|

市場調查報告書

商品編碼

1698285

肽類抗生素市場機會、成長動力、產業趨勢分析及2025-2034年預測Peptide Antibiotics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

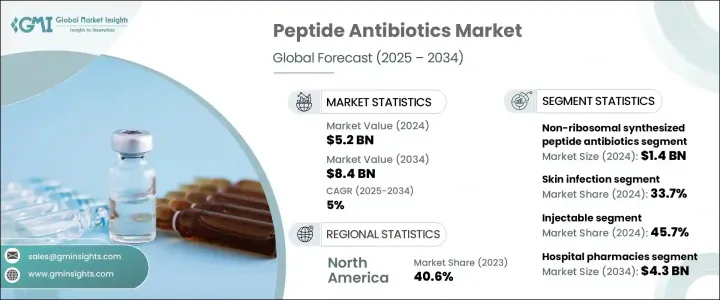

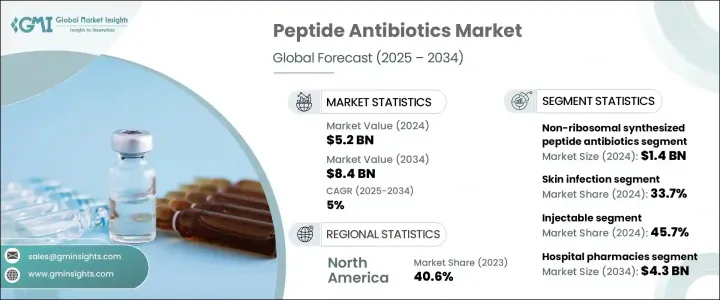

2024 年全球胜肽類抗生素市場價值為 52 億美元,預計 2025 年至 2034 年的複合年成長率為 5%。由於抗菌素抗藥性 (AMR) 威脅不斷升級,導致對先進抗生素解決方案的需求迫切,市場正在經歷顯著擴張。隨著細菌感染對傳統治療的抵抗力越來越強,胜肽類抗生素正成為重要的替代品。這些專門的抗生素,包括多粘菌素和短桿菌肽,對多重抗藥性 (MDR) 微生物表現出強大的活性,使其成為對抗抗藥性感染不可或缺的藥物。

隨著世界各地的醫療保健系統努力應對日益增多的抗生素抗藥性病例,製藥公司正致力於研發工作,將創新的胜肽類抗生素推向市場。院內感染 (HAI) 和血液感染的日益普及進一步加劇了對有效治療方案的需求,從而推動了對該領域的投資。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 52億美元 |

| 預測值 | 84億美元 |

| 複合年成長率 | 5% |

隨著製藥業的主要參與者合作開發可提高療效並最大限度降低抗藥性風險的新型藥物配方,基於胜肽的新型治療方法的管道正在不斷擴大。此外,政府應對抗生素抗藥性的舉措不斷增加以及對抗生素研究的資助在塑造市場成長軌跡方面發揮著至關重要的作用。人們越來越重視具有針對性作用且副作用最小的下一代抗生素,這推動了基於胜肽的解決方案的開發,這些解決方案對於治療不再對傳統療法有反應的嚴重細菌感染特別有用。

市場主要分為核醣體合成胜肽抗生素和非核醣體合成胜肽抗生素。 2024 年,非核醣體合成胜肽抗生素領域佔據市場主導地位,估值達 14 億美元。這些抗生素透過非核醣體胜肽合成酶(NRPS)產生,具有結構多樣性和增強的抗酶分解能力。它們能夠結合非蛋白質氨基酸,從而具有優異的抗菌性能,能夠更有效地對抗抗藥性極強的病原體。因此,非核醣體合成胜肽抗生素仍然是醫療保健提供者和研究人員尋求更持久、更廣譜的抗菌劑的首選。

肽類抗生素市場按應用細分,重點關注領域包括皮膚感染、醫院獲得性細菌性肺炎、血液感染和其他細菌性疾病。 2024 年,皮膚感染成為主要領域,佔 33.7% 的市場。蜂窩性組織炎、膿皰病和糖尿病足潰瘍等疾病的盛行率不斷上升,加上慢性傷口和術後感染的激增,推動了對這些有針對性的抗生素的需求。肽類抗生素提供了更精確的治療方法,同時降低了全身毒性,對於需要長期抗菌治療的潛在健康問題患者來說非常有效。

北美仍是胜肽類抗生素的主要區域市場,2023 年佔 40.6%。尤其是美國,在強大的製藥研究生態系統、完善的監管框架和大量醫療保健支出的支持下,繼續推動該領域的成長。美國領先的生物技術和製藥公司的存在促進了抗生素開發的持續創新。隨著抗菌藥物抗藥性病例的增加,國內對新型胜肽類抗生素的需求將會增加,以提供更有針對性、更有效的治療選擇,降低抗生素抗藥性的風險。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 多重抗藥性(MDR)細菌的盛行率不斷上升

- 急性和慢性傳染病發生率不斷上升

- 肽合成技術步驟

- 產業陷阱與挑戰

- 生產成本高

- 口服生物利用度有限

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 未來市場趨勢

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 核醣體合成胜肽抗生素

- 非核醣體合成胜肽類抗生素

第6章:市場估計與預測:按適應症,2021 年至 2034 年

- 主要趨勢

- 皮膚感染

- 本院獲得性細菌性肺炎和呼吸器相關性細菌性肺炎(HABP/VABP)

- 血流感染

- 其他適應症

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 注射劑

- 口服

- 主題

- 其他給藥途徑

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- ANI Pharmaceuticals

- Cumberland Pharmaceuticals

- Eli Lilly and Company

- GSK plc

- JHP Pharmaceuticals

- Merck

- Monarch Pharmachem

- Melinta Therapeutics

- NPS Pharmaceuticals

- Pfizer

- Sanofi

- Sandoz

- Teva Pharmaceuticals

- The Menarini Group

- Xellia Pharmaceuticals

The Global Peptide Antibiotics Market was valued at USD 5.2 billion in 2024 and is projected to grow at a CAGR of 5% from 2025 to 2034. The market is experiencing significant expansion due to the escalating threat of antimicrobial resistance (AMR), which has led to an urgent demand for advanced antibiotic solutions. With bacterial infections becoming increasingly resistant to conventional treatments, peptide antibiotics are emerging as a crucial alternative. These specialized antibiotics, including polymyxins and gramicidin, exhibit potent activity against multidrug-resistant (MDR) microbes, making them indispensable in combating resistant infections.

As healthcare systems worldwide grapple with rising cases of antibiotic resistance, pharmaceutical companies are focusing on research and development efforts to bring innovative peptide antibiotics to the market. The growing prevalence of hospital-acquired infections (HAIs) and bloodstream infections has further intensified the need for effective treatment options, driving investments in this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $8.4 Billion |

| CAGR | 5% |

The pipeline for new peptide-based treatments is expanding as major players in the pharmaceutical industry collaborate on novel drug formulations that enhance efficacy and minimize resistance risks. Additionally, increasing government initiatives to tackle AMR and funding for antibiotic research are playing a crucial role in shaping the growth trajectory of the market. The emphasis on next-generation antibiotics that provide targeted action with minimal side effects is fueling the development of peptide-based solutions, which are particularly useful in treating severe bacterial infections that no longer respond to traditional therapies.

The market is primarily categorized into ribosomal and non-ribosomal synthesized peptide antibiotics. In 2024, the non-ribosomal synthesized peptide antibiotics segment dominated the market, holding a valuation of USD 1.4 billion. These antibiotics, produced through non-ribosomal peptide synthetases (NRPSs), offer structural diversity and enhanced resistance to enzymatic degradation. Their ability to incorporate non-proteinogenic amino acids gives them superior antimicrobial properties, making them more effective in tackling highly resistant pathogens. As a result, non-ribosomal synthesized peptide antibiotics continue to be the preferred choice among healthcare providers and researchers striving for more durable and broad-spectrum antibacterial agents.

The peptide antibiotics market is segmented by application, with key focus areas including skin infections, hospital-acquired bacterial pneumonia, bloodstream infections, and other bacterial conditions. Skin infections emerged as the leading segment in 2024, accounting for a 33.7% share of the market. The increasing prevalence of conditions such as cellulitis, impetigo, and diabetic foot ulcers, along with a surge in chronic wounds and post-surgical infections, is fueling demand for these targeted antibiotics. Peptide antibiotics offer a more precise treatment approach with reduced systemic toxicity, making them highly effective for patients with underlying health conditions requiring prolonged antibacterial therapy.

North America remained the dominant regional market for peptide antibiotics, accounting for a 40.6% share in 2023. The United States, in particular, continues to drive growth in this sector, supported by a strong pharmaceutical research ecosystem, a well-established regulatory framework, and substantial healthcare spending. The presence of leading biotechnology and pharmaceutical firms in the U.S. fosters continuous innovation in antibiotic development. With the rise of AMR cases, the demand for new peptide antibiotics in the country is set to increase, providing more targeted and efficient treatment options that reduce the risk of antibiotic resistance.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of multi-drug resistant (MDR) bacteria

- 3.2.1.2 Increasing incidence of acute and chronic infectious diseases

- 3.2.1.3 Technological advancements in peptide synthesis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Limited oral bioavailability

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Future market trends

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ribosomal synthesized peptide antibiotics

- 5.3 Non-ribosomal synthesized peptide antibiotics

Chapter 6 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Skin infection

- 6.3 Hospital-acquired bacterial pneumonia and ventilator-associated bacterial pneumonia (HABP/VABP)

- 6.4 Blood stream infections

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injectable

- 7.3 Oral

- 7.4 Topical

- 7.5 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 ANI Pharmaceuticals

- 10.3 Cumberland Pharmaceuticals

- 10.4 Eli Lilly and Company

- 10.5 GSK plc

- 10.6 JHP Pharmaceuticals

- 10.7 Merck

- 10.8 Monarch Pharmachem

- 10.9 Melinta Therapeutics

- 10.10 NPS Pharmaceuticals

- 10.11 Pfizer

- 10.12 Sanofi

- 10.13 Sandoz

- 10.14 Teva Pharmaceuticals

- 10.15 The Menarini Group

- 10.16 Xellia Pharmaceuticals