|

市場調查報告書

商品編碼

1698323

無線感測器網路市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Wireless Sensor Network Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

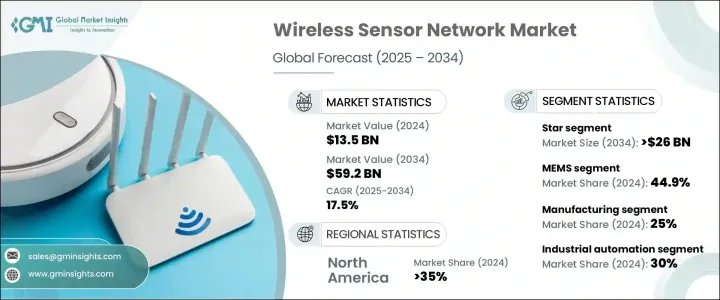

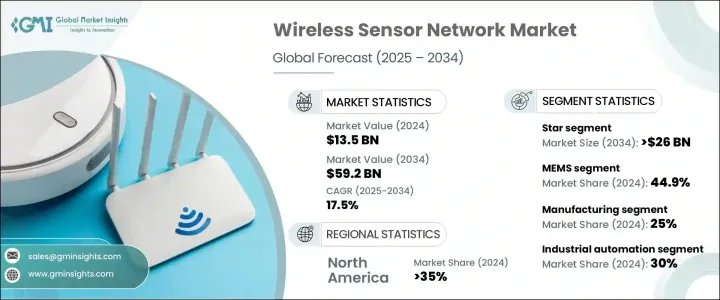

全球無線感測器網路市場規模在 2024 年將達到 135 億美元,預計在 2025 年至 2034 年期間的複合年成長率將達到 17.5%,這得益於各行各業對物聯網和智慧技術的日益普及。隨著企業和消費者不斷將連網設備融入日常營運中,對高效可靠的基於感測器的網路的需求正在激增。無線感測器網路對於實現工業流程自動化、最佳化即時資料收集以及增強不同應用之間的連接性至關重要。從智慧家庭和工業自動化到醫療保健和環境監測,這些網路正在簡化營運並提高效率。

隨著全球各地的組織加速數位轉型,各行各業都在加大對先進感測器網路的投資,以增強數據驅動的決策能力。工業 4.0 技術的廣泛應用正在推動對無線感測器網路的需求,尤其是在即時監控和自動化至關重要的製造業和物流業。這些網路能夠提供無縫連接,而不受傳統有線系統的限制,從而推動市場成長。政府和企業也正在投資智慧城市計劃,進一步推動基於感測器的網路在交通管理、空氣品質監測和安全等應用領域的應用。隨著低功耗通訊協定和邊緣運算的進步,無線感測器網路正在不斷發展,為各個行業提供更高的效率、可靠性和可擴展性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 135億美元 |

| 預測值 | 592億美元 |

| 複合年成長率 | 17.5% |

市場按網路拓樸細分,包括匯流排型、星型、樹型和網狀配置。 2024 年,星型拓樸結構佔據了 40% 的市場佔有率,預計到 2034 年將創造 260 億美元的市場價值。企業之所以青睞星型拓撲結構,是因為它的結構簡單,所有感測器節點都連接到中央集線器,從而降低了通訊複雜性並提高了系統可靠性。這種設計最大限度地減少了資料傳輸延遲,並確保了高速、安全的無線通訊,使其成為需要高效和易於部署的應用的理想選擇。星型拓樸結構的低維護要求和成本效益進一步促進了其在各行業的廣泛應用。

無線感測器網路也按感測器類型分類,其中 MEMS、基於 CMOS 的感測器、LED 感測器和其他感測器在市場中發揮重要作用。 MEMS感測器在2024年佔據主導地位,佔據44.9%的市場佔有率。它們體積小、能源效率高,並且能夠無縫整合到電子設備中,因此成為工業自動化、醫療保健和環境監測應用的首選。隨著各行各業越來越依賴數據驅動的洞察力,MEMS 感測器在增強即時監控和營運效率方面發揮著不可估量的價值。

美國引領無線感測器網路市場,2024 年佔有 35% 的佔有率。該國仍處於工業物聯網應用的前沿,企業利用無線感測器網路來提高生產力、簡化物流並推動自動化。成熟的感測器技術產業與強大的無線基礎設施相結合,正在加速市場擴張。隨著連接技術的進步和智慧解決方案的普及,無線感測器網路將在塑造多個領域的自動化、即時分析和智慧決策的未來方面發揮變革性作用。

目錄

第1章:方法論與範圍

- 研究設計

- 研究方法

- 資料收集方法

- 基礎估算與計算

- 基準年計算

- 市場評估的主要趨勢

- 預測模型

- 初步研究和驗證

- 主要來源

- 資料探勘來源

- 市場範圍和定義

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 解決方案提供者

- 服務提供者

- 技術提供者

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 監管格局

- 衝擊力

- 成長動力

- 對物聯網和智慧型設備的需求不斷成長

- 在工業自動化和智慧城市的應用日益廣泛

- 與人工智慧和機器學習的整合

- 產業陷阱與挑戰

- 安裝和維護成本高

- 能源消耗挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按拓樸結構,2021 - 2034 年

- 主要趨勢

- 公車

- 星星

- 樹

- 網

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 陸地

- 地下

- 水下

- 多媒體

- 移動的

第7章:市場估計與預測:按感測器,2021 - 2034 年

- 主要趨勢

- 微機電系統

- 基於CMOS的感測器

- LED 感應器

- 其他

第8章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 無線HART

- 無線網

- 無線上網

- IPv6

- 藍牙

- Dash 7

- Z-Wave

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 家庭和建築自動化

- 工業自動化

- 軍事監視

- 智慧交通

- 病患監護

- 機器監控

- 其他

第10章:市場估計與預測:依產業,2021 - 2034 年

- 主要趨勢

- 汽車

- 衛生保健

- 能源與公用事業

- IT和電信

- 製造業

- 零售

- 航太與國防

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東及非洲

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- ABB

- Advantech

- Analog Devices

- Broadcom

- Butlr Technologies

- Cisco

- Digi International

- Emerson Electric

- FreeWave Technologies

- Honeywell

- Intel

- Libelium

- Link Labs

- NXP Semiconductors

- Qualcomm

- Schneider Electric

- Siemens

- STMicroelectronics

- TE Connectivity

- Texas Instruments

The Global Wireless Sensor Network Market, valued at USD 13.5 billion in 2024, is projected to expand at a CAGR of 17.5% between 2025 and 2034, driven by the increasing adoption of IoT and smart technology across industries. As businesses and consumers continue to integrate connected devices into their daily operations, the demand for efficient and reliable sensor-based networks is surging. Wireless sensor networks are becoming essential for automating industrial processes, optimizing real-time data collection, and enhancing connectivity across diverse applications. From smart homes and industrial automation to healthcare and environmental monitoring, these networks are streamlining operations and improving efficiency.

As organizations worldwide accelerate digital transformation efforts, industries are increasingly investing in advanced sensor networks to enhance data-driven decision-making. The widespread adoption of Industry 4.0 technologies is fueling the demand for wireless sensor networks, particularly in manufacturing and logistics, where real-time monitoring and automation are critical. The ability of these networks to provide seamless connectivity without the limitations of traditional wired systems is propelling market growth. Governments and enterprises are also investing in smart city initiatives, further driving the adoption of sensor-based networks for applications such as traffic management, air quality monitoring, and security. With advancements in low-power communication protocols and edge computing, wireless sensor networks are evolving to deliver greater efficiency, reliability, and scalability across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.5 billion |

| Forecast Value | $59.2 billion |

| CAGR | 17.5% |

The market is segmented by network topology, including bus, star, tree, and mesh configurations. In 2024, the star topology segment held a 40% market share and is expected to generate USD 26 billion by 2034. Businesses prefer star topology due to its straightforward structure, where all sensor nodes connect to a central hub, reducing communication complexity and enhancing system reliability. This design minimizes data transfer delays and ensures high-speed, secure wireless communication, making it ideal for applications that require efficiency and ease of deployment. The low maintenance requirements and cost-effectiveness of star topology further contribute to its growing adoption across various industries.

Wireless sensor networks are also categorized by sensor type, with MEMS, CMOS-based sensors, LED sensors, and others playing a significant role in the market. MEMS sensors dominated in 2024, accounting for a 44.9% market share. Their compact size, energy efficiency, and ability to integrate seamlessly into electronic devices make them a preferred choice for industrial automation, healthcare, and environmental monitoring applications. With industries increasingly relying on data-driven insights, MEMS sensors are proving invaluable in enhancing real-time monitoring and operational efficiency.

The U.S. leads the wireless sensor network market, holding a 35% share in 2024. The country remains at the forefront of Industrial IoT adoption, with businesses leveraging wireless sensor networks to enhance productivity, streamline logistics, and drive automation. A well-established sensor technology industry, combined with robust wireless infrastructure, is accelerating market expansion. As connectivity technologies advance and smart solutions gain traction, wireless sensor networks are set to play a transformative role in shaping the future of automation, real-time analytics, and intelligent decision-making across multiple sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution provider

- 3.1.2 Services provider

- 3.1.3 Technology provider

- 3.1.4 End Use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for IoT and smart devices

- 3.7.1.2 Growing adoption in industrial automation and smart cities

- 3.7.1.3 Integration with AI and machine learning

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High costs of installation and maintenance

- 3.7.2.2 Energy consumption challenges

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Topology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Bus

- 5.3 Star

- 5.4 Tree

- 5.5 Mesh

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Terrestrial

- 6.3 Underground

- 6.4 Underwater

- 6.5 Multimedia

- 6.6 Mobile

Chapter 7 Market Estimates & Forecast, By Sensors, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 MEMS

- 7.3 CMOS-based sensors

- 7.4 LED sensors

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Wireless HART

- 8.3 ZigBee

- 8.4 Wi-Fi

- 8.5 IPv6

- 8.6 Bluetooth

- 8.7 Dash 7

- 8.8 Z-Wave

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Home and building automation

- 9.3 Industrial automation

- 9.4 Military surveillance

- 9.5 Smart transportation

- 9.6 Patient monitoring

- 9.7 Machine monitoring

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Industry, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Automotive

- 10.3 Healthcare

- 10.4 Energy & utilities

- 10.5 IT & telecom

- 10.6 Manufacturing

- 10.7 Retail

- 10.8 Aerospace & defense

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 ABB

- 12.2 Advantech

- 12.3 Analog Devices

- 12.4 Broadcom

- 12.5 Butlr Technologies

- 12.6 Cisco

- 12.7 Digi International

- 12.8 Emerson Electric

- 12.9 FreeWave Technologies

- 12.10 Honeywell

- 12.11 Intel

- 12.12 Libelium

- 12.13 Link Labs

- 12.14 NXP Semiconductors

- 12.15 Qualcomm

- 12.16 Schneider Electric

- 12.17 Siemens

- 12.18 STMicroelectronics

- 12.19 TE Connectivity

- 12.20 Texas Instruments