高了複雜駕駛條件下的牽引力和控制力。汽車製造商正在投資改進動力系統技術,以提供更好的操控性、穩定性和性能。隨著業界繼續優先考慮先進的車輛控制系統,三電機設定仍然是高階高性能電動車的首選。

從地區來看,受該地區電動車產業快速擴張的推動,亞太市場到 2024 年將佔 40% 的佔有率。中國、日本和韓國的汽車製造商正在大力投資先進的推進和操控解決方案,使 e-Corner 系統成為現代電動車的關鍵技術。在大力推動節能解決方案的背景下,政府和製造商正致力於開發高性能、差異化的控制系統,以提高車輛的安全性和效率。隨著亞太地區對電動車的需求持續激增,e-Corner 系統市場有望大幅成長,從而鞏固其作為汽車產業變革技術的角色。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 零件製造商

- 技術提供者

- 汽車製造商

- 供應商和分銷商

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 案例研究

- 成本效益分析

- 衝擊力

- 成長動力

- 對增強車輛機動性和先進停車解決方案的需求不斷成長

- 整合式線控轉向和線控制動技術的自動駕駛汽車和電動車的普及率不斷上升

- 更重視車輛安全性、穩定性和動態控制

- 輪轂馬達技術和模組化電子轉角架構的進步

- 產業陷阱與挑戰

- 開發和整合成本高

- 監管和標準化挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依馬達配置,2021 - 2034 年

- 主要趨勢

- 三馬達配置

- 四馬達配置

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- 越野車

- 商用車

- 輕型商用車 (LCV)

- 重型商用車(HCV)

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 電的

- 純電動車

- 油電混合車

- 插電式混合動力汽車

- 燃料電池電動車

第8章:市場估計與預測:依車輛配置,2021 - 2034 年

- 主要趨勢

- 兩輪驅動(2WD)

- 全輪驅動(AWD)

- 四輪驅動(4WD)

第9章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 油壓

- 電的

- 其他

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Aptiv

- Benteler

- Canoo

- Continental

- Denso

- Elaphe

- Faurecia

- GKN Automotive

- Hitachi

- Hyundai

- Indigo Technologies

- Mitsubishi

- Nissan

- Protean Electric

- REE Automotive

- Schaeffler

- Siemens

- Valeo

- Zeekr

- ZF Friedrichshafen

The Global e-Corner System Market, valued at USD 177.7 million in 2024, is projected to expand at a remarkable CAGR of 40.8% between 2025 and 2034, driven by the increasing adoption of electric vehicles (EVs) and the push for advanced vehicle control systems. This exponential growth is fueled by the automotive industry's transition toward electrification, with manufacturers focusing on sustainability, efficiency, and enhanced driving performance.

The e-Corner system is revolutionizing EV design by integrating steering, braking, suspension, and propulsion into each wheel. This technology enhances vehicle maneuverability, allowing for precise torque control and improved stability. Automakers are increasingly adopting e-Corner systems as they seek innovative solutions to optimize energy consumption and extend battery range. As governments worldwide implement stricter emission regulations and promote zero-emission vehicles, the demand for these advanced systems is expected to surge. The growing preference for intelligent and adaptive mobility solutions is further boosting market expansion, positioning e-Corner systems as a critical component in next-generation EVs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $177.7 Million |

| Forecast Value | $6.6 Billion |

| CAGR | 40.8% |

Segmented by propulsion type, the e-Corner system market includes electric and internal combustion engine (ICE) vehicles. The electric segment dominated in 2024, capturing 80% of the market share, and is projected to generate USD 5 billion by 2034. The rise in EV adoption is a significant factor driving this trend, as e-Corner systems play a crucial role in optimizing propulsion efficiency and improving vehicle handling. These systems enable precise control over each wheel's movement, enhancing traction, safety, and overall driving experience. With global EV sales on the rise, the adoption of e-Corner technology is expected to accelerate, further cementing its importance in the future of automotive engineering.

The market is also categorized by motor configuration, with tri-motor and quad-motor setups being the primary options. In 2024, the tri-motor segment accounted for 76% of the market share, offering superior torque distribution and enhanced vehicle dynamics. Tri-motor configurations optimize power allocation across individual wheels, improving traction and control in complex driving conditions. Automakers are investing in refining powertrain technologies to deliver better handling, stability, and performance. As the industry continues to prioritize advanced vehicle control systems, tri-motor setups remain the preferred choice for premium and high-performance EVs.

Regionally, the Asia Pacific market held a 40% share in 2024, driven by the region's rapidly expanding EV sector. Automakers across China, Japan, and South Korea are heavily investing in advanced propulsion and handling solutions, making e-Corner systems a key technology in modern electric mobility. With a strong push for energy-efficient solutions, governments and manufacturers are focusing on the development of high-performance, differentiated control systems to enhance vehicle safety and efficiency. As demand for EVs continues to surge across Asia Pacific, the e-Corner system market is poised for substantial growth, reinforcing its role as a transformative technology in the automotive industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component manufacturers

- 3.1.2 Technology providers

- 3.1.3 Automotive manufacturers

- 3.1.4 Suppliers & distributors

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Case studies

- 3.9 Cost-benefit analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for enhanced vehicle maneuverability and advanced parking solutions

- 3.10.1.2 Rising adoption of autonomous and electric vehicles integrating steer-by-wire and brake-by-wire technologies

- 3.10.1.3 Increasing focus on vehicle safety, stability, and dynamic control

- 3.10.1.4 Advancements in in-wheel motor technology and modular e-corner architectures

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High development and integration costs

- 3.10.2.2 Regulatory and standardization challenges

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Motor Configuration, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Tri-motor configuration

- 5.3 Quad-motor configuration

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchbacks

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.3.1 BEV

- 7.3.2 HEV

- 7.3.3 PHEV

- 7.3.4 FCEV

Chapter 8 Market Estimates & Forecast, By Vehicle Configuration, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 2-Wheel Drive (2WD)

- 8.3 All-Wheel Drive (AWD)

- 8.4 4-Wheel Drive (4WD)

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Hydraulic

- 9.3 Electric

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Benteler

- 11.3 Canoo

- 11.4 Continental

- 11.5 Denso

- 11.6 Elaphe

- 11.7 Faurecia

- 11.8 GKN Automotive

- 11.9 Hitachi

- 11.10 Hyundai

- 11.11 Indigo Technologies

- 11.12 Mitsubishi

- 11.13 Nissan

- 11.14 Protean Electric

- 11.15 REE Automotive

- 11.16 Schaeffler

- 11.17 Siemens

- 11.18 Valeo

- 11.19 Zeekr

- 11.20 ZF Friedrichshafen