|

市場調查報告書

商品編碼

1698306

格林-巴利症候群診斷市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Guillain-Barre Syndrome Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

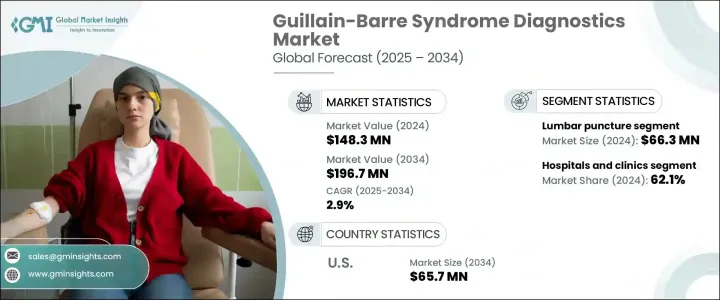

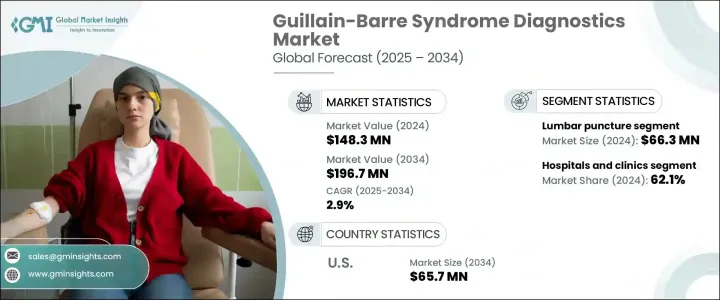

2024 年全球格林巴利症候群 (GBS) 診斷市場價值為 1.483 億美元,預計 2025 年至 2034 年期間的複合年成長率為 2.9%。這一成長得益於神經系統檢測方法的進步和早期診斷意識的提高。自體免疫疾病盛行率的不斷上升、診斷程序的可及性的提高以及醫療基礎設施投資的不斷增加都導致了這一上升趨勢。隨著醫療技術的發展,醫療保健提供者正致力於提高診斷準確性,以便及時干預,降低與格林-巴利綜合症相關的嚴重併發症的風險。

格林巴利症候群是一種罕見的自體免疫疾病,患者免疫系統會錯誤地攻擊周邊神經。這會導致肌肉無力,嚴重時甚至會導致癱瘓。雖然確切病因尚不清楚,但病毒和細菌感染被認為是主要誘因。鑑於這種疾病的潛在嚴重性,早期發現至關重要,這推動了對先進診斷測試的需求。世界各地的醫療機構都優先進行格林-巴利綜合症篩檢,並整合最先進的設備以提高診斷精度。研究和開發計劃也在促進創新,公司正在探索新的基於生物標記的測試方法,這可能會徹底改變診斷領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1.483億美元 |

| 預測值 | 1.967億美元 |

| 複合年成長率 | 2.9% |

市場根據測試類型進行細分,包括腰椎穿刺、神經傳導研究、肌電圖和其他診斷方法。 2024 年,腰椎穿刺領域將引領市場,創造 6,630 萬美元的產值。作為一項黃金標準診斷程序,腰椎穿刺可以進行腦脊髓液分析,透過檢測升高的蛋白質水平和正常的白血球計數來幫助確認格林-巴利綜合症。此方法因其可靠性和準確性而受到高度評價,因此成為醫療保健專業人士的首選。隨著技術的不斷進步,腰椎穿刺技術不斷改進,確保了患者的治療效果。

格林巴利症候群診斷的最終用途應用包括醫院和診所、診斷實驗室和其他醫療機構。 2024 年,醫院和診所佔據市場主導地位,佔總佔有率的 62.1%。由於擁有專門的神經病學部門、經驗豐富的醫療專業人員和尖端的診斷設備,這些設施仍然是格林-巴利綜合症診斷的主要場所。神經學中心和綜合醫院進行大部分 GBS 測試,包括神經傳導研究、肌電圖和腰椎穿刺。醫院內配備齊全的實驗室可確保患者得到及時且準確的診斷,從而鞏固了該領域的主導地位。

在美國,格林-巴利症候群診斷市場在 2023 年創造了 4,880 萬美元的產值,預計到 2034 年將達到 6,570 萬美元。格林-巴利綜合症發病率的上升加大了診斷能力的提升力度,醫療保健提供者強調早期發現和介入。該國人口老化進一步促進了市場擴張,因為老年人罹患自體免疫疾病的風險增加。因此,對創新診斷解決方案的需求不斷成長,促使製造商投資研發。擴大醫療保健政策和改善保險覆蓋範圍也在加速市場成長方面發揮作用,使得 GBS 診斷在美國醫療保健領域更容易獲得。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 格林-巴利症候群發生率不斷上升

- 人們對罕見疾病的認知不斷提高

- 診斷技術的進步

- 人口老化加劇

- 產業陷阱與挑戰

- 診斷費用高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按測試類型,2021 年至 2034 年

- 主要趨勢

- 腰椎穿刺

- 神經傳導

- 肌電圖

- 其他測試類型

第6章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院和診所

- 診斷實驗室

- 其他最終用途

第7章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第8章:公司簡介

- Alpine Biomed

- Avanos

- Bionen Medical Devices

- Cadwell Industries

- Cardinal Health

- Clarity Medical

- Deymed Diagnostic

- EMS Biomedical

- Medtronic

- Natus Medical Incorporated

- Neurosoft

- Nihon Kohden

- Rochester Electro-Medical

The Global Guillain-Barre Syndrome (GBS) Diagnostics Market was valued at USD 148.3 million in 2024 and is projected to expand at a CAGR of 2.9% from 2025 to 2034. The growth is driven by advancements in neurological testing methods and rising awareness of early diagnosis. The increasing prevalence of autoimmune disorders, improved accessibility to diagnostic procedures, and growing investments in healthcare infrastructure contribute to this upward trend. As medical technology evolves, healthcare providers are focusing on enhancing diagnostic accuracy to facilitate timely intervention, reducing the risk of severe complications associated with GBS.

Guillain-Barre syndrome is a rare autoimmune condition in which the body's immune system erroneously attacks the peripheral nerves. This leads to muscle weakness and in severe cases, paralysis. Although the exact cause remains unknown, viral and bacterial infections are considered major triggers. Given the potential severity of the disorder, early detection is crucial, fueling demand for advanced diagnostic tests. Healthcare facilities worldwide are prioritizing GBS screening, integrating state-of-the-art equipment to improve diagnostic precision. Research and development initiatives are also fostering innovation, with companies exploring new biomarker-based testing approaches that could revolutionize the diagnostic landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $148.3 Million |

| Forecast Value | $196.7 Million |

| CAGR | 2.9% |

The market is segmented based on test types, including lumbar puncture, nerve conduction studies, electromyography, and other diagnostic methods. In 2024, the lumbar puncture segment led the market, generating USD 66.3 million. As a gold-standard diagnostic procedure, lumbar puncture enables cerebrospinal fluid analysis, which helps confirm GBS by detecting elevated protein levels with normal white blood cell counts. This method is highly regarded for its reliability and accuracy, making it the preferred choice among healthcare professionals. With ongoing technological advancements, lumbar puncture techniques continue to improve, ensuring enhanced patient outcomes.

End-use applications of Guillain-Barre syndrome diagnostics include hospitals and clinics, diagnostic laboratories, and other healthcare facilities. Hospitals and clinics dominated the market in 2024, accounting for 62.1% of the total share. These facilities remain the primary settings for GBS diagnosis due to the availability of specialized neurology units, experienced medical professionals, and cutting-edge diagnostic equipment. Neurology centers and general hospitals conduct the majority of GBS tests, including nerve conduction studies, electromyography, and lumbar punctures. The presence of well-equipped laboratories within hospitals ensures that patients receive prompt and accurate diagnoses, reinforcing the dominance of this segment.

In the United States, the Guillain-Barre syndrome diagnostics market generated USD 48.8 million in 2023 and is expected to reach USD 65.7 million by 2034. The rising incidence of GBS has intensified efforts to enhance diagnostic capabilities, with healthcare providers emphasizing early detection and intervention. The country's aging population further contributes to market expansion, as older individuals face an increased risk of developing autoimmune disorders. As a result, demand for innovative diagnostic solutions is growing, prompting manufacturers to invest in research and development. Expanding healthcare policies and improved insurance coverage are also playing a role in accelerating market growth, making GBS diagnostics more accessible across the US healthcare landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of Guillain-Barre syndrome

- 3.2.1.2 Growing awareness for the rare disease

- 3.2.1.3 Technological advancements in diagnostics

- 3.2.1.4 Rise in aging population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High diagnostic costs

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Lumbar puncture

- 5.3 Nerve conduction

- 5.4 Electromyography

- 5.5 Other test types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals and clinics

- 6.3 Diagnostic laboratories

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Alpine Biomed

- 8.2 Avanos

- 8.3 Bionen Medical Devices

- 8.4 Cadwell Industries

- 8.5 Cardinal Health

- 8.6 Clarity Medical

- 8.7 Deymed Diagnostic

- 8.8 EMS Biomedical

- 8.9 Medtronic

- 8.10 Natus Medical Incorporated

- 8.11 Neurosoft

- 8.12 Nihon Kohden

- 8.13 Rochester Electro-Medical