|

市場調查報告書

商品編碼

1698333

智慧型藥物輸送系統市場機會、成長動力、產業趨勢分析及 2025-2034 年預測Smart Drug Delivery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

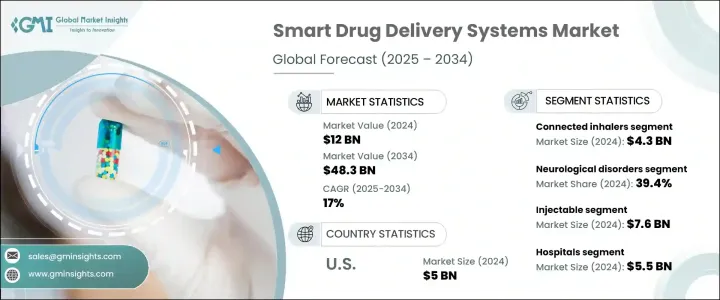

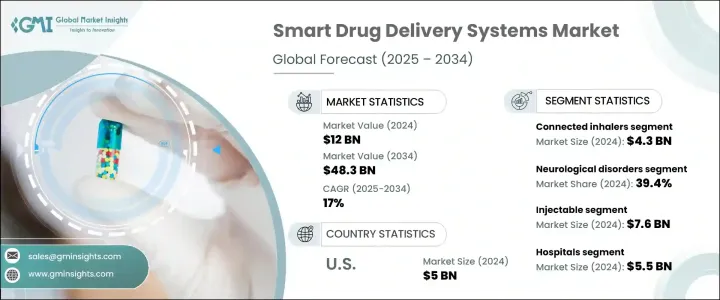

2024 年全球智慧藥物輸送系統市場價值為 120 億美元,預計 2025 年至 2034 年的複合年成長率為 17%。這些先進的系統透過精準輸送治療劑、減少副作用和改善患者預後來提高藥物療效。智慧藥物傳輸整合了奈米技術、微感測器和控釋機制,以最佳化藥物管理。糖尿病、癌症和心血管疾病等慢性疾病的發生率不斷上升,推動了對標靶藥物輸送解決方案的需求。隨著醫療保健向數位醫療技術和以患者為中心的護理轉變,這些智慧藥物傳輸系統的採用正在增加。奈米技術、生物材料和感測器的技術進步正在提高這些系統的準確性和效率,推動市場擴張。

市場按產品分類,連網吸入器在 2024 年將創造 43 億美元的收入,預計複合年成長率為 16.8%。氣喘和慢性呼吸系統疾病發病率的上升推動了對這些設備的需求,這些設備提供即時資料追蹤和使用情況監控,提高治療依從性。感測器和數位應用的整合增強了患者參與度和症狀管理,進一步推動了市場成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 120億美元 |

| 預測值 | 483億美元 |

| 複合年成長率 | 17% |

按應用分類,神經系統疾病領域佔 39.4% 的收入佔有率,到 2024 年將達到 47 億美元。阿茲海默症、帕金森氏症、癲癇和多發性硬化症的發病率不斷上升,對可提高治療效果的先進藥物輸送解決方案的需求也隨之增加。這些技術提高了藥物管理的準確性,最佳化了治療結果並減少了治療相關的挑戰。針對複雜的神經系統疾病提供針對性治療的能力對細分市場的成長做出了重大貢獻。

根據給藥途徑,市場分為注射劑、吸入劑和口服給藥。受材料科學、奈米技術和智慧感測器進步的推動,注射劑領域在 2024 年的收入將達到 76 億美元。這些創新增強了藥物傳輸、監測和客製化,確保了精確的劑量和改善的治療效果。美國 FDA 等機構的監管批准正在支持這些解決方案的商業化,從而加速市場成長。

醫院是最大的終端使用領域,2024 年將創造 55 億美元的收入。醫院擴大採用智慧藥物傳輸技術,從而改善藥物管理、確保更好的治療依從性並最佳化患者護理。住院率的上升、醫療基礎設施的進步以及對智慧醫療設備的投資正在推動該領域的擴張。

從地區來看,北美引領智慧藥物輸送系統市場,2024 年市場規模達 55 億美元,預計到 2034 年將達到 222 億美元。美國以 2024 年 50 億美元的收入主導了該地區市場。製藥和醫療器材公司之間的密切合作,以及對創新醫療技術的監管支持,正在推動該地區的市場成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率上升

- 數位健康科技的日益普及

- 轉向以病人為中心和以家庭為基礎的護理

- 藥物傳輸技術進步

- 產業陷阱與挑戰

- 設備開發和生產成本高昂

- 缺乏標準化

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 專利分析

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

CHAPTER 5 : Market Estimates and Forecast:By Product, 2021 – 2034

- 主要趨勢

- 網路吸入器

- 聯網自動注射器

- 連網筆式注射器

- 連網穿戴注射器

- 附加感測器

- 其他產品

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 代謝紊亂

- 神經系統疾病

- 呼吸系統疾病

- 荷爾蒙失調

- 其他應用

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 注射劑

- 吸入

- 口服

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 診所

- 居家護理

- 門診護理設置

- 其他最終用戶

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amiko Digital Health

- Becton, Dickinson and Company

- Biocorp

- Elcam Medical

- Johnson & Johnson

- Medtronic

- Merck

- Nemera

- Novo Nordisk

- Pfizer

- Phillips-Medisize

- Portal Instruments

- Teva Pharmaceutical Industries

- West Pharmaceutical Services

- Ypsomed

The Global Smart Drug Delivery Systems Market was valued at USD 12 billion in 2024 and is projected to grow at a CAGR of 17% from 2025 to 2034. These advanced systems enhance drug efficacy by delivering therapeutic agents with precision, reducing side effects, and improving patient outcomes. Smart drug delivery integrates nanotechnology, microsensors, and controlled-release mechanisms to optimize medication administration. The rising prevalence of chronic diseases, including diabetes, cancer, and cardiovascular conditions, is fueling the demand for targeted drug delivery solutions. With healthcare shifting towards digital health technologies and patient-centric care, the adoption of these intelligent drug delivery systems is increasing. Technological advancements in nanotechnology, biomaterials, and sensors are refining the accuracy and efficiency of these systems, driving market expansion.

The market is categorized by product, with connected inhalers generating USD 4.3 billion in revenue in 2024 and set to grow at a CAGR of 16.8%. The rising incidence of asthma and chronic respiratory diseases is driving demand for these devices, which offer real-time data tracking and usage monitoring, improving treatment adherence. The integration of sensors and digital applications enhances patient engagement and symptom management, further propelling market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12 Billion |

| Forecast Value | $48.3 Billion |

| CAGR | 17% |

By application, the neurological disorders segment held a 39.4% revenue share, reaching USD 4.7 billion in 2024. The increasing occurrence of Alzheimer's disease, Parkinson's disease, epilepsy, and multiple sclerosis is generating demand for advanced drug delivery solutions that enhance treatment efficacy. These technologies improve drug administration accuracy, optimizing therapeutic outcomes and reducing treatment-related challenges. The ability to deliver targeted therapies for complex neurological conditions contributes significantly to segment growth.

The market is segmented by route of administration into injectables, inhalation, and oral drug delivery. The injectable segment led with USD 7.6 billion in revenue in 2024, driven by advancements in materials science, nanotechnology, and smart sensors. These innovations enhance drug delivery, monitoring, and customization, ensuring precise dosing and improved treatment outcomes. Regulatory approvals from agencies like the U.S. FDA are supporting the commercialization of these solutions, accelerating market growth.

Hospitals represent the largest end-use segment, generating USD 5.5 billion in revenue in 2024. The increasing adoption of smart drug delivery technologies in hospitals is improving medication management, ensuring better treatment adherence, and optimizing patient care. Growing hospitalization rates, advancements in healthcare infrastructure, and investments in smart medical devices are driving segment expansion.

Regionally, North America led the smart drug delivery systems market, reaching USD 5.5 billion in 2024, with projections to hit USD 22.2 billion by 2034. The U.S. dominated the regional market with USD 5 billion in revenue in 2024. Strong collaborations between pharmaceutical and medical device companies, along with regulatory support for innovative medical technologies, are propelling market growth in the region.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° Synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Growing adoption of digital health technologies

- 3.2.1.3 Shift towards patient-centric and home-based care

- 3.2.1.4 Technological advancements in drug delivery

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with device development and production

- 3.2.2.2 Lack of standardization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Patent analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Connected inhalers

- 5.3 Connected autoinjectors

- 5.4 Connected pen injectors

- 5.5 Connected wearable injectors

- 5.6 Add-on sensors

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Metabolic disorders

- 6.3 Neurological disorders

- 6.4 Respiratory disorders

- 6.5 Hormonal disorders

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Injectable

- 7.3 Inhalation

- 7.4 Oral

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Clinics

- 8.4 Home care

- 8.5 Ambulatory care settings

- 8.6 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amiko Digital Health

- 10.2 Becton, Dickinson and Company

- 10.3 Biocorp

- 10.4 Elcam Medical

- 10.5 Johnson & Johnson

- 10.6 Medtronic

- 10.7 Merck

- 10.8 Nemera

- 10.9 Novo Nordisk

- 10.10 Pfizer

- 10.11 Phillips-Medisize

- 10.12 Portal Instruments

- 10.13 Teva Pharmaceutical Industries

- 10.14 West Pharmaceutical Services

- 10.15 Ypsomed