|

市場調查報告書

商品編碼

1698505

扁平材市場機會、成長動力、產業趨勢分析及2025-2034年預測Flat Steel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034 |

||||||

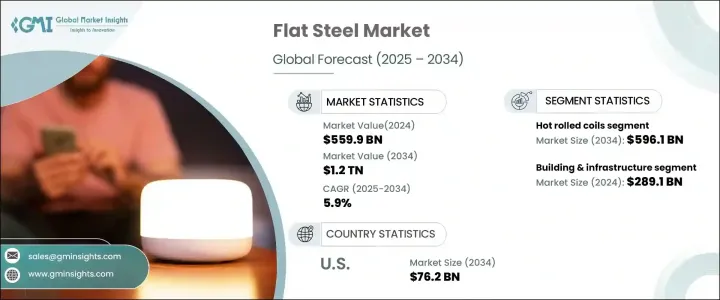

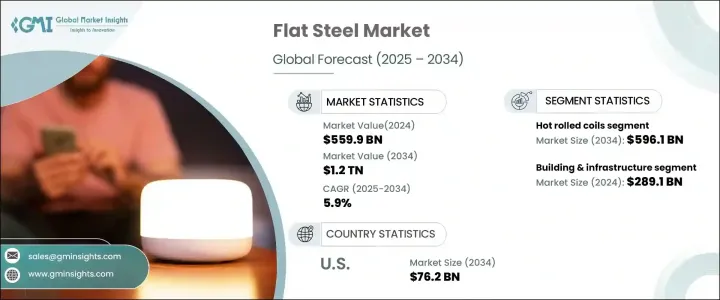

2024 年全球扁平鋼市場規模將達到 5,599 億美元,受建築和汽車產業需求成長的推動,預計 2025 年至 2034 年期間複合年成長率將達到 5.9%。扁鋼的成本效益、能源效率和環保特性使其成為各種應用的首選材料。隨著各國政府和私人企業加大基礎建設投資,高速公路、橋樑、大型交通工程對扁平材的需求持續上升。隨著城市化和工業化的快速成長,市場參與者專注於創新和永續的生產技術,以滿足不斷變化的行業需求。

扁平材市場的擴張與汽車產業的進步密切相關,汽車製造商優先考慮輕質、高強度的材料,以提高燃油效率並滿足嚴格的排放法規。向電動車的轉變進一步擴大了電池外殼和結構部件對扁鋼的需求。此外,先進金屬塗層的使用日益增多,增強了耐腐蝕性,並延長了多個行業產品的使用壽命。由於消費者和製造商尋求耐用且節能的材料,家電產業也受益。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5599億美元 |

| 預測值 | 1.2兆美元 |

| 複合年成長率 | 5.9% |

熱軋捲仍將是主導產品類別,預計到 2034 年產值將達到 5,961 億美元,複合年成長率為 7%。由於其多功能性和機械強度,這些線圈對於工業和結構應用是不可或缺的。同時,隨著各行各業都強調能源效率,尤其是在變壓器和電動馬達領域,對電工鋼板和電工鋼帶的需求也日益增加。隨著全球能源標準越來越嚴格,電氣應用領域對專用扁鋼產品的需求將大幅成長。

建築和基礎設施領域在 2024 年達到 2,891 億美元,佔 55.3% 的市場佔有率,預計 2025 年至 2034 年的複合年成長率為 6%。不斷擴大的城市中心、大規模的住宅和商業開發以及政府主導的基礎設施項目推動持續的需求。優質鋼材因其耐用性、永續性和成本效益,在現代建築中仍然不可或缺。同時,運輸業採用扁平鋼來提高車輛性能、減輕重量並最佳化燃料消耗。隨著鋼鐵製造技術的進步,業界領導者正在推出符合嚴格品質標準的高強度、輕量鋼材。

預計到 2034 年,美國扁平材市場規模將達到 762 億美元,自 2024 年起的複合年成長率為 4.8%。經濟和技術進步正在重塑該行業,從而推動高性能鋼鐵解決方案的採用。汽車和航太領域尤其推動了創新,因為製造商尋求能夠增強結構完整性同時減輕重量的材料。此外,住宅和商業建築項目投資的增加也持續增強需求。隨著各行各業優先考慮現代化和永續的解決方案,扁平鋼市場將穩步成長,主要參與者將專注於效率、可回收性和減少對環境的影響。

目錄

第1章:方法論與範圍

- 市場範圍和定義

- 基礎估算與計算

- 預測計算

- 資料來源

- 基本的

- 次要

- 付費來源

- 公共資源

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 產業衝擊力

- 成長動力

- 加強基礎建設

- 汽車產業需求不斷成長

- 擴大再生能源項目

- 市場挑戰

- 環境法規與永續發展壓力

- 成長動力

- 法規和市場影響

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場規模及預測:依產品,2021-2032

- 主要趨勢

- 熱軋平板

- 熱軋捲板

- 電工板材及帶材

- 金屬塗層鋼板及帶材

- 非金屬塗層板材及帶材

- 鍍錫板

第6章:市場規模及預測:依最終用途,2021-2032

- 主要趨勢

- 建築和基礎設施

- 汽車與運輸

- 機械設備

- 電器

- 農業設備

- 氣體容器

- 其他

第7章:市場規模及預測:依地區,2021-2032

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東及非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第8章:公司簡介

- Allegheny Technologies (ATI)

- ArcelorMittal

- China Steel Corporation

- Essar Steel

- Gerdau SA

- Hyundai Steel Co., Ltd.

- Nucor Corporation

- Nippon Steel & Sumitomo Metal Corporation (NSSMC)

- POSCO

- Severstal JSC

- Thyssenkrupp AG

- Tata Steel Limited

- Voestalpine Group

- Wuhan Iron & Steel Corporation (WISCO)

The Global Flat Steel Market reached USD 559.9 billion in 2024 and is set to expand at a CAGR of 5.9% between 2025 and 2034, driven by rising demand from the construction and automotive industries. Flat steel's cost-effectiveness, energy efficiency, and eco-friendly properties make it a preferred material across various applications. As governments and private enterprises worldwide increase infrastructure investments, the demand for flat steel in highways, bridges, and large-scale transportation projects continues to rise. With rapid urbanization and industrial growth, market players are focusing on innovation and sustainable production techniques to align with evolving industry needs.

The expansion of the flat steel market is closely linked to advancements in the automotive sector, where manufacturers prioritize lightweight, high-strength materials to improve fuel efficiency and meet stringent emission regulations. The shift toward electric vehicles further amplifies the demand for flat steel in battery casings and structural components. Additionally, the rising use of advanced metallic coatings enhances corrosion resistance, extending product lifespan across multiple industries. The appliance sector also benefits, as consumers and manufacturers seek durable and energy-efficient materials.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $559.9 Billion |

| Forecast Value | $1.2 Trillion |

| CAGR | 5.9% |

Hot rolled coils will remain a dominant product category, projected to generate USD 596.1 billion by 2034 at a CAGR of 7%. These coils are integral to industrial and structural applications due to their versatility and mechanical strength. Meanwhile, electrical sheets and strips are witnessing heightened demand as industries emphasize energy efficiency, particularly in transformers and electric motors. As global energy standards tighten, the need for specialized flat steel products in electrical applications is poised for significant growth.

The building and infrastructure segment accounted for USD 289.1 billion in 2024, capturing a 55.3% market share, and is projected to grow at a CAGR of 6% from 2025 to 2034. Expanding urban centers, large-scale residential and commercial developments, and government-led infrastructure projects drive consistent demand. Premium-grade steel remains essential in modern construction due to its durability, sustainability, and cost-effectiveness. Meanwhile, the transportation industry integrates flat steel to enhance vehicle performance, reduce weight, and optimize fuel consumption. With technological advancements in steel manufacturing, industry leaders are introducing high-strength, lightweight variants that meet stringent quality standards.

U.S. flat steel market is projected to reach USD 76.2 billion by 2034, growing at a CAGR of 4.8% from 2024. Economic and technological advancements are reshaping the industry, leading to increased adoption of high-performance steel solutions. The automotive and aerospace sectors, in particular, drive innovation as manufacturers seek materials that enhance structural integrity while minimizing weight. Additionally, rising investments in residential and commercial construction projects continue to reinforce demand. As industries prioritize modernized and sustainable solutions, the flat steel market is set for steady growth, with key players focusing on efficiency, recyclability, and reduced environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing infrastructure development

- 3.7.1.2 Rising demand from the automotive sector

- 3.7.1.3 Expansion of renewable energy projects

- 3.7.2 Market challenges

- 3.7.2.1 Environmental regulations and sustainability pressures

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2032 (USD Billion) (Million Tons)

- 5.1 Key trends

- 5.2 Hot rolled flat sheets

- 5.3 Hot rolled coils

- 5.4 Electrical sheet & strip

- 5.5 Metallic coated sheet & strip

- 5.6 Non-metallic coated sheet & strip

- 5.7 Tin plates

Chapter 6 Market Size and Forecast, By End Use, 2021-2032 (USD Billion) (Million Tons)

- 6.1 Key trends

- 6.2 Building & infrastructure

- 6.3 Automotive & transportation

- 6.4 Mechanical equipment

- 6.5 Electrical appliances

- 6.6 Agriculture equipment

- 6.7 Gas containers

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2032 (USD Billion) (Million Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Allegheny Technologies (ATI)

- 8.2 ArcelorMittal

- 8.3 China Steel Corporation

- 8.4 Essar Steel

- 8.5 Gerdau S.A.

- 8.6 Hyundai Steel Co., Ltd.

- 8.7 Nucor Corporation

- 8.8 Nippon Steel & Sumitomo Metal Corporation (NSSMC)

- 8.9 POSCO

- 8.10 Severstal JSC

- 8.11 Thyssenkrupp AG

- 8.12 Tata Steel Limited

- 8.13 Voestalpine Group

- 8.14 Wuhan Iron & Steel Corporation (WISCO)