|

市場調查報告書

商品編碼

1698271

上皮瘤治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Epithelioma Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

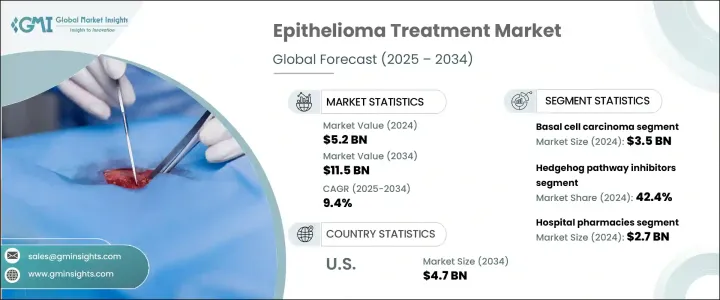

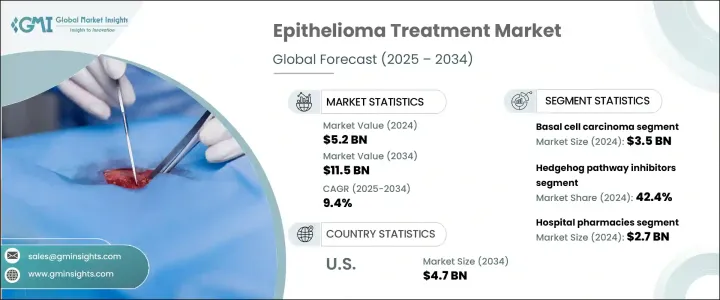

2024 年全球上皮瘤治療市場價值約為 52 億美元,預計 2025 年至 2034 年期間的複合年成長率為 9.4%。由於上皮組織腫瘤病例的增加,市場正在擴大,這些腫瘤可能是良性的,也可能是惡性的,例如基底細胞癌和鱗狀細胞癌。治療的重點是切除腫瘤、預防復發和減輕有害影響。提高意識、早期發現和政府措施是推動市場成長的關鍵因素。皮膚癌病例的不斷增加刺激了對創新療法的需求,從而導致治療方法取得了重大進展。持續的研發努力和新藥核准正在進一步推動市場擴張。監管機構正在支持引入先進的治療方案,改善患者獲得有效治療選擇的機會。醫療技術的進步也透過更好的疾病管理促進了市場的成長。

市場按類型、藥品類別和配銷通路細分。根據類型,基底細胞癌佔最大佔有率,2024 年創造 35 億美元的收入。作為最常見的非黑色素瘤皮膚癌形式,其發生率的上升增加了對有效治療的需求。長期暴露於紫外線和生活方式的改變等因素導致病例激增。人們對早期檢測的認知不斷提高,進一步推動了對先進療法的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 52億美元 |

| 預測值 | 115億美元 |

| 複合年成長率 | 9.4% |

按藥物類別分類,Hedgehog 通路抑制劑佔據主導地位,到 2024 年將貢獻 42.4% 的總市場收入。此細分市場的成長是由基底細胞癌盛行率的上升所推動的,尤其是在日照強度高和人口老化的地區。這些抑制劑已被證明在治療晚期和轉移性病例方面有效,因此其採用率高於傳統的化療和放射療法。正在進行的研究和臨床試驗可能會引入更多的刺蝟通路抑制劑,擴大患者的治療選擇。

在分銷管道方面,醫院藥房成為領先細分市場,2024 年銷售額達 27 億美元。這些藥房在為接受上皮瘤治療的住院患者提供即時藥物方面發揮著至關重要的作用。因基底細胞癌和鱗狀細胞癌入院的人數不斷增加,促進了該領域的擴張。醫院藥局也提供支持性護理服務,確保全面治療並改善病患治療效果。

從地區來看,北美是上皮瘤治療市場的關鍵參與者。尤其是美國,預計將大幅成長,市場收入將從 2023 年的 20 億美元增加到 2034 年的 47 億美元。該國受益於有利的監管環境,有利於促進先進療法的採用。預計新療法的監管批准將推動市場發展,增強該地區未來幾年的主導地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 皮膚癌發生率上升

- 標靶治療和免疫療法的進展

- 支持性醫療基礎設施和宣傳活動

- 產業陷阱與挑戰

- 治療費用高

- 疾病晚期療效有限且有不良反應

- 成長動力

- 成長潛力分析

- 監管格局

- 差距分析

- 專利分析

- 管道分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 基底細胞癌

- 鱗狀細胞癌

- 其他類型

第6章:市場估計與預測:依藥物類別,2021 年至 2034 年

- 主要趨勢

- Hedgehog 路徑抑制劑

- 免疫檢查點抑制劑

- 化療藥物

- 其他藥物類別

第7章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

- 其他分銷管道

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Amgen

- AstraZeneca

- BeiGene

- Bristol-Myers Squibb

- F. Hoffmann-La Roche

- Johnson & Johnson

- Merck and Co.

- Novartis

- Pfizer

- Regeneron Pharmaceuticals

- Sanofi

- Sun Pharmaceutical Industries

The Global Epithelioma Treatment Market was valued at approximately USD 5.2 billion in 2024 and is projected to grow at a 9.4% CAGR from 2025 to 2034. The market is expanding due to rising cases of epithelial tissue tumors, which may be benign or malignant, such as basal cell carcinoma and squamous cell carcinoma. Treatment focuses on removing tumors, preventing recurrence, and mitigating harmful effects. Increasing awareness, early detection, and government initiatives are key factors driving market growth. The growing number of skin cancer cases has fueled demand for innovative therapies, leading to significant advancements in treatment methods. Continuous R&D efforts and new drug approvals are further propelling market expansion. Regulatory bodies are supporting the introduction of advanced therapeutic solutions, improving patient access to effective treatment options. Medical technology improvements have also strengthened market growth by enabling better disease management.

The market is segmented by type, drug class, and distribution channel. Based on type, basal cell carcinoma accounted for the largest share, generating USD 3.5 billion in revenue in 2024. As the most prevalent form of non-melanoma skin cancer, its rising incidence has increased the demand for effective treatments. Factors such as prolonged UV exposure and shifting lifestyle patterns have contributed to the surge in cases. Greater awareness of early detection has further boosted the need for advanced therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $11.5 Billion |

| CAGR | 9.4% |

By drug class, hedgehog pathway inhibitors held the dominant share, contributing 42.4% of total market revenue in 2024. The segment growth is driven by the increasing prevalence of basal cell carcinoma, especially in regions with high sunlight exposure and aging populations. These inhibitors have demonstrated efficacy in treating advanced and metastatic cases, leading to their higher adoption over traditional chemotherapy and radiation therapies. Ongoing research and clinical trials are likely to introduce additional hedgehog pathway inhibitors, expanding treatment options for patients.

Regarding distribution channels, hospital pharmacies emerged as the leading segment, generating USD 2.7 billion in 2024. These pharmacies play a crucial role in providing immediate access to medications for inpatients undergoing treatment for epithelioma. The rising number of hospital admissions for basal cell carcinoma and squamous cell carcinoma has contributed to segment expansion. Hospital pharmacies also facilitate supportive care services, ensuring comprehensive treatment and improving patient outcomes.

Regionally, North America is a key player in the epithelioma treatment market. The United States, in particular, is projected to witness substantial growth, with market revenue increasing from USD 2 billion in 2023 to USD 4.7 billion by 2034. The country benefits from a favorable regulatory landscape that promotes the adoption of advanced therapies. Regulatory approvals for novel treatments are expected to drive market progression, strengthening the region's dominance in the coming years.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of skin cancer

- 3.2.1.2 Advancements in targeted therapies and immunotherapies

- 3.2.1.3 Supportive healthcare infrastructure and awareness campaigns

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment costs

- 3.2.2.2 Limited efficacy and adverse effects in advanced stages of the disease

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Patent analysis

- 3.7 Pipeline analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Basal cell carcinoma

- 5.3 Squamous cell carcinoma

- 5.4 Other types

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hedgehog pathway inhibitors

- 6.3 Immune checkpoint inhibitors

- 6.4 Chemotherapeutic agents

- 6.5 Other drug classes

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

- 7.5 Other distribution channels

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Amgen

- 9.2 AstraZeneca

- 9.3 BeiGene

- 9.4 Bristol-Myers Squibb

- 9.5 F. Hoffmann-La Roche

- 9.6 Johnson & Johnson

- 9.7 Merck and Co.

- 9.8 Novartis

- 9.9 Pfizer

- 9.10 Regeneron Pharmaceuticals

- 9.11 Sanofi

- 9.12 Sun Pharmaceutical Industries