|

市場調查報告書

商品編碼

1698327

胰島素市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Insulin Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

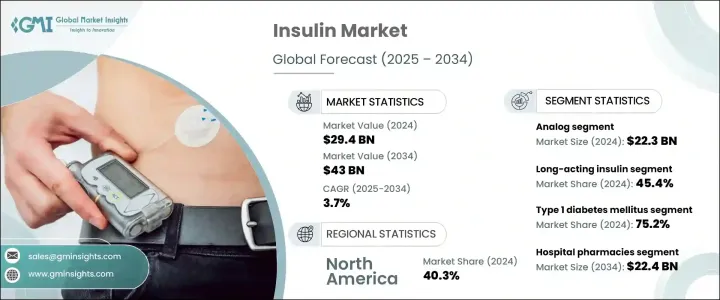

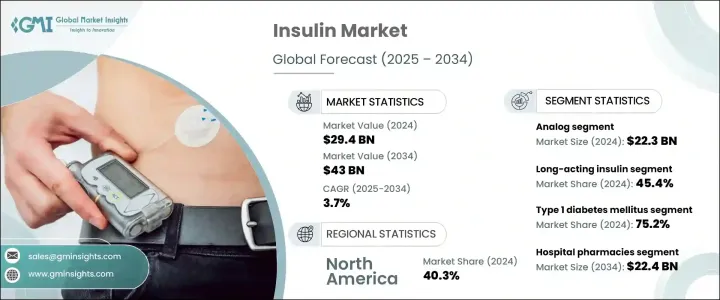

2024 年全球胰島素市值為 294 億美元,預計 2025 年至 2034 年的複合年成長率為 3.7%。糖尿病(尤其是第 2 型糖尿病)盛行率的不斷上升正在推動市場擴張。久坐不動的生活方式、肥胖率上升以及人口老化等因素是造成這種成長的主要原因。其他風險因素,包括高熱量飲食、遺傳傾向和壓力,也在糖尿病盛行率中發揮至關重要的作用。

不斷增強的認知和早期的醫療干預增加了對胰島素治療的需求,這對糖尿病管理仍然至關重要。胰島素製劑的進步,包括超速效、長效和生物相似藥胰島素,提高了治療順從性和患者的治療效果。此外,政府和非政府組織對發展中地區的投資增加擴大了胰島素的取得管道,進一步增強了市場。已開發經濟體的優惠報銷政策也促進了市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 294億美元 |

| 預測值 | 430億美元 |

| 複合年成長率 | 3.7% |

胰島素對於調節血糖水平、確保有效的能量利用至關重要。市場包括各種胰島素製劑,包括速效、短效、中效、長效和預混劑以及生物相似藥。

市場分為人類胰島素和胰島素類似物。胰島素類似物佔據市場主導地位,2024 年市場規模達 223 億美元。與傳統人類胰島素相比,胰島素類似物因其卓越的療效、更低的低血糖風險以及更好的患者依從性而被廣泛採用。胰島素類似物提供了更大的劑量靈活性,減少了餐後血糖峰值,並提供了更可預測的反應。與常規胰島素相比,長效胰島素類似物(例如地特胰島素)也能最大限度地減少體重增加。生物相似藥胰島素類似物的出現進一步擴大了其可近性和可負擔性。

根據產品類型,市場分為長效胰島素、速效胰島素、組合胰島素、生物相似藥和其他產品。長效胰島素在2024年佔最大佔有率,為45.4%。其緩釋機制可確保穩定的胰島素水平,減少注射頻率並增強患者的依從性。這些配方有效模擬基礎胰島素分泌,降低了低血糖的風險。先進的長效胰島素產品的開發和胰島素輸送裝置的改進繼續支撐市場主導地位。

根據應用,市場分為第 1 型糖尿病、2 型糖尿病和妊娠期糖尿病。 2024 年,1 型糖尿病佔了 75.2% 的市場佔有率,預計複合年成長率為 3.6%。 1 型糖尿病患者依賴每日注射胰島素來維持血糖值。與第 2 型糖尿病不同,改變生活型態和口服藥物可能有效,而第 1 型糖尿病則需要持續注射胰島素。

在分銷管道方面,醫院藥房在 2024 年引領市場,預計到 2034 年將達到 224 億美元。糖尿病相關住院人數高、胰島素產品種類繁多以及先進的醫療保健系統促成了該領域的主導地位。

從地區來看,北美在 2023 年佔據 40.3% 的市場佔有率,佔據市場主導地位。美國市場規模從 2022 年的 96 億美元成長到 2023 年的 102 億美元。該國糖尿病患病率高、醫療保健基礎設施健全以及對胰島素研發的大力投資繼續推動市場成長。領先胰島素製造商的存在進一步支持了市場擴張。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 糖尿病盛行率不斷上升

- 胰島素輸送系統的進展

- 政府措施和政策

- 關注兒童糖尿病

- 產業陷阱與挑戰

- 胰島素成本高昂

- 替代療法的可用性

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 糖尿病概況

- 2023年全球各地區糖尿病患者數

- 2023年糖尿病患者最多的國家

- 2023年全球各地區糖尿病死亡人數

- 預計 2045 年全球糖尿病患者數量最多的國家

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 人類胰島素

- 胰島素類似物

第6章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 速效胰島素

- 長效胰島素

- 複合胰島素

- 生物相似藥

- 其他產品

第7章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 1 型糖尿病

- 2型糖尿病

- 妊娠糖尿病

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Adocia

- Biocon

- Boehringer Ingelheim International

- Eli Lilly and Company

- Gan & Lee Pharmaceuticals

- Gland Pharma

- Julphar

- MannKind Corporation

- Novo Nordisk

- Pfizer

- Sanofi

- Shanghai Fosun Pharmaceutical

- Tonghua Dongbao Pharmaceutical

- United Laboratories International

- Wockhardt

The Global Insulin Market was valued at USD 29.4 billion in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2034. The increasing prevalence of diabetes, especially type 2, is driving market expansion. Factors such as a sedentary lifestyle, rising obesity rates, and an aging population significantly contribute to this growth. Other risk factors, including high-calorie diets, genetic predisposition, and stress, also play a crucial role in diabetes prevalence.

Growing awareness and early medical interventions have increased the demand for insulin therapy, which remains essential for diabetes management. Advances in insulin formulations, including ultra-rapid-acting, long-acting, and biosimilar insulins, have improved treatment adherence and patient outcomes. Additionally, increased government and NGO investments in developing regions have expanded insulin access, further strengthening the market. Favorable reimbursement policies in developed economies have also contributed to market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.4 Billion |

| Forecast Value | $43 Billion |

| CAGR | 3.7% |

Insulin is essential in regulating blood glucose levels, ensuring efficient energy utilization. The market includes various insulin formulations, including rapid-acting, short-acting, intermediate-acting, long-acting, and premixed options, as well as biosimilars.

The market is segmented into human insulin and insulin analogs. Insulin analogs dominated the market, accounting for USD 22.3 billion in 2024. Their widespread adoption stems from superior efficacy, lower risk of hypoglycemia, and better patient adherence compared to traditional human insulin. Insulin analogs provide greater dosing flexibility, reduce postprandial glucose spikes, and offer a more predictable response. Long-acting insulin analogs, such as insulin detemir, also minimize weight gain compared to regular insulin. The availability of biosimilar insulin analogs has further expanded accessibility and affordability.

By product type, the market is divided into long-acting insulin, rapid-acting insulin, combination insulin, biosimilars, and other products. Long-acting insulin held the largest share at 45.4% in 2024. Its slow-release mechanism ensures stable insulin levels, reducing the frequency of injections and enhancing patient adherence. These formulations effectively mimic basal insulin secretion, lowering the risk of hypoglycemia. The development of advanced long-acting insulin products and improvements in insulin delivery devices continue to support market dominance.

The market is categorized by application into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 1 diabetes accounted for 75.2% of the market in 2024 and is expected to grow at a CAGR of 3.6%. Patients with type 1 diabetes rely on daily insulin injections to maintain blood glucose levels. Unlike type 2 diabetes, where lifestyle modifications and oral medications may be effective, type 1 diabetes necessitates consistent insulin administration.

In terms of distribution channels, hospital pharmacies led the market in 2024, projected to reach USD 22.4 billion by 2034. High diabetes-related hospital admissions, access to a wide range of insulin products, and advanced healthcare systems contribute to this segment's dominance.

Regionally, North America led the market with a 40.3% share in 2023. The US market grew from USD 9.6 billion in 2022 to USD 10.2 billion in 2023. The country's high diabetes prevalence, robust healthcare infrastructure, and strong investments in insulin research and development continue to drive market growth. The presence of leading insulin manufacturers further supports market expansion.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes

- 3.2.1.2 Advancements in insulin delivery systems

- 3.2.1.3 Government initiatives and policies

- 3.2.1.4 Focus on pediatric diabetes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of insulin

- 3.2.2.2 Availability of alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Diabetes landscape

- 3.6.1 Number of diabetics worldwide, by region, 2023

- 3.6.2 Countries with the highest number of diabetics, 2023

- 3.6.3 Number of diabetes deaths worldwide, by region, 2023

- 3.6.4 Countries with the highest projected number of diabetics worldwide in 2045

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Human insulin

- 5.3 Insulin analog

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Rapid-acting insulin

- 6.3 Long-acting insulin

- 6.4 Combination insulin

- 6.5 Biosimilar

- 6.6 Other products

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Type 1 diabetes mellitus

- 7.3 Type 2 diabetes mellitus

- 7.4 Gestational diabetes

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Adocia

- 10.2 Biocon

- 10.3 Boehringer Ingelheim International

- 10.4 Eli Lilly and Company

- 10.5 Gan & Lee Pharmaceuticals

- 10.6 Gland Pharma

- 10.7 Julphar

- 10.8 MannKind Corporation

- 10.9 Novo Nordisk

- 10.10 Pfizer

- 10.11 Sanofi

- 10.12 Shanghai Fosun Pharmaceutical

- 10.13 Tonghua Dongbao Pharmaceutical

- 10.14 United Laboratories International

- 10.15 Wockhardt