|

市場調查報告書

商品編碼

1698292

乳糜瀉治療市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Celiac Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

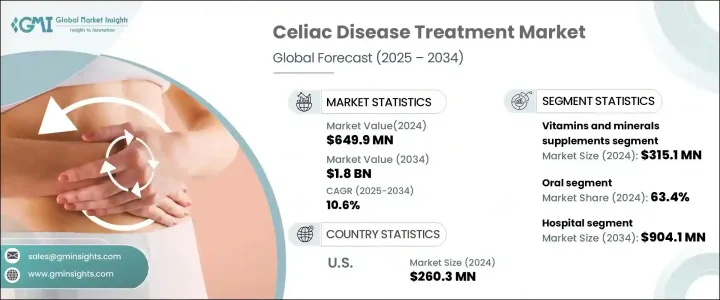

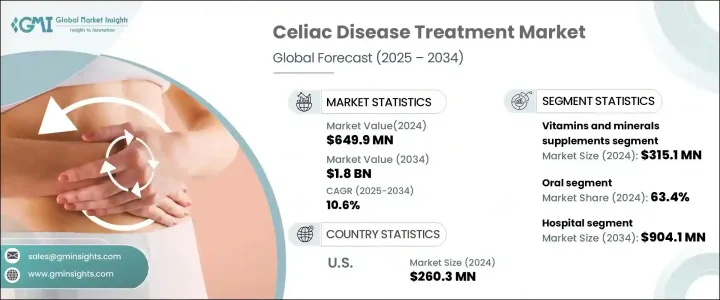

2024 年全球乳糜瀉治療市場價值為 6.499 億美元,預計 2025 年至 2034 年的複合年成長率為 10.6%。乳糜瀉盛行率的不斷上升以及醫療保健專業人員對先進診斷工具的認知不斷提高,正在推動市場的發展。隨著檢測方法的改進,越來越多的人被診斷出患有癌症,對有效治療的需求不斷上升。研發的進步正在加速藥物治療的引入,進一步推動市場擴張。乳糜瀉患者以外的人群對無麩質飲食的偏好激增,以及創新非侵入性診斷工具的採用,正在加強該行業的發展。 HLA 分型和抗體檢測技術的進步正在提高診斷準確性並縮短檢測時間,從而提高診斷率並增加對治療方案的需求。

該市場專注於乳糜瀉的管理和治療,乳糜瀉是一種由遺傳易感人群攝取麩質引發的自體免疫疾病。它包括旨在緩解症狀、預防併發症和增強患者健康的藥物、補充劑和療法。市場分為無麩質飲食、維生素和礦物質補充劑以及醫療療法。維生素和礦物質補充劑類別占主導地位,2024 年貢獻 3.151 億美元,因為乳糜瀉會損害營養吸收,需要補充劑來維持健康。特別強調鈣和維生素 D 的攝入,以解決與吸收不良相關的骨骼健康問題。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6.499億美元 |

| 預測值 | 18億美元 |

| 複合年成長率 | 10.6% |

消費者越來越尋求支持腸道健康的專門補充劑,從而推動了市場擴張。根據給藥途徑,市場分為口服治療和腸外治療。口服藥物市場在 2024 年佔據了 63.4% 的顯著佔有率,因其便利性而受到青睞,患者無需醫療保健提供者的幫助即可管理自己的病情。新型口服製劑(包括酵素補充劑和免疫調節劑)的引入正在拓寬治療選擇並提高患者的依從性。這些進步提高了藥物的功效、生物利用度和吸收率,提高了採用率。與注射和輸液相比,口服療法由於給藥方便而仍然受到青睞,適合需要靈活治療方案的忙碌生活患者。

最終用戶市場分為醫院、專科診所、家庭護理機構和其他類別。醫院在 2024 年佔最大的佔有率,預計到 2034 年將達到 9.041 億美元。治療性疫苗和抗發炎藥物的整合正在擴大醫院的治療服務。先進的診斷工具和多種治療選擇可以改善患者的治療效果,增加因疾病管理而入院的人數。醫院提供必要的一線治療,包括營養療法、無麩質飲食和生物製劑,而這些在初級保健環境中並不總是可用的。對生物製劑和酵素療法的依賴推動了頻繁的醫院就診,從而促進了市場成長。

2024年,美國以2.603億美元的估值佔據北美市場的主導地位。乳糜瀉病例的增加加劇了對先進治療的需求。美國佔北美病例的很大一部分,凸顯了患者群體的不斷擴大。主要市場參與者對創新治療方法、增強診斷系統和策略差異化的持續研究正在促進產業成長。藥物進步旨在減輕免疫系統反應,解決最緊迫的未滿足醫療需求之一。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 乳糜瀉盛行率上升

- 治療方案的技術進步

- 無麩質產品需求不斷成長

- 乳糜瀉診斷技術日益進步

- 產業陷阱與挑戰

- 無麩質產品成本高

- 嚴格的法規核准

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依治療方式,2021 年至 2034 年

- 主要趨勢

- 維生素和礦物質補充劑

- 無麩質飲食

- 醫學療法

第6章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 腸外

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 專科診所

- 居家照護環境

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- ActoBio

- Amgen

- Amneal Pharmaceuticals

- BioLineRx

- Calypso Biotech

- General Mills

- Glenmark Life Sciences

- Hikma Pharmaceuticals

- Innovate Biopharmaceutical

- Novartis

- Takeda Pharmaceutical Company

- Teva Pharmaceutical

- Viatris

- Zydus Pharmaceuticals

The Global Celiac Disease Treatment Market was valued at USD 649.9 million in 2024 and is projected to expand at a CAGR of 10.6% from 2025 to 2034. The increasing prevalence of celiac disease and growing awareness among healthcare professionals regarding advanced diagnostic tools are driving the market. As more people are diagnosed due to improved detection methods, the demand for effective treatment continues to rise. Advancements in research and development are accelerating the introduction of pharmaceutical treatments, further propelling market expansion. The surge in gluten-free dietary preferences beyond the celiac population and the adoption of innovative non-invasive diagnostic tools are strengthening the industry. Technological advancements in HLA typing and antibody testing are enhancing diagnostic accuracy and reducing test duration, thereby increasing diagnosis rates and boosting demand for therapeutic solutions.

The market focuses on the management and treatment of celiac disease, an autoimmune disorder triggered by gluten ingestion in genetically predisposed individuals. It includes pharmaceutical products, supplements, and therapies designed to alleviate symptoms, prevent complications, and enhance patient well-being. The market is segmented into gluten-free diets, vitamin and mineral supplements, and medical therapies. The vitamins and minerals supplements category dominated, contributing USD 315.1 million in 2024, as celiac disease impairs nutrient absorption, necessitating supplementation to maintain health. Calcium and vitamin D intake is particularly emphasized for addressing bone health concerns associated with malabsorption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $649.9 Million |

| Forecast Value | $1.8 Billion |

| CAGR | 10.6% |

Consumers are increasingly seeking specialized supplements that support gut health, fueling market expansion. Based on administration routes, the market is divided into oral and parenteral treatments. The oral segment held a significant share of 63.4% in 2024, favored for its convenience, allowing patients to manage their condition without healthcare provider assistance. The introduction of novel oral formulations, including enzyme supplements and immune modulators, is broadening treatment options and improving patient adherence. These advancements enhance drug efficacy, bioavailability, and absorption, increasing adoption rates. Oral therapies remain preferred due to their ease of administration compared to injections and infusions, accommodating patients with busy lifestyles who require flexible treatment solutions.

The end-user market is classified into hospitals, specialty clinics, homecare settings, and other categories. Hospitals accounted for the largest segment in 2024, with projections reaching USD 904.1 million by 2034. The integration of therapeutic vaccines and anti-inflammatory drugs is expanding hospital-based treatment offerings. Advanced diagnostic tools and a diverse range of therapeutic options improve patient outcomes, increasing hospital admissions for disease management. Hospitals provide essential first-line treatments, including nutrition therapy, gluten-free diets, and biologics, which are not always available in primary care settings. The reliance on biologic agents and enzyme therapies drives frequent hospital visits, contributing to market growth.

In 2024, the United States dominated the North American market with a valuation of USD 260.3 million. Rising celiac disease cases are intensifying the demand for advanced treatments. The U.S. accounts for a significant portion of North American cases, highlighting an expanding patient base. Ongoing research into innovative treatment approaches, enhanced diagnostic systems, and strategic differentiation by key market players is fostering industry growth. Pharmaceutical advancements aim to mitigate immune system reactions, addressing one of the most pressing unmet medical needs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of celiac disease

- 3.2.1.2 Technological advancements in therapeutic options

- 3.2.1.3 Increasing demand for gluten-free products

- 3.2.1.4 Increasing diagnostic technologies for celiac disease diagnosis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of gluten-free products

- 3.2.2.2 Stringent regulatory approvals

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Vitamins and mineral supplements

- 5.3 Gluten-free diet

- 5.4 Medical therapies

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Homecare settings

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ActoBio

- 9.2 Amgen

- 9.3 Amneal Pharmaceuticals

- 9.4 BioLineRx

- 9.5 Calypso Biotech

- 9.6 General Mills

- 9.7 Glenmark Life Sciences

- 9.8 Hikma Pharmaceuticals

- 9.9 Innovate Biopharmaceutical

- 9.10 Novartis

- 9.11 Takeda Pharmaceutical Company

- 9.12 Teva Pharmaceutical

- 9.13 Viatris

- 9.14 Zydus Pharmaceuticals